Hawaii Income and Expense Statement

Description

How to fill out Hawaii Income And Expense Statement?

Among numerous complimentary and premium samples available online, you can't guarantee their precision.

For instance, who created them or if they possess the qualifications to handle your requirements.

Stay composed and make use of US Legal Forms!

After signing up and purchasing your subscription, you can utilize your Hawaii Income and Expense Statement as frequently as you wish or for as long as it is active in your state. Modify it with your preferred editor, complete it, sign it, and produce a printed version of it. Achieve more for less with US Legal Forms!

- Explore Hawaii Income and Expense Statement samples crafted by experienced legal experts and avoid the costly and tedious task of seeking an attorney and subsequently paying them to draft a document for you that you can obtain on your own.

- If you hold a subscription, Log In to your account and locate the Download button adjacent to the form you need.

- You'll also have access to your previously saved templates in the My documents section.

- If you're visiting our website for the first time, adhere to the steps outlined below to obtain your Hawaii Income and Expense Statement with ease.

- Ensure that the document you are viewing corresponds to your location.

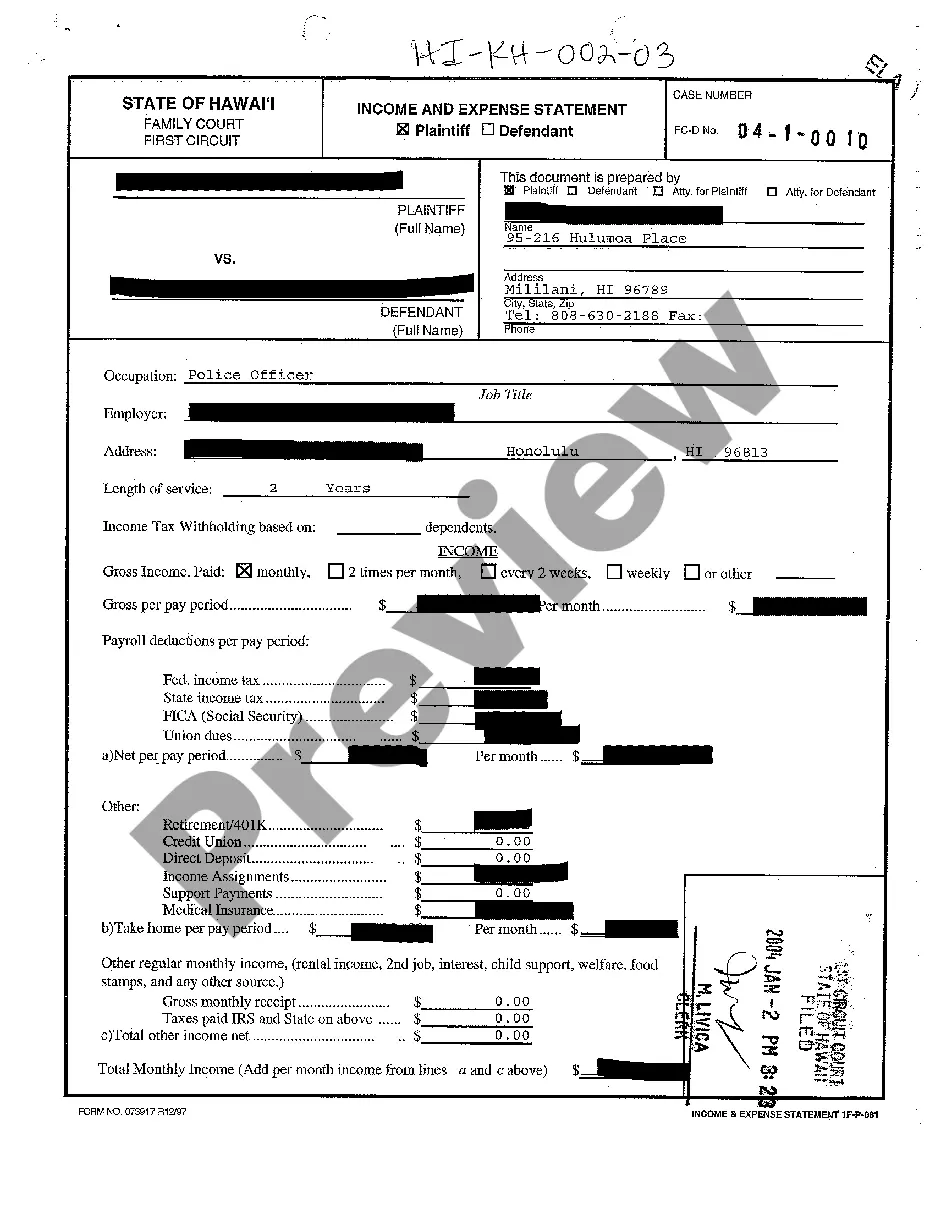

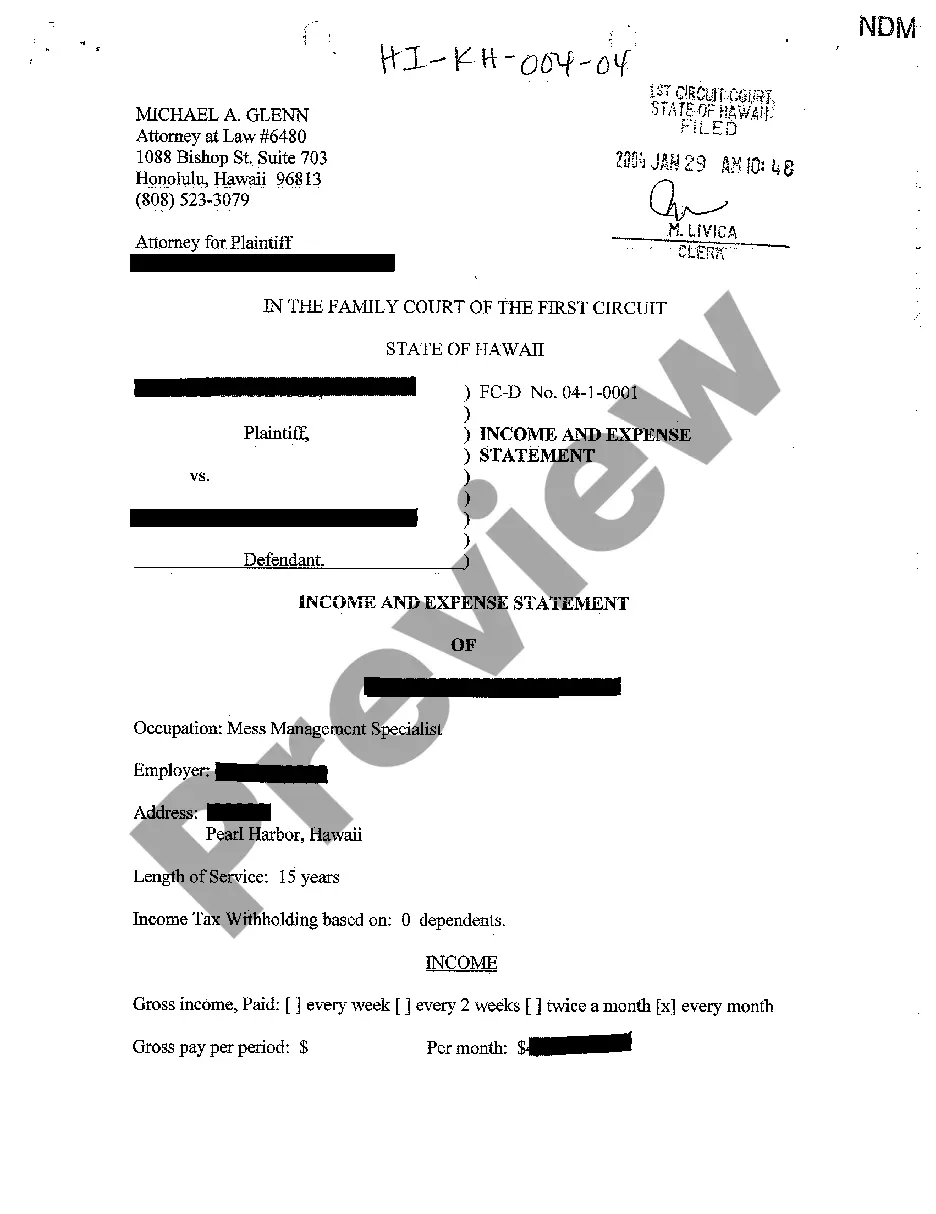

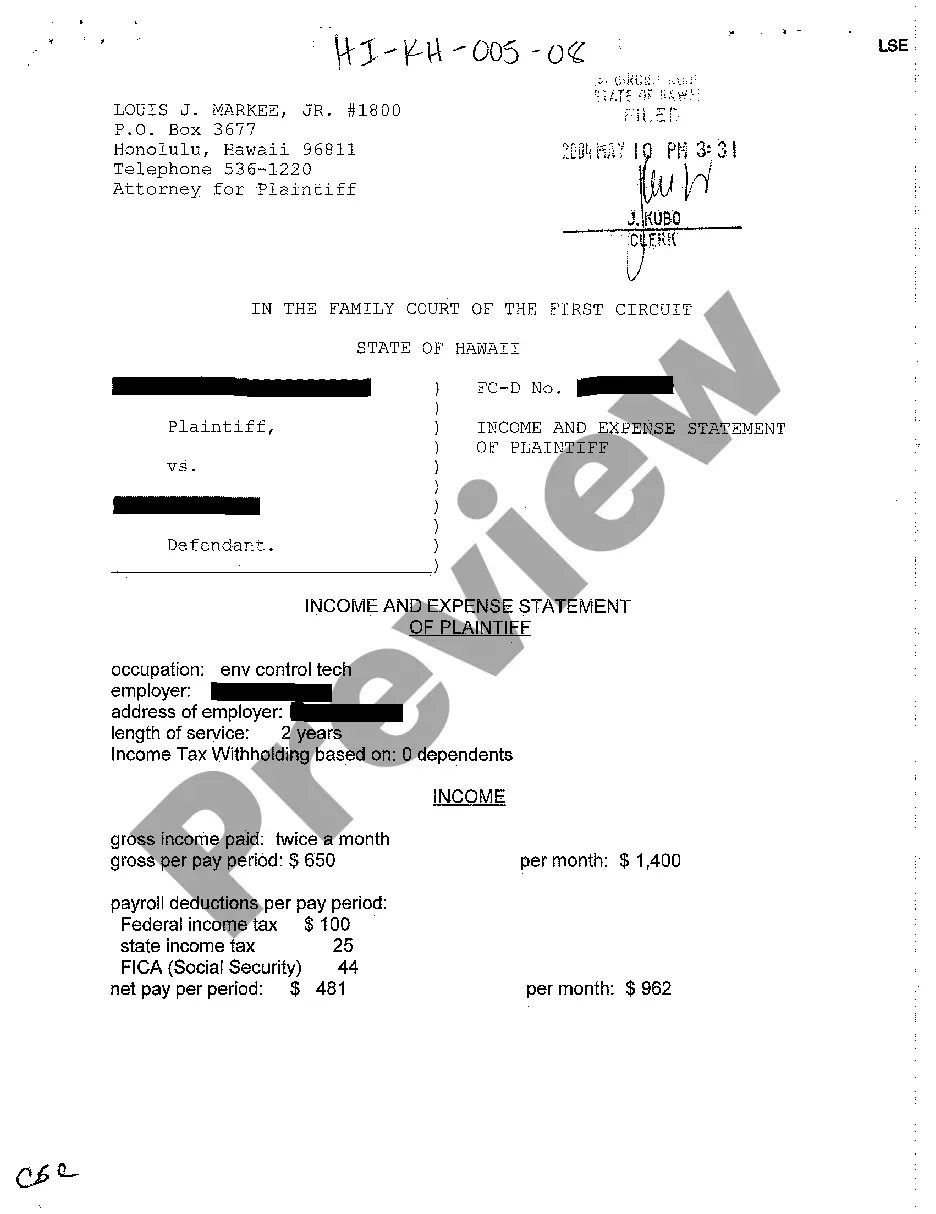

- Examine the template by reviewing the information using the Preview feature.

Form popularity

FAQ

Modifying child custody in Hawaii requires you to file a motion with the family court that issued the original custody order. You should provide evidence showing a significant change in circumstances, which may include changes in your financial situation reflected in a Hawaii Income and Expense Statement. Having support from legal experts can help you present a strong case for modification.

To file for custody in Hawaii, you need to complete the necessary forms and submit them to your local family court. Include a current Hawaii Income and Expense Statement to provide the court with insight into your financial circumstances. Be prepared to attend a hearing where you can present your case, and consider seeking guidance from legal professionals to navigate this important process.

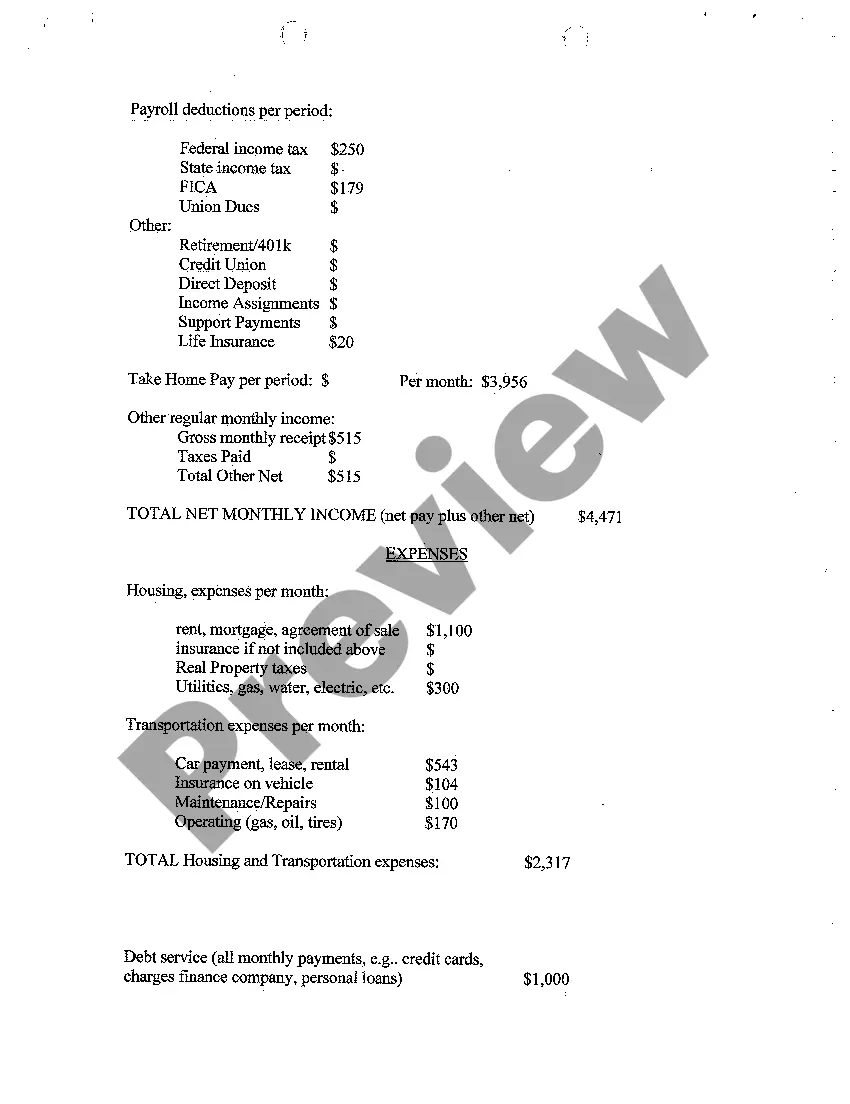

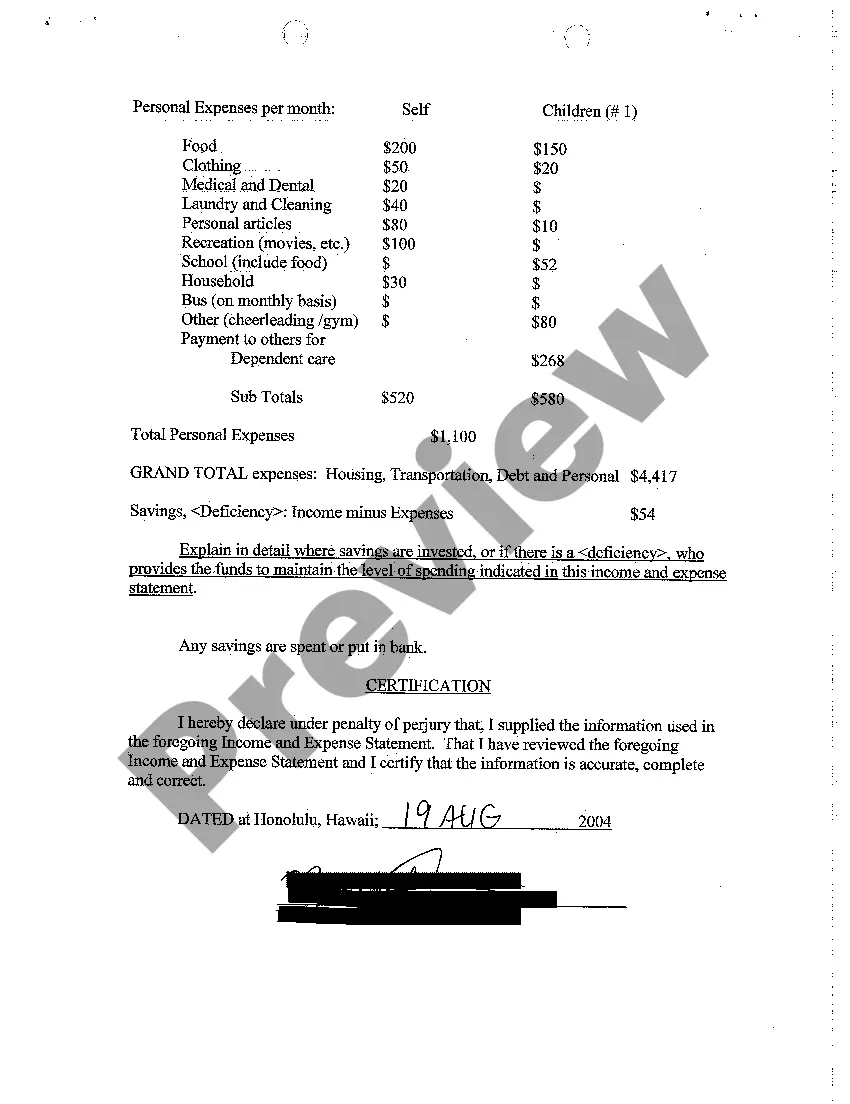

The Hawaii Income and Expense Statement shows your financial health by comparing total income against total expenses. It illustrates whether you are operating at a surplus or a deficit, which can significantly impact legal decisions. Understanding these figures is critical in custody cases, as they inform the court about your financial stability and capability to support a child.

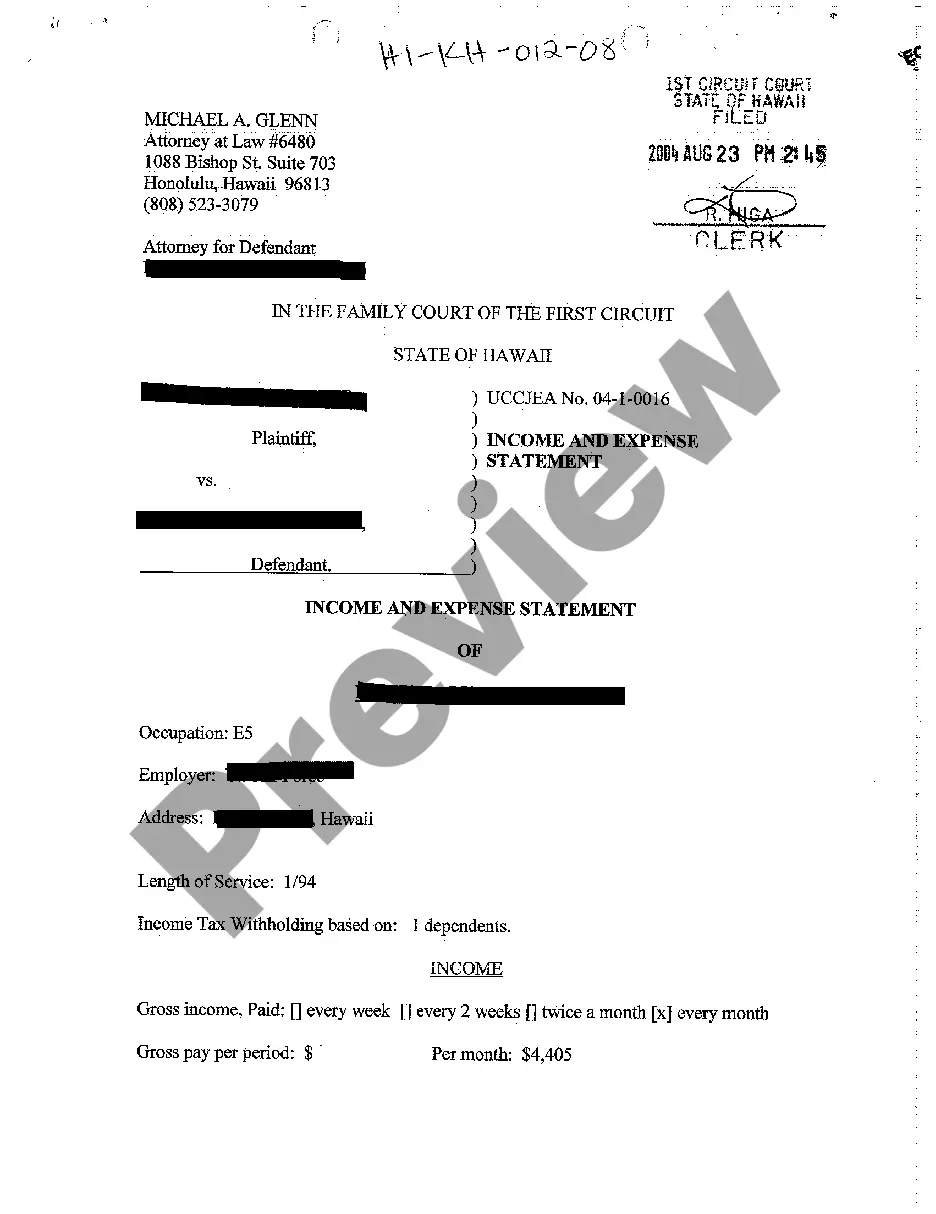

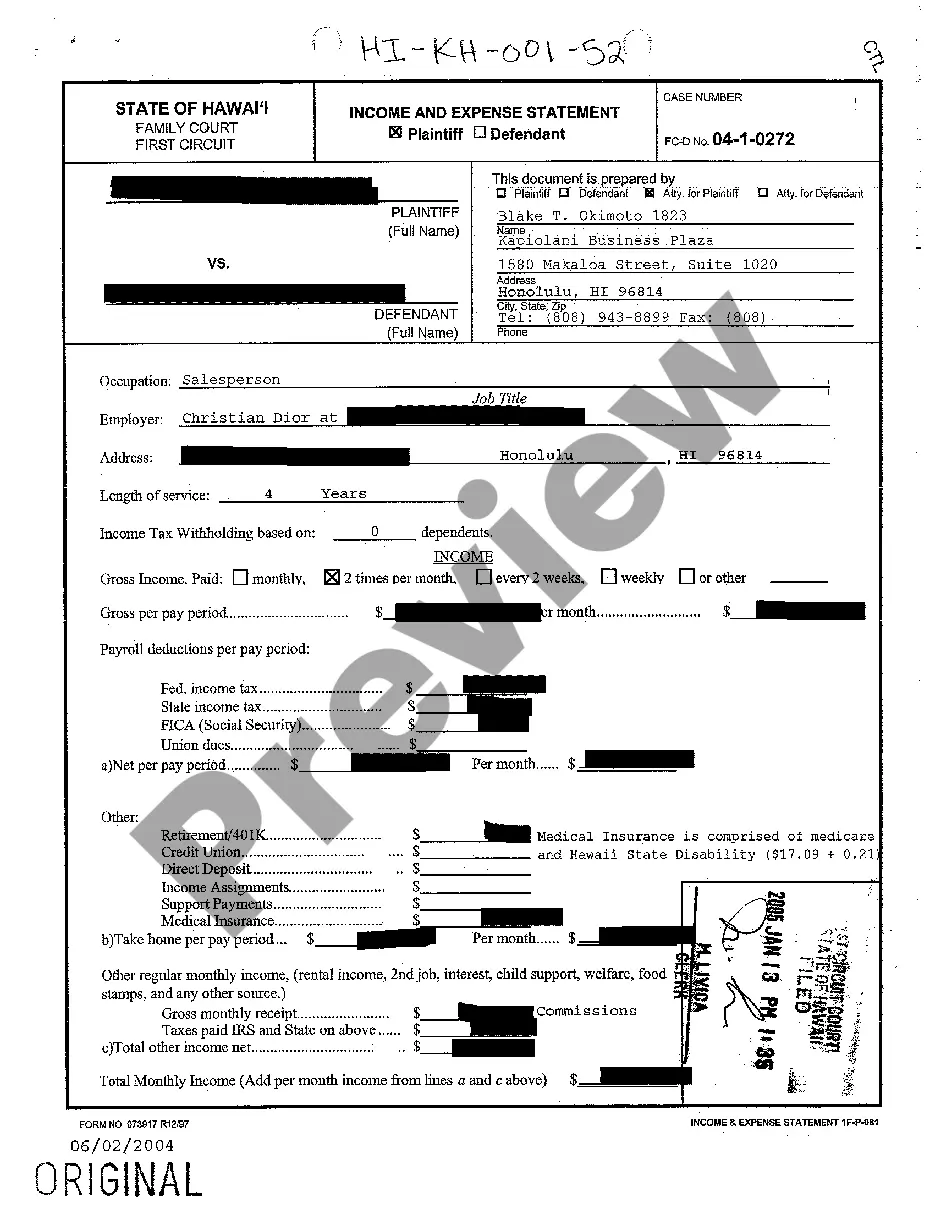

An income and expense statement in Hawaii includes detailed records of all your income sources and expenses. This statement typically lists wages, salaries, rental income, and dividends alongside costs such as housing, food, and medical expenses. It provides a clear financial snapshot, essential for understanding your financial situation, especially in legal matters involving custody and support.

Yes, in many cases, you are required to fill out a Hawaii Income and Expense Statement. This document is crucial for various legal proceedings, such as divorce or family court cases, where financial transparency is essential. By completing this statement, you provide valuable information about your financial situation, helping the court make informed decisions. Using the US Legal Forms platform can simplify this process, offering templates and guidance tailored to your needs.

To create an income and expense statement, gather all sources of income and itemize all relevant expenses over the specified time period. Ensure that your data is accurate and well-organized for easy interpretation. Using tools from US Legal Forms can simplify this process, helping you create a precise Hawaii Income and Expense Statement efficiently.

Writing an income statement format requires a clear structure, starting with revenue followed by expenses and finishing with net income. Use headings and subheadings to enhance readability, categorizing each element carefully. A well-formatted Hawaii Income and Expense Statement provides clarity and makes financial analysis straightforward.

Typically, taxes recorded on an income and expense statement include income taxes and self-employment taxes. It's important to separate these tax expenses to maintain clarity in financial reporting. This separation is particularly beneficial when preparing a Hawaii Income and Expense Statement.

On an income and expense statement, you record all sources of income alongside every incurred expense. Income entries may include sales and investments, while expenses should encompass all business-related costs. This detailed tracking creates a clearer view of financial health within a Hawaii Income and Expense Statement.

To find income before income tax expense on an income statement, start with total revenue. Next, subtract all operating expenses, interest, and other expenditures, excluding income tax. This calculation reveals the pre-tax income, which is essential for a comprehensive Hawaii Income and Expense Statement.