Hawaii Expense Report

Description

How to fill out Expense Report?

Have you found yourself in a scenario where you need documents for personal or business purposes almost every day.

There are many official document templates accessible online, but locating forms you can trust is challenging.

US Legal Forms offers thousands of template options, including the Hawaii Expense Report, designed to comply with state and federal regulations.

Choose the pricing plan you need, fill out the required information to create your account, and make a purchase using your PayPal or credit card.

Pick a suitable file format and download your copy. Retrieve all the document templates you have purchased from the My documents section. You can obtain an additional copy of the Hawaii Expense Report anytime you need. Just select the appropriate form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of official forms, to save time and minimize mistakes. The service provides correctly crafted legal document templates that can be used for various purposes. Register on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Hawaii Expense Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

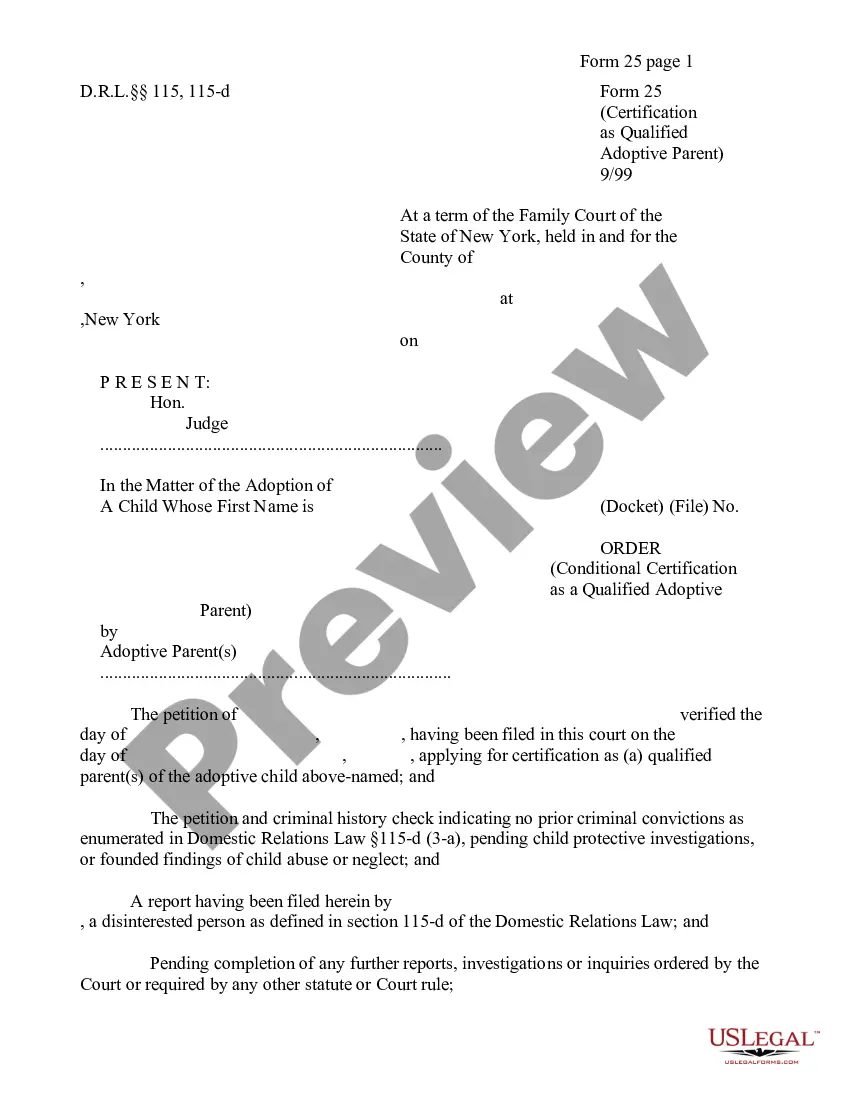

- Use the Review button to examine the form.

- Check the description to confirm you have selected the correct template.

- If the form does not match what you require, use the Search field to find a form that suits your needs and preferences.

- Once you find the correct form, click Get now.

Form popularity

FAQ

To fill out an expense report, including your Hawaii Expense Report, initiate by entering necessary personal or company information. List out expenses chronologically or by categories, stating the amounts and providing clear descriptions. Adding receipts increases the report's credibility and aids in a smoother reimbursement process.

Filling out an expense report, particularly a Hawaii Expense Report, involves organizing your expenses systematically. Begin by documenting each expense's date and nature, then categorize them accordingly. Don’t forget to attach all required receipts as proof of your expenditures to complete your submission.

To fill an expense claim form for your Hawaii Expense Report, start by entering your personal and company details at the top. Next, list each expense, ensuring to provide relevant dates, amounts, and supporting documentation like receipts. Remember, accuracy is key to avoid delays in reimbursement.

The basic expense report for Hawaii focuses on summarizing your expenditures over a specific time frame. It typically includes essential details like the total amount spent, dates, categories, and purpose. This format helps ensure that all necessary information is communicated, making it easier for approval and reimbursement processes.

An example of an expense report, specifically a Hawaii Expense Report, might include sections for daily expenses during a business trip. It will show individual expenses like airline tickets, hotel stays, and meals, with totals at the end. This structure helps in verifying and processing reimbursements effectively.

Creating an itemized list of expenses for your Hawaii Expense Report requires detailing each spending activity. Begin by categorizing your expenses, such as transportation, meals, and accommodations. For each category, clearly state the date, amount, and a brief description to ensure clarity and accuracy in your reporting.

To complete the daily expense form for your Hawaii Expense Report, start by entering the date and purpose of your expenditures. Then, list each expense item with the appropriate categories, such as meals, lodging, or travel. Be sure to include the total amount spent along with any necessary receipts to support your claims.

Certain expenses in Hawaii may be tax deductible, depending on specific criteria established by the IRS. For example, expenses that are necessary and ordinary for your business can often qualify. When compiling your Hawaii Expense Report, remember to include these deductible expenses to maximize your potential savings. Utilizing tools like uslegalforms can simplify the documentation process and ensure compliance with tax regulations.

Yes, Hawaii does have a gross receipts tax, commonly referred to as the General Excise Tax (GET). This tax applies to businesses operating in Hawaii and affects the income generated from different activities. When preparing your Hawaii Expense Report, it is essential to consider the impact of this tax on your business expenses. Keeping accurate records will help you navigate this requirement efficiently.

Yes, in Hawaii, certain businesses are required to file an annual report, which provides updated information about the company. This report is essential for maintaining good standing and is separate from personal tax filings. For businesses managing their finances, integrating an expense reporting tool can simplify tracking annual obligations along with your Hawaii Expense Report.