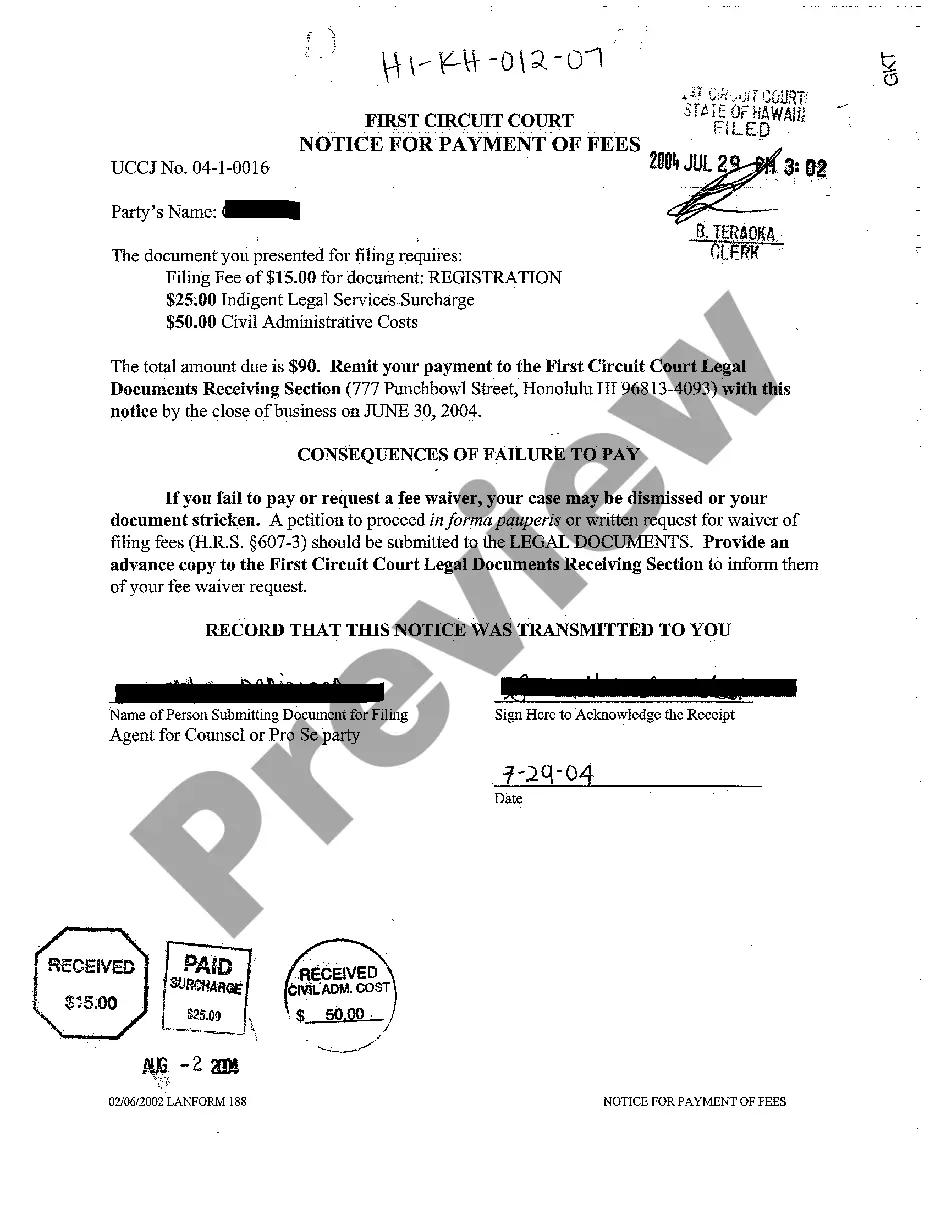

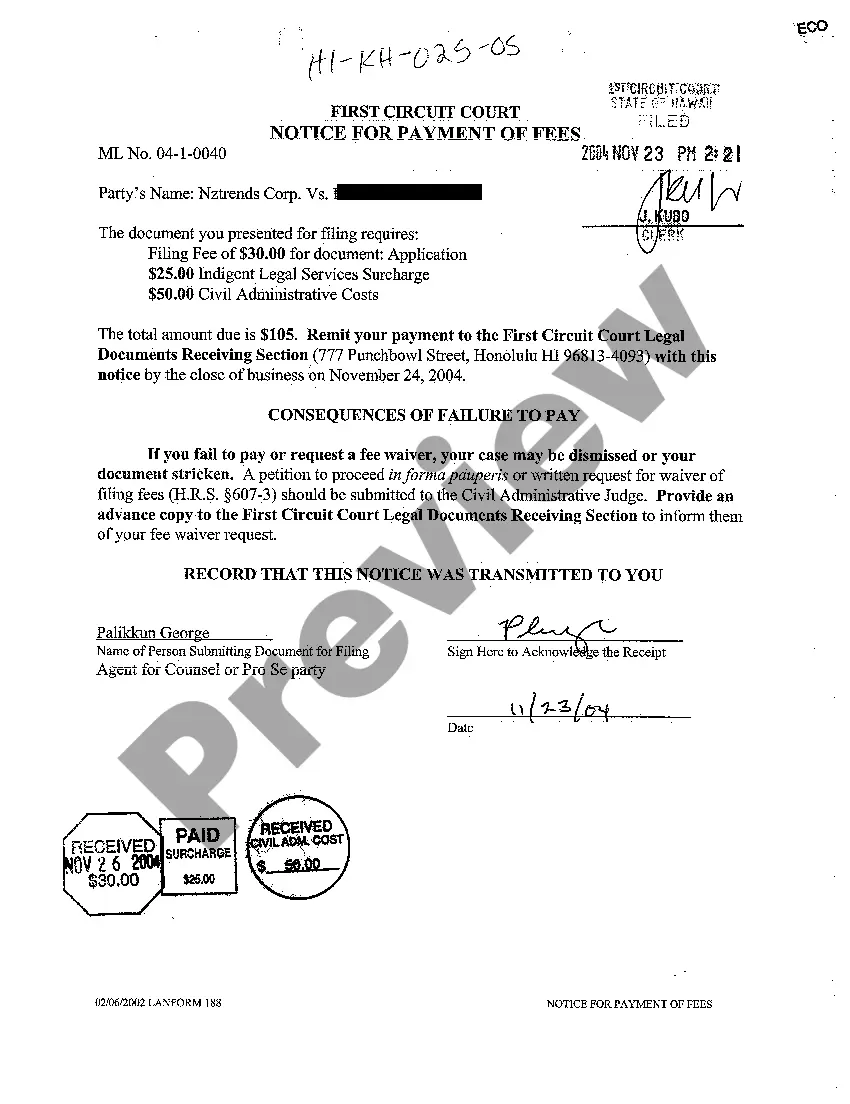

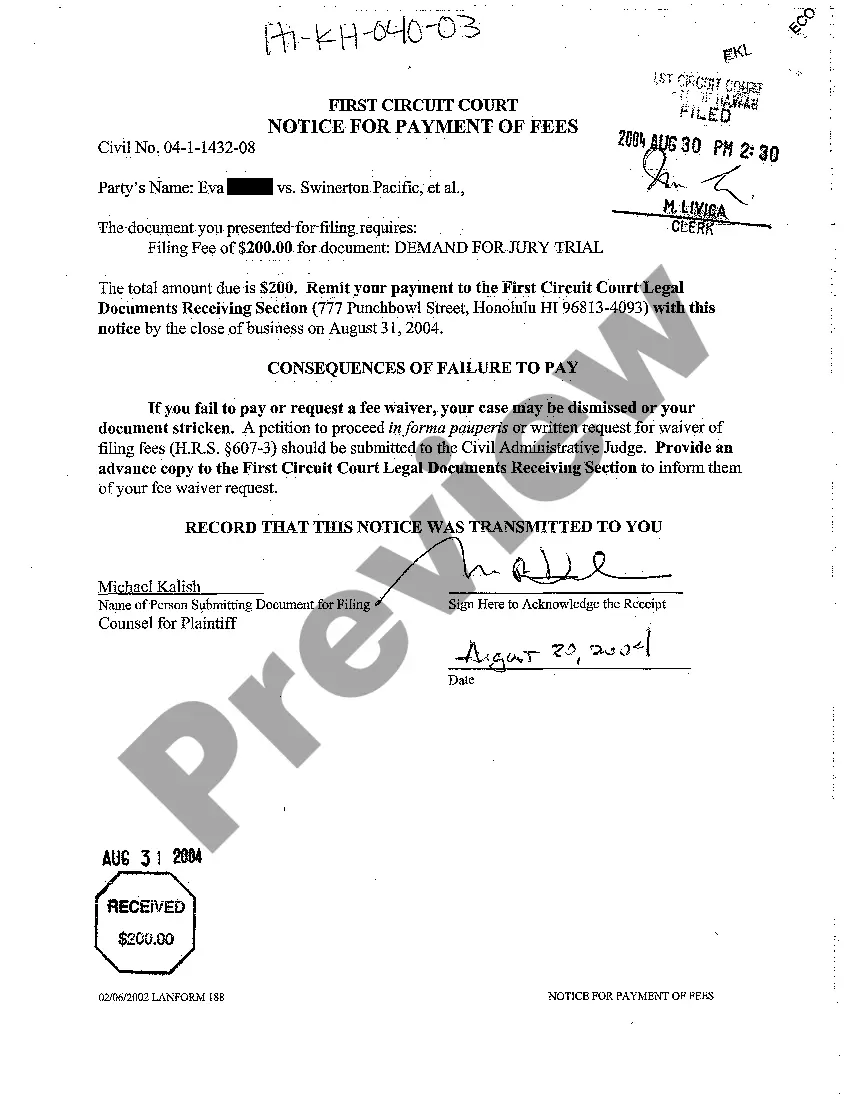

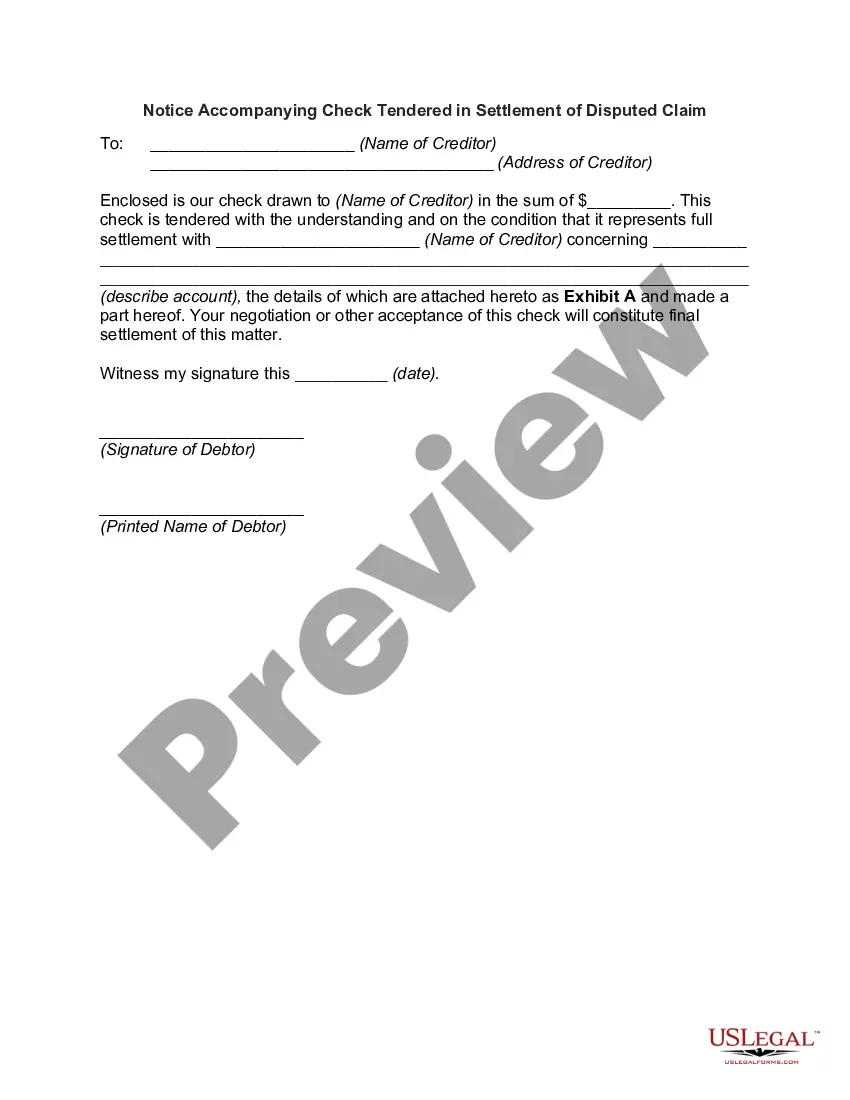

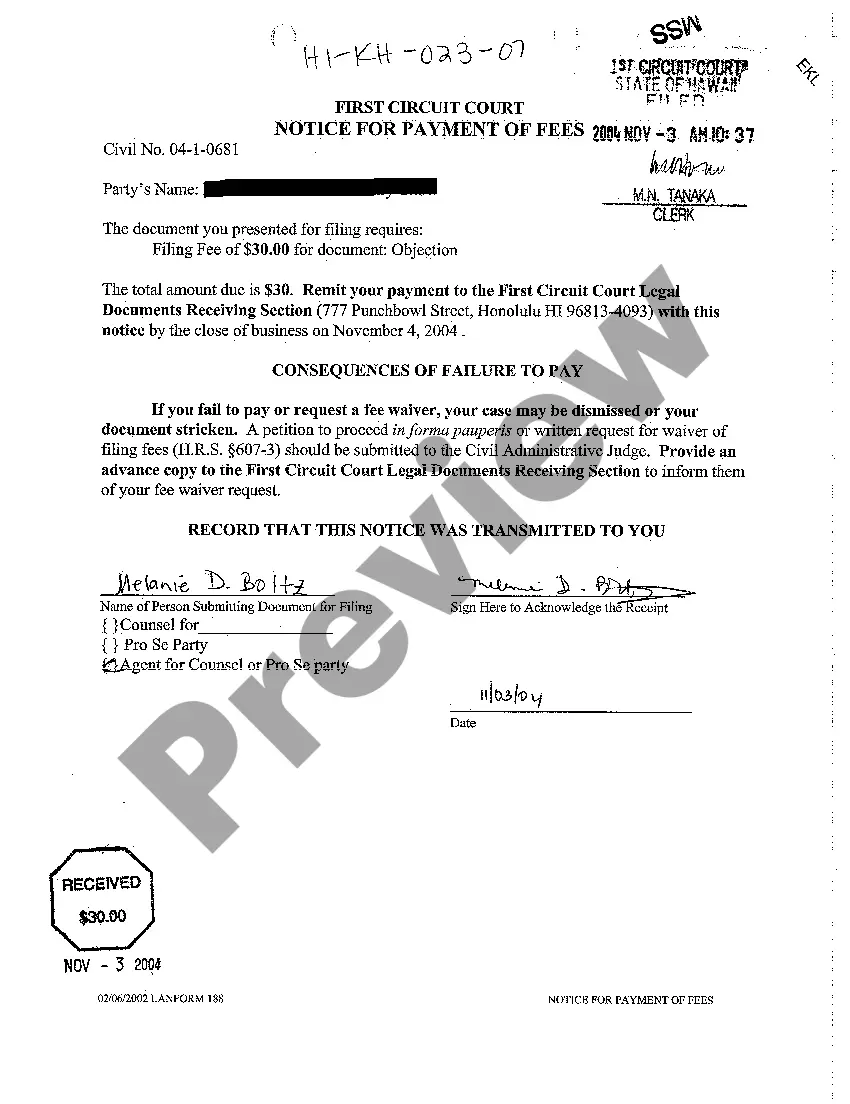

Hawaii Notice for Payment of Fees

Description

How to fill out Hawaii Notice For Payment Of Fees?

Among numerous complimentary and paid samples available online, you cannot guarantee their precision and dependability.

For instance, who created them or whether they possess adequate expertise to handle what you require them for.

Remain composed and make use of US Legal Forms!

Click Buy Now to initiate the purchasing process or search for additional examples using the Search field in the header.

- Uncover Hawaii Notice for Payment of Fees templates crafted by skilled attorneys and avoid the expensive and lengthy process of seeking an attorney and subsequently paying them to draft a document for you that you could easily obtain yourself.

- If you already hold a membership, Log In to your account and locate the Download button adjacent to the file you wish to access.

- You will also have the ability to review all of your previously downloaded documents in the My documents section.

- If this is your first time using our platform, adhere to the guidelines outlined below to acquire your Hawaii Notice for Payment of Fees effortlessly.

- Ensure that the document you find is applicable in your residing state.

- Examine the template by reviewing the description while utilizing the Preview function.

Form popularity

FAQ

The maximum amount for small claims court in Hawaii is set at $3,500. This limit applies to most disputes that require quick resolutions without extensive legal proceedings. If your claim involves fees addressed under a Hawaii Notice for Payment of Fees, ensure your documentation is in order for a smooth process. Knowing this limit can save you time and effort when deciding how to proceed with your claim.

The maximum amount you can sue for in court in Hawaii varies depending on the type of court. In small claims court, it's $3,500, while in regular claims court, the limit is $40,000. Understanding these limits helps you choose the appropriate court for your lawsuit. Furthermore, you should be aware of any necessary filings, such as a Hawaii Notice for Payment of Fees, to support your claim.

In Hawaii, the maximum amount you can claim in small claims court is $3,500. This limit is designed to expedite the resolution of smaller disputes without the need for extensive legal representation. If your claim involves fees related to a Hawaii Notice for Payment of Fees, presenting clear evidence can enhance your case. Always check for any updates to the claims limit before filing.

To close an LLC in Hawaii, you must first cease all business activities and settle outstanding debts. Next, file the necessary documents, including the Articles of Dissolution, with the Hawaii Department of Commerce and Consumer Affairs. Additionally, obtaining a Hawaii Notice for Payment of Fees can be beneficial to ensure all liabilities are resolved before closure. Following these steps will help you close your LLC properly.

In Hawaii, the limit for regular claims court is generally $40,000. If your claim exceeds this amount, you will need to pursue it in a higher state court. It's important to understand the process to file a Hawaii Notice for Payment of Fees to avoid delays. Proper documentation and adherence to legal procedures can facilitate your claim.

Yes, typically, you need to file both G45 and G49 forms if they apply to your situation. The G45 is for periodic payments, while G49 is for annual reconciliation. Understanding how each form relates to the Hawaii Notice for Payment of Fees can help you maintain proper compliance and avoid unnecessary penalties.

To establish a payment plan in Hawaii, you should contact the Department of Taxation and request information about available options. Typically, you will need to provide financial information and agree to a structured repayment schedule. Utilizing resources like uslegalforms can simplify this process by offering the necessary forms and guidance related to the Hawaii Notice for Payment of Fees.

Filing G49 late can lead to penalties, which may include fines or interest on the unpaid amount. It is crucial to submit your forms in a timely manner to avoid these fees. Understanding the implications of the Hawaii Notice for Payment of Fees can help you stay informed and compliant with your tax obligations.

Hawaii tax forms should be mailed to the specific address outlined on the form itself, usually provided by the Department of Taxation. Make sure to verify that you are sending it to the correct location to ensure timely processing. Following these guidelines can prevent issues related to your Hawaii Notice for Payment of Fees.

To request penalty abatement in Hawaii, you should submit a written request to the tax authority explaining your situation and why you believe the penalty should be removed. Include relevant documents that support your case. Addressing your notice under the Hawaii Notice for Payment of Fees could enhance your chances for approval.