Hawaii New Employee Survey

Description

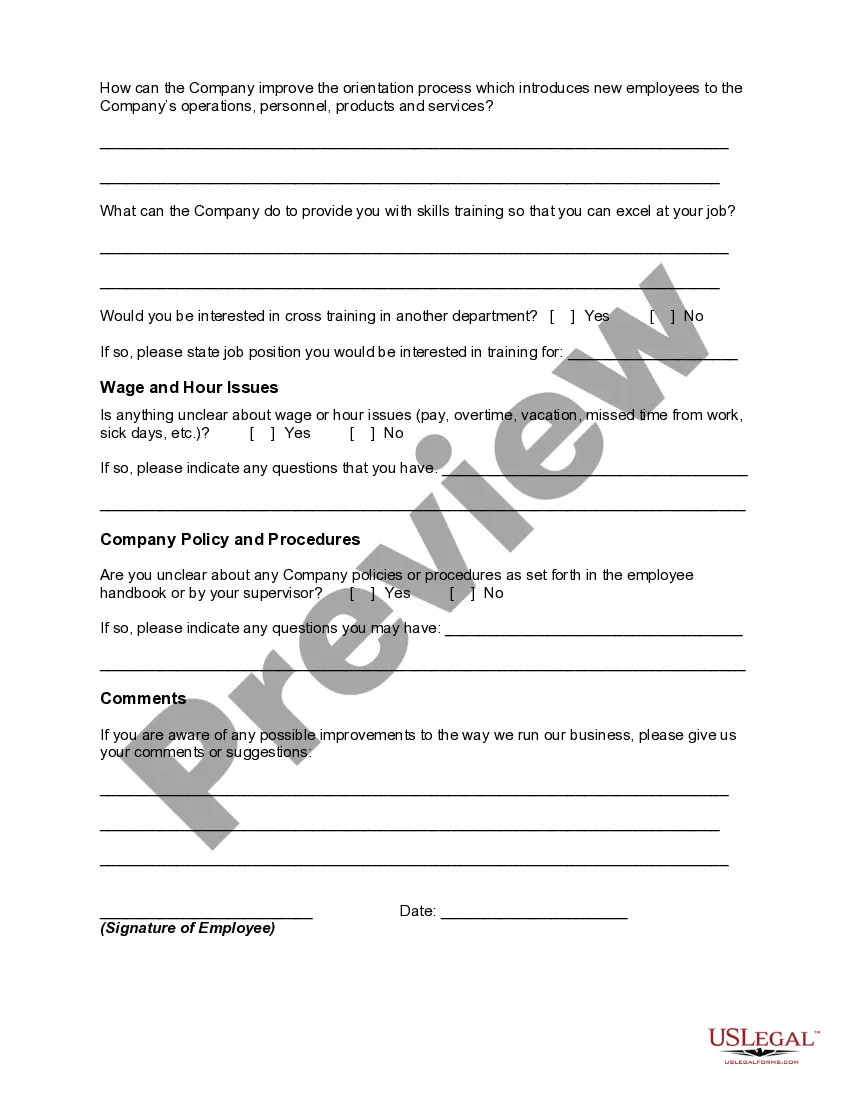

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

If you require complete, download, or print lawful document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you need.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Get now button. Choose the pricing plan you prefer and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your Visa, Mastercard, or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it onto your device. Step 7. Complete, modify and print or sign the Hawaii New Employee Survey. Each legal document template you obtain is your property forever. You have access to all forms you downloaded in your account. Check the My documents section and choose a form to print or download again. Be proactive and download, and print the Hawaii New Employee Survey with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to access the Hawaii New Employee Survey with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Download option to retrieve the Hawaii New Employee Survey.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you've chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms of the legal type design.

Form popularity

FAQ

Steps to Hiring your First Employee in HawaiiStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?11-Oct-2021

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

All employers doing business and having employees in Pennsylvania--regardless of their industry, occupation, profit status, or sizeare required by law to report each new hire to the Program, if the individual is considered an employee for the purposes of federal income tax withholding.

Applicants must fill out the CL-1 Form. Applications for this certificate can be downloaded at: . Completed applications may be faxed to the Wage Standards Division.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Effective October 1, 2021, all Florida employers (regardless of size) are required to report new hires and rehires to the State Directory of New Hires within 20 days of hire. The amendment is a significant change for Florida businesses and imposes new requirements for employers who were not previously affected.

Hawaii employers must report new hires within 20 days from the date of hire or rehire by sending the employee's Form W-4 to: Child Support Enforcement Agency. New Hire Reporting. Kakuhihewa Building. 601 Kamokila Blvd., Suite 251. Kapolei, HI 96707.You can read more information about new hire reporting here.