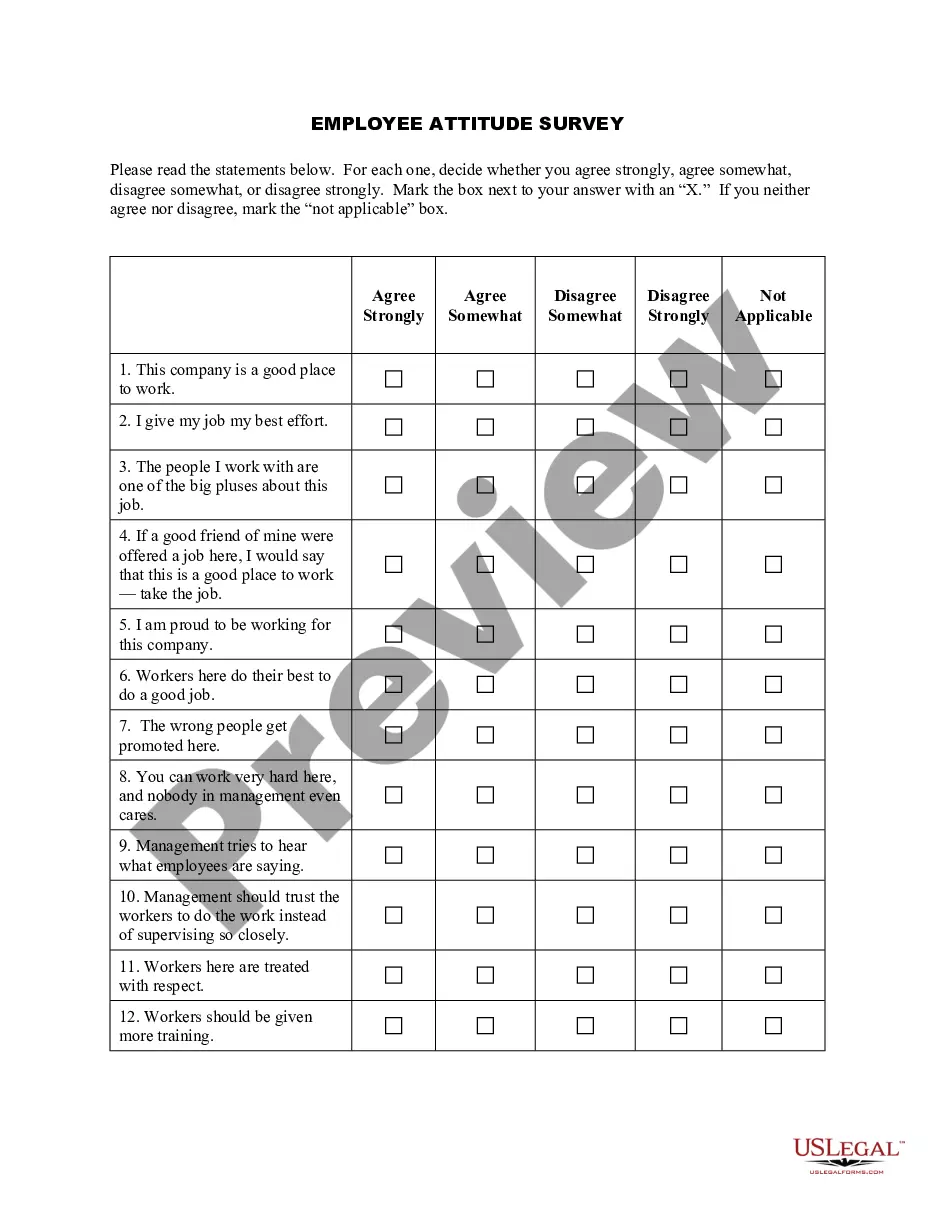

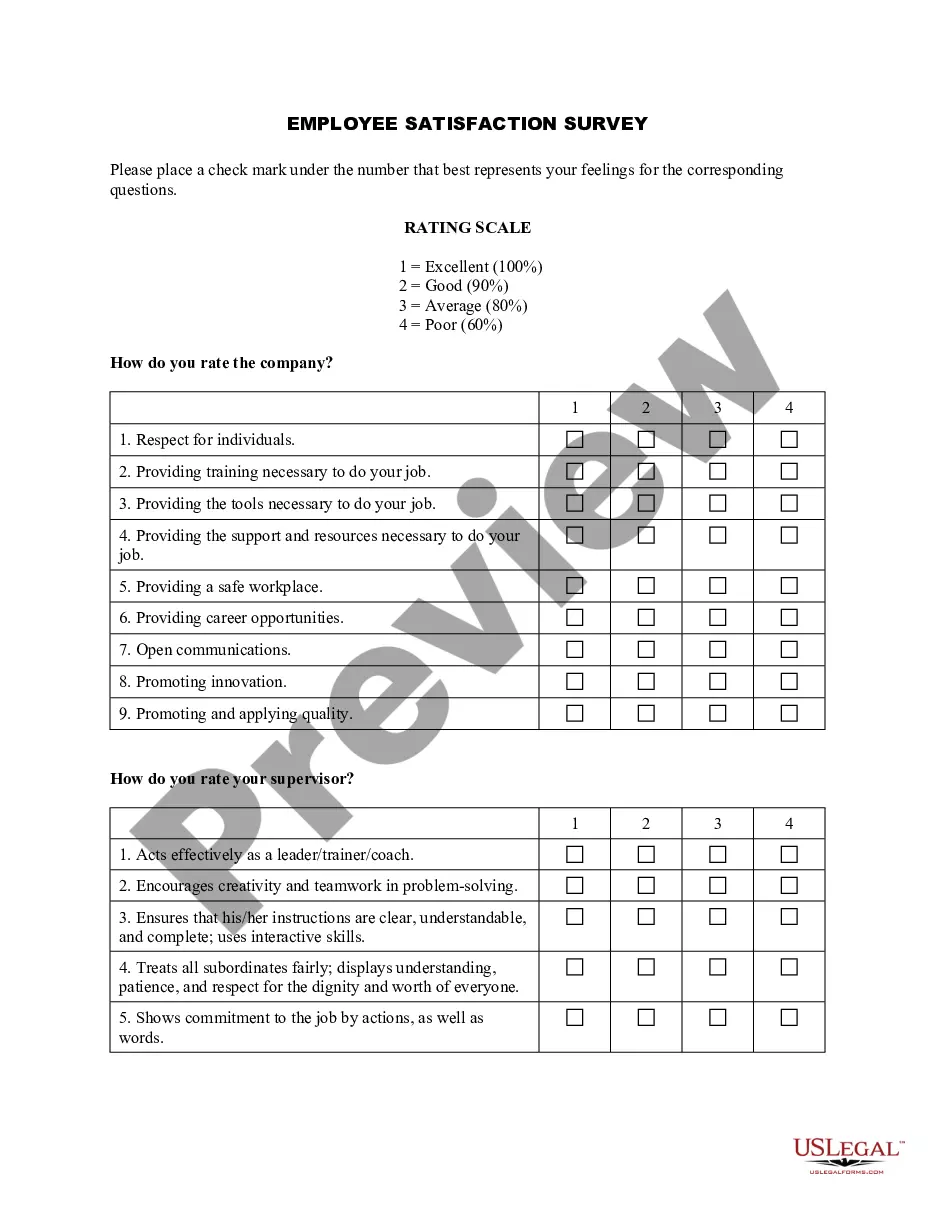

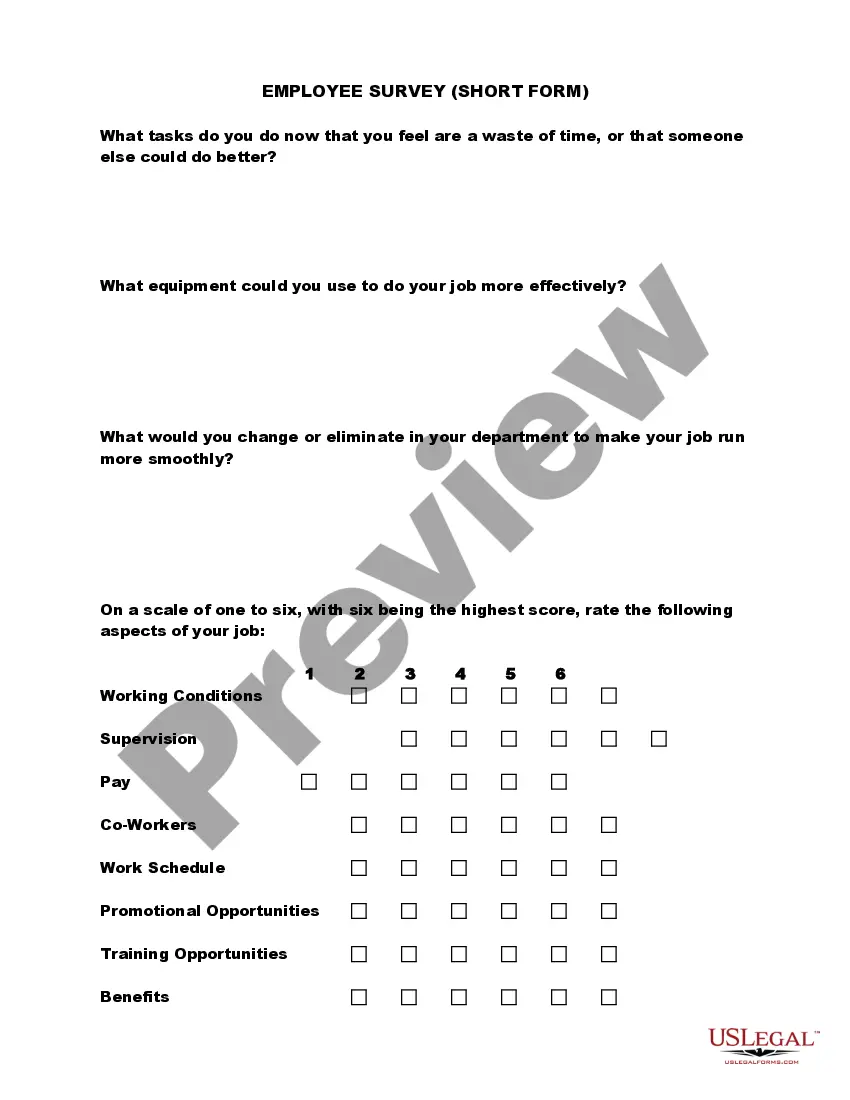

Hawaii Employee Survey (Short Form)

Description

How to fill out Employee Survey (Short Form)?

You might invest hours online attempting to locate the authentic document template that satisfies the state and federal requirements you need. US Legal Forms provides thousands of legal forms that have been evaluated by professionals.

You can download or print the Hawaii Employee Survey (Short Form) from my service. If you already have a US Legal Forms account, you may Log In and click the Download button. After that, you may complete, modify, print, or sign the Hawaii Employee Survey (Short Form). Every legal document template you obtain is yours to keep permanently.

To retrieve another copy of any purchased form, visit the My documents section and click the relevant option. If this is your first time using the US Legal Forms website, follow the simple instructions below: First, ensure that you have selected the correct document template for the county/city of your choice. Review the form description to confirm you have chosen the right form.

Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If available, use the Review option to examine the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- Once you have identified the template you desire, click Purchase now to proceed.

- Select the pricing plan you want, enter your credentials, and register for an account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your system.

- Make adjustments to your document if necessary. You may complete, modify, sign, and print the Hawaii Employee Survey (Short Form).

Form popularity

FAQ

If you believe that an employee has claimed excess allowances for the employee's situation (generally more than 10) or misstated the employee's marital status, you must send a copy of the Form HW-4 for that employee to the Hawaii Department of Taxation, P. O. Box 3827, Honolulu, Hawaii 96812-3827.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Hawaii requires employers to insure employees or pay temporary disability benefits for up to six months. The State of Hawaii requires employers to provide temporary disability insurance (TDI) or payments to workers who suffer short-term, non-work related illness or injuries, including pregnancy.

How to Fill Out an HW-4 Form?Employee information - completed by the employee. Write down your full name, social security number, and address.Employer information - completed by the employer. Indicate the employer's name, address, and Hawaii tax identification number.

How do I file a TDI claim?Notify your employer immediately of your disability.Ask for Form TDI-45, Claim for TDI Benefits, from your employer.Complete Part A, Claimant's Statement, of the claim form.Take the form to your physician to certify your disability on Part C, Doctor's Statement.More items...

How do I get a withholding (WH) account number? Use Form BB-1 to request a withholding (WH) account number. You may also add a withholding account on Hawaii Tax Online if you already have a login.

The 2022 tax rates range from 0.2% to 5.8% on the first $500 in wages paid to each employee in a calendar year. If you're a new employer (congratulations!), you pay a flat rate of 3%.

Submit only original forms. FILING PERIOD. The withholding tax returns (Forms HW-14) are used to report the. wages paid and the taxes withheld.

How do I get a withholding (WH) account number? Use Form BB-1 to request a withholding (WH) account number. You may also add a withholding account on Hawaii Tax Online if you already have a login.

Hawaii Tax ID's that were issued prior to the modernization project begin with the letter "W" and are followed by 10 digits. (Example: W99999999-01.) Hawaii SalesTax ID's that are issued after the modernization project begin with the letters "GE" and are followed by 12 digits. (Example: GE-999-999-9999-01.)