Hawaii Option to Purchase - Short Form

Description

How to fill out Option To Purchase - Short Form?

Are you currently in a location where you frequently require documents for either business or personal reasons.

There are numerous legal document templates available online, but finding reliable ones isn't straightforward.

US Legal Forms offers a wide array of templates, including the Hawaii Option to Purchase - Short Form, designed to comply with federal and state requirements.

Once you find the appropriate template, click Get now.

Choose the pricing plan you desire, fill in the necessary information to create your account, and finalize the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Hawaii Option to Purchase - Short Form template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for your specific city/state.

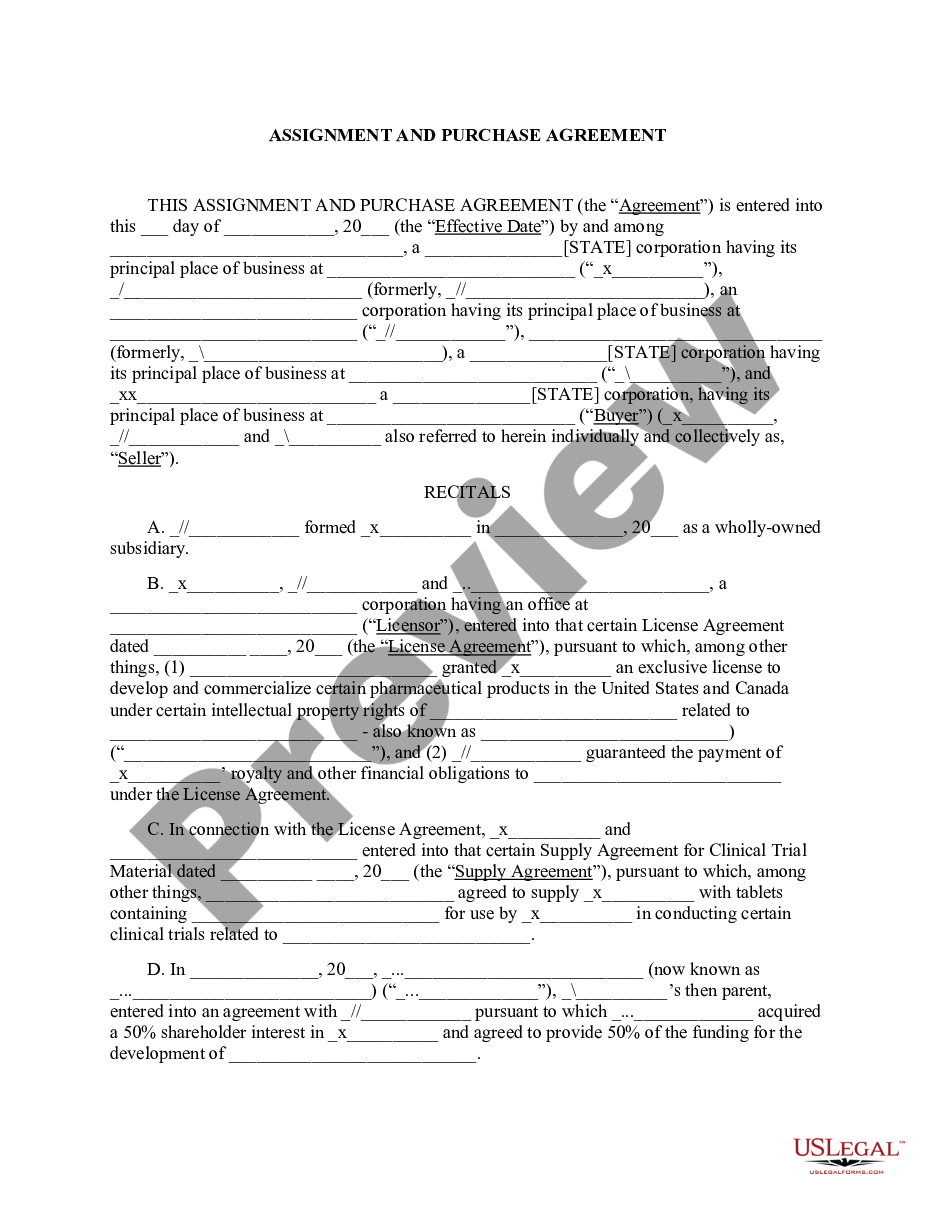

- Use the Preview button to view the form.

- Check the description to verify that you have selected the correct template.

- If the template isn't what you are looking for, use the Search field to find the one that fits your needs.

Form popularity

FAQ

In Hawaii, partnerships must file a partnership return if they have gross income amounting to $1,000 or more during the tax year. This requirement is essential for compliance and transparency in business operations. If you are new to the partnership return process, consider using resources, such as those provided by uslegalforms, to simplify your understanding.

A Hawaii Agreement of Sale is a purchase contract and, if properly recorded, a security device between a Seller and Buyer of real property in which the Seller provides financing to buy the property for an agreed-upon purchase price and the Buyer repays the loan in installments.

The standard range by which most sellers follow is between one and five years. Buyers have the opportunity to purchase the real estate asset at any point during the option period. However, if the period expires, the agreement terminates, and the buyer loses option fees paid to the seller.

What Is An Option To Purchase? An option to purchase agreement gives a home buyer the exclusive right to purchase a property within a specified time period and for a fixed or sometimes variable price. This, in turn, prevents sellers from providing other parties with offers or selling to them within this time period.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Purchase Option Price means an amount equal to the amount required to defease or otherwise discharge the Bonds under the Trust Agreement plus the amount of any Additional Payments which are due or accrued hereunder at the time which any purchase option hereunder is exercised.

An option to purchase real estate is a legally-binding contract that allows a prospective buyer to enter into an agreement with a seller, in which the buyer is given the exclusive option to purchase the property for a period of time and for a certain (sometimes variable) price.

Definition: An agreement of sale constitutes the terms and conditions of sale of a property by the seller to the buyer. These terms and conditions include the amount at which it is to be sold and the future date of full payment.

The Purchase & Sale Agreement (P&S) is a legally binding contract that dictates how the sale of a home will proceed. It comes after the Offer to Purchase, and supersedes that earlier document once it's signed. The P&S is more substantial than the offer and can seem pretty complicated, so I'm going to break it down.

Sometimes referred to as a right of first opportunity or first right to purchase, this provision requires the owner to give the holder the first chance to buy a property after the owner decides to sell. Unlike the option to purchase, the holder cannot force the owner to sell.