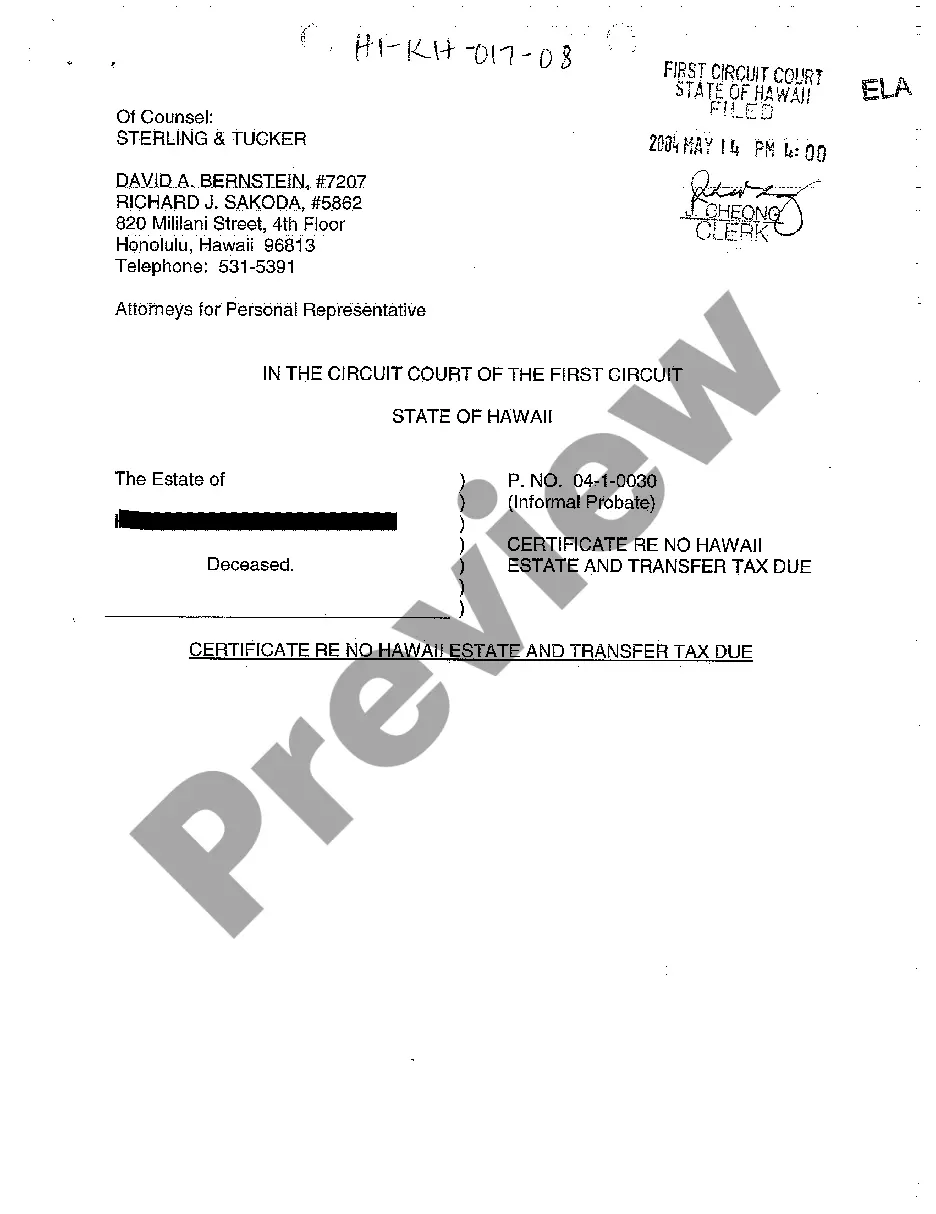

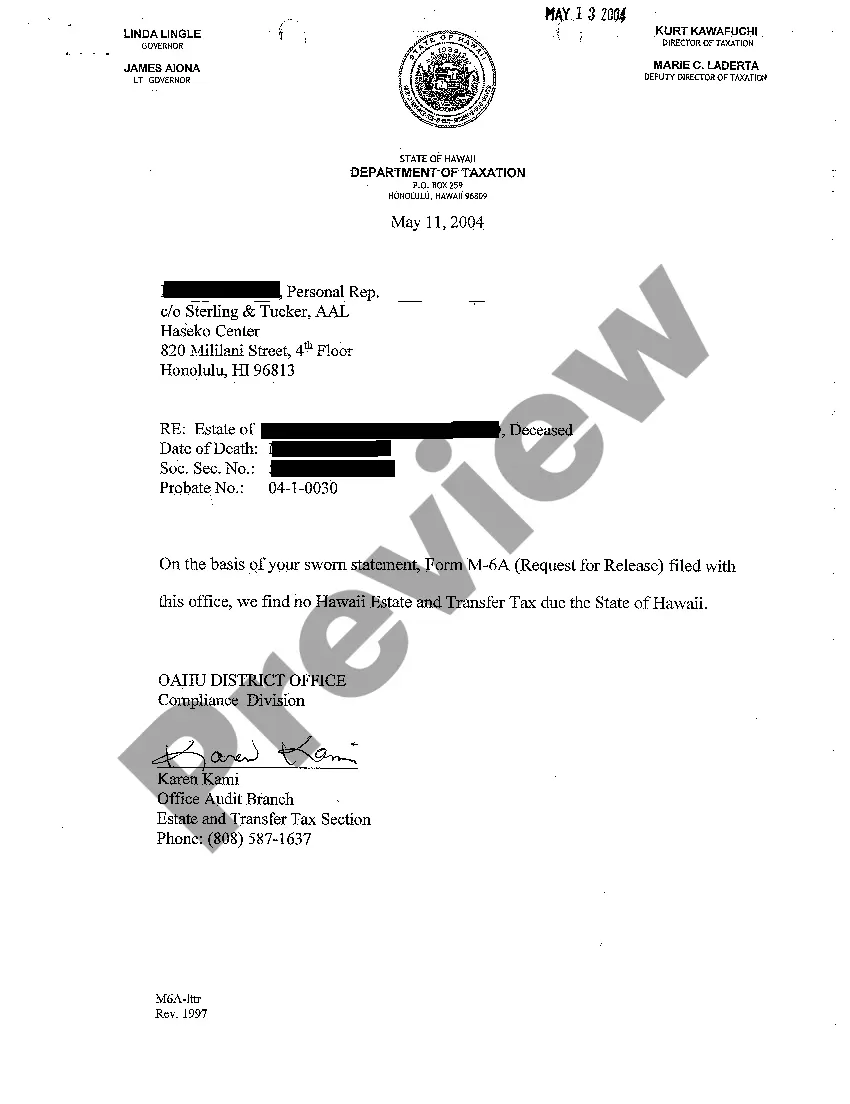

Certificate Re No Hawaii Estate and Transfer Tax Due

Description

How to fill out Certificate Re No Hawaii Estate And Transfer Tax Due?

Among numerous complimentary and premium templates that you can discover online, you cannot guarantee their precision.

For instance, who created them or if they’re skilled enough to handle the task you require them for.

Always remain composed and utilize US Legal Forms! Locate Certificate Re No Hawaii Estate and Transfer Tax Due samples crafted by qualified attorneys and steer clear of the expensive and lengthy process of searching for a lawyer and then compensating them to prepare a document for you that you can obtain on your own.

Select a pricing plan and create an account. Pay for the subscription using your credit/debit card or PayPal. Download the form in your desired file format. Once you’ve registered and paid for your subscription, you can utilize your Certificate Re No Hawaii Estate and Transfer Tax Due as many times as necessary or for as long as it remains valid in your region. Edit it with your preferred editor, fill it out, sign it, and print a hard copy. Achieve more for less with US Legal Forms!

- If you possess a subscription, Log In to your account and locate the Download button next to the document you seek.

- You will also be able to access all your previously saved documents in the My documents section.

- If you are using our platform for the first time, adhere to the instructions below to swiftly acquire your Certificate Re No Hawaii Estate and Transfer Tax Due.

- Ensure that the file you find is legitimate in your area.

- Examine the document by reading the details using the Preview function.

- Click Buy Now to initiate the purchasing process or search for another sample utilizing the Search field found in the header.

Form popularity

FAQ

Property tax exemptions in Hawaii may be available to several groups, including homeowners, seniors, and individuals with disabilities. Qualification criteria include residency, income levels, and property use. To navigate the complexities of the application process efficiently, US Legal Forms can be a helpful resource. They provide essential forms and information on how to qualify for benefits related to the certificate re no Hawaii estate and transfer tax due.

In Hawaii, property taxes may not decrease automatically because of age alone, but individuals aged 65 or older can access specific exemptions. The exemptions may lower the taxable value of the property, resulting in a reduced tax bill depending on various factors. Understanding these exemptions can be vital to maximizing tax benefits, and the US Legal Forms platform can assist in preparing your application for any relevant certificates. This knowledge is crucial regarding the certificate re no Hawaii estate and transfer tax due.

To obtain a Hawaii tax clearance certificate, you must complete an application form through the Hawaii Department of Taxation. It’s advisable to gather all necessary documents that show you have settled any outstanding taxes. For assistance with the application process, consider visiting US Legal Forms. They offer templates that can help ensure you meet the requirements surrounding the certificate re no Hawaii estate and transfer tax due.

In Honolulu, individuals aged 60 and older may qualify for a property tax exemption. This age group can benefit from exemptions that reduce assessed property value, effectively lowering property tax bills. To learn more about the specifics, including how to apply, visiting the US Legal Forms platform can provide you with necessary documents and guidelines. This can help streamline your application process for those seeking to understand their eligibility under the certificate re no Hawaii estate and transfer tax due.

In Hawaii, the threshold for inheritance tax often changes, and currently, there is a limit of $1 million for estate tax. Inheritors can receive amounts below this without incurring taxes. To navigate these rules effectively, understanding the Certificate Re No Hawaii Estate and Transfer Tax Due can be helpful, guiding you to manage your inheritance wisely.

Avoiding estate tax in Hawaii often involves proactive estate planning. Options can include establishing revocable trusts, gifting strategies, and insurance policies set to cover potential tax liabilities. By properly structuring your estate, you can utilize the Certificate Re No Hawaii Estate and Transfer Tax Due in a way that supports your financial goals.

To legally avoid estate tax, consider strategies like gifting assets before death or utilizing trusts effectively. Engaging with an estate planning professional can help you navigate the complexities. They can help you use the Certificate Re No Hawaii Estate and Transfer Tax Due as a part of your strategy, ensuring compliance while minimizing tax liabilities.

In Hawaii, the transfer tax typically falls on the seller of the property, which means the person transferring ownership is responsible for the tax. However, this can vary based on specific sales agreements or conditions outlined in the transaction. Understanding this can help significantly during estate planning and when preparing for the Certificate Re No Hawaii Estate and Transfer Tax Due.

As of now, Hawaii's estate tax is expected to remain active in 2025. There have been discussions about reform, but until any legislation passes, the Certificate Re No Hawaii Estate and Transfer Tax Due will still apply. It's essential to stay informed about potential changes as they could impact your estate planning.

Certain assets are exempt from estate tax in Hawaii. Generally, these may include life insurance proceeds, retirement accounts, and assets held in certain trusts. However, it is important to review your entire estate in relation to the Certificate Re No Hawaii Estate and Transfer Tax Due to ensure compliance and optimize your tax obligations.