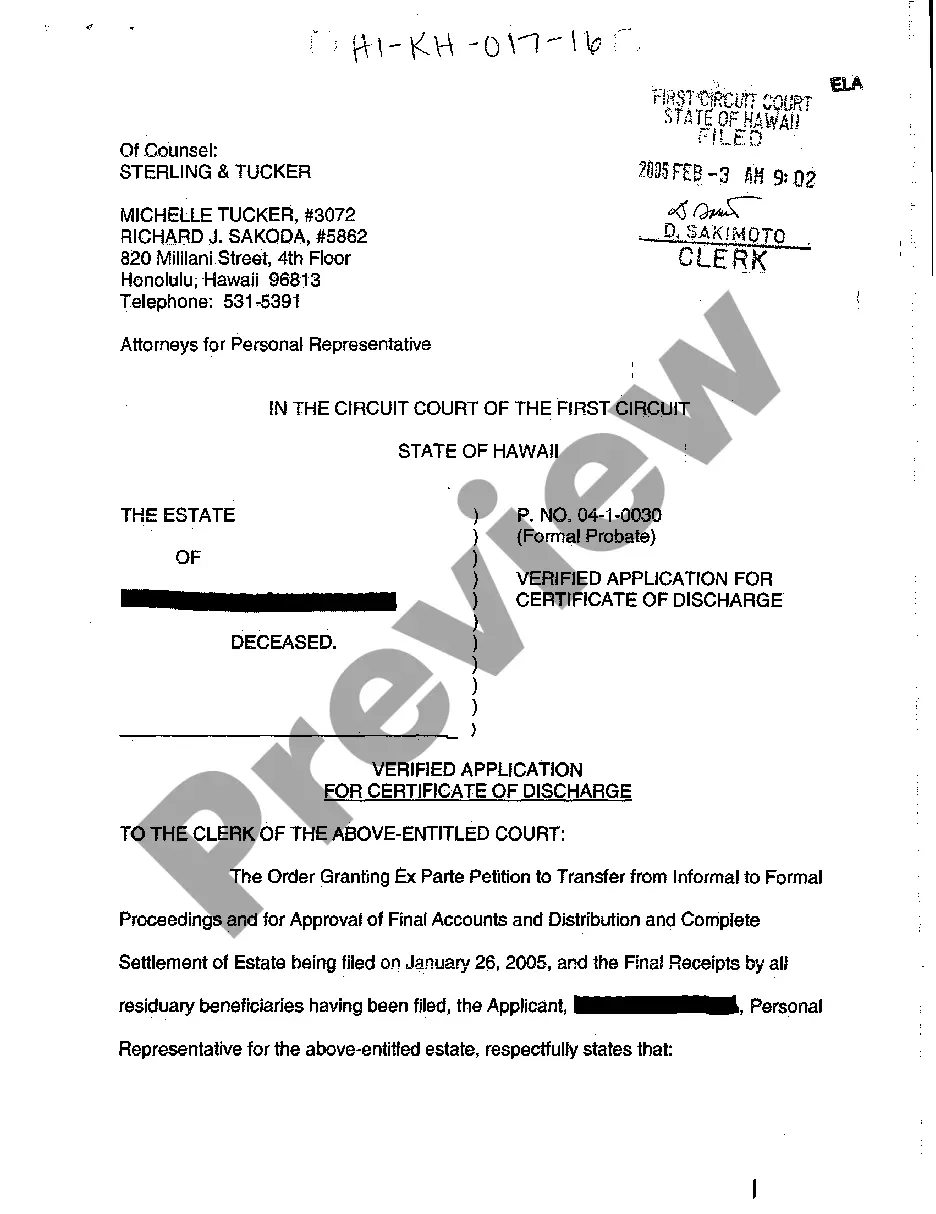

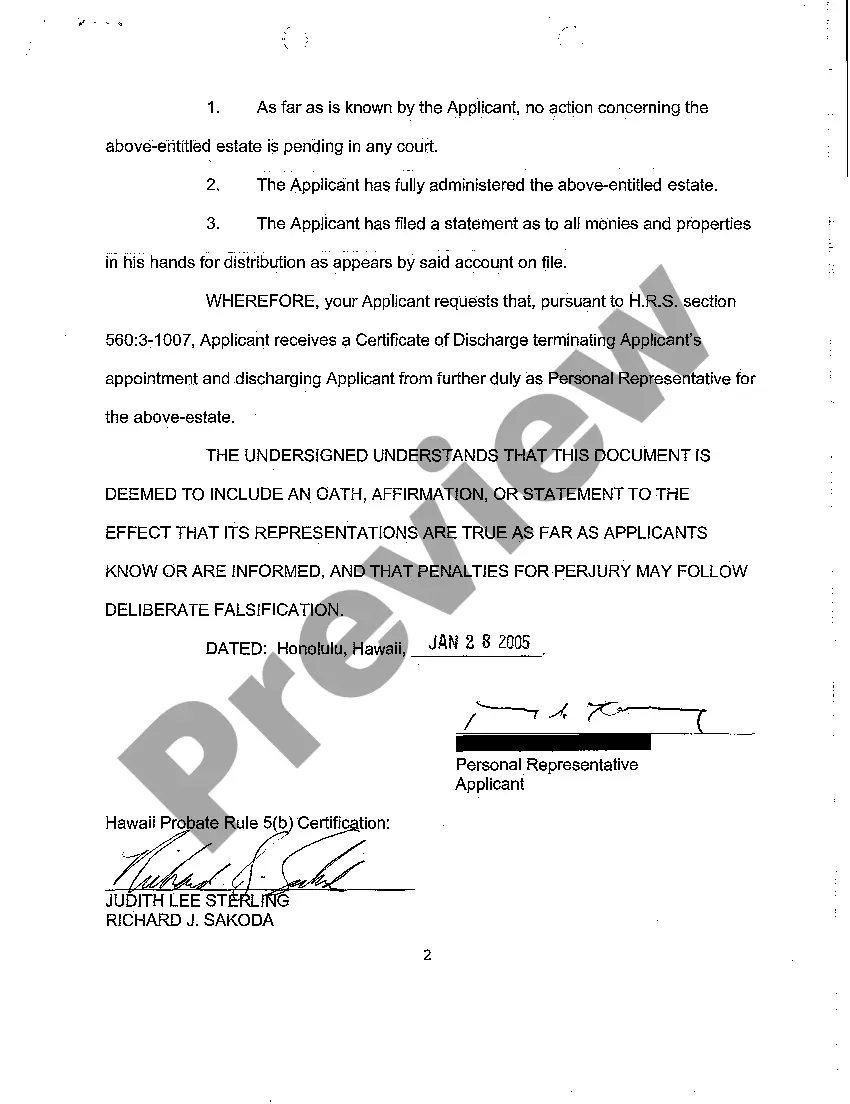

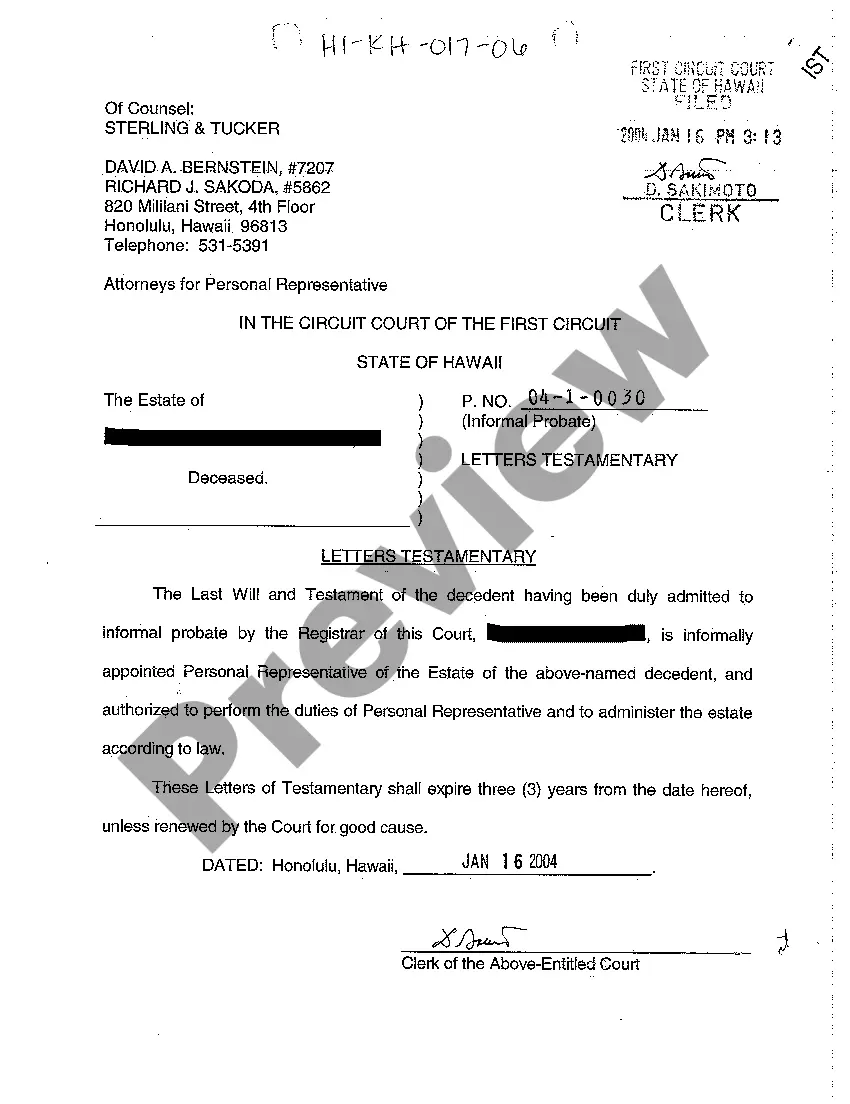

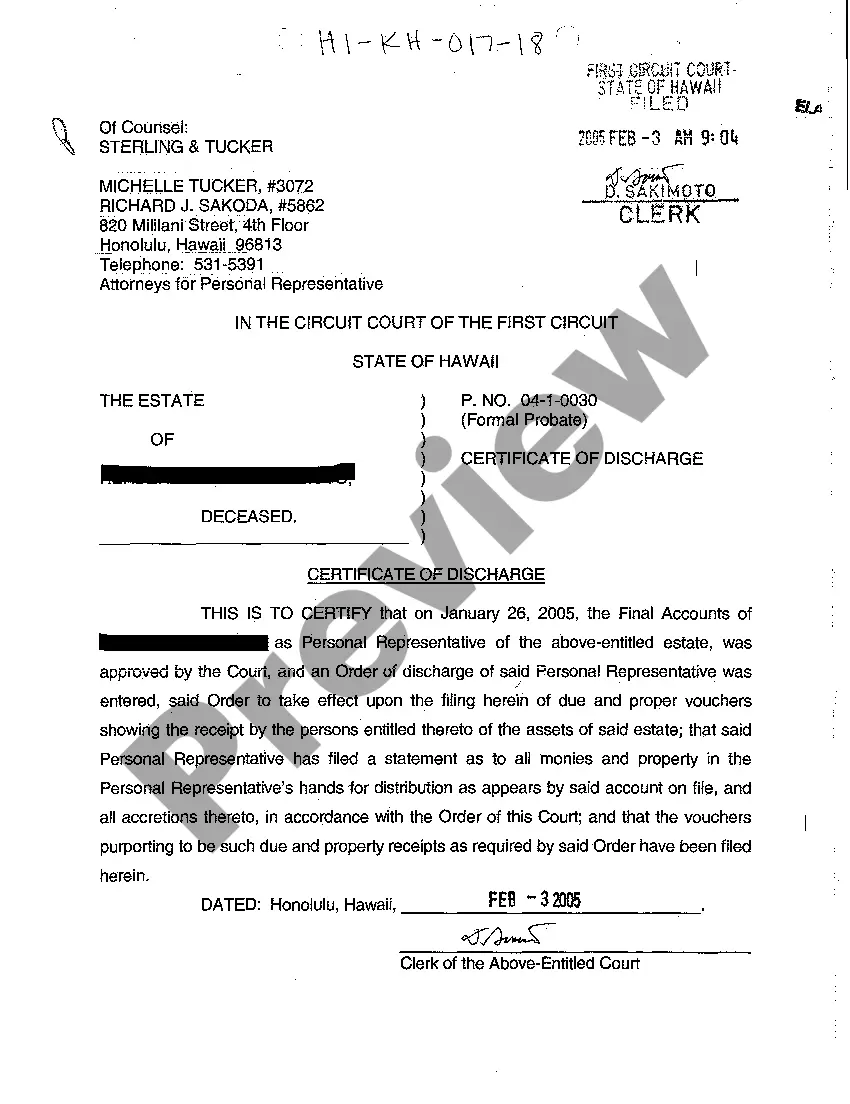

Hawaii Verified Application for Certificate of Discharge

Description

How to fill out Hawaii Verified Application For Certificate Of Discharge?

Among various premium and complimentary examples available online, you cannot guarantee their precision and dependability.

For instance, who developed them or if they possess the expertise necessary to fulfill your requirements.

Remain composed and take advantage of US Legal Forms! Obtain Hawaii Verified Application for Certificate of Discharge templates crafted by experienced legal professionals and avoid the expensive and time-consuming task of searching for an attorney and then compensating them to draft documents for you that you can source independently.

Choose a pricing plan and create an account. Pay for the subscription with your credit/debit card or Paypal. Download the document in the desired file format. After registering and purchasing your subscription, you can utilize your Hawaii Verified Application for Certificate of Discharge as frequently as you require or for as long as it remains valid in your state. Modify it in your preferred editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you already hold a subscription, Log In to your account and locate the Download button beside the form you seek.

- You will also have access to your previously saved templates in the My documents section.

- If this is your first time using our platform, adhere to the instructions below to easily obtain your Hawaii Verified Application for Certificate of Discharge.

- Ensure that the document you find is valid in your residing state.

- Review the document by examining the description through the Preview feature.

- Click Buy Now to initiate the ordering process or search for another template using the Search field in the header.

Form popularity

FAQ

Filing G49 late may attract penalties, including fines and interest on the unpaid amounts. The severity of penalties can impact your financial obligations, so it's essential to file on time. If you face challenges during the filing process, US Legal Forms can assist you with the necessary tools and guidelines for your Hawaii Verified Application for Certificate of Discharge.

Yes, you file both G45 and G49 if you operate a business that is subject to general excise tax and is concluding its operations. Filling out both forms ensures that you meet all tax obligations before completing the Hawaii Verified Application for Certificate of Discharge. Proper filing helps avoid potential penalties, making the process smoother for you.

The G45 form is a general excise tax return, while the G49 is specifically for reporting the final excise tax. Both forms are essential for compliance but serve different purposes in tax filing. Understanding these distinctions can help ensure that you file the correct documents accurately, which can include the Hawaii Verified Application for Certificate of Discharge.

Hawaii tax forms should be mailed to the Department of Taxation at the address indicated on the specific form. Depending on your situation, the mailing address may vary, so it is crucial to consult the relevant form instructions. For further assistance in managing your forms, US Legal Forms can provide tailored resources, especially for your Hawaii Verified Application for Certificate of Discharge.

You should mail Hawaii Form G-49 to the address specified on the form itself, usually directed to the Department of Taxation. Ensure that you send it via a secure method, and retain a copy for your records. If you’re unsure, consider visiting US Legal Forms to find additional instructions on submitting the Hawaii Verified Application for Certificate of Discharge.

To file AG 49 in Hawaii, you need to complete the required form, ensuring accuracy throughout the process. Once completed, submit your documentation through the appropriate channels. Utilizing online resources can streamline your filing process, including platforms like US Legal Forms that provide guidance for the Hawaii Verified Application for Certificate of Discharge.

A verified practitioner in Hawaii is an individual authorized to prepare and file the Hawaii Verified Application for Certificate of Discharge. They possess the necessary skills and qualifications to navigate legal requirements efficiently. Clients benefit from their expertise, ensuring that all documents are correctly filed and adhere to state guidelines.

The difference between Land Court and the regular system in Hawaii lies in how property titles are recorded. Land Court provides a more secure title registration process which is backed by the state. In contrast, the regular system relies on recorded documents and can be more susceptible to disputes. Utilizing the Hawaii Verified Application for Certificate of Discharge can help clarify any ambiguities in title issues in both systems.

To get a copy of your deed in Hawaii, you should go to the Bureau of Conveyances or check your county's office of Records. You may submit a request in person or online, depending on the services offered. Including the Hawaii Verified Application for Certificate of Discharge can also help in resolving any issues related to the deed.

Applying for a General Excise (GE) license in Hawaii involves filling out an application at the Department of Taxation. You need to provide personal information and details about your business. Once you complete the application, you can streamline the process with the Hawaii Verified Application for Certificate of Discharge, ensuring you meet all legal requirements.