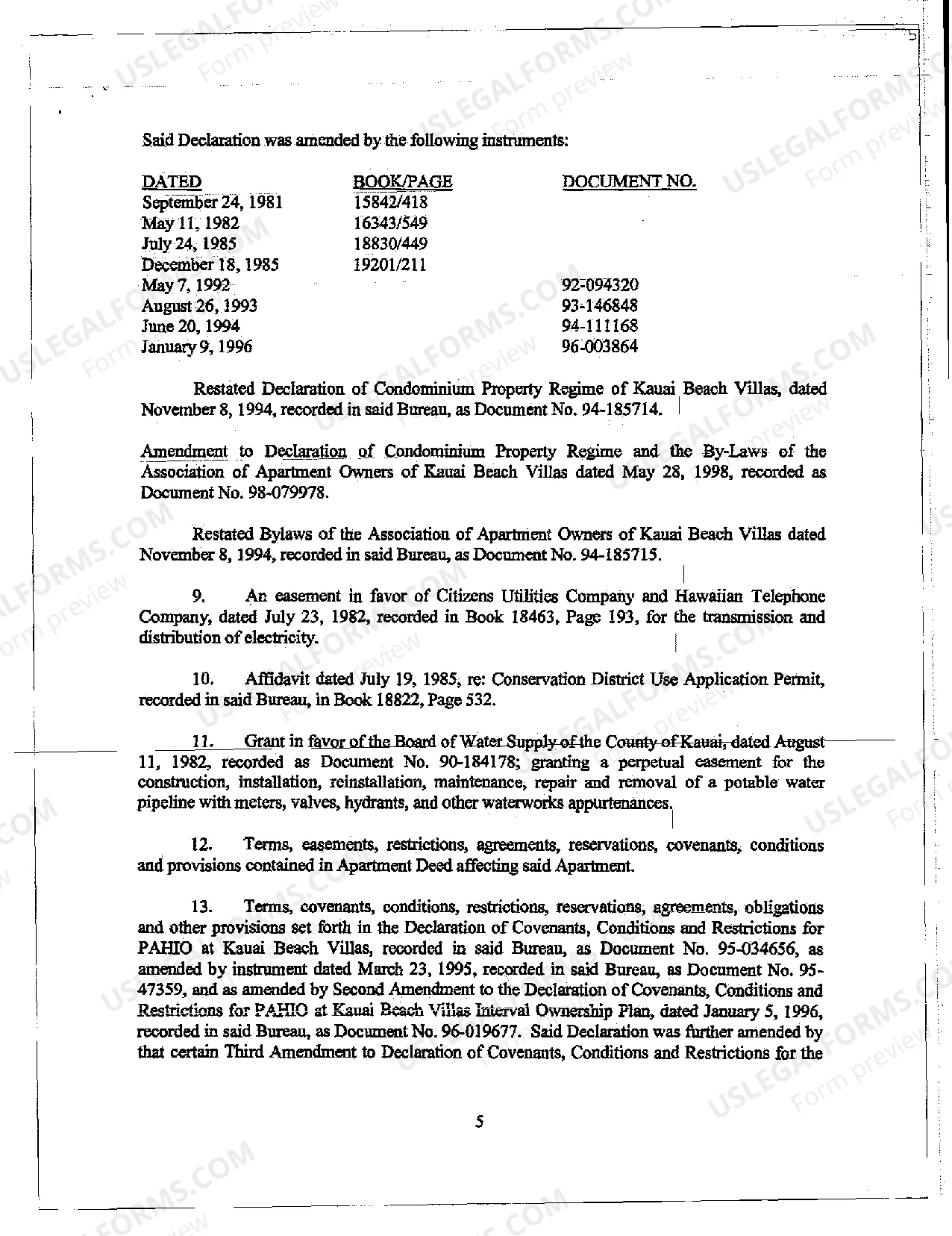

Hawaii Deed regarding Foreclosure Sale

Description

How to fill out Hawaii Deed Regarding Foreclosure Sale?

Among countless complimentary and premium examples that you can find online, you can't be assured of their authenticity.

For instance, who authored them or if they possess the necessary qualifications to handle what you require them for.

Stay calm and utilize US Legal Forms!

Once you’ve registered and paid for your subscription, you can utilize your Hawaii Deed regarding Foreclosure Sale as often as you wish or for as long as it stays valid in your area. Modify it using your preferred online or offline editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- Find Hawaii Deed related to Foreclosure Sale examples crafted by expert legal professionals and evade the expensive and lengthy process of searching for a lawyer and subsequently compensating them to draft a document that you can obtain independently.

- If you have a subscription, Log In to your account and look for the Download button next to the form you're looking for.

- You will also be able to retrieve your previously downloaded examples in the My documents section.

- If you’re using our site for the first time, follow the steps below to easily acquire your Hawaii Deed regarding Foreclosure Sale.

- Ensure that the document you're viewing is applicable in your state.

- Review the template by checking the information through the Preview function.

Form popularity

FAQ

When a homeowner is referred to as 120 days delinquent, it means they have missed mortgage payments for four consecutive months. This status can trigger specific legal processes related to foreclosure. Knowing your standing can help you consider options, such as a Hawaii Deed regarding Foreclosure Sale, to regain control over your financial situation.

Certain circumstances may allow exceptions to the 120-day foreclosure rule in Hawaii. For instance, if a homeowner has committed fraud or the property is abandoned, lenders may bypass the waiting period. Understanding these exceptions can empower you and guide you in seeking a Hawaii Deed regarding Foreclosure Sale or other alternatives effectively.

Negotiating a deed in lieu of foreclosure involves communicating directly with your lender to surrender your property voluntarily. Start by gathering your financial documents and explaining your situation clearly. Often, lenders prefer these arrangements as they simplify the foreclosure process, making a Hawaii Deed regarding Foreclosure Sale a potential solution to reduce your debts and transition smoothly.

The 120-day rule is a regulation that affects the process of foreclosures in Hawaii. It specifies that a lender must wait for a minimum of 120 days before initiating a foreclosure action. This rule gives homeowners time to explore alternatives, such as negotiating a Hawaii Deed regarding Foreclosure Sale, which can help them avoid foreclosure entirely.

A deed in lieu of foreclosure typically has a less negative impact on your credit score compared to a full foreclosure. While it may still be reported as a negative item, it usually allows for a quicker recovery in your credit standing. If you are considering a Hawaii deed regarding foreclosure sale, it is important to understand how it will affect your credit and future borrowing potential.

Generally, a foreclosure is considered worse than a deed in lieu of foreclosure. A foreclosure can severely affect a homeowner's credit score and create lasting financial repercussions. In contrast, a deed in lieu often results in less damage to credit and can lead to an easier recovery process afterward.

Lenders prefer a deed in lieu of foreclosure because it reduces costs associated with legal proceedings and property maintenance. The process is typically quicker and less complicated than formal foreclosure. This efficiency benefits both the lender and the borrower, allowing for a smoother resolution in situations involving Hawaii deeds regarding foreclosure sales.

The foreclosure process in Hawaii typically involves several steps, starting with a notice of default from the lender. If the borrower does not rectify the default within 120 days, the lender can file for foreclosure, leading to a public auction of the property. Homeowners have the right to reclaim their property until the auction, but many may consider alternatives, such as a deed in lieu of foreclosure.

The 120-day rule for foreclosure in Hawaii requires lenders to wait 120 days after the borrower defaults on a payment before initiating foreclosure proceedings. This gives homeowners a chance to resolve their financial issues. During this time, homeowners can explore options such as a Hawaii deed regarding foreclosure sale to potentially avoid foreclosure.

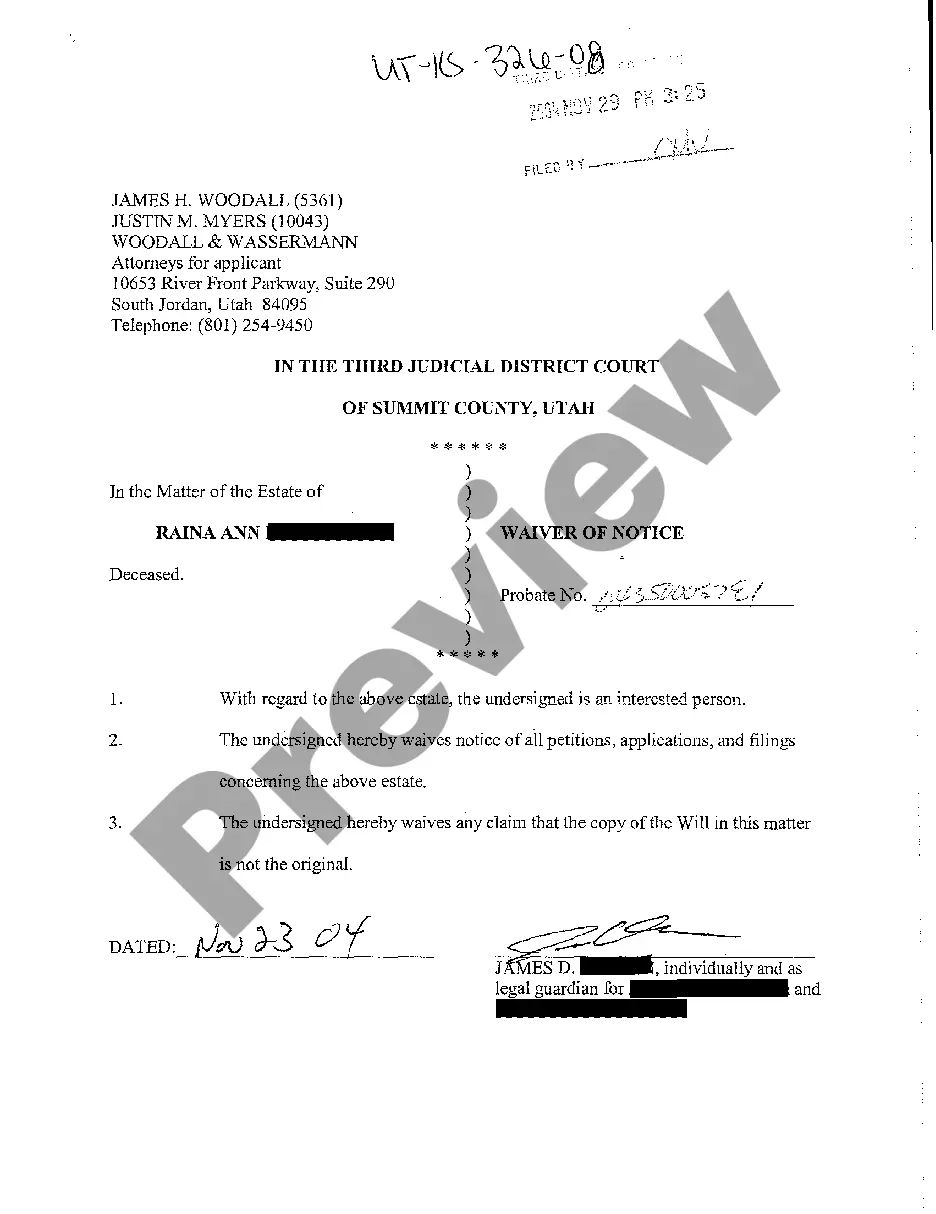

To file a deed in lieu of foreclosure in Hawaii, you must first reach an agreement with your lender. This may involve contacting your lender to discuss your situation and gathering necessary documentation, such as your mortgage details. Once approved, you will sign the deed, and it will be recorded with your county’s recorder's office to finalize the process.