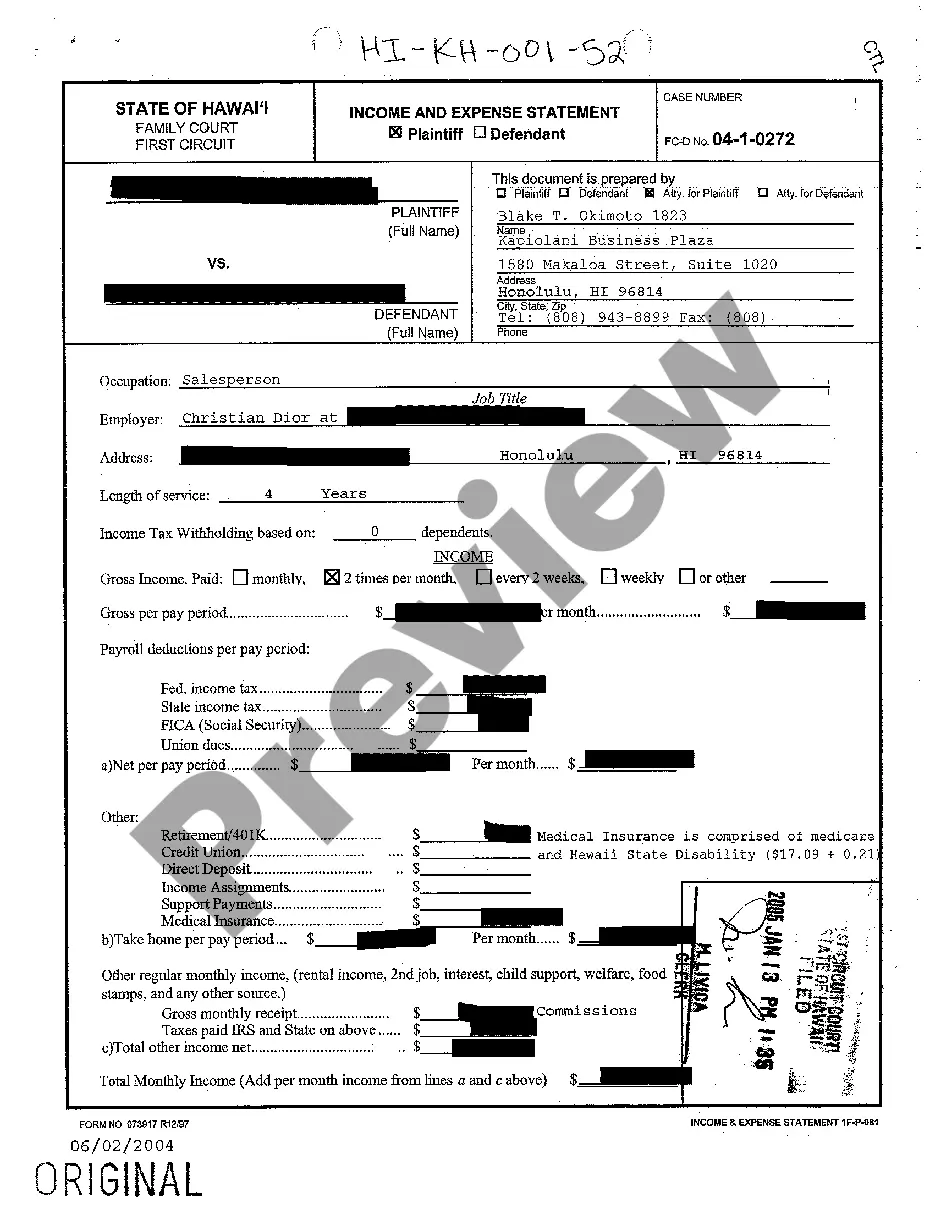

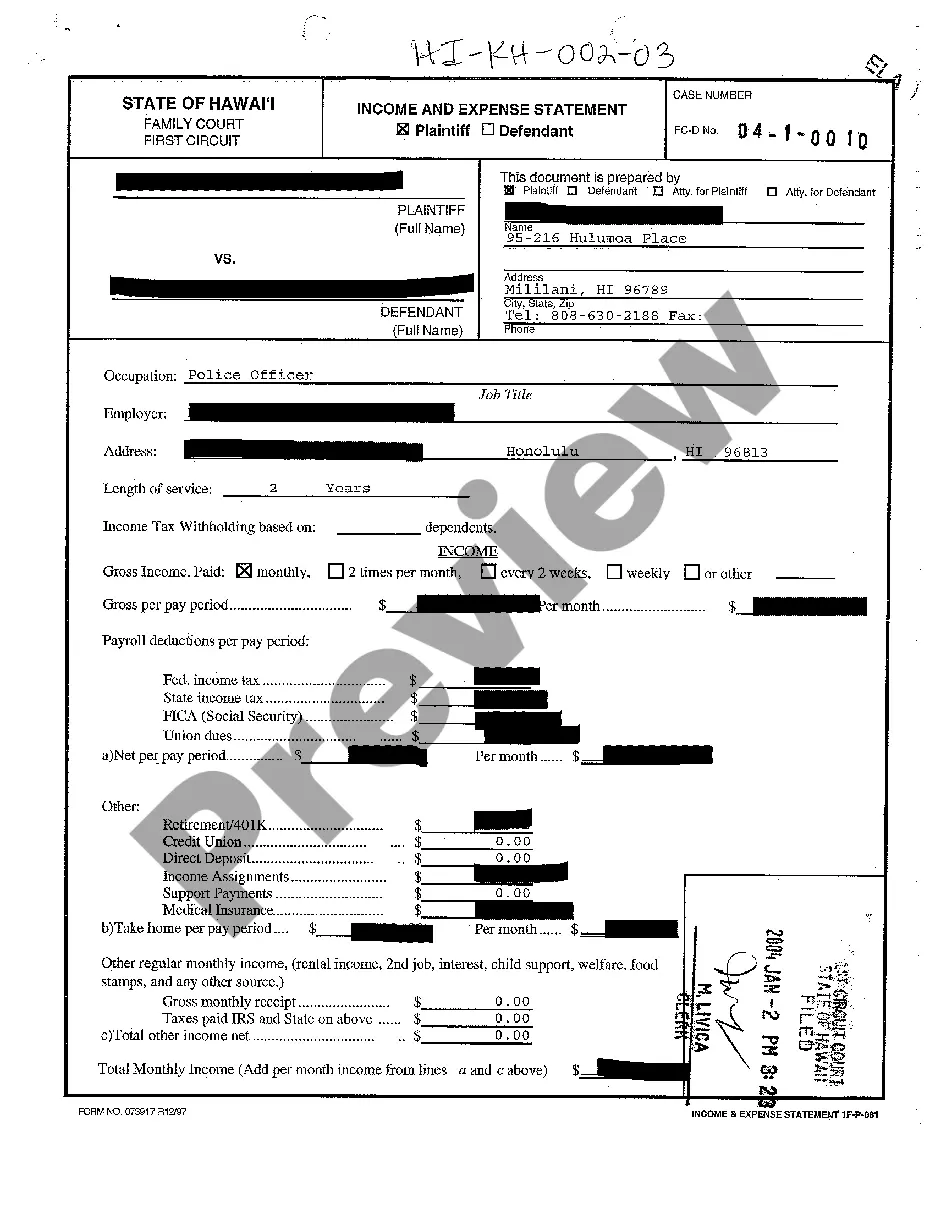

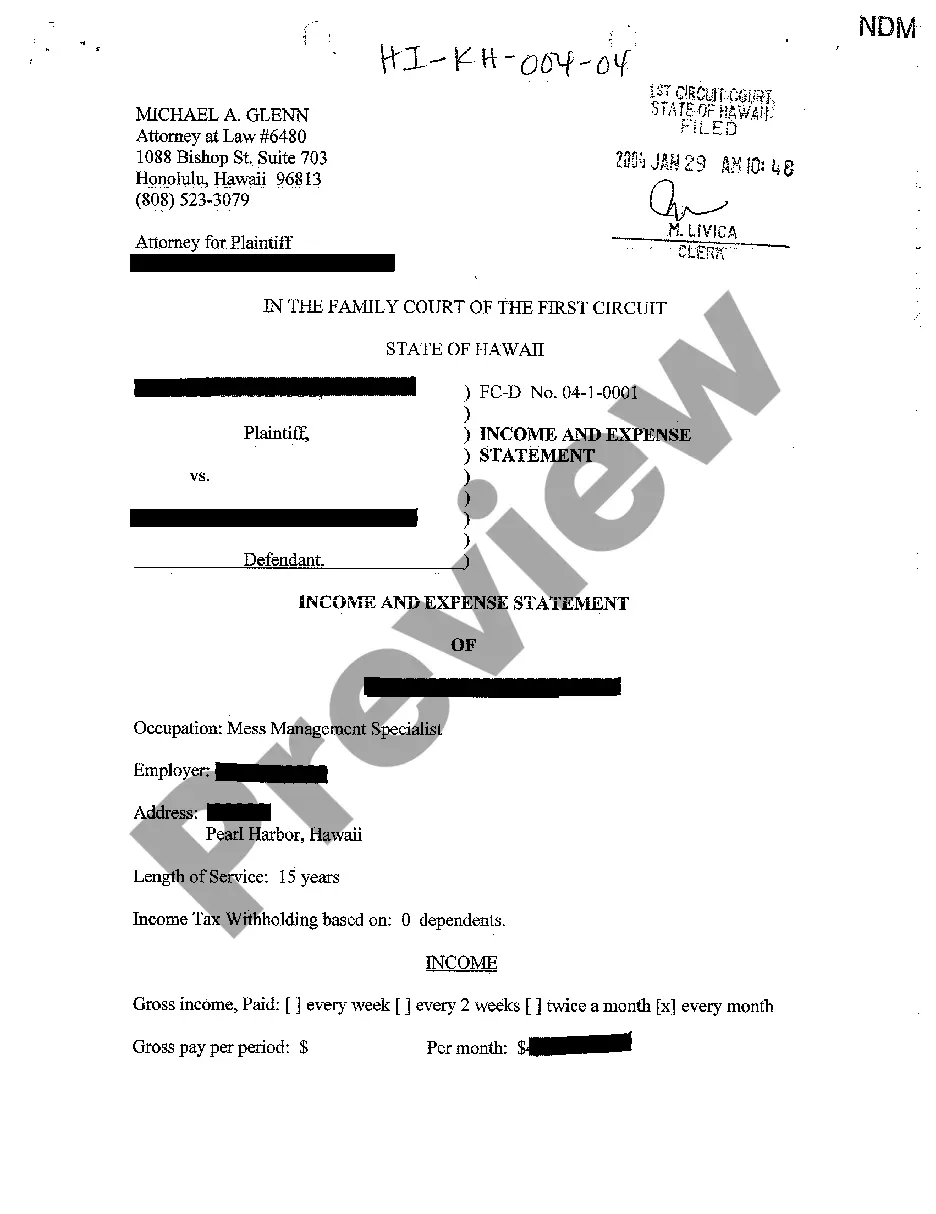

Hawaii Income and Expense Statement

Description

How to fill out Hawaii Income And Expense Statement?

Amidst countless free and paid templates available online, you cannot guarantee their precision and dependability.

For instance, who created them or if they possess adequate qualifications to fulfill your requirements.

Always remain composed and utilize US Legal Forms!

Click Buy Now to initiate the purchase process or search for another example using the Search field located in the header.

- Find Hawaii Income and Expense Statement templates crafted by expert attorneys and avoid the expensive and time-consuming task of searching for a lawyer and then compensating them to draft a document for you that you can obtain on your own.

- If you already hold a subscription, Log In to your account and locate the Download button next to the file you are seeking.

- You will also have the capability to access your previously purchased templates in the My documents section.

- If you are using our website for the first time, follow the steps below to effortlessly acquire your Hawaii Income and Expense Statement.

- Ensure that the document you find is applicable in your region.

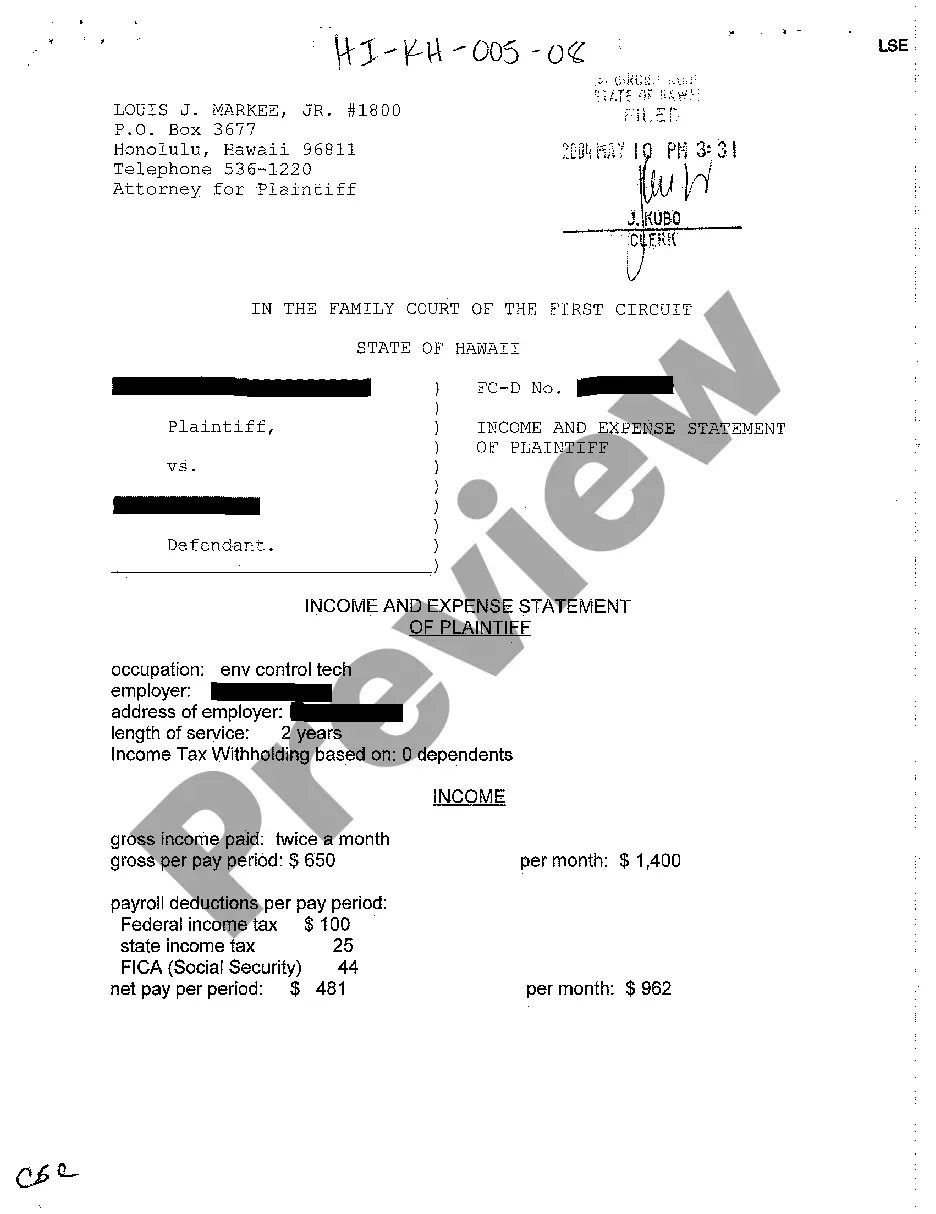

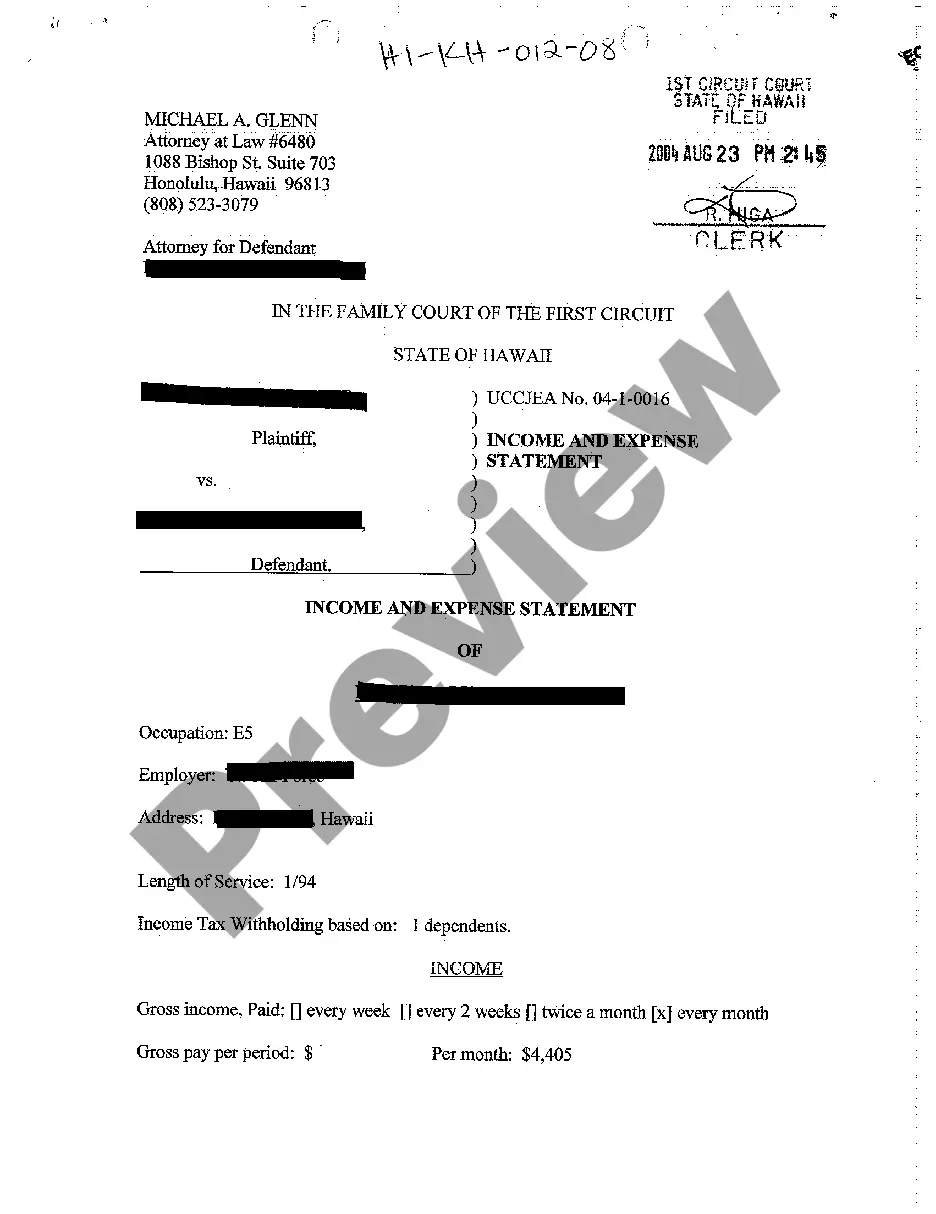

- Examine the template by reading the description and utilizing the Preview function.

Form popularity

FAQ

The document that shows your income and expenses is the Hawaii Income and Expense Statement. This statement is crucial for legal matters, particularly in divorce cases, as it details your financial landscape. It helps the court make informed decisions regarding support and asset division. To access a user-friendly version of this document, check out US Legal Forms for a smooth experience.

Income and expenses are recognized on the Hawaii Income and Expense Statement. This document serves as a comprehensive record of your financial details, enabling the court to understand your economic standing. By clearly listing your inflows and outflows, this statement plays a significant role in fair financial negotiations during divorce proceedings. You can conveniently create this statement through US Legal Forms.

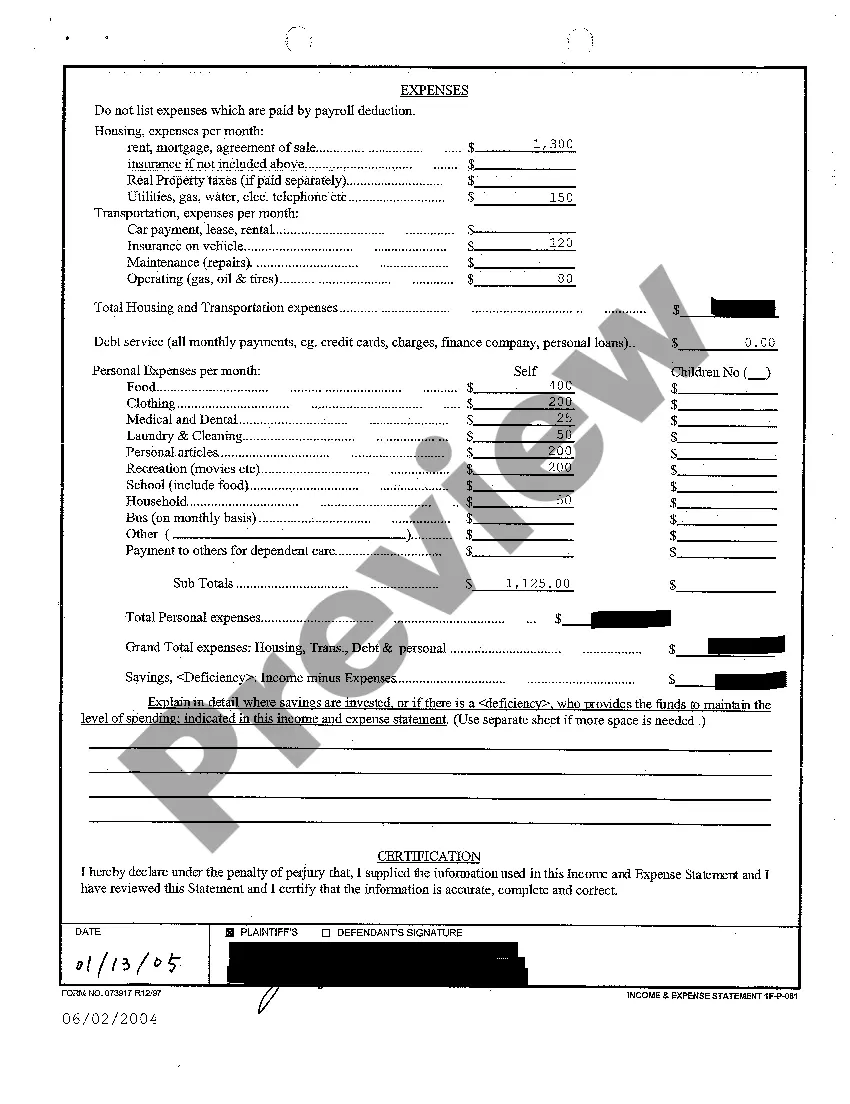

The income and expense declaration for divorce is a legal form that outlines your financial situation during the divorce process. This essential document highlights your income, expenses, assets, and liabilities, providing transparency to the court. It's critical for determining spousal support and child support obligations. Utilizing the Hawaii Income and Expense Statement simplifies this process and ensures you present accurate information.

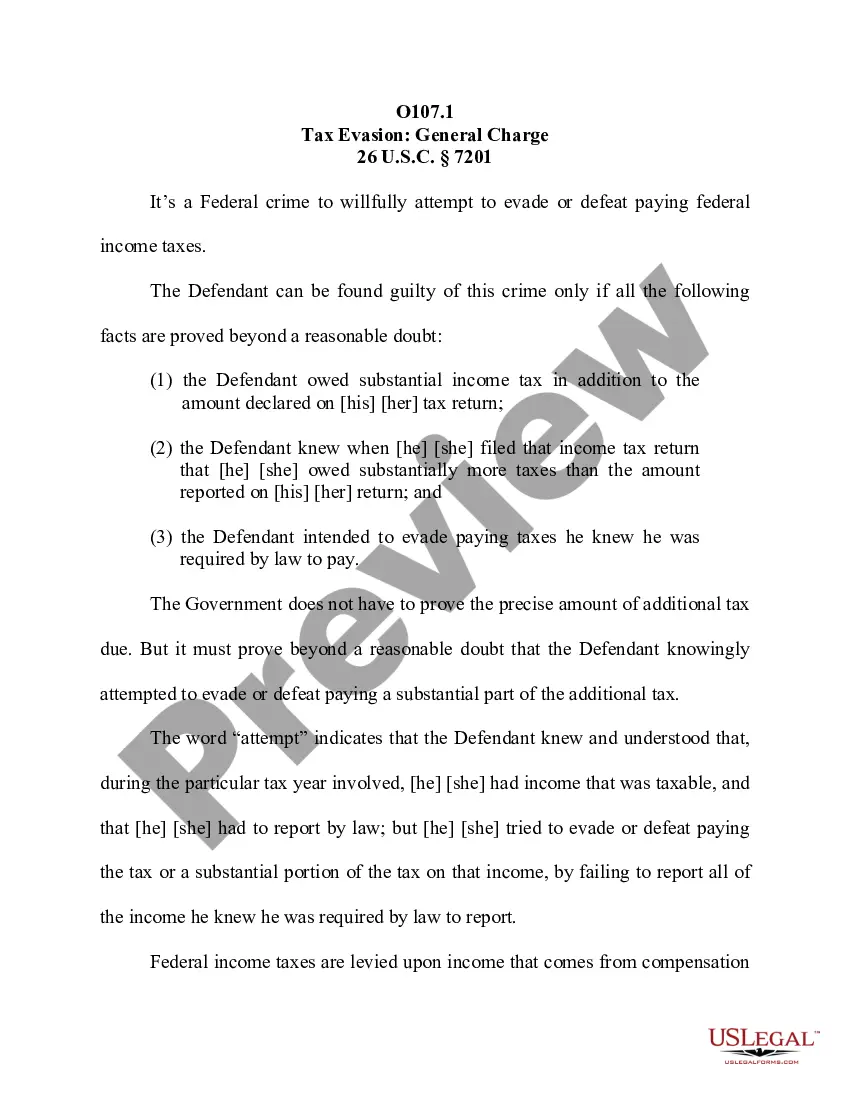

Taxes are recorded on the income and expense statement typically near the bottom, following the operating income and before the net income is calculated. This positioning clarifies the impact of tax obligations on your overall earnings. Understanding where taxes appear enhances financial transparency. With uslegalforms, easy-to-follow structures provide clarity in your income and expense statements.

Taxes recorded on the income and expense statement typically include income tax, sales tax, and employment taxes. These obligations affect your net income and should be tracked diligently. Properly accounting for these taxes allows for accurate financial insights and compliance. Using uslegalforms, you can simplify the accounting process and ensure all relevant taxes are considered.

On a Hawaii Income and Expense Statement, you record all forms of income, including sales, services, and any other revenue streams. Additionally, carefully list all expenses, ensuring to distinguish between necessary costs and discretionary spending. This thorough record aids in evaluating your financial health. The uslegalforms tool can streamline this process and help you maintain accurate records.

The tax expense on the income statement represents the estimated tax obligations based on the pre-tax income. This figure quantifies how much you owe to federal and state governments before any tax credits. Understanding this expense is crucial for financial reporting and future planning. With uslegalforms, you can create a detailed income statement that correctly allocates tax expenses.

Finding income before income tax expense on your income statement is straightforward. You should focus on your total revenue and subtract all operating expenses, interest, and any additional costs. This calculation gives you the pre-tax income, which is essential for accurate financial analysis. For clarity in presentation, utilize a structured format from the uslegalforms platform.

To write a Hawaii Income and Expense Statement, begin by listing all your income sources. Next, itemize your expenses, categorizing them into fixed and variable costs. Be sure to summarize the total income and total expenses, leading to your net income or loss. By using a template from uslegalforms, you can ensure that your statement is comprehensive and easy to understand.

Filling out an income statement involves listing all revenue streams first, followed by expenses grouped into appropriate categories. Ensure that all figures are accurate and supported by receipts or documentation. By following the Hawaii Income and Expense Statement guide, you can streamline this process and enhance the clarity of your financial position.