Hawaii Assignment of Partnership Interest

Description

How to fill out Assignment Of Partnership Interest?

Are you presently in a situation where you require documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding forms you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Hawaii Assignment of Partnership Interest, which are designed to meet state and federal requirements.

When you find the appropriate form, click on Purchase now.

Choose the pricing plan you prefer, submit the required information to create your account, and complete the transaction using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Assignment of Partnership Interest template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

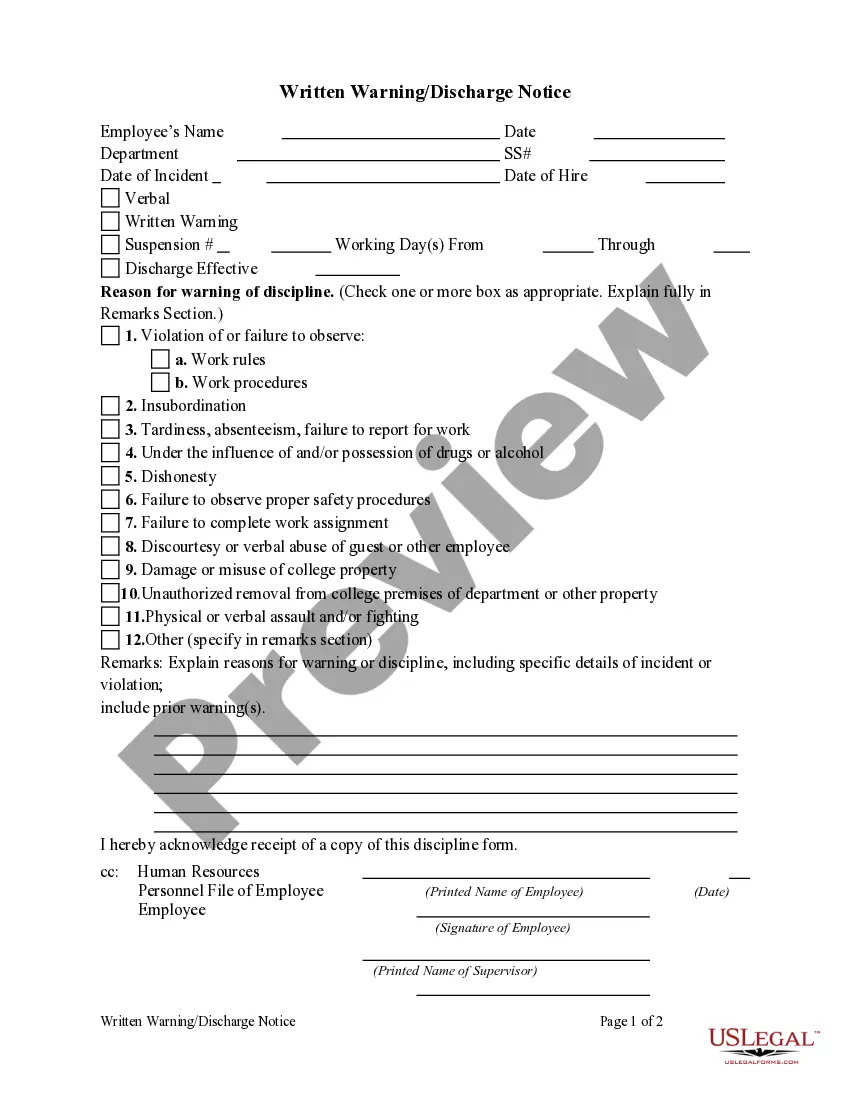

- Use the Review option to verify the form.

- Check the summary to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search bar to find the document that fits your needs.

Form popularity

FAQ

To transfer ownership interest in a partnership, the partner must execute a formal assignment agreement, which often requires consent from other partners. The agreement should detail the terms of the transfer, including any compensation. If you are considering a Hawaii Assignment of Partnership Interest, utilizing a template can streamline the process and ensure compliance.

An Assignment of partnership interest refers to the process of transferring a partner’s stake in the partnership to another party. This document outlines the rights and obligations of both the assignor and the assignee and must comply with the partnership's operating agreement. In a Hawaii Assignment of Partnership Interest, it is crucial to ensure legal adherence to local regulations.

Yes, a transfer of partnership interest is generally taxable, especially if it involves a gain. The tax implications can vary based on the nature of the asset transferred and the partnership’s activities. When handling a Hawaii Assignment of Partnership Interest, consider consulting with a tax professional to fully understand your obligations.

You report a 751 gain on your federal income tax return, generally on form 1065 if you are a partnership member. Additionally, the partnership will help you with necessary allocations of income and deductions related to the gain. If you're dealing with a Hawaii Assignment of Partnership Interest, ensure that you have the appropriate information handy to make filing seamless.

Yes, the sale of a partnership interest must be reported on Schedule K-1, which is part of form 1065. When you sell your interest in a partnership, the partnership must report your share of income, deductions, credits, and other items on this form. If you are involved in a Hawaii Assignment of Partnership Interest, this reporting is essential to ensure compliance with IRS regulations.

Yes, you can assign a partnership interest to another individual. This assignment is a way to transfer rights and obligations associated with the interest, but it typically needs the approval of the other partners as per the partnership agreement. A well-prepared Hawaii Assignment of Partnership Interest can streamline this process and protect everyone’s interests.

Yes, you can change partners in a partnership. However, the process often requires the agreement and cooperation of existing partners, as stipulated in the partnership agreement. A formal Hawaii Assignment of Partnership Interest ensures that all legal aspects of the change are recognized and documented.

In Hawaii, the partnership itself must file a partnership return if it has income, deductions, or credits. Additionally, every partner needs to report their share of the partnership income on their individual tax returns. Understanding the requirements of a Hawaii Assignment of Partnership Interest can help ensure that filings are accurate and compliant.

Yes, you can gift an interest in a partnership to another individual or entity. However, it is crucial to inform the other partners and adhere to the partnership agreement guidelines. A proper Hawaii Assignment of Partnership Interest should document the gift to maintain clarity in ownership and rights within the partnership.

Yes, you can transfer partnership interest, but it's essential to follow the guidelines set forth in the partnership agreement. Transfers typically require the consent of other partners, depending on the terms of the agreement. Completing a formal Hawaii Assignment of Partnership Interest ensures the transfer is legally recognized and protects all parties involved.