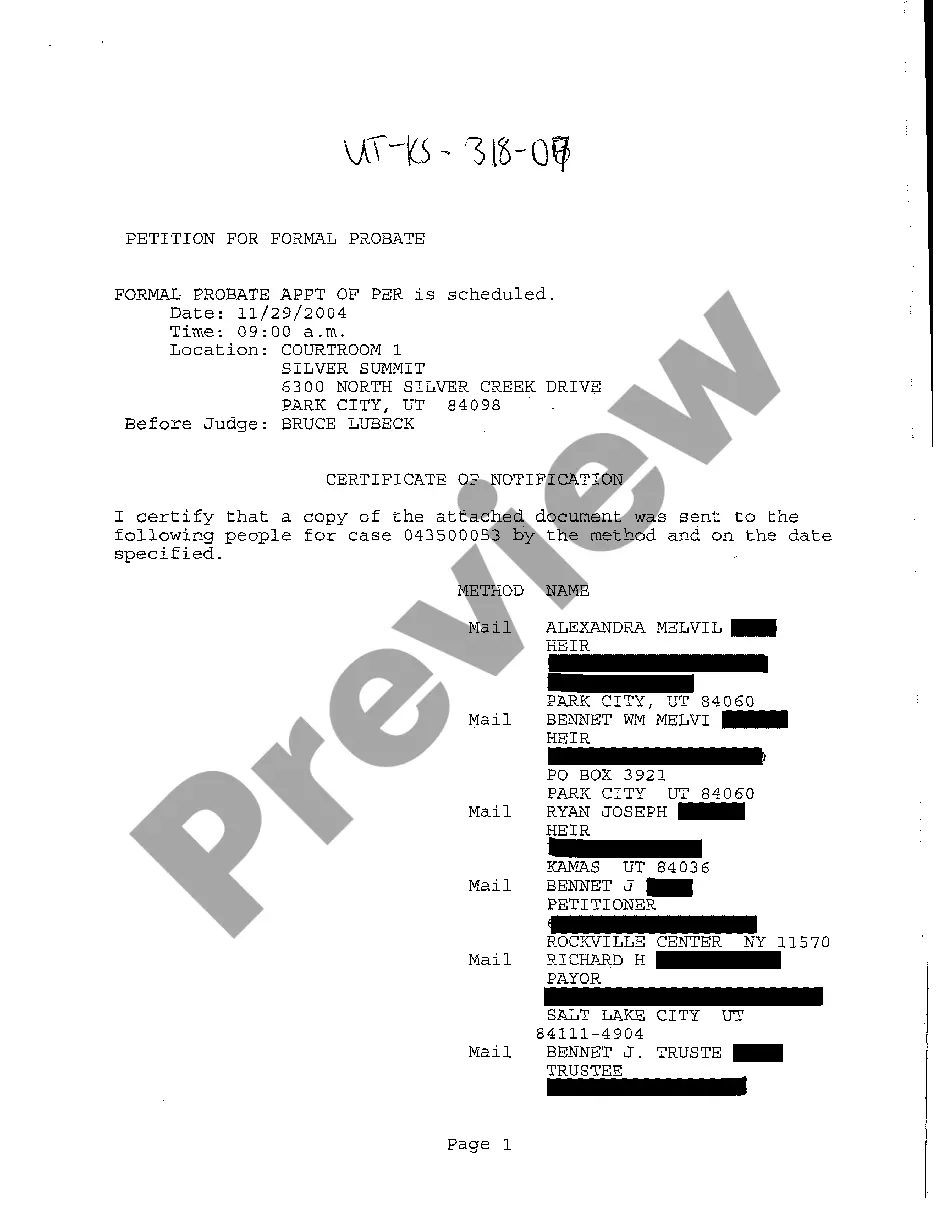

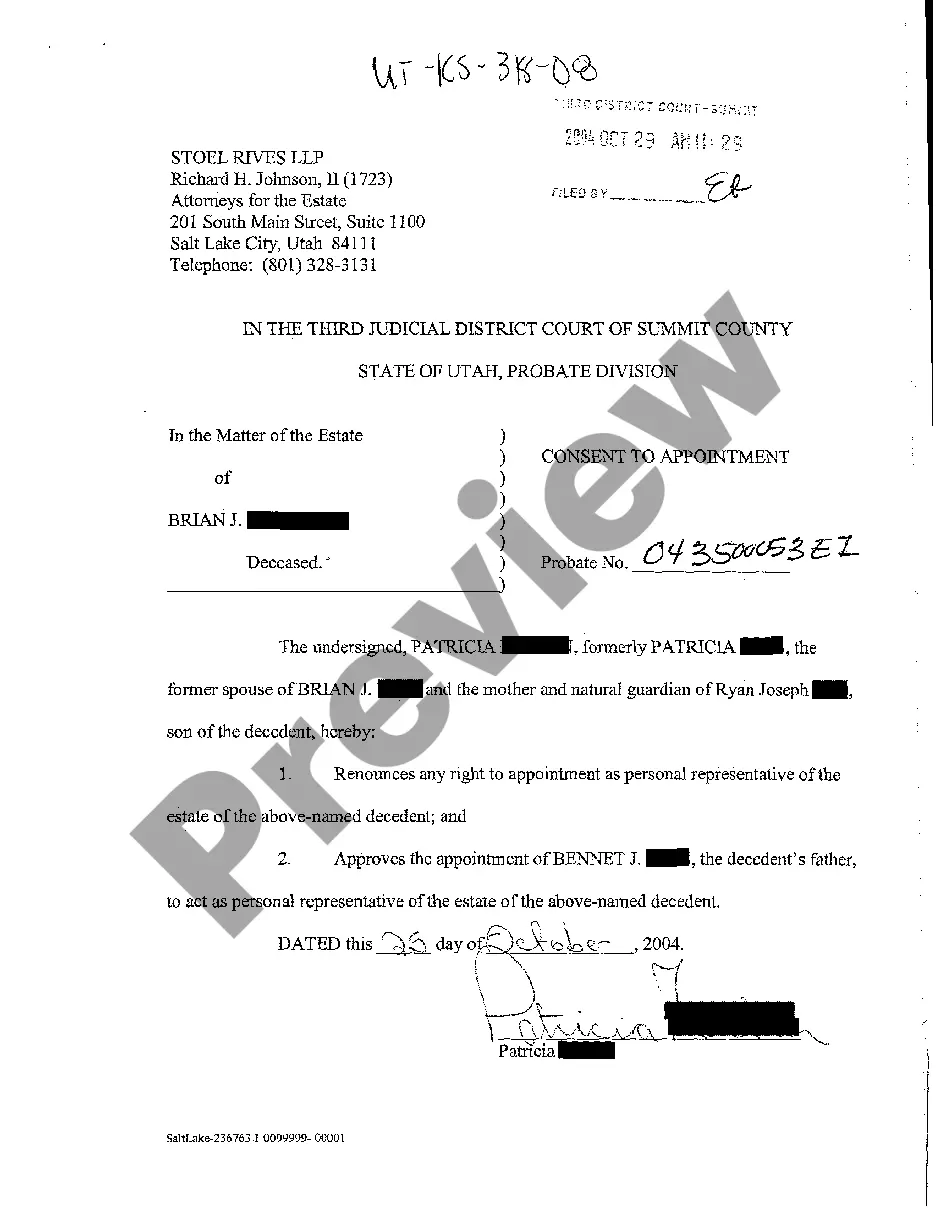

The Hawaii Release of Garnishee is an official form used in the state of Hawaii to release an employer, bank, or other financial institution from its obligation to deduct wages from an employee's paycheck or to freeze money in a bank account in order to satisfy a court judgment. The form, which must be signed by the employer, bank, or other financial institution, releases the entity from any further obligation to comply with the garnishment order. There are two types of Hawaii Release of Garnishee: an Absolute Release and a Partial Release. The Absolute Release releases the employer, bank, or other financial institution from its obligation to withhold wages or freeze funds in a bank account. The Partial Release releases the employer, bank, or other financial institution from its obligation to withhold wages or freeze funds in a bank account up to a certain amount.

Hawaii Release of Garnishee

Description

How to fill out Hawaii Release Of Garnishee?

Drafting official documents can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the forms you discover, as all of them adhere to federal and state guidelines and are validated by our professionals.

Acquiring your Hawaii Release of Garnishee from our collection is as simple as 1-2-3. Previously registered users with an active subscription need merely Log In and click the Download button once they locate the correct template. Subsequently, if necessary, users can utilize the same blank from the My documents section of their account.

Haven't you explored US Legal Forms yet? Register for our service today to acquire any formal document swiftly and effortlessly whenever you require, and maintain your paperwork organized!

- Document compliance verification. You should carefully review the content of the form you desire and verify whether it meets your requirements and complies with your state regulations. Previewing your document and assessing its general description will assist you in doing just that.

- Alternative search (optional). If there are any discrepancies, search the library using the Search tab at the top of the page until you find a suitable blank, and click Buy Now once you identify what you need.

- Account setup and form purchase. Establish an account with US Legal Forms. After account confirmation, Log In and select your desired subscription plan. Process a payment to proceed (both PayPal and credit card options are offered).

- Template download and subsequent usage. Choose the file format for your Hawaii Release of Garnishee and click Download to save it on your device. Print it to complete your paperwork manually, or utilize a comprehensive online editor to create an electronic version more quickly and efficiently.

Form popularity

FAQ

A judgment in Hawaii will last for ten years unless it is renewed or satisfied. Creditors can take collection actions during this time, which may include wage garnishment. Understanding the longevity of a judgment can help you plan your financial recovery and explore options such as the Hawaii Release of Garnishee to regain control over your finances. It's advisable to monitor judgments closely and act within the designated time frame.

In Hawaii, a judgment does not automatically fall off after seven years; it lasts for ten years. Creditors have the right to enforce the judgment during this period, impacting your financial situation. After ten years, you may be eligible for a Hawaii Release of Garnishee, as the judgment could no longer be enforced. Keeping track of this timeline can assist you in aiming for financial freedom.

To garnish wages in Hawaii, a creditor must obtain a judgment against you and file a wage garnishment order with the court. This process requires proper legal documentation and typically involves notifying your employer. It's important to understand your rights in this situation, as you may have options for a Hawaii Release of Garnishee to contest or limit the garnishment. Legal platforms like USLegalForms can streamline this process and guide you through necessary steps.

In Hawaii, the maximum amount that can be garnished from your paycheck is 25% of your disposable earnings. However, if your disposable income falls below a certain threshold, less can be garnished, ensuring you still have funds for living expenses. Understanding these limits is crucial, especially if you are facing wage garnishment due to debts. You may also want to consider exploring the options for a Hawaii Release of Garnishee if applicable.

A default judgment in Hawaii lasts for ten years, similar to other judgments. If you fail to respond to a lawsuit, creditors may obtain a default judgment, allowing them to garnish your wages or take other collection actions. After the ten-year mark, creditors cannot enforce the judgment any longer, leading to possible eligibility for a Hawaii Release of Garnishee. Being aware of this can aid in planning your financial recovery.

A judgment in Hawaii typically lasts for ten years from the date it is entered. This implies that creditors can seek enforcement of the judgment during this period, potentially impacting your finances even after the debt may feel old. After ten years, you might be able to seek a Hawaii Release of Garnishee, as the judgment expires and can no longer be enforced. Understanding this timeframe can help you manage your debts better.

In Hawaii, a debt generally becomes uncollectible after a period of six years from the date of the last payment or acknowledgment. This is essential to understand as it usually marks the end of the creditor's ability to seek enforcement through legal action. However, if a judgment has been obtained, different rules may apply. Knowing the timeline can help you navigate options like the Hawaii Release of Garnishee more effectively.

The federal rule for writ of garnishment is governed by the Federal Rules of Civil Procedure, specifically Rule 69. This rule outlines the procedures creditors must follow to obtain garnishment from employers or financial institutions. Many states, including Hawaii, have their own specific rules complementing federal guidelines. If you encounter garnishment issues, understanding these regulations can impact how you utilize the Hawaii Release of Garnishee effectively.

Yes, it is possible for someone to garnish your wages without your prior knowledge. Typically, a creditor files a court motion for a writ of garnishment, and you are notified only after the court issues it. Receiving notification about the Hawaii Release of Garnishee could come as a surprise; therefore, staying informed about your financial obligations is crucial.

In Hawaii, you generally have two years from the date of the incident or injury to file a lawsuit. However, this timeframe can vary based on the type of case. It’s important to act promptly, as missing the deadline may prevent you from seeking the Hawaii Release of Garnishee. Consult a qualified attorney to ensure you meet all necessary deadlines.