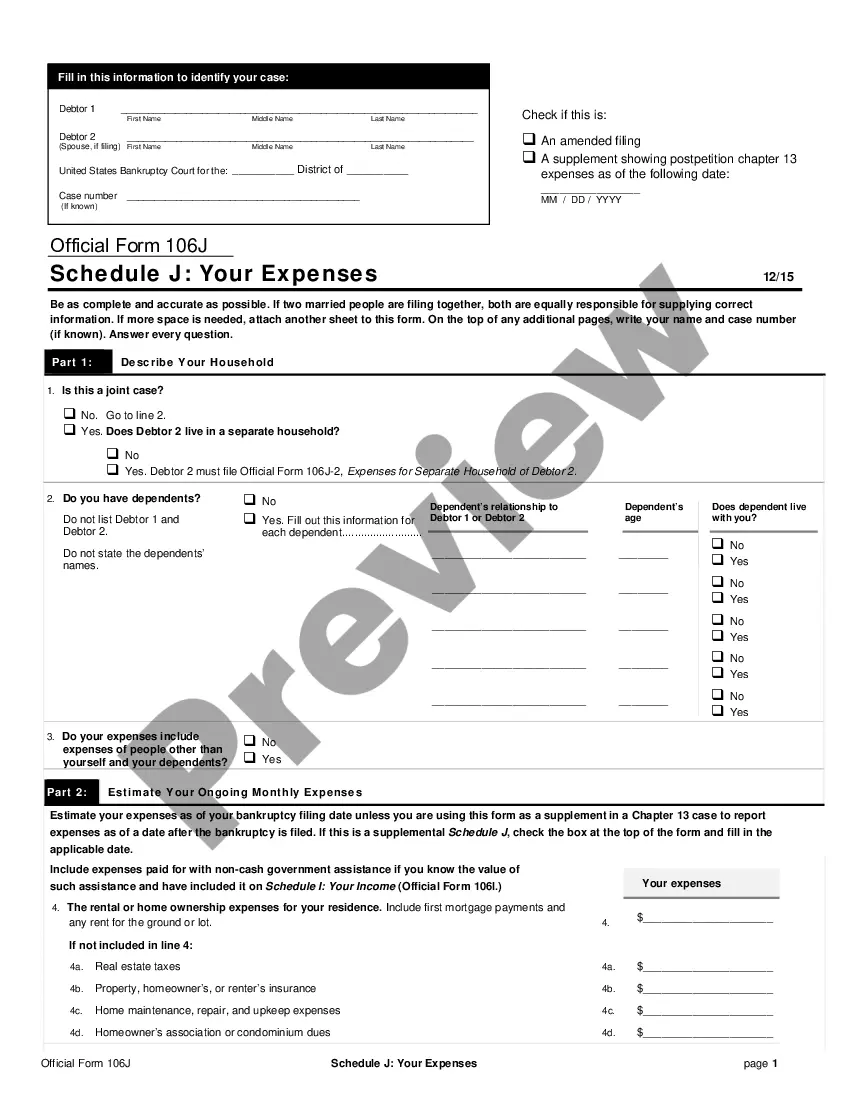

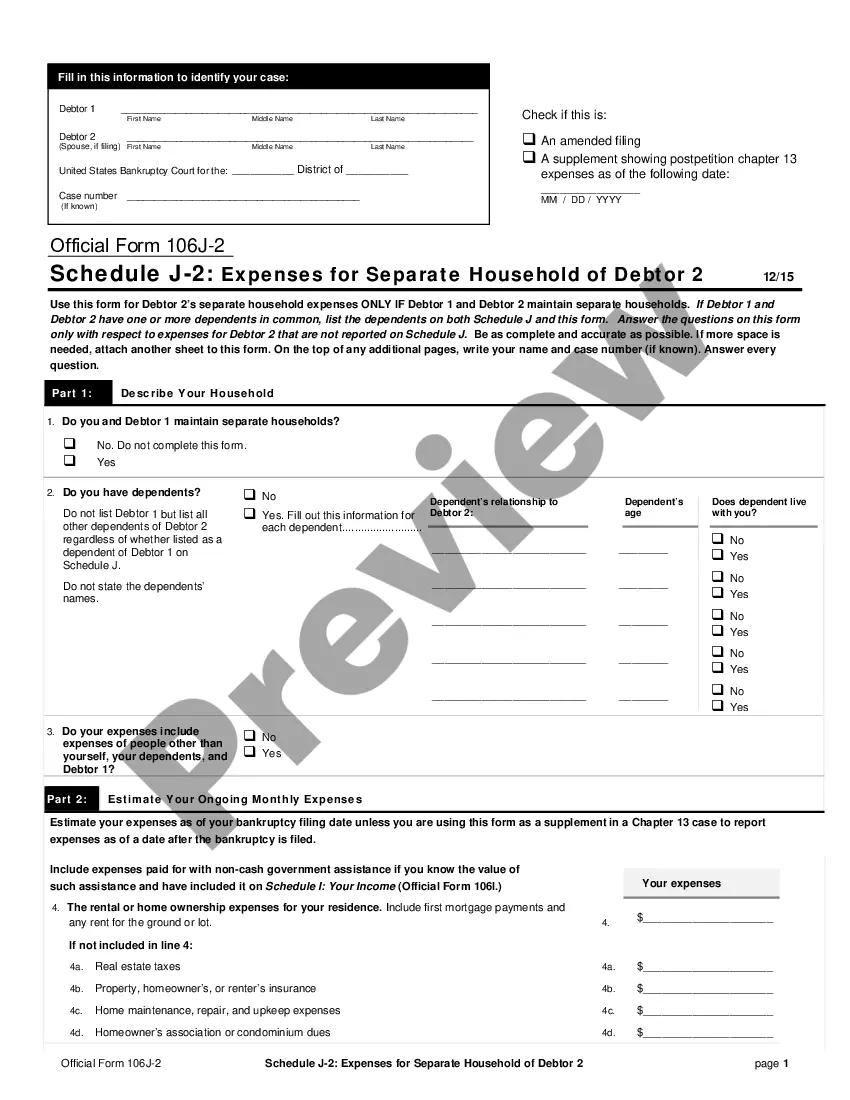

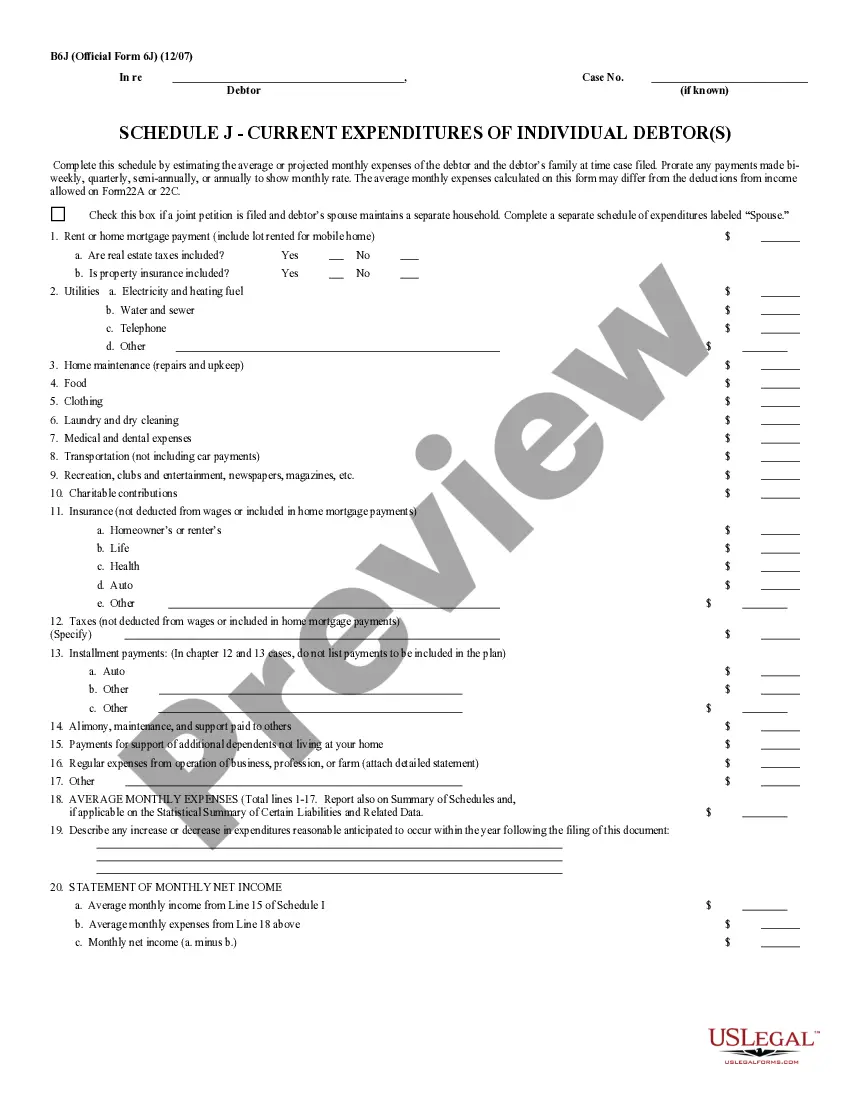

Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2 is a form used in the Bankruptcy Court of the District of Hawaii for filing a Chapter 7 or Chapter 13 bankruptcy petition. The form is used to identify and list the expenses that Debtor 2 (the debtor who is living in a separate household) incurs in the maintenance and support of his/her household. The form is divided into two sections: the first section is for "Current Monthly Expenses" and the second section is for "Additional Expenses". The "Current Monthly Expenses" section requires the debtor to list all of his/her current monthly expenses, such as housing expenses (rent/mortgage, insurance, taxes, etc.), utilities (electricity, gas, water, etc.), food/groceries, clothing, medical expenses, transportation, and other miscellaneous expenses. The "Additional Expenses" section requires the debtor to list any additional expenses that he/she may have, such as childcare, alimony/spousal support, educational expenses, and other expenses related to the maintenance and support of his/her household. There are three types of Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2: one for Chapter 7 bankruptcies, one for Chapter 13 bankruptcies, and one for both Chapter 7 and Chapter 13 bankruptcies.

Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2

Description

How to fill out Hawaii Schedule J-2: Expenses For Separate Household Of Debtor 2?

If you’re seeking a method to suitably finalize the Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2 without engaging a legal professional, then you’re exactly in the right place.

US Legal Forms has established itself as the largest and most credible resource for formal documents suited for every personal and business need. Every document you find on our website is crafted in compliance with federal and state laws, ensuring your paperwork is correctly formatted.

Another great advantage of US Legal Forms is that you will never lose the documents you’ve purchased - you can access any of your downloaded forms in the My documents section of your profile whenever needed.

- Confirm the document you observe on the page aligns with your legal circumstance and state laws by reviewing its text description or perusing the Preview mode.

- Input the form name in the Search tab at the top of the page and choose your state from the list to locate an alternate template if inconsistencies arise.

- Recheck the content and click Buy now when you feel assured that the paperwork meets all the standards.

- Log in to your account and hit Download. Register for the service and choose a subscription plan if you do not already have one.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The template will be available for download immediately afterward.

- Choose the format you prefer to receive your Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2 and download it by clicking the appropriate button.

- Incorporate your template into an online editor to complete and sign it quickly or print it to prepare your physical copy manually.

Form popularity

FAQ

The official form 106J Schedule J is a crucial document in bankruptcy proceedings, specifically designed to outline monthly expenses in relation to a debtor's separate household. It provides a clear picture of ongoing financial obligations, facilitating a structured approach to manage debts. Completing this form accurately is vital for those utilizing the Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2. To ensure compliance and clarity in your filing, consider utilizing the US Legal Forms platform for expert resources and templates.

In the context of Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2, allowable expenses typically include necessary living costs. These may encompass housing expenses, utilities, food, and transportation. It's essential to accurately document each expense to align with the requirements set forth by the bankruptcy process. For detailed guidance and necessary forms, the US Legal Forms platform serves as a reliable resource.

Allowable expenses for a Flexible Spending Account (FSA) include medical costs and dependent care expenses, which can provide significant tax savings. While FSA expenses differ from those on the Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2, both can impact your overall financial health. Utilizing an FSA can help you manage out-of-pocket medical expenses efficiently. It’s wise to evaluate your expenses regularly to maximize your savings potential.

The official form 106J is part of the bankruptcy filing process, specifically designed for detailing your living expenses. On this form, you list your monthly expenses in relation to the Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2. This documentation helps the court understand your financial situation and determine your eligibility for bankruptcy relief. Completing this form accurately is vital to ensure you account for all legitimate expenses.

In Chapter 7 bankruptcy, certain living expenses are considered allowable under the Hawaii Schedule J-2: Expenses for Separate Household of Debtor 2. These typically include housing costs like rent or mortgage, utilities, food, clothing, and transportation. It’s crucial to account for these necessary expenses to allow for a realistic budget during bankruptcy proceedings. By managing your finances in this way, you can focus on rebuilding after bankruptcy.

Services & Forms Forms. Schedule J-2: Expenses for Separate Household of Debtor 2 (individuals)

Form Number: B 106I. Category: Individual Debtors. Effective onDecember 1, 2015. This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Completing Schedule J: Your Expenses Schedule J is where you list your current monthly expenses and all of your dependents, whether living in your household or not.