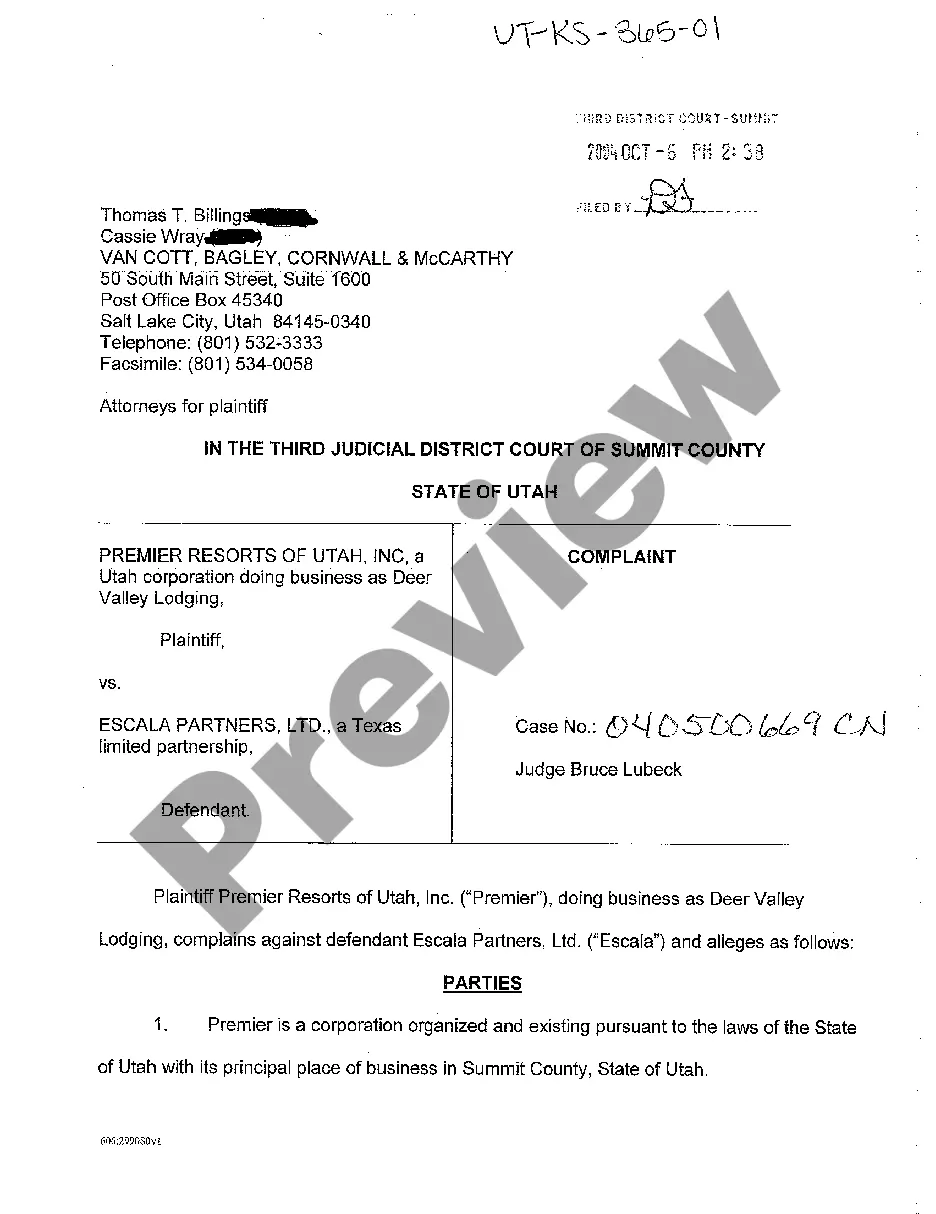

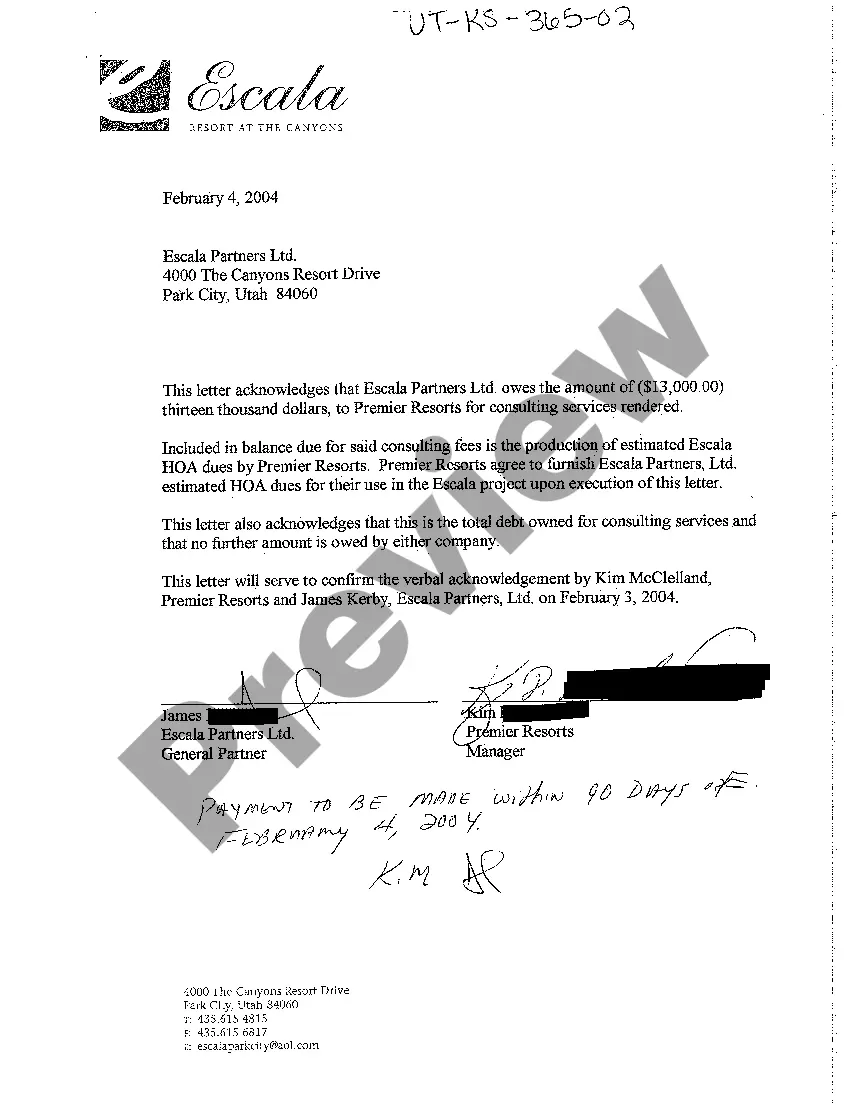

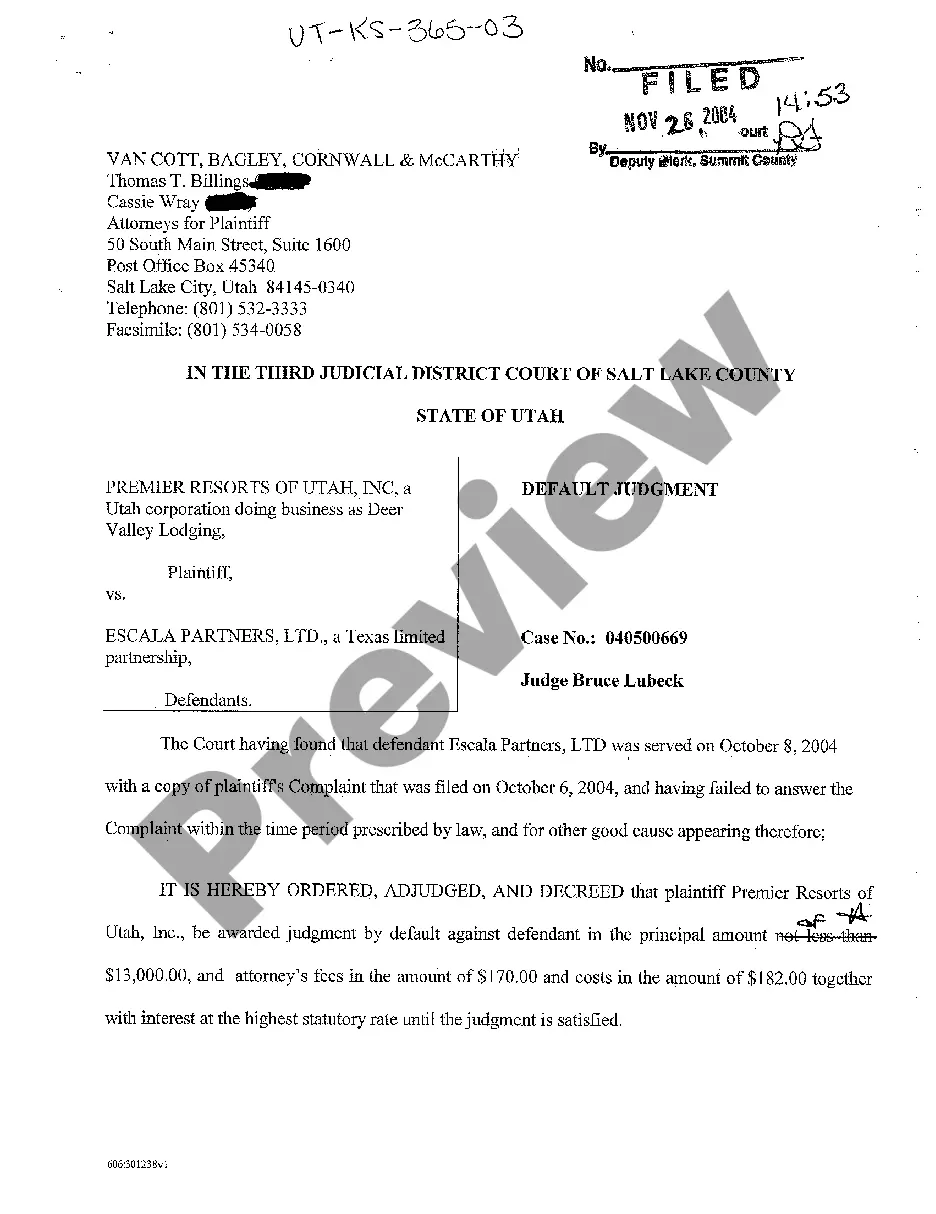

Hawaii Release of Garnishee is a court-ordered document that is required for a creditor to release funds from a debtor's bank or wage account. The creditor must obtain a court order from the court to be able to garnish or seize the debtor’s wages or bank account. The Hawaii Release of Garnishee form must then be filled out and submitted to the financial institution. The form requires the name of the debtor, creditor, court, and amount of money being released. There are two types of Hawaii Release of Garnishee forms: a Wage Garnishment Release and a Bank Account Garnishment Release. The Wage Garnishment Release is used when the creditor is seeking to release funds from the debtor’s wages, while the Bank Account Garnishment Release is used when the creditor is seeking to release funds from the debtor’s bank account.

Hawaii Release of Garnishee

Description

How to fill out Hawaii Release Of Garnishee?

How much duration and resources do you generally allocate for composing formal documentation.

There's a superior opportunity to acquire such forms than employing legal professionals or squandering hours searching the internet for an appropriate template. US Legal Forms is the premier online repository that provides professionally crafted and validated state-specific legal documents for any purpose, such as the Hawaii Release of Garnishee.

Another benefit of our library is that you can retrieve previously purchased documents, which you securely store in your profile under the My documents tab. Access them at any time and redo your paperwork as many times as you require.

Conserve time and effort while preparing legal documentation with US Legal Forms, one of the most reliable online services. Register with us today!

- Examine the form content to ensure it complies with your state regulations. To do this, review the form description or make use of the Preview option.

- If your legal template does not satisfy your needs, find another one using the search tab located at the top of the page.

- If you are already a member of our service, Log In and download the Hawaii Release of Garnishee. If not, proceed to the subsequent steps.

- Click Buy now once you discover the suitable document. Select the subscription plan that best fits your needs to access the full capabilities of our library.

- Create an account and complete the payment for your subscription. You can pay with your credit card or through PayPal - our service is completely dependable for that.

- Download your Hawaii Release of Garnishee onto your device and complete it either on a printed hard copy or electronically.

Form popularity

FAQ

To garnish wages in Hawaii, you must first obtain a court judgment against the debtor. Following this, you would file a request for a writ of garnishment with the court. This process may seem daunting, but tools and resources from US Legal Forms can guide you through obtaining a Hawaii Release of Garnishee and help you understand each step involved.

While you can technically garnish wages without a lawyer, having legal assistance can significantly streamline the process. Lawyers can help ensure all paperwork is properly completed and filed, reducing the likelihood of errors or delays. Using legal resources or platforms such as US Legal Forms can also help you understand the procedure for obtaining a Hawaii Release of Garnishee without needing a lawyer.

A release of writ of garnishment is a legal document that ends the garnishment of wages or assets after the debt obligation has been satisfied. This release can provide peace of mind, allowing the debtor to regain control of their earnings. If you need assistance in navigating this process, consider platforms that offer insights on the Hawaii Release of Garnishee.

Garnishing someone's wages can be a straightforward process, but it does require legal steps. Creditors must secure a judgment before initiating garnishment, and the process may involve paperwork and court hearings. Utilizing resources like US Legal Forms can simplify your understanding of the necessary steps in obtaining a Hawaii Release of Garnishee.

In Hawaii, the maximum amount that can be garnished from your wages is limited by both state and federal laws. Generally, creditors can garnish up to 25% of your disposable earnings or the amount by which your weekly income exceeds 30 times the federal minimum wage, whichever is less. Understanding these limits is crucial when dealing with a Hawaii Release of Garnishee.

Deciding whether to sue someone for $500 depends on various factors, including your time, effort, and potential legal fees. While it is possible to pursue small claims, you may want to weigh the benefits versus the costs involved. The Hawaii Release of Garnishee could offer insights into how to handle small disputes effectively. If you feel the case is unfairly impacting you, exploring your options might still be worthwhile.

In Hawaii, a writ of garnishment can be filed by a creditor seeking to collect a debt from a debtor's wages or bank accounts. Generally, you must have a valid judgment against the debtor before initiating this process. If you are unsure how to approach garnishment, using resources like US Legal Forms can simplify the process. They provide the necessary forms and instructions to help you navigate the garnishment process smoothly.

In Hawaii, you can technically sue for any amount, including very small sums. However, practical considerations suggest that pursuing claims for amounts less than $500 might not be worth your time and effort, given legal fees and court costs. It’s essential to assess the potential outcomes before proceeding. For small claims, look into the Hawaii Release of Garnishee for guidance on how to manage your case effectively.

Yes, you can sue for emotional distress in Hawaii, but your claim generally needs to meet specific legal standards. To be successful, you must demonstrate that you suffered significant emotional trauma due to another party's actions. Additionally, understanding the nuances of these claims often requires legal insight, so you may consider utilizing a platform like US Legal Forms for assistance with necessary documentation related to your case. They can guide you through the process effectively.

In Hawaii, the general statute of limitations for filing a lawsuit is two years for personal injury cases, but it can vary depending on the type of claim. It's crucial to understand these deadlines, as missing them can forfeit your ability to sue. For specific guidance related to your situation, reviewing resources on the Hawaii Release of Garnishee can be beneficial. You might also find it helpful to consult with a legal professional.