Hawaii Requisition Slip

Description

How to fill out Requisition Slip?

If you need to obtain, secure, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Utilize the site's user-friendly search feature to find the documentation you require. A selection of templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to locate the Hawaii Requisition Slip in just a few clicks.

Every legal document template you purchase is yours for a lifetime. You will have access to every form you acquired within your account. Select the My documents section and choose a form to print or download again.

Stay competitive and obtain, then print the Hawaii Requisition Slip using US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Hawaii Requisition Slip.

- You can also access forms you have previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

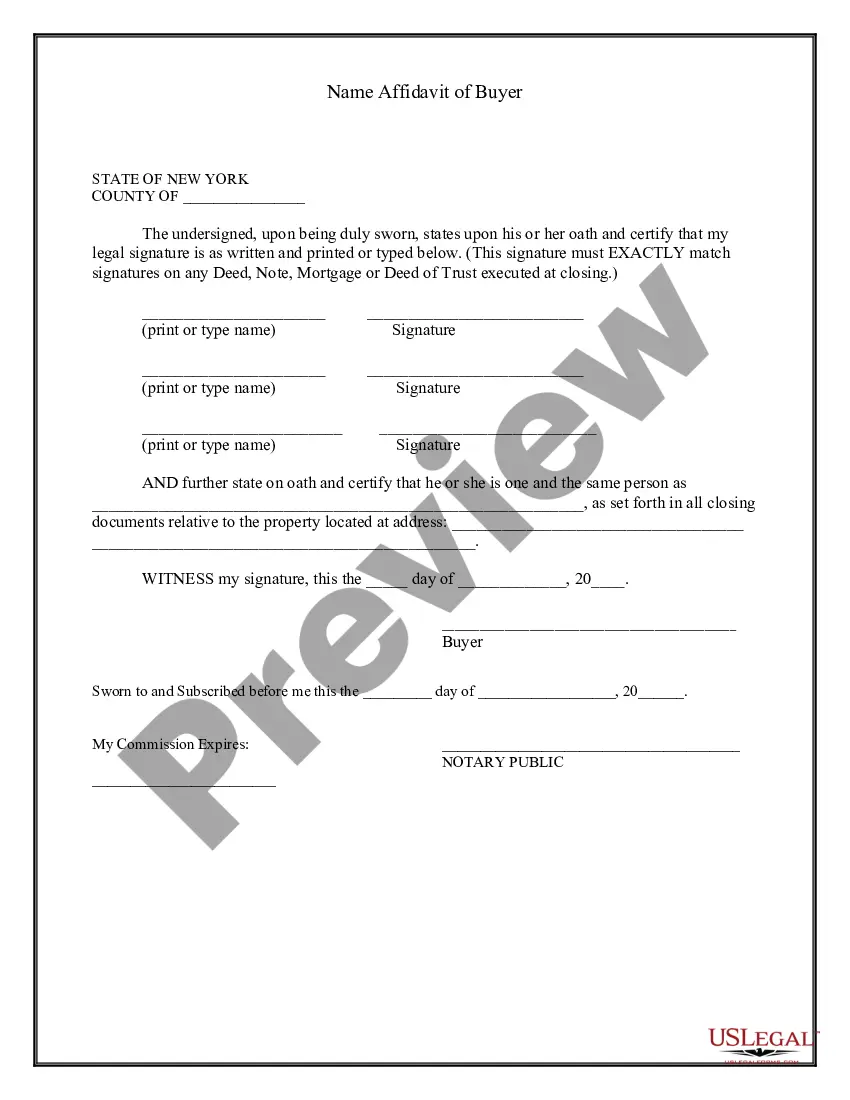

- Step 2. Use the Preview option to review the form’s content. Remember to read the details carefully.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other forms in the legal form repository.

- Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and provide your details to register for the account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Hawaii Requisition Slip.

Form popularity

FAQ

Several factors can disqualify you from receiving unemployment benefits in Hawaii. These include failing to meet work search requirements, voluntarily quitting without good cause, or being terminated for misconduct. Knowing these criteria can help you avoid issues, so be sure to keep your Hawaii Requisition Slip updated with your activities related to your claim.

To amend a tax return in Hawaii, you will need to use Form N-101A. This form allows you to correct any errors or make necessary adjustments to your previously filed tax return. Remember to attach your Hawaii Requisition Slip with the amendment to ensure a smooth processing experience.

You should send your Hawaii tax return to the address specified on the form you are using. Ensure you double-check this information to avoid delays. Including the Hawaii Requisition Slip helps you track your submission and ensure everything is in order.

The maximum unemployment benefit in Hawaii is based on your previous earnings and is subject to change each year. Currently, the maximum weekly benefit amount can provide essential support during tough times. For exact figures, it is wise to review your Hawaii Requisition Slip or check the official state resources.

A medical waiver for unemployment in Hawaii allows individuals to remain eligible for benefits despite being unable to search for work due to medical reasons. To apply for this waiver, you typically need to provide relevant medical documentation. Submitting your Hawaii Requisition Slip is crucial in this process to ensure your claim is properly processed.

The Hawaii form UC B6 is a document used for unemployment insurance claims. This form helps individuals report their earnings while receiving benefits. To ensure compliance and receive the correct benefits, you may need to submit your Hawaii Requisition Slip along with this form.

Yes, if you are operating a business and collecting general excise tax, you will need to file both G45 and G49 forms. The G45 is for ongoing reports, while the G49 summarizes the annual totals. The Hawaii Requisition Slip can provide assistance to help you streamline both of these filings.

If you require more time for your federal tax return, you must file a federal extension. It's equally important to check if you need to file a state tax extension in Hawaii. To manage this process efficiently, refer to the Hawaii Requisition Slip for the necessary forms and steps.

Yes, Hawaii allows taxpayers to file their state taxes online. The state offers an online portal for tax filing, making the process more convenient. Additionally, the Hawaii Requisition Slip can direct you to the right resources to complete your online filing smoothly.

You should file the G49 form with the Hawaii Department of Taxation. This can often be done online, but you may also submit it by mail. To ensure you are following the correct process, refer to the Hawaii Requisition Slip for detailed instructions and resources.