Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Waiver Of Qualified Joint And Survivor Annuity - QJSA?

Locating the appropriate legal document template can be a challenge. Naturally, there are numerous designs accessible online, but how will you find the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA, applicable for business and personal purposes.

All forms are reviewed by experts and comply with state and federal regulations.

Once you are confident that the form is accurate, click on the Buy now button to acquire the form. Choose the pricing plan you prefer and input the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, and print and sign the received Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA. US Legal Forms is the premier repository of legal forms where you can discover various document templates. Utilize the service to obtain professionally-created paperwork that adheres to state regulations.

- If you are already a member, Log In to your account and select the Download option to acquire the Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA.

- Use your account to browse the legal forms you have previously obtained.

- Navigate to the My documents section of your account to retrieve an additional copy of the documents you require.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- Firstly, confirm that you have chosen the correct form for your locality/region. You can preview the form using the Review option and examine the form description to ensure it meets your needs.

- If the form does not satisfy your requirements, utilize the Search area to find the appropriate form.

Form popularity

FAQ

A joint annuity provides payments to two people together but ceases once one partner passes away. On the other hand, a joint and survivor annuity, like the Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA, ensures that the surviving spouse continues to receive annuity payments. This distinction effectively protects the financial wellbeing of the survivor.

The Hawaii Waiver of Qualified Joint and Survivor Annuity - QJSA offers peace of mind by ensuring financial security for your spouse after your passing. It guarantees a steady stream of income, relieving concerns about future financial hardship. Additionally, this structure protects against the risk of outliving your retirement savings, making it a smart choice for couples.

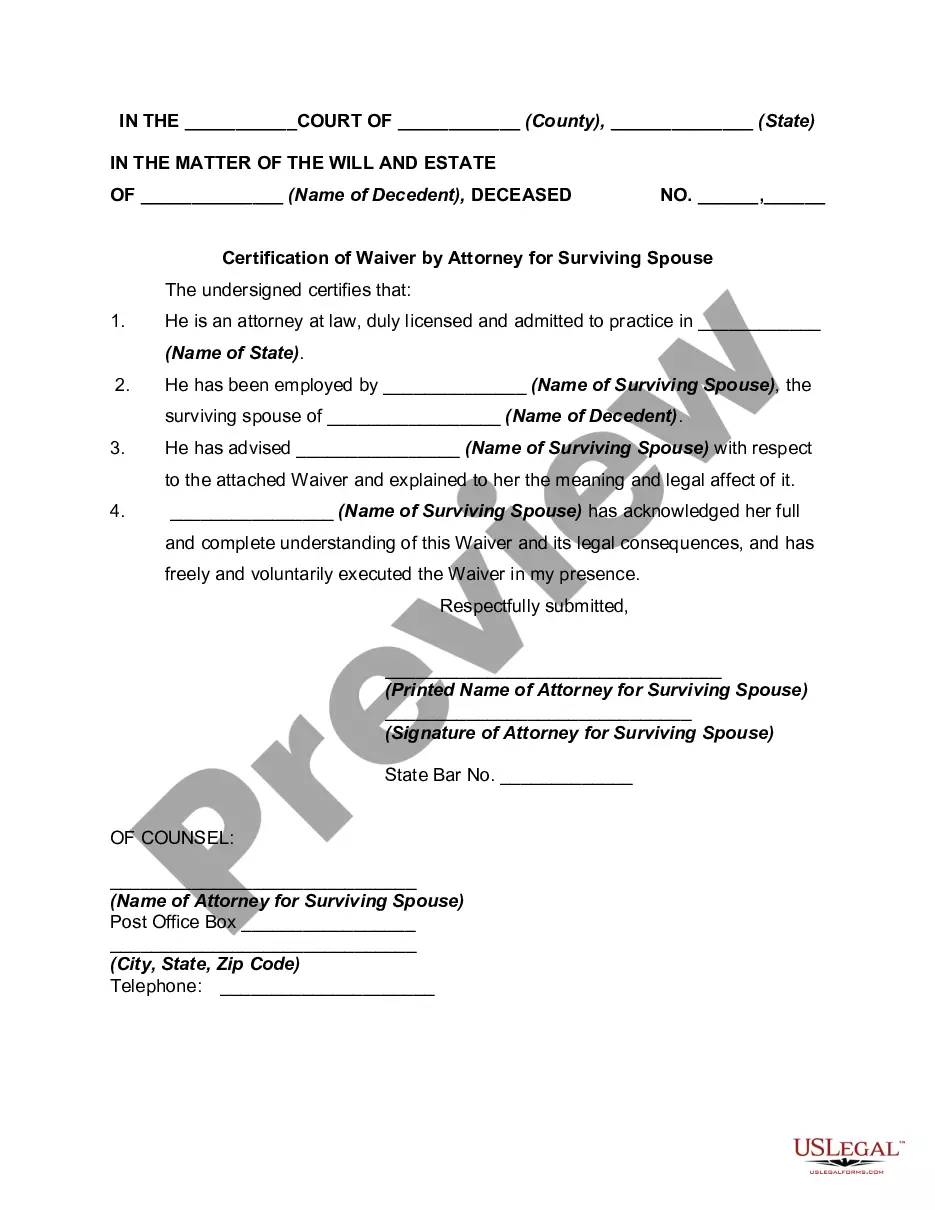

When the participant dies, the spouse will receive lifetime payments in the same or reduced amount. The participant may waive the Qualified Joint and Survivor Annuity with spousal consent and elect to receive another form of payment.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

A joint and survivor annuity is an insurance product designed for couples that continues to make regular payments as long as one spouse lives. A joint and survivor annuity has the advantage of providing income if one or both people live longer than expected. This is not a good choice for a younger couple.

Qualified Joint and Survivor Annuity (QJSA) includes a level monthly payment for your lifetime and a survivor benefit for your spouse after your death equal to the percentage designated of that monthly payment.

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

life annuity provides the largest monthly payment but pays only during your lifetime. It's a poor choice if your spouse will need income from your pension to pay routine expenses. A jointandsurvivor annuity pays you during your lifetime and then continues to pay your spouse or other named beneficiary.

A QJSA is when retirement benefits are paid as a life annuity (a series of payments, usually monthly, for life) to the participant and a survivor annuity over the life of the participant's surviving spouse (or a former spouse, child or dependent who must be treated as a surviving spouse under a QDRO) following the

Qualified Joint and Survivor AnnuityIf your spouse consents to change the way the Plan's retirement benefits are paid, your spouse gives up his or her right to the QJSA payments. This is referred to as a waiver of the QJSA payment form.