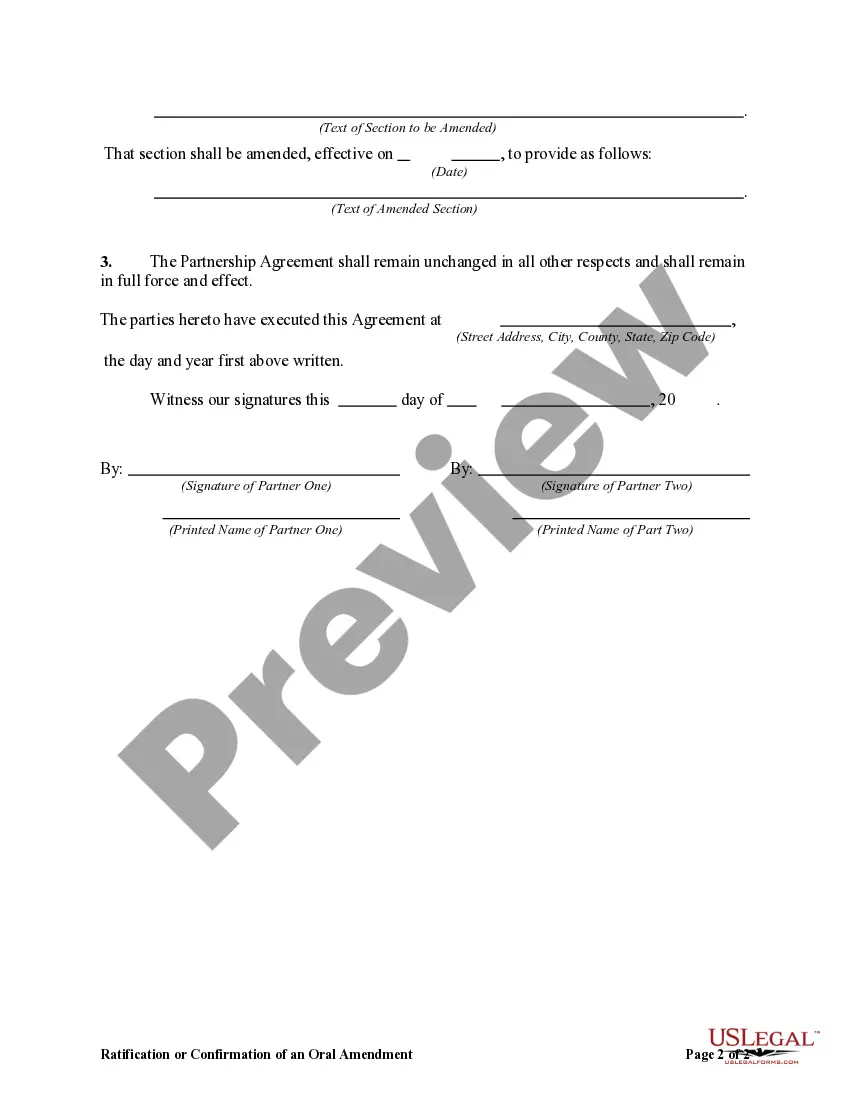

Texas Ratification or Confirmation of an Oral Amendment to Partnership Agreement

Description

How to fill out Ratification Or Confirmation Of An Oral Amendment To Partnership Agreement?

US Legal Forms - one of the largest repositories of legal templates in the United States - provides a variety of legal document formats that you can download or print.

By using the site, you can locate thousands of templates for both business and personal use, organized by categories, states, or keywords.

You will find the latest versions of documents like the Texas Ratification or Confirmation of an Oral Amendment to a Partnership Agreement within moments.

If the form does not meet your needs, use the Search box at the top of the page to find one that does.

Once satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and enter your details to register for an account.

- If you already have an account, Log In and download the Texas Ratification or Confirmation of an Oral Amendment to a Partnership Agreement from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You can access all your previously downloaded forms in the My documents section of your account.

- If you are a first-time user of US Legal Forms, here are simple steps to get started.

- Ensure you have selected the appropriate form for your area/state.

- Click the Preview button to examine the content of the form.

Form popularity

FAQ

Yes, Texas has adopted the Uniform Transfer on Death Security Registration Act. This law enhances the transfer of securities upon the death of the owner without going through probate. It is an essential component for partners in Texas, particularly if they want to ensure their investments are managed according to their wishes.

Yes, Texas has adopted the Uniform Commercial Code (UCC), which standardizes laws pertaining to commercial transactions. The UCC facilitates smooth business operations by providing a consistent legal structure. For partnerships, understanding the UCC is beneficial, especially when making amendments to agreements.

No, the Uniform Partnership Act is not law in every state, although many states utilize it to some extent. Each state may have its variations of partnership laws, which can affect how partnerships operate. It is important to review state-specific regulations, including Texas laws, for clarity on agreements.

Numerous states have adopted the Uniform Partnership Act, though specific provisions may vary. This uniformity provides a consistent legal backdrop for partnerships across those states. Understanding the nuances in each state, including Texas, is critical for partners planning amendments to their agreements.

Yes, Texas has adopted the Uniform Trade Secrets Act, providing strong protections for trade secrets. This alignment helps businesses safeguard their proprietary information from misappropriation. By adhering to these standards, Texas businesses can effectively enforce their rights concerning trade secrets.

Partnership deal is an agreement is used to form a partnership business200b.

1. Changing partners. When a new partner comes into the partner or when an existing partner leaves, you may want to amend the partnership agreement. This may be desirable to reflect new roles in the business, as well as new allocations of partnership items for tax purposes.

Do partnership agreements need to be in writing? Partnerships are unique business relationships that don't require a written agreement. However, it's always a good idea to have such a document.

A partner can be added to an existing partnership in four ways, including: New partner can purchase part of the interest of another partner. New partner can invest cash or other assets in the business. New partner can pay a bonus to existing partners by paying more than interest percentage received.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.