Hawaii Trustee — Authorize Supplemental Distribution (Motion) is an action taken by a Trustee to distribute additional funds to the beneficiaries of a trust. This motion is typically used in situations where the Trustee deems it necessary to provide additional funds to the trust's beneficiaries beyond the amount provided in the original trust documents. The motion must be approved by the court. There are two types of Hawaii Trustee — Authorize Supplemental Distribution (Motion): 1. Diversionary Supplemental Distribution Motion: This motion is used in cases where the Trustee wishes to provide additional funds to the beneficiaries of a trust after all the trust's assets have been distributed. 2. Interim Supplemental Distribution Motion: This motion is used in cases where the Trustee wishes to provide additional funds to the beneficiaries of a trust before all the trust's assets have been distributed.

Hawaii Trustee - Authorize Supplemental Distribution (Motion)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Trustee - Authorize Supplemental Distribution (Motion)?

Drafting legal documents can be a significant source of tension if you lack accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the templates you discover, as they all adhere to federal and state laws and are authenticated by our experts.

Thus, if you need to finalize Hawaii Trustee - Authorize Supplemental Distribution (Motion), our platform is the ideal place to retrieve it.

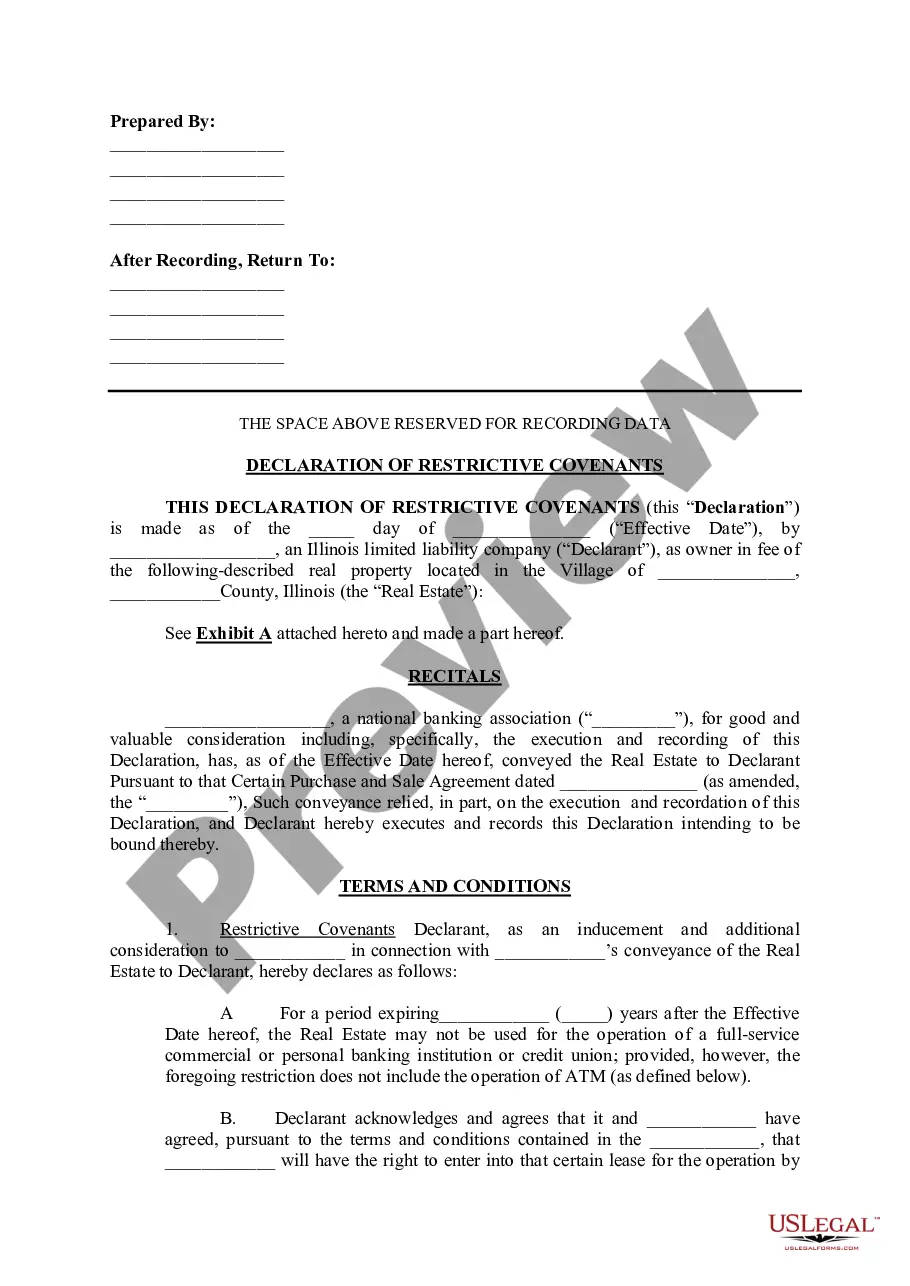

Here is a quick reference for you: Document compliance review. You should thoroughly inspect the contents of the template you seek to determine whether it fulfills your requirements and complies with your state’s legal standards. Previewing your document and assessing its general description will assist you in achieving that.

- Acquiring your Hawaii Trustee - Authorize Supplemental Distribution (Motion) from our collection is as simple as 1-2-3.

- Users who have been previously authorized and possess a valid subscription only need to Log In and press the Download button after locating the appropriate template.

- Later, should they wish to, users can access the same blank from the My documents section of their account.

- Nonetheless, even if you are unfamiliar with our service, registering with a valid subscription will only require a few minutes.

Form popularity

FAQ

Rule 42 in the Hawaii probate context provides guidelines on the appointment of personal representatives and their duties. It emphasizes transparency and the protection of all estate assets and beneficiaries. Familiarity with this rule is beneficial when dealing with matters such as Hawaii Trustee - Authorize Supplemental Distribution (Motion), thereby ensuring proper handling of all assets.

Rule 50 in Hawaii's probate law outlines the requirements for filing a petition for the final distribution of an estate. This rule ensures that all creditors are addressed and that beneficiaries receive their rightful share in a timely manner. Understanding this is crucial when managing a Hawaii Trustee - Authorize Supplemental Distribution (Motion) to ensure compliance and avoid potential disputes.

In Hawaii, you typically have three years from the date of death to file for probate. However, it is advisable to begin the process sooner to avoid complications related to the estate. If you are navigating issues like Hawaii Trustee - Authorize Supplemental Distribution (Motion), timely filing can clarify and expedite the process.

Rule 48 in Hawaii pertains to the rules governing the administration of trusts and estates. It sets forth the procedures for handling supplemental distributions and ensures that all distributions are consistent with the wishes of the deceased. This rule is especially relevant when dealing with complex scenarios such as Hawaii Trustee - Authorize Supplemental Distribution (Motion).

You should mail your Hawaii Form N-15 to the address provided in the instructions section of the form itself. It's vital to check the latest guidelines as addresses may change. When submitting your form related to Hawaii Trustee - Authorize Supplemental Distribution (Motion), ensure you follow the instructions carefully to avoid delays.

To mail your Hawaii Form N-15, you should send it to the Department of Taxation at the specific address mentioned in the instructions on the form. Ensure you include all necessary documents and signatures. Using the correct mailing address ensures timely processing of your form, especially when dealing with matters like Hawaii Trustee - Authorize Supplemental Distribution (Motion).

Trustees typically have the authority to change distributions, but they must act in accordance with the trust document. Changes often require valid reasons and should align with the best interests of the beneficiaries. To navigate these complex situations, utilizing resources like Hawaii Trustee - Authorize Supplemental Distribution (Motion) through our platform can be invaluable. Our solutions help trustees and beneficiaries alike understand their rights and responsibilities clearly.

Yes, a beneficiary can sue a trustee if they believe the trustee is not following the terms of the trust. Such legal actions often seek to compel the trustee to make a distribution as outlined in the trust agreement. If you need guidance on this process, consider exploring the Hawaii Trustee - Authorize Supplemental Distribution (Motion) options available through our platform. We provide tools that simplify the legal steps and help ensure your rights are protected.

In Hawaii, a trustee must notify beneficiaries promptly after the trust becomes irrevocable. Legally, this notification should typically occur within a reasonable time frame, often within 60 days. By utilizing the Hawaii Trustee - Authorize Supplemental Distribution (Motion), trustees can ensure that they adhere to the timeline and effectively communicate with beneficiaries, keeping everyone informed about their rights and interests.

Filling out form 1041 requires accurate information about the estate’s income, deductions, and distributions. For Hawaii Trustees, it is important to include all relevant details regarding distributions made under the Hawaii Trustee - Authorize Supplemental Distribution (Motion). You can refer to resources available on the US Legal Forms platform for guidance, ensuring correct compliance when dealing with fiduciary responsibilities.