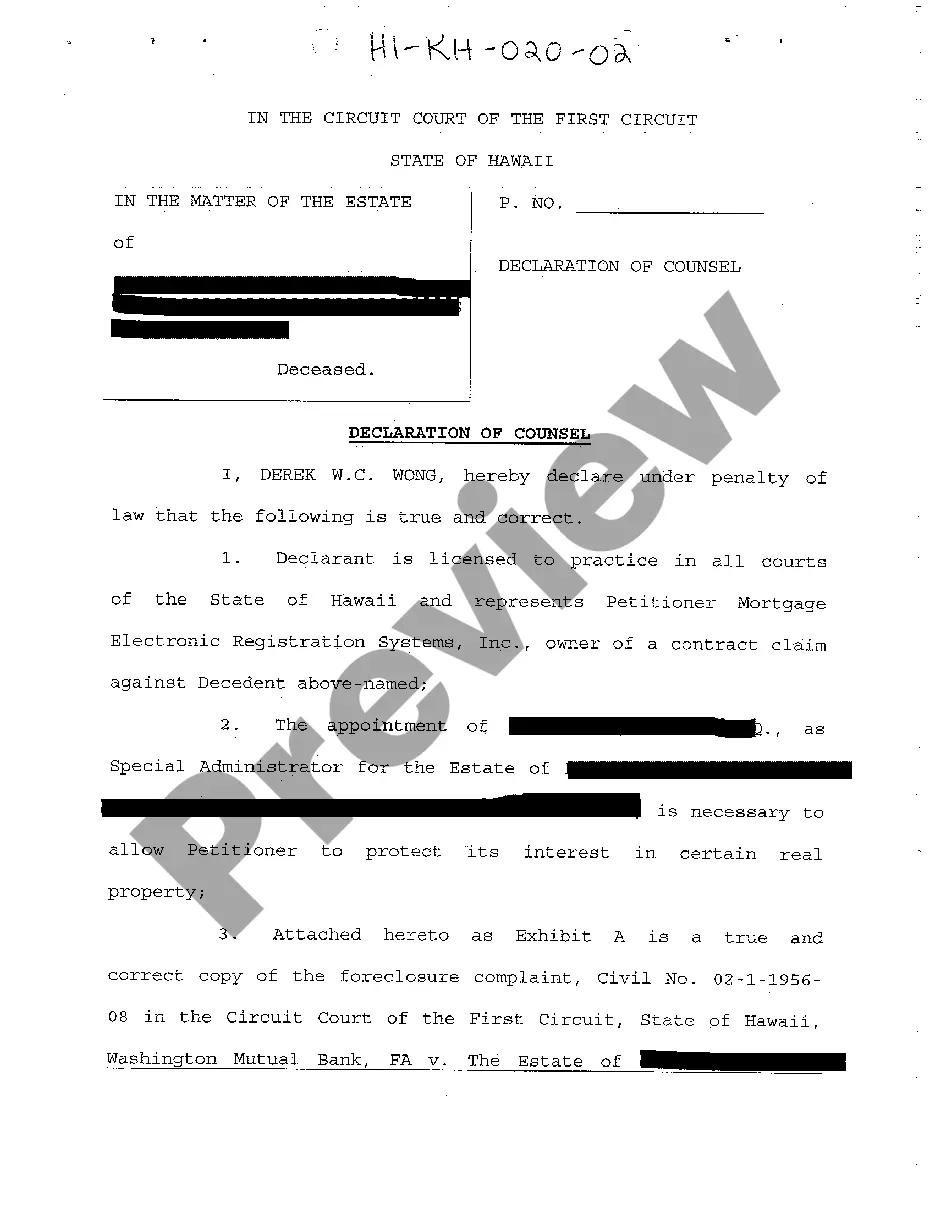

Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary

Description

How to fill out Hawaii Declaration Of Counsel Of Petitioner That Special Administrator Is Necessary?

Amidst numerous paid and complimentary samples available online, you cannot be guaranteed of their precision.

For instance, who created them or if they possess sufficient qualifications to address your specific needs.

Stay calm and make use of US Legal Forms! Obtain Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary forms crafted by experienced attorneys and save yourself from the costly and time-intensive task of searching for a lawyer and subsequently paying them to prepare a document you could obtain yourself.

Once you’ve registered and purchased your subscription, you can use your Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary as many times as you wish or for as long as it remains valid in your region. Modify it with your preferred offline or online editor, complete it, sign it, and print it. Accomplish more for less with US Legal Forms!

- Confirm that the document you find is applicable in your region.

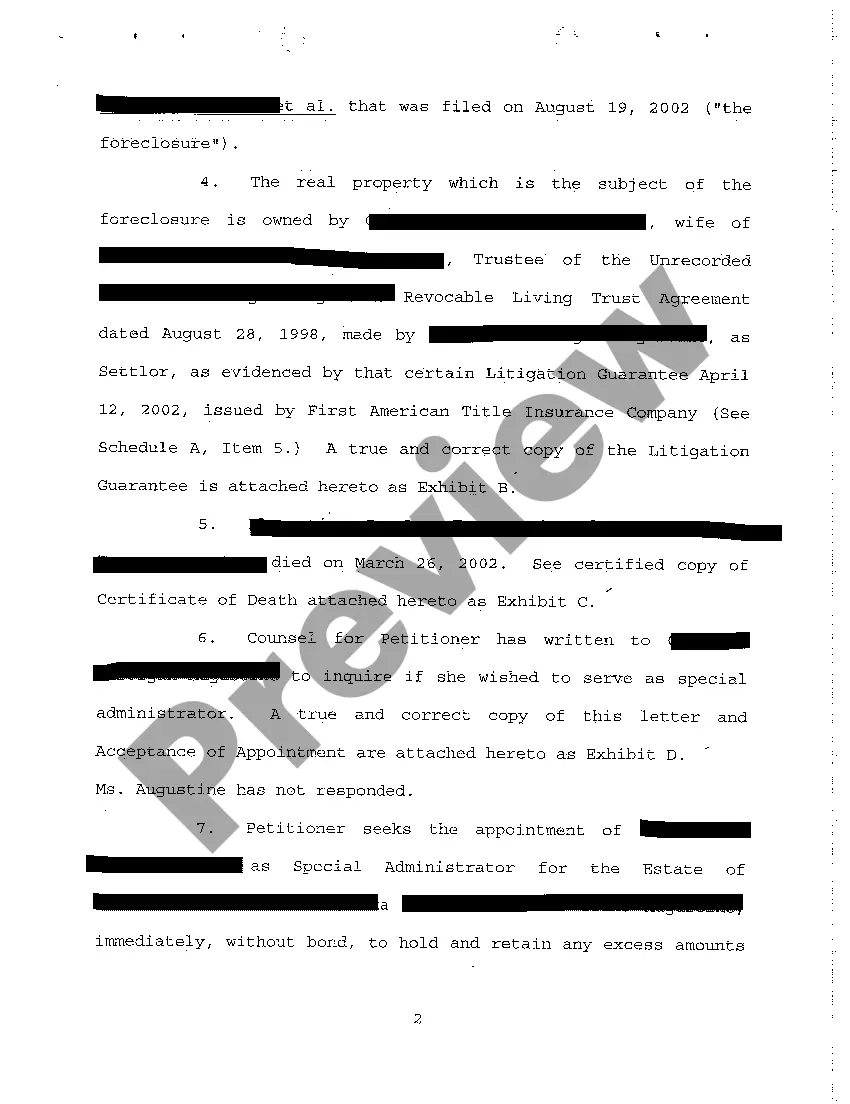

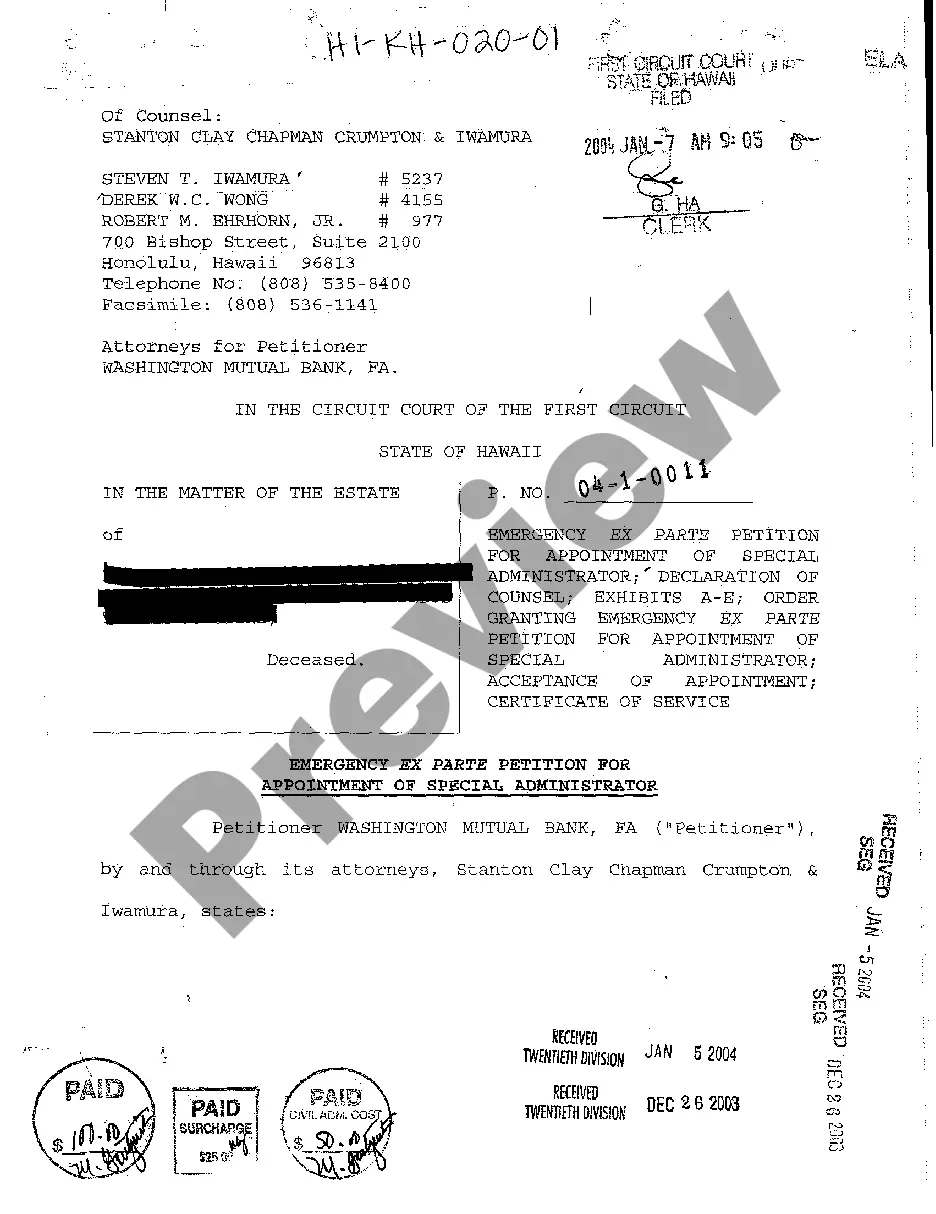

- Evaluate the file by reviewing the information using the Preview feature.

- Select Buy Now to initiate the purchasing process or search for another template using the Search bar in the header.

- Select a pricing plan and set up an account.

- Complete the payment for the subscription with your credit/debit card or PayPal.

- Download the form in the desired format.

Form popularity

FAQ

Avoiding probate in Hawaii can be accomplished through proper estate planning. Techniques such as setting up living trusts, joint ownership of property, and designating beneficiaries can help. If you need assistance with your planning, consider utilizing the Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary to navigate complex situations and protect your loved ones.

In Hawaii, you typically have to file for probate within three years after a person's death. However, it is best to initiate the probate process as soon as possible to ensure that the estate is handled efficiently. If you find yourself needing a Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary, this can streamline the process and address specific estate concerns effectively.

To avoid probate in Hawaii, focus on asset titling and beneficiary designations. You can also transfer assets into a living trust, which will help you manage your estate outside of the probate process. Be sure to research the Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary, as it can play a pivotal role in effectively managing your estate. Planning now will lead to peace of mind for both you and your loved ones.

The best way to avoid probate court is to plan your estate thoughtfully and set up mechanisms such as trusts. By transferring assets into a trust, you can bypass the lengthy probate process altogether. Moreover, if you file a Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary, it can further streamline your estate management. Consider reviewing your estate plan regularly to adapt to any changes in your life circumstances.

You can avoid probate in Hawaii by establishing a living trust or holding assets in joint tenancy. Additionally, naming beneficiaries on accounts or insurance policies can also prevent probate court involvement. It is wise to consult with legal professionals about the Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary for further guidance on this process. This proactive approach will save time and reduce potential complications.

Probate in Hawaii typically triggers when a person passes away leaving behind assets in their name alone. This process is essential to distribute those assets according to the deceased's will or state laws. If a Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary is filed, it can help manage the estate efficiently during probate. It is crucial for beneficiaries and heirs to understand these steps to ensure a smooth transition.

Rule 48 pertains to the procedures for claims against the estate in Hawaii probate cases. It sets guidelines for how claims are to be filed and addressed, ensuring accountability and transparency. When submitting claims, referencing a Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary can support your position, especially if urgent resolutions are needed. Understanding Rule 48 helps you and your counsel navigate the claims process efficiently.

The probate threshold in Hawaii is typically set at $100,000. This figure indicates the minimum value for assets requiring probate proceedings. If your situation involves unique complexities, like needing a Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary, you may face different requirements. Keeping abreast of these thresholds will aid you in managing and planning your estate effectively.

In Hawaii, any estate worth more than $100,000 requires probate. However, if you're faced with a situation necessitating a Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary, your estate's value may influence the urgency and need for a special administrator. Engaging in probate helps ensure the proper distribution of the decedent's assets and resolution of debts. Understanding these thresholds can help you make informed decisions about estate management.

To obtain letters of testamentary in Hawaii, you must file a petition with the probate court along with the decedent's will. This process may involve providing a Hawaii Declaration of Counsel of Petitioner that Special Administrator is Necessary if immediate action is required. Once the court approves your petition, you will receive the letters, allowing you to act on behalf of the estate. Following these steps ensures you handle the estate's affairs without unnecessary complications.