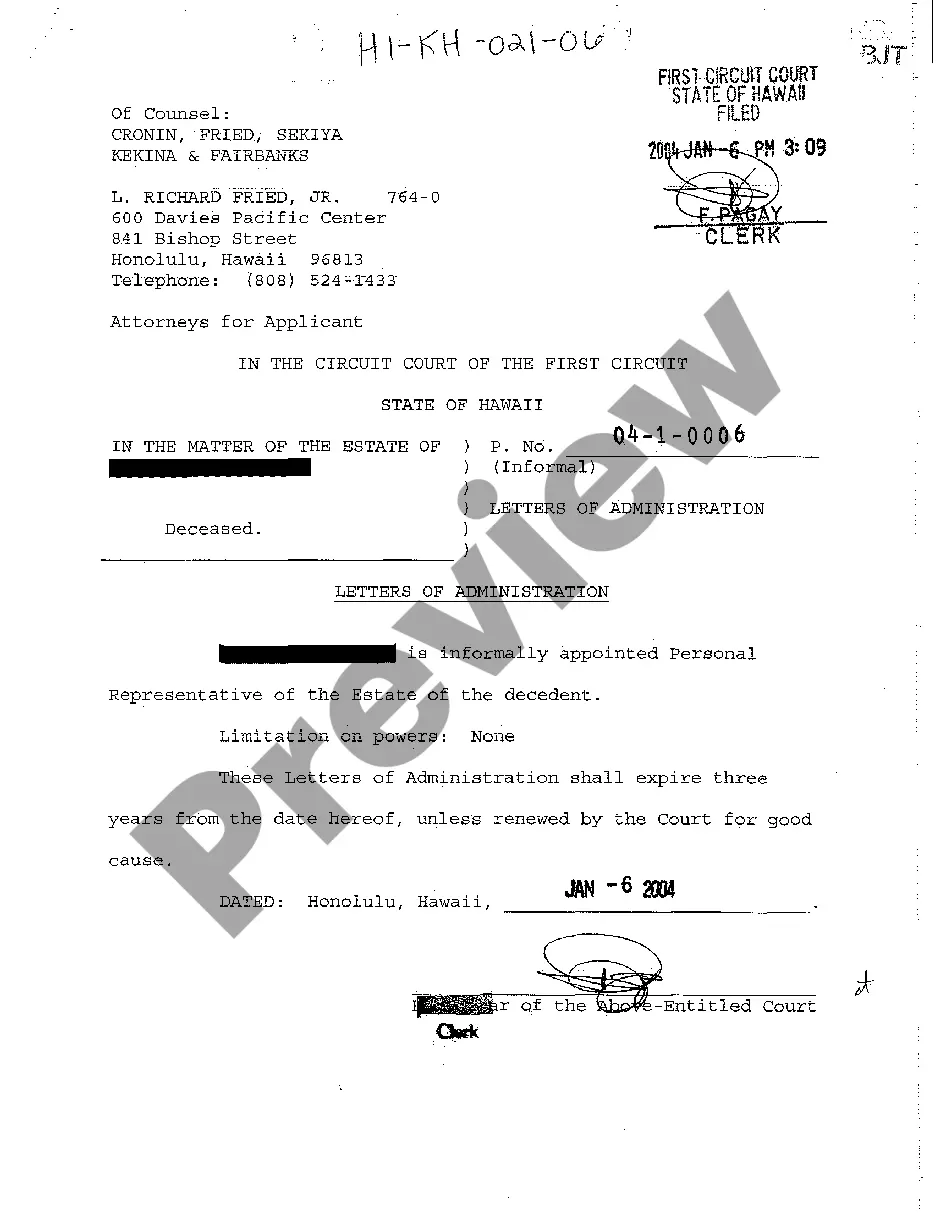

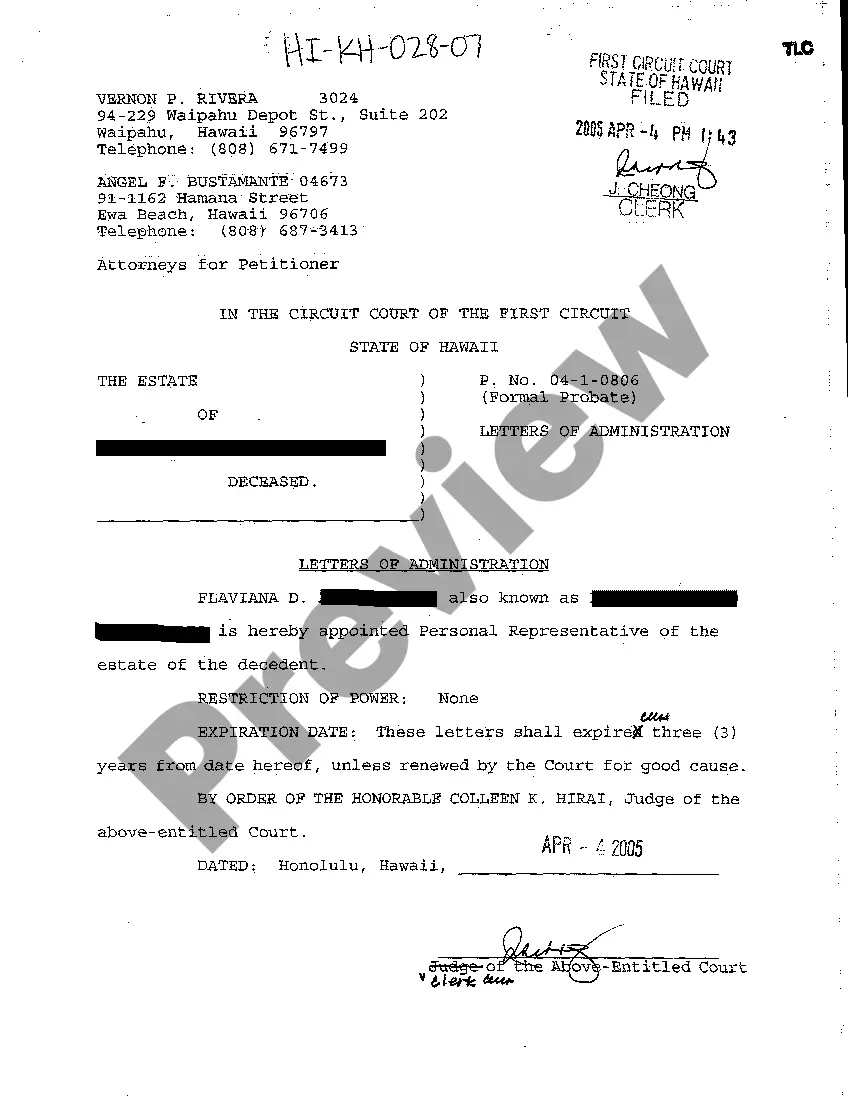

Hawaii Letters of Administration

Description

How to fill out Hawaii Letters Of Administration?

Among numerous complimentary and paid templates available online, you cannot guarantee their precision and dependability.

For instance, who created them or if they possess the necessary skills to address your requirements.

Stay composed and utilize US Legal Forms!

If you are using our service for the first time, follow the instructions listed below to obtain your Hawaii Letters of Administration effortlessly: Ensure the document you find is valid in your state. Review the document by checking the information using the Preview function. Click Buy Now to initiate the buying process or search for another sample using the Search field located in the header. Choose a pricing strategy and establish an account. Complete the payment for the subscription with your credit/debit card or Paypal. Download the template in the necessary file format. Once you have registered and purchased your subscription, you can utilize your Hawaii Letters of Administration as frequently as you require, or for as long as it remains valid in your area. Modify it in your desired offline or online editor, complete it, sign it, and print a hard copy. Accomplish more for less with US Legal Forms!

- Find Hawaii Letters of Administration templates crafted by experienced legal professionals.

- Avoid the costly and prolonged process of seeking an attorney.

- And subsequently paying them to draft a document for you that you can create yourself.

- If you hold a membership, Log In to your profile.

- and locate the Download button adjacent to the form you are looking for.

- You will also have access to all your previously saved templates in the My documents section.

Form popularity

FAQ

In Hawaii, you should file for probate within three years after the death of the individual. Delaying beyond this period may complicate the process of obtaining Hawaii Letters of Administration. It’s essential to act promptly and consult legal resources or platforms like US Legal Forms for assistance with your probate needs.

The probate threshold in Hawaii is primarily set at $100,000 for most estates. If your estate meets or exceeds this amount, you typically need to initiate the probate process and obtain Hawaii Letters of Administration. Keeping this threshold in mind aids in better estate planning and management.

Rule 42 governs the appointment and powers of personal representatives in Hawaii probate cases. This rule provides clarity about the authority granted to individuals who manage the estate, often needing Hawaii Letters of Administration. Understanding Rule 42 can help ensure that the estate is administered according to the wishes of the deceased.

Rule 50 addresses the timely submission of claims within the probate process in Hawaii. This rule promotes efficiency and ensures that all relevant claims are acknowledged during estate administration. By understanding these procedures, individuals can effectively navigate the requirements associated with Hawaii Letters of Administration.

Probate in Hawaii is typically triggered when an individual passes away with assets in their name. If the estate values exceed $100,000, you will likely need to obtain Hawaii Letters of Administration to manage the estate. Unexpected complications can arise without proper probate, so consulting resources like US Legal Forms is advisable.

While there isn't a specific minimum estate value required for probate in Hawaii, estates valued over $100,000 usually must undergo the probate process. Hawaii Letters of Administration help simplify estate administration and protect heirs’ rights. Therefore, assessing your estate's total value is crucial for determining the necessity of probate.

Rule 48 in Hawaii pertains to the regulations and procedures for handling probate cases. It emphasizes the importance of expedited processing of certain claims and facilitating the distribution of assets under Hawaii Letters of Administration. This rule ensures that the interests of all heirs and beneficiaries are effectively managed.

The threshold for probate in Hawaii is generally $100,000 for most estates. If the estate's total value falls below this amount, it may not require formal probate proceedings. However, obtaining Hawaii Letters of Administration can be beneficial for legal clarity and proper estate management.

In Hawaii, the minimum estate value for probate is not strictly defined, but generally, if the total value of the estate exceeds $100,000, it typically requires probate. This process often involves obtaining Hawaii Letters of Administration to manage and distribute the estate. When considering whether you need to go through probate, always consult with a legal professional or resources like US Legal Forms.

The distinction between letters testamentary and letters of administration lies primarily in the deceased's estate plan. If the deceased left a will, letters testamentary authorize the executor to manage their financial affairs, while letters of administration come into play when there is no will. In such cases, Hawaii Letters of Administration enable appointed individuals to handle the estate's assets and liabilities. Understanding this difference is crucial for effective estate management and compliance with Hawaii law.