Hawaii Option to Purchase Stock - Short Form

Description

How to fill out Option To Purchase Stock - Short Form?

You can spend numerous hours on the web searching for the valid document template that meets the state and federal requirements you desire.

US Legal Forms provides a considerable array of valid forms that are reviewed by experts.

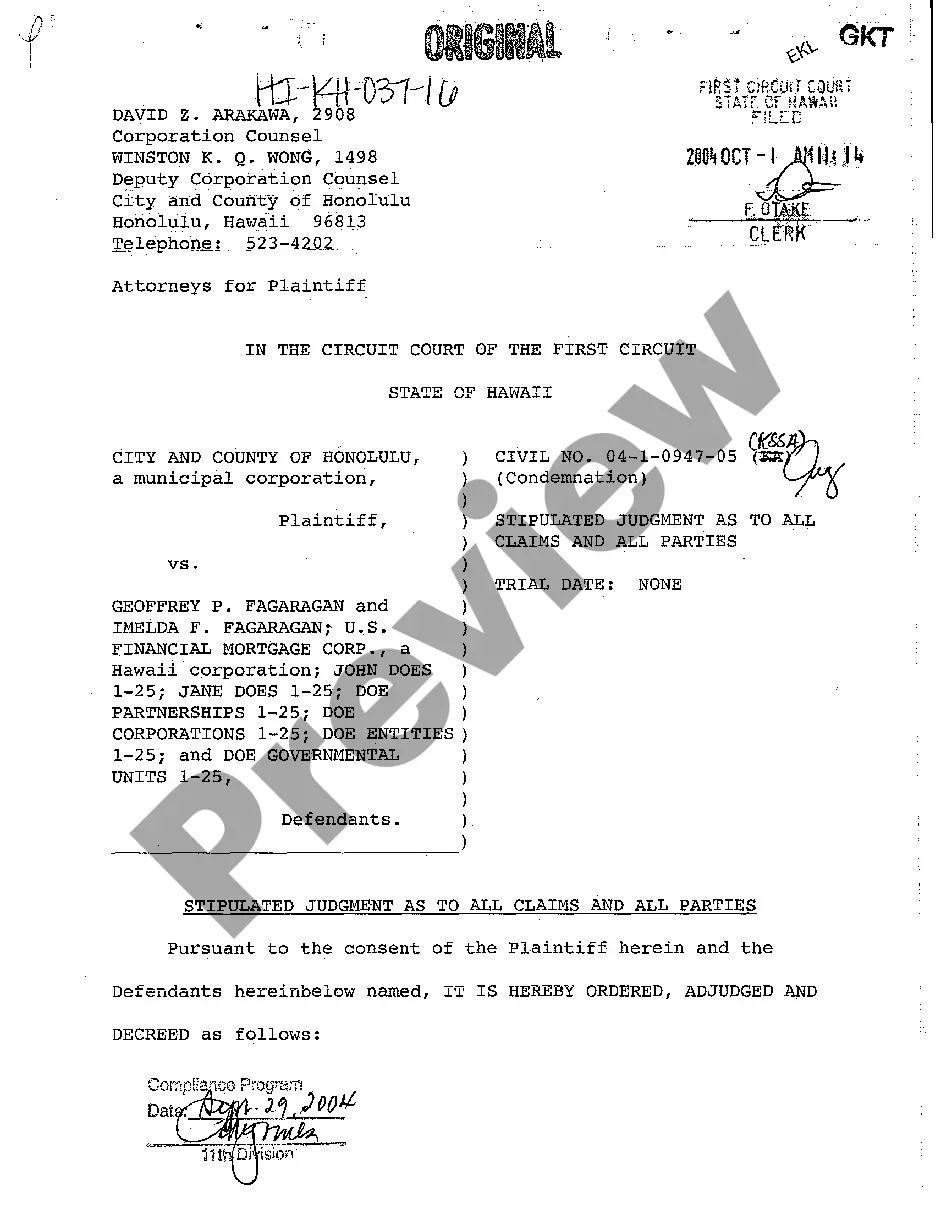

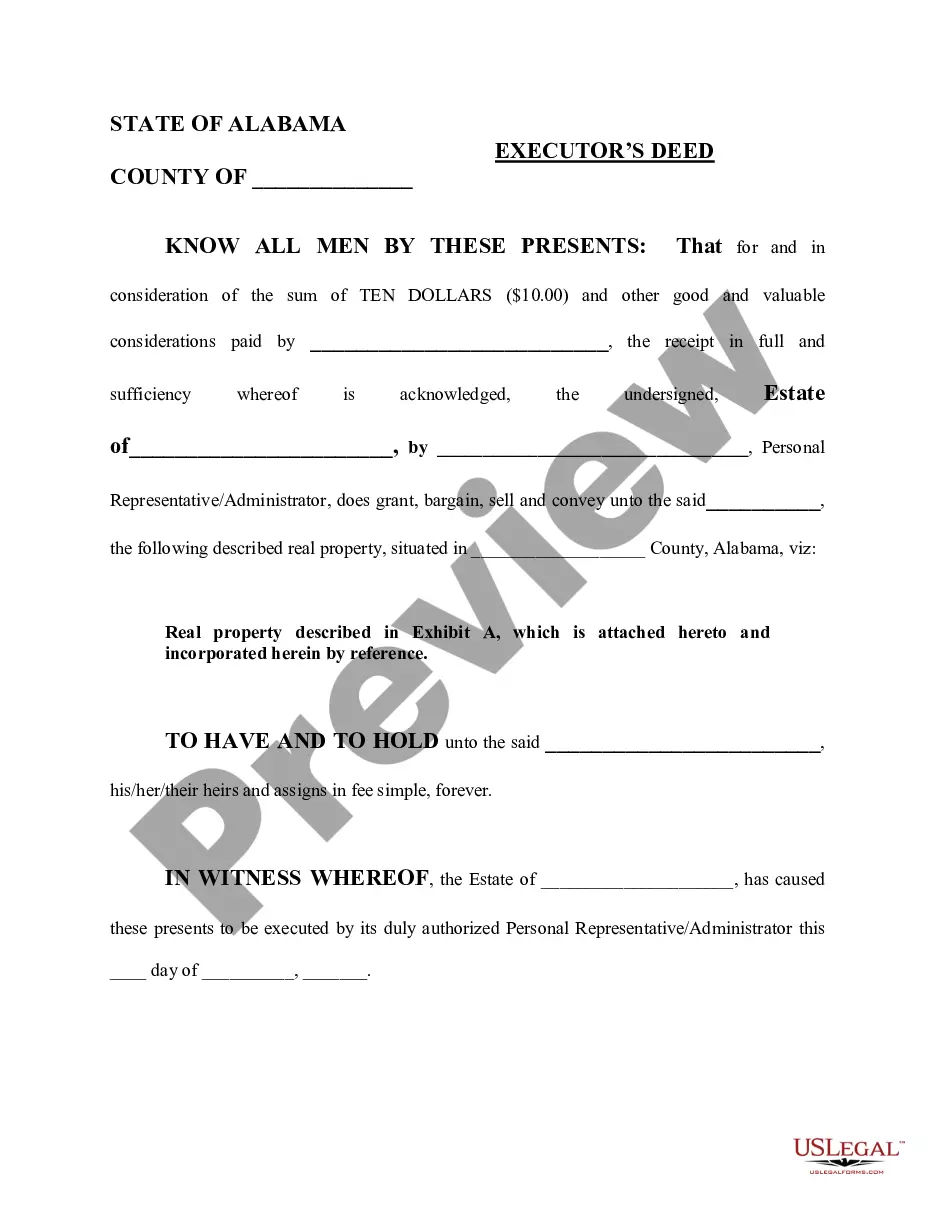

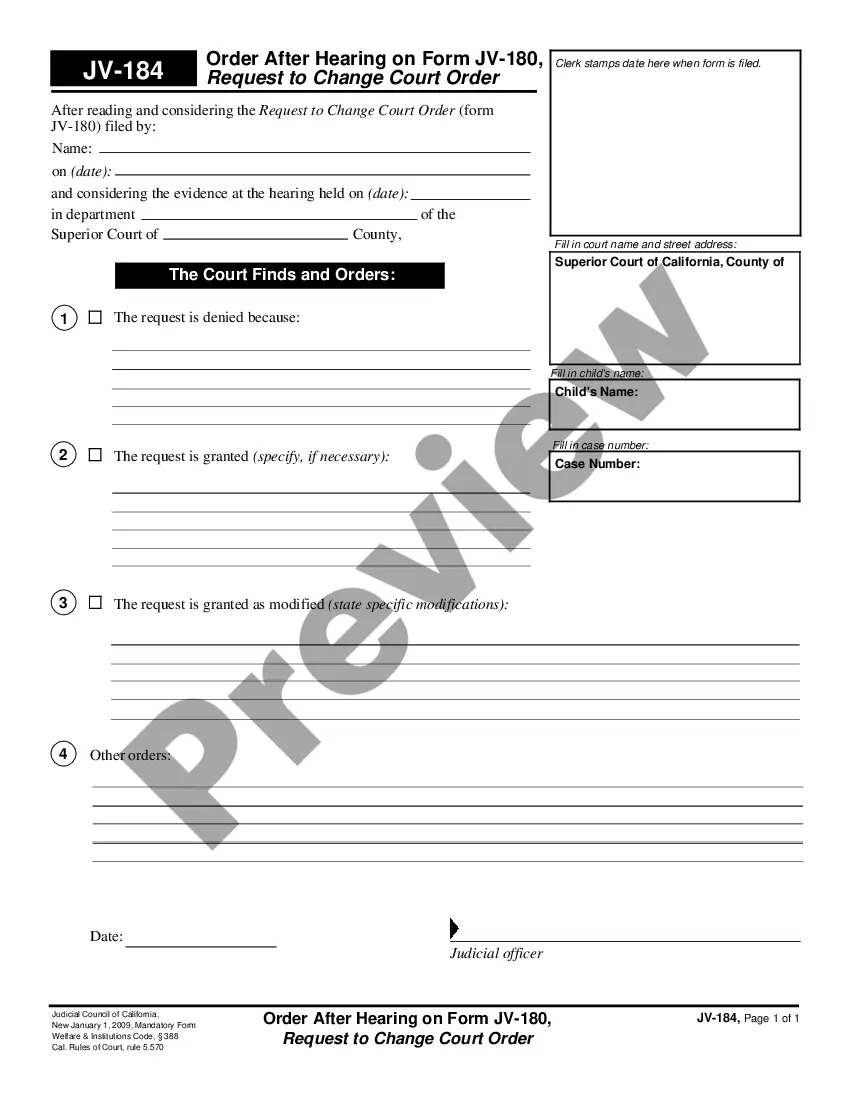

It is easy to download or print the Hawaii Option to Purchase Stock - Short Form from the site.

If available, use the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you may Log In and then select the Download option.

- After that, you can complete, modify, print, or sign the Hawaii Option to Purchase Stock - Short Form.

- Every valid document template you buy is yours forever.

- To obtain an extra copy of the purchased form, navigate to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your choice.

- Examine the form details to confirm you have chosen the right template.

Form popularity

FAQ

The N11 form is a tax return form for residents of Hawaii who have simple tax situations. This form streamlines the filing process, allowing you to report your income easily. If you've exercised stock options during the year, you may need to include information related to these transactions on this form. For additional guidance, using tools from uslegalforms can simplify this process.

The traditional way of shorting involves borrowing shares from your broker and selling them in the open market. Clearly, you want the value of the stock to decline, so you can buy the shares back at a lower price. Your profit is simply the price sold minus the price purchased pretty straightforward.

The traditional way of shorting involves borrowing shares from your broker and selling them in the open market. Clearly, you want the value of the stock to decline, so you can buy the shares back at a lower price. Your profit is simply the price sold minus the price purchased pretty straightforward.

As options strategies go, shorting the stock and buying the call is very straightforward. One starts with shorting a stock in the usual manner. However, the investor also purchases a call option at the same time. The call gives the investor the right to buy the stock at a certain price during a specific time period.

A short call strategy is one of two simple ways options traders can take bearish positions. It involves selling call options, or calls. Calls give the holder of the option the right to buy an underlying security at a specified price. If the price of the underlying security falls, a short call strategy profits.

Can You Short Sell Options? Short selling involves the sale of financial instruments, including options, based on the assumption that their price will decline.

Key Takeaways. A short call is a strategy involving a call option, which obligates the call seller to sell a security to the call buyer at the strike price if the call is exercised. A short call is a bearish trading strategy, reflecting a bet that the security underlying the option will fall in price.

Rather than borrowing shares, selling them, and buying them back as you would with the standard short-selling process, you can short a stock with options. Specifically, you can use call and put options to create what is known as a synthetic short position.

Can I Short Sell Put Options? A put option allows the contract holder the right, but not the obligation, to sell the underlying asset at a predetermined price by a specific time. This includes the ability to short-sell the put option as well.

A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. If the price drops, you can buy the stock at the lower price and make a profit.