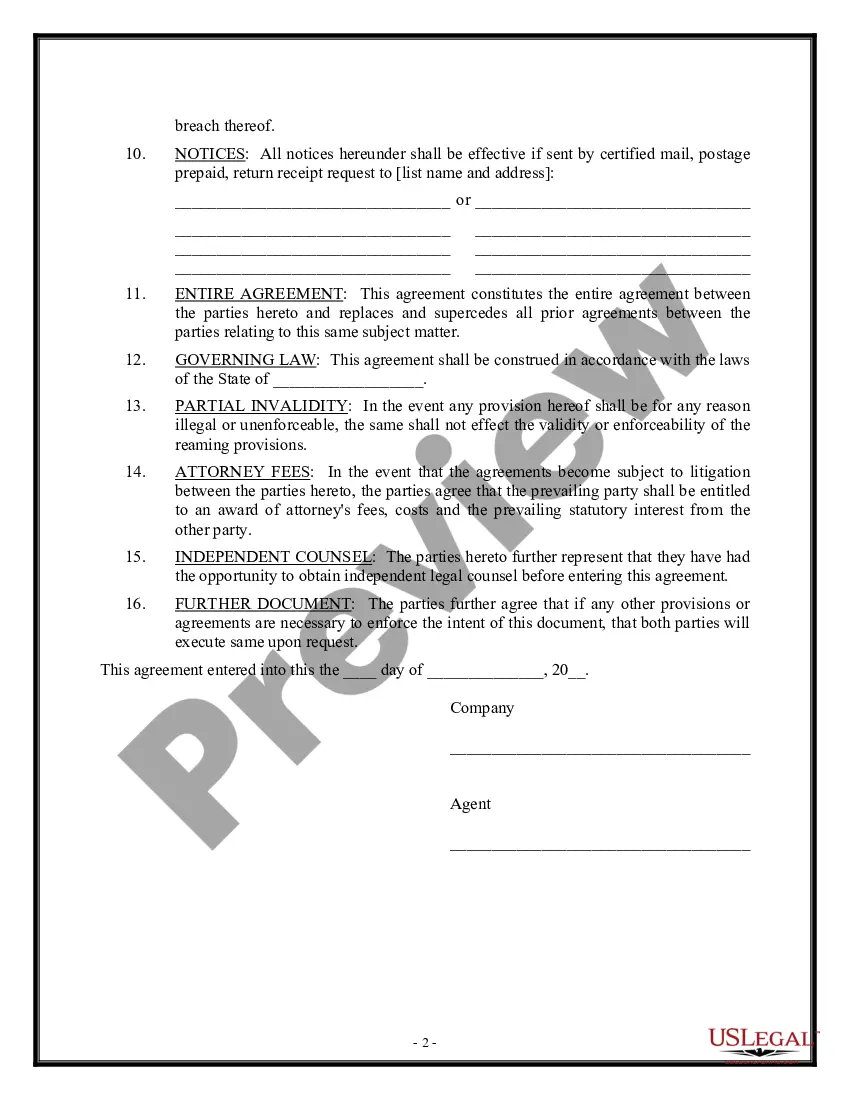

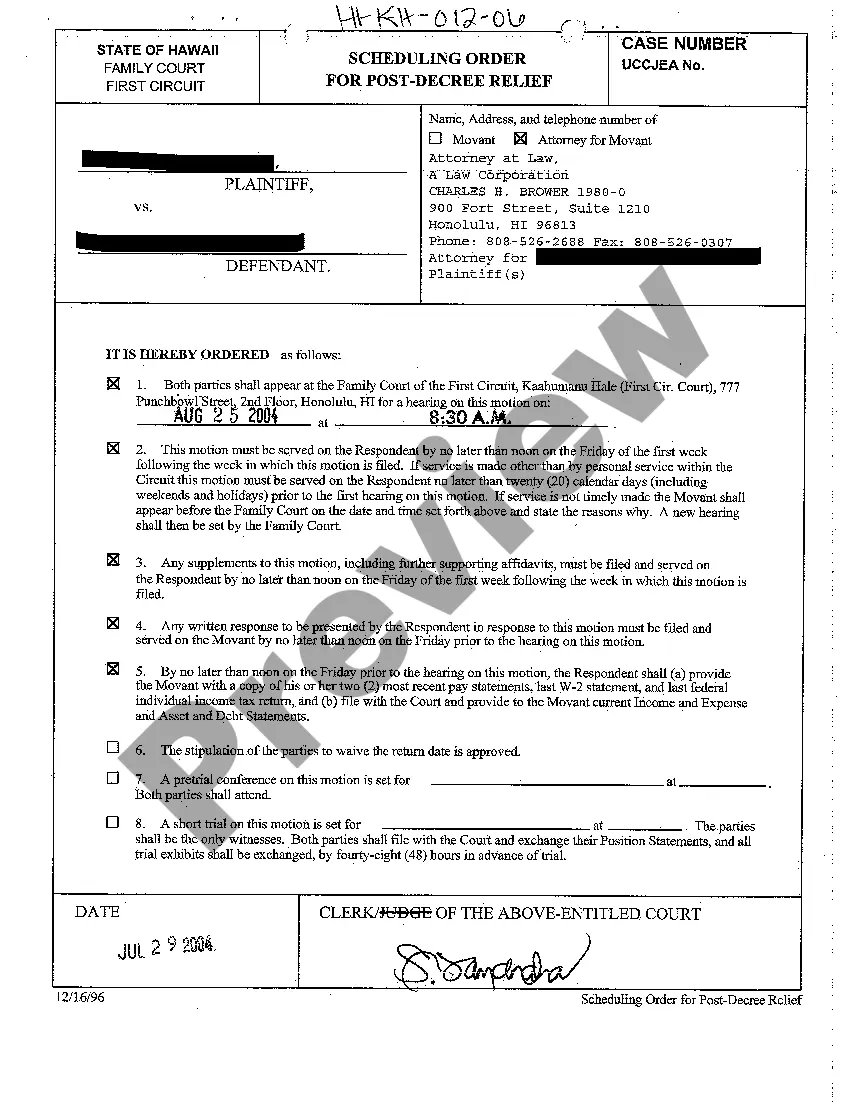

Hawaii Commission Agreement - General

Description

How to fill out Commission Agreement - General?

It is feasible to spend hours online looking for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a multitude of legal forms that have been reviewed by experts.

You can download or print the Hawaii Commission Agreement - General from their service.

In order to obtain an extra version of the form, utilize the Search box to find the template that meets your needs and preferences.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Hawaii Commission Agreement - General.

- Each legal document format you buy is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document format for the state/region of your choice.

- Review the form description to confirm you have chosen the correct type.

Form popularity

FAQ

A GE tax license is essential in Hawaii for any business that earns income from services or goods. This license allows you to collect and remit taxes effectively and ensures compliance with the Hawaii Commission Agreement - General. By obtaining this license, you demonstrate your commitment to operating within the law, which can enhance your business’s credibility.

To get a general contractor's license in Hawaii, you first need to meet specific experience and education requirements. Then, you can apply through the Hawaii Department of Commerce and Consumer Affairs. During this process, you will need to submit proof of your experience, as well as understand the requirements related to the Hawaii Commission Agreement - General to ensure compliance. Passing the necessary exams will complete your application.

Any business operating in Hawaii, including sole proprietorships, partnerships, and corporations, needs a Hawaii tax ID number. If your business is involved in receiving taxable income under the Hawaii Commission Agreement - General, this ID is crucial for reporting taxes accurately. Moreover, if you plan to hire employees, having a tax ID number is mandatory to comply with state regulations.

You can file the G49 form, which is an annual tax return for General Excise tax, through the Hawaii Department of Taxation's Online Services system. Submitting it online provides convenience and ensures timely processing under the Hawaii Commission Agreement - General. If you prefer, you can also file by mail; just make sure to adhere to the deadlines. For assistance with the filing process, uslegalforms can offer valuable resources.

Anyone earning income from business activities in Hawaii, including sole proprietors, LLCs, and corporations, needs a GE tax license. This requirement helps maintain orderly tax processes under the Hawaii Commission Agreement - General. If you are unsure whether you need one, consult with professionals or utilize uslegalforms for guidance tailored to your needs.

Yes, an LLC operating in Hawaii must obtain a GE tax license. The General Excise tax applies to the revenue generated from any business activity under the Hawaii Commission Agreement - General. This license is critical for compliance, as failing to have it may lead to penalties. Consider visiting uslegalforms for a streamlined process in obtaining your license.

If you conduct business in Hawaii, you generally need a General Excise (GE) tax license, regardless of your business structure. This requirement applies to various activities that generate income under the Hawaii Commission Agreement - General. Securing this license ensures you remain compliant with state tax regulations. You can obtain more details and instructions on uslegalforms for your specific situation.

A general services agreement is a formal document that defines the relationship and deliverables between a service provider and a client. It details the services provided, payment terms, timelines, and any other pertinent provisions. By utilizing a Hawaii Commission Agreement - General, you ensure that both parties are aligned with expectations, aiding in smoother transactions and fostering trust.

A general service agreement outlines the terms and conditions between a service provider and a client for a particular service. This document establishes expectations, responsibilities, and the scope of work. It serves as a vital reference for both parties to ensure clarity and avoid misunderstandings. When you use a Hawaii Commission Agreement - General, you gain a structured framework that benefits both the service provider and the client.

The G-45 form is used for reporting general excise tax for the current year, whereas the G-49 is utilized for annual reconciliation. Both forms play a vital role in the compliance processes for businesses under the Hawaii Commission Agreement - General. Proper filing of these forms can help maintain your good standing with state tax authorities.