The Hawaii Application is a suite of software programs used by the state of Hawaii to manage and administer various services. This includes applications for licensing, registration, and tax payment, as well as applications for managing government contracts, grants, and other services. There are different types of Hawaii Application available, such as the Hawaii State Tax Office Application, the Hawaii Business Registration Application, and the Hawaii Contractor Licensing Application. The Hawaii Application suite also includes applications for filing and paying taxes, managing state reports, and managing public records. The Hawaii Application is designed to provide the state of Hawaii with an easy and secure way to manage its services and resources.

Hawaii Application

Description

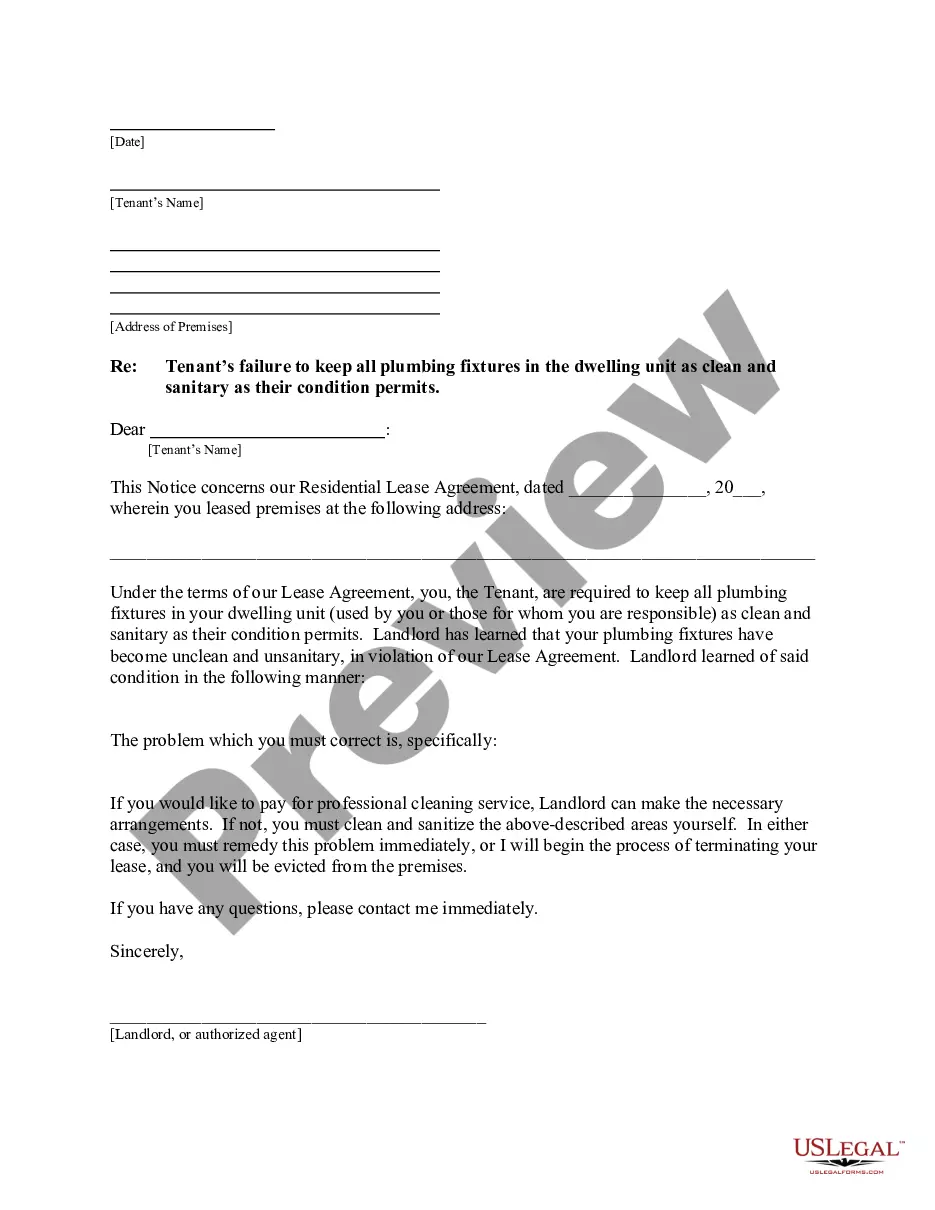

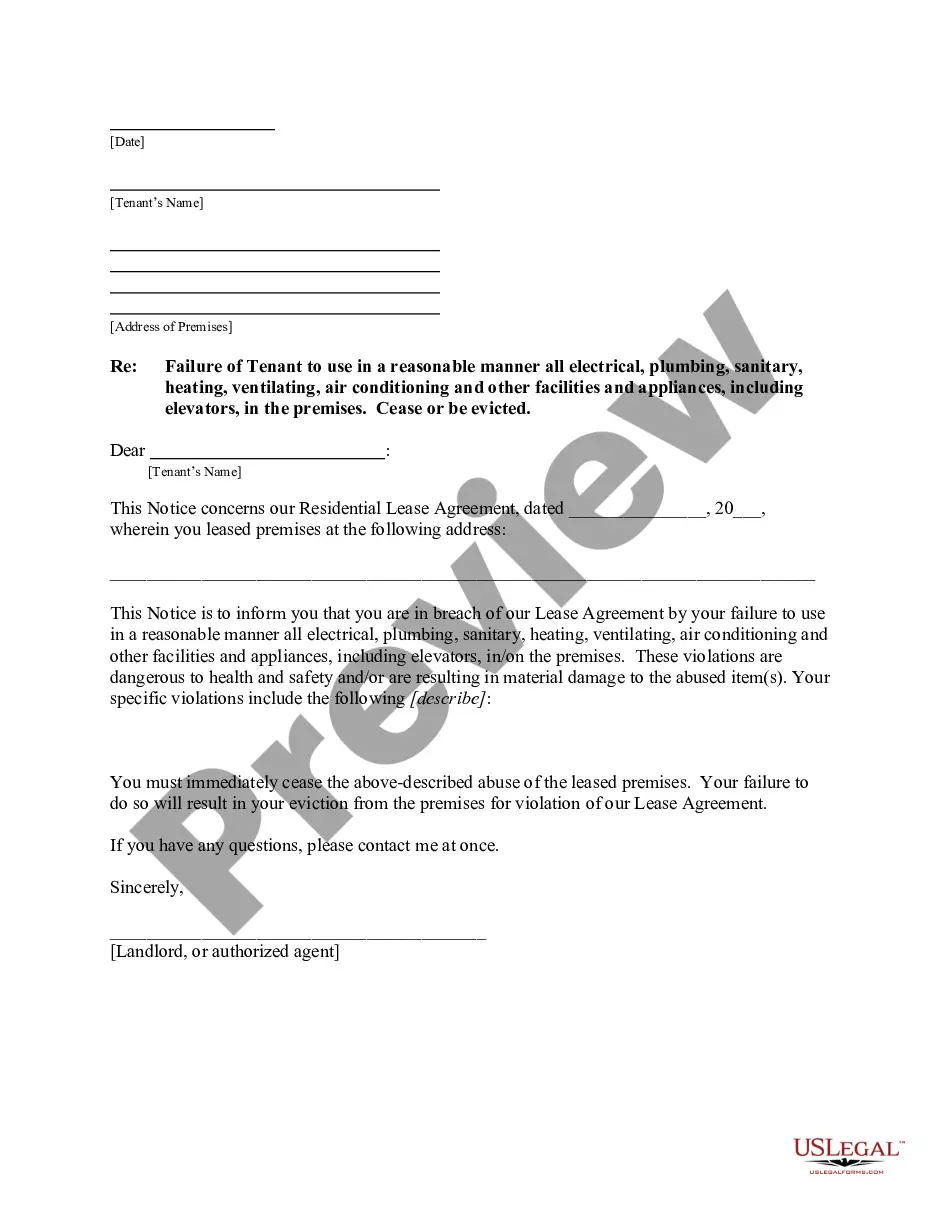

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Application?

Completing formal documents can be quite a pressure if you lack readily available fillable templates. With the US Legal Forms online library of official paperwork, you can rest assured about the forms you discover, as all are in accordance with federal and state laws and have been vetted by our specialists.

Thus, if you need to obtain your Hawaii Application, our service is the ideal place to retrieve it.

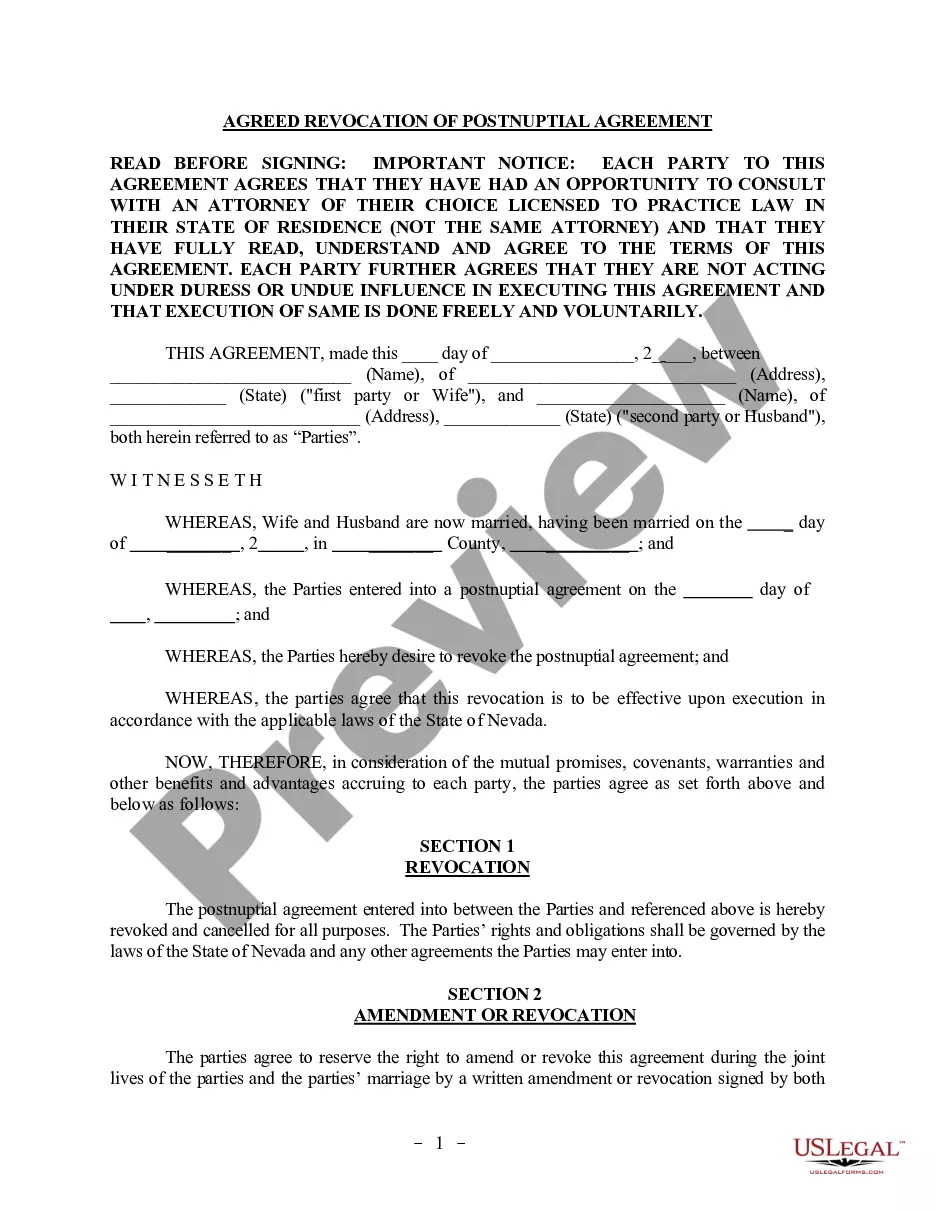

Document compliance review. You should thoroughly check the content of the form you desire and confirm whether it meets your specifications and adheres to your state law requirements. Previewing your document and examining its general overview will assist you in doing so.

- Acquiring your Hawaii Application from our catalog is as simple as 123. Previous users with an active subscription just need to Log In and click the Download button once they've located the appropriate template.

- Subsequently, if necessary, users can access the same document from the My documents section of their account.

- Alternatively, even if you are a newcomer to our service, registering with a valid subscription will only take a few moments.

- Here’s a brief guide for you.

Form popularity

FAQ

Yes, you must fill out a form to enter Hawaii. This process is essential for maintaining the state's health regulations and travel safety. The Hawaii Application simplifies this task, allowing you to provide necessary information quickly and efficiently.

Filling out a form for Hawaii helps state officials manage health and safety protocols for incoming travelers. The information you provide helps monitor the COVID-19 situation and ensure public health compliance. By submitting a Hawaii Application, you contribute to a safer travel environment for everyone.

Yes, filling out a form is necessary when flying to Hawaii. This form collects important information about your travel plans and health status. Completing the Hawaii Application ensures that you meet all requirements for entry and helps facilitate your arrival.

Yes, registering your trip to Hawaii is a good practice. While it may not be a strict requirement, it helps local authorities assist you during emergencies and enhance your travel experience. Using a Hawaii Application can help you navigate any necessary registration processes smoothly.

The income limit for CHIP Hawaii varies based on your family's size and income. Generally, it is designed to assist families with lower incomes who are seeking healthcare coverage for their children. To ensure proper assistance, you can use the Hawaii Application to check your eligibility and get more information about CHIP.

To enter Hawaii, you will need a valid government-issued photo ID, such as a passport or driver's license. Additionally, if you are traveling from another country, you may require a visa. It is also crucial to complete a Hawaii Application, which helps streamline your entry process.

All individuals, both residents and non-residents, who earn income in Hawaii are required to file a Hawaii state tax return. This includes individuals with rental income, wages from jobs, or any business earnings in the state. Utilize resources such as the uslegalforms platform to navigate this process effortlessly.

In Hawaii, non-resident property owners are subject to the same property tax rates as residents. However, property tax assessments may vary based on location and property type. Understanding these rates through your Hawaii Application can help you budget effectively.

To obtain a Hawaii tax ID number, visit the Hawaii Department of Taxation's website and complete the application process. This number is crucial for filing your taxes and is required for both residents and non-residents engaging in business activities. You can find helpful templates and guidance on platforms like uslegalforms.

Yes, if you earned income sourced from Hawaii, you need to file taxes as a non-resident. The Hawaii Application ensures that you accurately report your income and comply with state tax laws. It’s advisable to familiarize yourself with the specific requirements for non-residents.