Hawaii Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Are you presently in a situation where you require documents for various business or particular purposes almost on a daily basis.

There are numerous legal document templates accessible online, but finding forms you can trust is not easy.

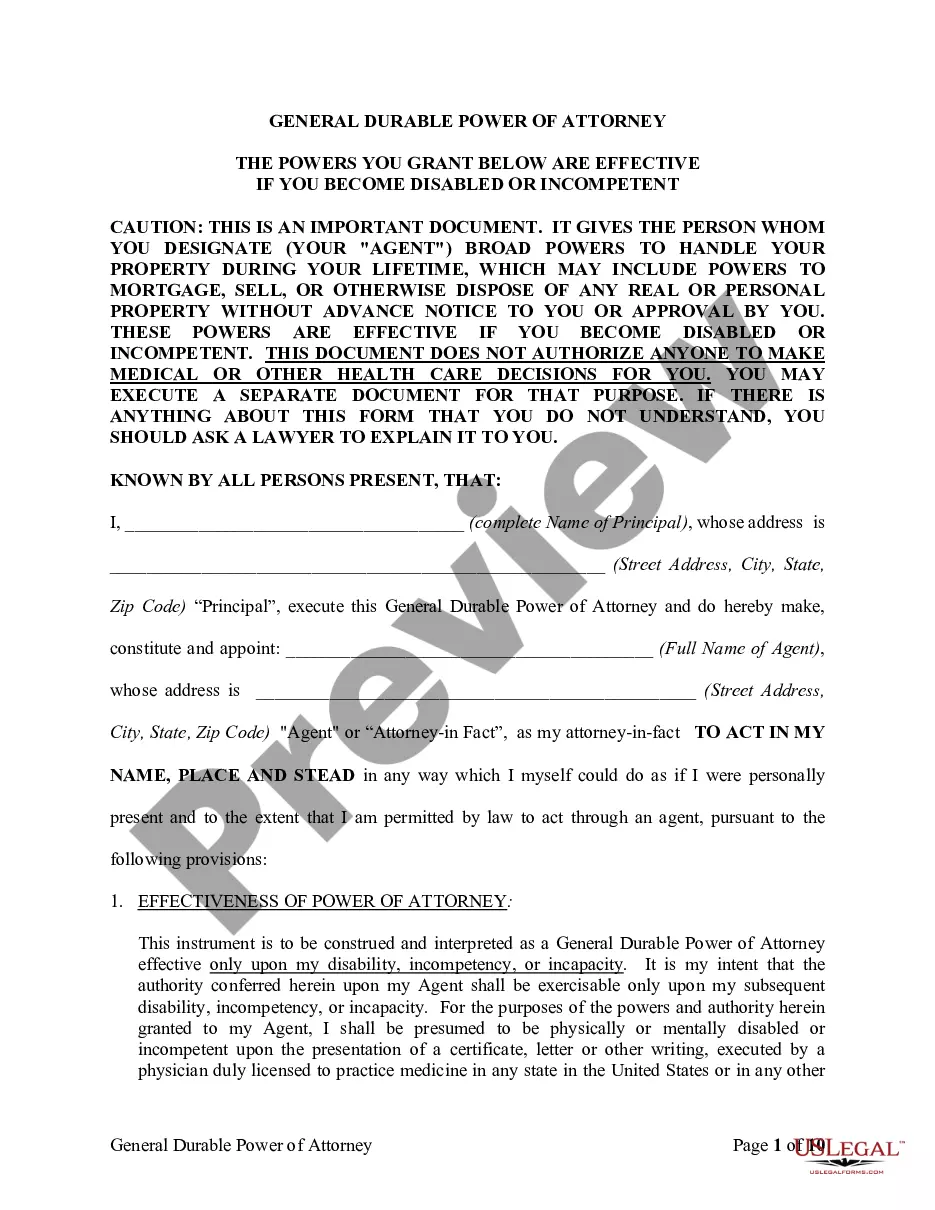

US Legal Forms offers a wide array of form templates, such as the Hawaii Separation Notice for 1099 Employee, tailored to meet federal and state regulations.

When you find the correct form, click Purchase now.

Select the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Separation Notice for 1099 Employee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct jurisdiction/county.

- Utilize the Preview option to review the form.

- Read the description to ensure you have chosen the correct form.

- If the form does not meet your requirements, use the Search feature to find a form that suits your needs.

Form popularity

FAQ

A. Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report is mailed to the last known mailing address on file for all active employers, fifteen days prior to the end of EACH calendar quarter.

Generally, Hawaii is an at will State. This means an employer does not need to give you a reason to let you go, lay you off, or fire you unless: You have a contract with the employer that requires you be notified of the reason.

Yes, employees receiving severance may still apply for unemployment insurance.

At-will employment is an employer-employee agreement in which a worker can be fired or dismissed for any reason, without warning, and without explanation.

It is therefore possible to dismiss even on a first offense and without any prior warnings having been issued, but that will depend on the severity of the offense, the circumstances under which it was committed, and the provisions of the employer's Disciplinary Code.

California is an at-will state, which implies that at any moment of jobs with or without reason an employer can terminate you for any reason. This means that if your employer doesn't like your personality if you run out of work, think you're lazy or just don't want staff anymore, they can fire you at any moment.

Under Section 388-3(a), HRS, whenever an employer discharges an employee, the employer is required to pay all earned wages in full at the time of discharge, or not later than the next working day.

You should file your claim immediately upon becoming unemployed. During the interview process, you will be asked to report your severance and/or vacation pay. Your period of disqualification will be determined through Adjudication. Click here for more information on Unemployment Benefits, including applying online.

Self-employed individuals, independent contractors, or gig workers who have had to suspend their work because of COVID-19, or had a significant reduction in work, may be eligible for PUA.

You can earn up to $150 a week and still receive your full unemployment check. If you are still employed and working and earning less than your weekly benefit amount, you may qualify for the difference between your earnings over $150 and your weekly benefit amount.