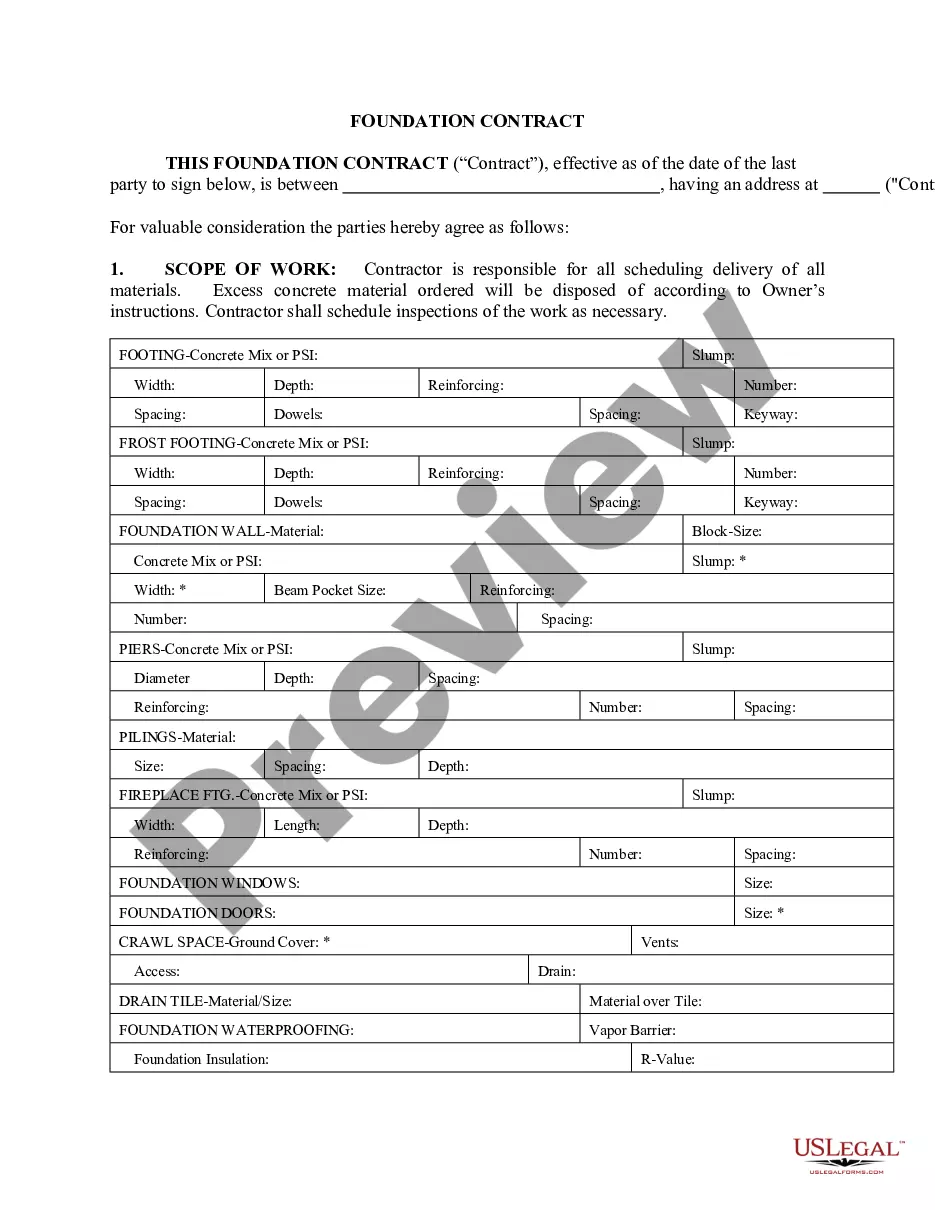

Hawaii Schedule J Your Expenses is a form required for filing Hawaii state income taxes. It is used to report any itemized deductions you may be entitled to, such as charitable contributions, medical expenses, and other qualified expenses. It is important to note that you cannot claim any deductions that exceed the standard deduction. There are two types of Hawaii Schedule J Your Expenses: Schedule J-1 and Schedule J-2. Schedule J-1 is used to report itemized deductions for individuals, while Schedule J-2 is used for married couples filing jointly. On each form, you will need to report the total amount of each deduction, along with any applicable supporting documents.

Hawaii Schedule J Your Expenses

Description

How to fill out Hawaii Schedule J Your Expenses?

Drafting legal documents can be a significant hassle if you lack accessible fillable templates. With the US Legal Forms digital library of official paperwork, you can trust the forms you receive, as all of them adhere to federal and state standards and are verified by our experts.

Obtaining your Hawaii Schedule J Your Expenses from our collection is as easy as 1-2-3. Previously registered users with an active subscription need only Log In and hit the Download button after locating the correct template. Later, if they wish, users can access the same form from the My documents section of their account.

Haven't you experienced US Legal Forms yet? Register for our service today to acquire any official document swiftly and easily whenever you need it, and keep your paperwork organized!

- Document compliance evaluation. You should meticulously examine the content of the form you require to ensure it meets your needs and adheres to your state law stipulations. Previewing your document and reviewing its general outline will assist you in doing just that.

- Alternative search (optional). If you encounter any discrepancies, navigate the library using the Search tab at the top of the page until you find a suitable template, and click Buy Now once you identify the desired one.

- Account setup and form acquisition. Establish an account with US Legal Forms. After your account is verified, Log In and select your desired subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and additional usage. Select the file format for your Hawaii Schedule J Your Expenses and click Download to save it on your device. Print it to fulfill your paperwork manually, or utilize a feature-rich online editor to create an electronic version more quickly and effectively.

Form popularity

FAQ

The Schedule J form is a tax document used in Hawaii to report allowable expenses tied to income. This form enables taxpayers to detail their expenses accurately, thus reducing their overall taxable income. The Hawaii Schedule J Your Expenses is crucial for ensuring compliance with state tax regulations while maximizing potential refunds or reducing liabilities. Using uslegalforms can streamline your experience in completing the Schedule J form, making tax time less stressful.

Yes, investment expenses can be deductible in Hawaii, but there are specific guidelines that you need to follow. Expenses related to producing taxable income are often eligible, depending on how they relate to your investments. To fully comprehend the deductions available to you, it's important to review the Hawaii Schedule J Your Expenses carefully. Additionally, uslegalforms can assist you in navigating these deductions, ensuring you take full advantage of what you are entitled to.

Schedule J income refers to the earnings from various sources, including wages, business income, and certain types of investment returns, as recorded on the Hawaii Schedule J Your Expenses form. This form helps taxpayers determine eligible expenses and calculate their net income accurately. By utilizing Schedule J, individuals can benefit from a clearer understanding of their overall financial picture, ensuring they make informed decisions. Therefore, consider using uslegalforms to help simplify the process of managing your Schedule J income.

Schedule J is a tax form that helps you report your farming income and expenses, specifically for farmers and agricultural producers. It allows you to calculate your average annual income and the detailed expenses incurred during the tax year, aiding you in maintaining accurate records. If you need help with filling out your Hawaii Schedule J Your Expenses, consider using USLegalForms—our platform simplifies the process and provides easy access to necessary forms and information.

Hawaii does not generally allow a moving expense deduction for most taxpayers. However, certain members of the military can deduct moving expenses under specific conditions. To understand how this might affect your Hawaii Schedule J Your Expenses, it’s best to consult a tax professional familiar with state regulations. For detailed assistance, USLegalForms can guide you through the nuances of moving expenses and other financial planning.

In Hawaii, you can deduct qualified medical expenses on your Hawaii Schedule J Your Expenses, but only if you itemize your deductions. This deduction can cover various expenses, including insurance premiums, doctor visits, and prescription medications. However, these expenses must exceed a certain percentage of your adjusted gross income to qualify. By taking advantage of this deduction, you may lower your overall tax burden and retain more of your income for essential needs.

In Hawaii, certain pensions are not subject to state income tax, primarily for retired government employees and some military pensions. This means that if you receive a qualifying pension, you may report it on your Hawaii Schedule J Your Expenses without worrying about state taxes. This exemption can provide significant financial relief and allow retirees to stretch their retirement savings further. Always consult the latest tax guidelines to understand how these exemptions apply to your specific situation.

The standard deduction in Hawaii varies based on filing status and is adjusted annually. For most taxpayers, claiming the standard deduction simplifies the filing process and allows you to avoid itemizing deductions on your Hawaii Schedule J Your Expenses. This can save you time and effort while ensuring that you're still entitled to significant tax relief. Always check the latest updates, as these amounts may change.

Yes, Hawaii does allow itemized deductions, which you can detail on your Hawaii Schedule J Your Expenses. These deductions can include various expenses like mortgage interest, property taxes, and charitable donations. By itemizing your deductions, you may reduce your taxable income, potentially leading to a lower tax bill. It's essential to compare the benefits of itemizing with the standard deduction to determine the best option for your situation.