Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Hawaii Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Gain access to one of the most extensive collections of legal documents.

US Legal Forms serves as a resource to locate any state-specific paperwork in just a few clicks, including Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual forms.

There’s no need to squander several hours hunting for a court-admissible template. Our certified experts guarantee that you receive current examples consistently.

After selecting a pricing plan, create an account. Pay with a credit card or PayPal. Download the sample to your device by clicking Download. That’s it! You need to fill out the Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Register and effortlessly explore over 85,000 useful samples.

- To utilize the document library, select a subscription and create an account.

- If you have already set one up, simply Log In and then hit Download.

- The Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual template will be automatically saved in the My documents section (a section for each form you download on US Legal Forms).

- To create a new account, review the brief instructions provided below.

- If you need to use a state-specific template, ensure you select the correct state.

- If available, check the description to understand all the details of the document.

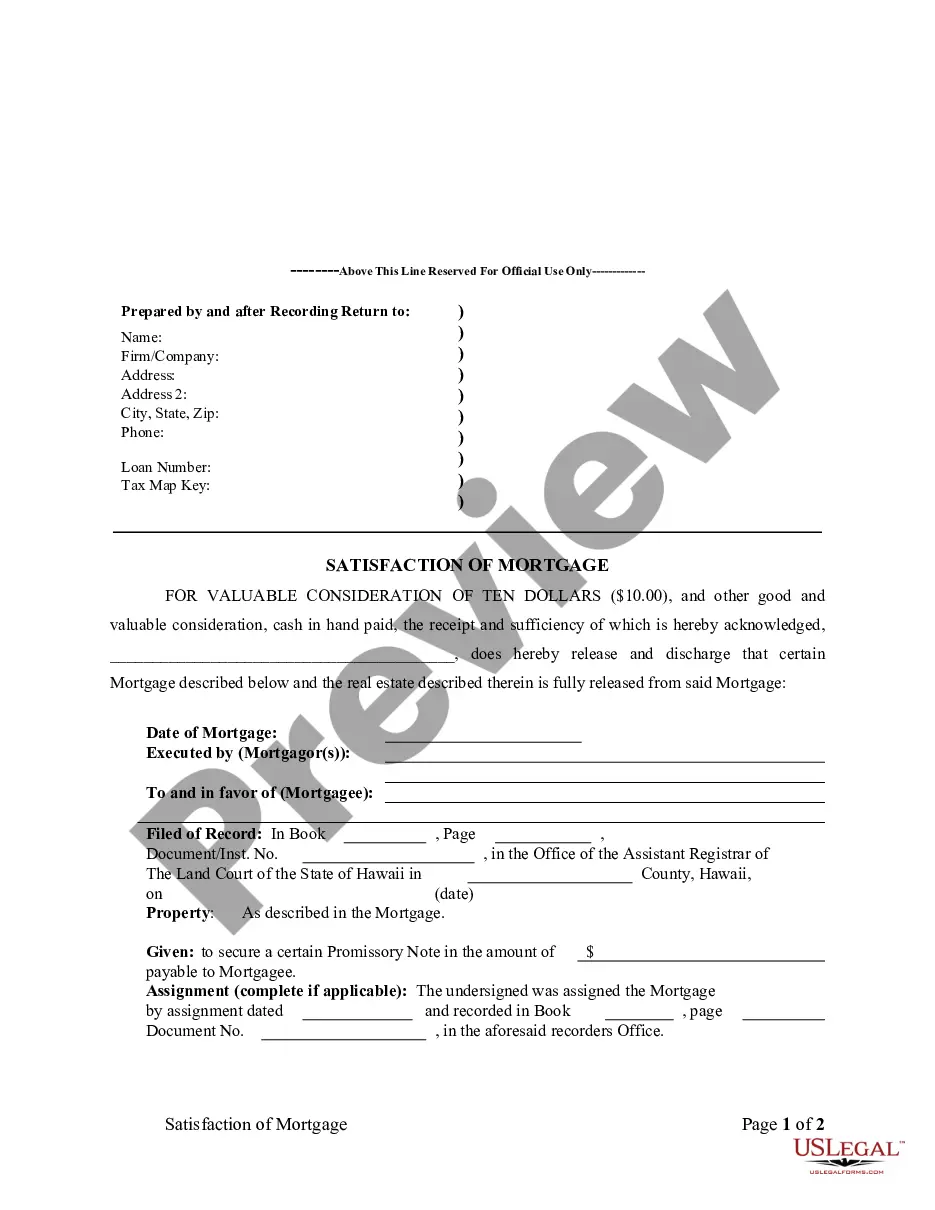

- Utilize the Preview feature if it’s accessible to review the document's details.

- If everything appears correct, click the Buy Now button.

Form popularity

FAQ

A mortgage release is a formal acknowledgment that you have completed your mortgage payments, while a discharge typically refers to the legal process of canceling the debt. Both terms signify that the lender no longer has a claim on the property. Understanding these terms is vital for owners wanting clarity on their property’s legal status, particularly in relation to Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.

To record a satisfaction of your mortgage in Hawaii, you need to complete a satisfaction document. File this document with your local county recorder's office. Ensure you have the proper details, such as your mortgage's original recording information. This action formally indicates that you have fulfilled your obligations under the mortgage agreement.

To complete a satisfaction of mortgage, first obtain the necessary form, which is usually from your lender. Fill it out, ensuring all information is accurate, and sign it. Finally, submit the completed form to your county's clerk or recorder's office to officially document the Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.

Typically, the lender or mortgage holder files the satisfaction of a mortgage with the local recorder’s office. However, in some cases, the borrower can take responsibility for filing this document after receiving it. Understanding these responsibilities is crucial for achieving Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.

The timeline for obtaining a mortgage satisfaction letter can vary, but generally, it takes a few weeks after the final payment has been made. Factors such as lender processing times and local regulations can affect this duration. For quick access to forms and helpful guidance, consider using the USLegalForms platform for your Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.

No, a satisfaction of mortgage is not considered a deed. Rather, it is a legal document that confirms the borrower has repaid the mortgage in full. This document serves to release the lien the mortgage had on your property, facilitating the Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.

To complete a satisfaction of a mortgage, you first need to obtain a satisfaction form from your lender or state. After filling out the form, sign it and then submit it to the appropriate county recorder’s office. This process finalizes your Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.

Writing a satisfaction of a mortgage requires including specific details such as the date, names of involved parties, and a clear statement that the mortgage has been satisfied. Ensure that your document is signed and dated by the lender. You may want to consult with legal professionals or platforms like uslegalforms to ensure compliance with Hawaii laws. This way, you can effectively document your Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.

No, a release of a mortgage is not the same as a deed. While a deed transfers ownership of property, a release signifies that the mortgage has been satisfied or canceled. It's essential to understand this distinction as you navigate the complexities of property ownership. When dealing with Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual, you want clear documentation to avoid any future confusion regarding your property.

After the release of your mortgage, it's important to keep the document in a safe place as proof that you have successfully satisfied your mortgage obligation. You should also review your credit report to ensure that the release is accurately reflected. Additionally, consider notifying any relevant financial institutions or credit agencies to help maintain your credit profile. By doing this, you secure your financial standing post-Hawaii Satisfaction, Release or Cancellation of Mortgage by Individual.