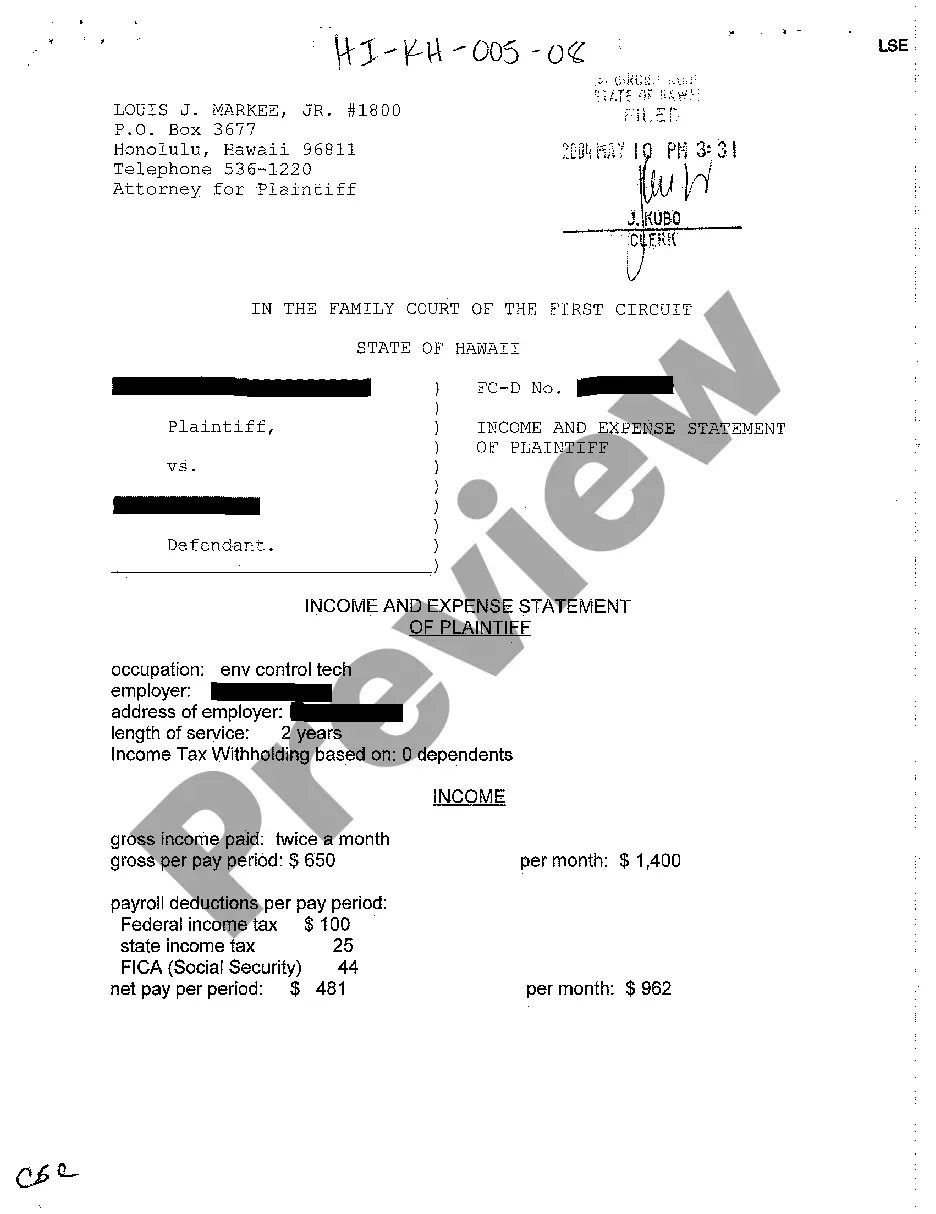

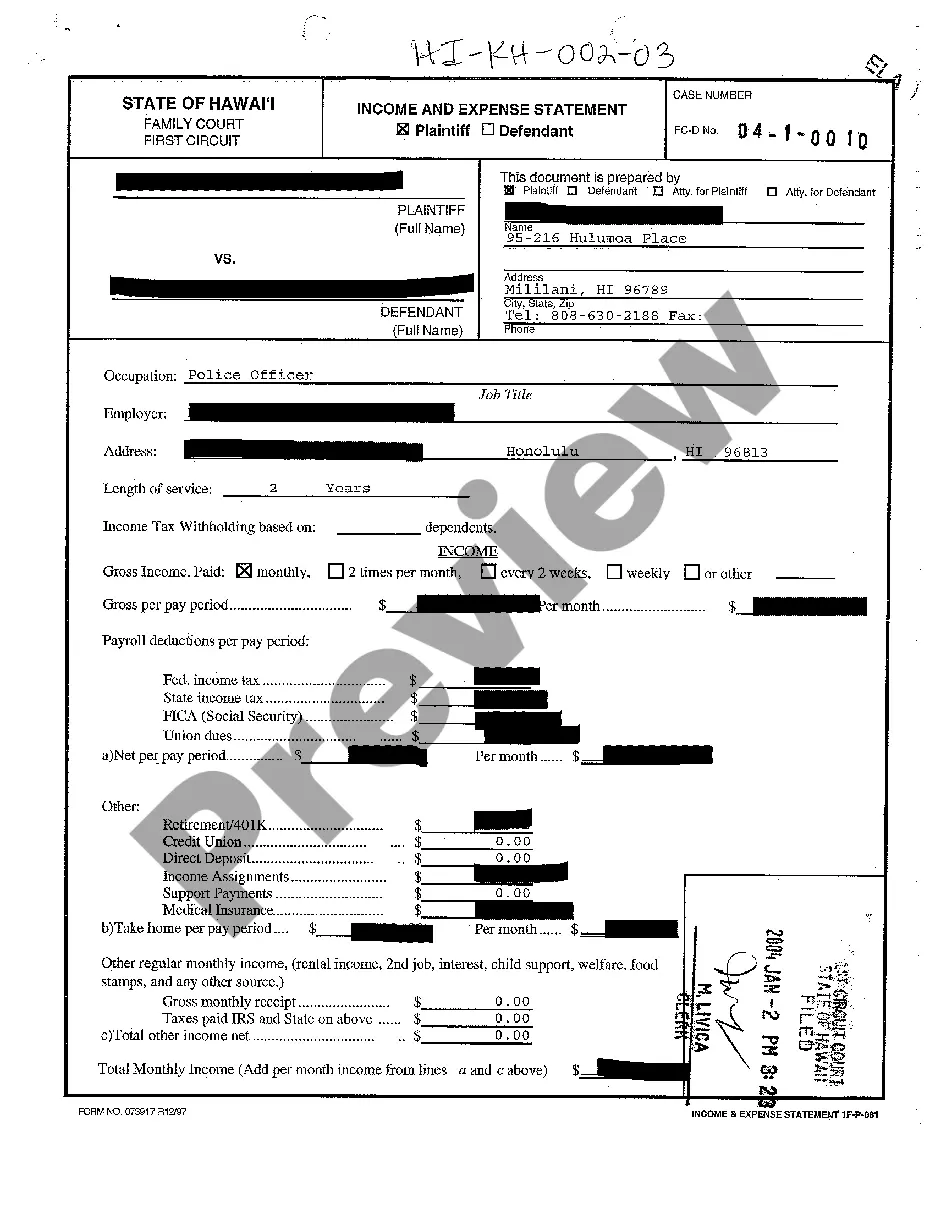

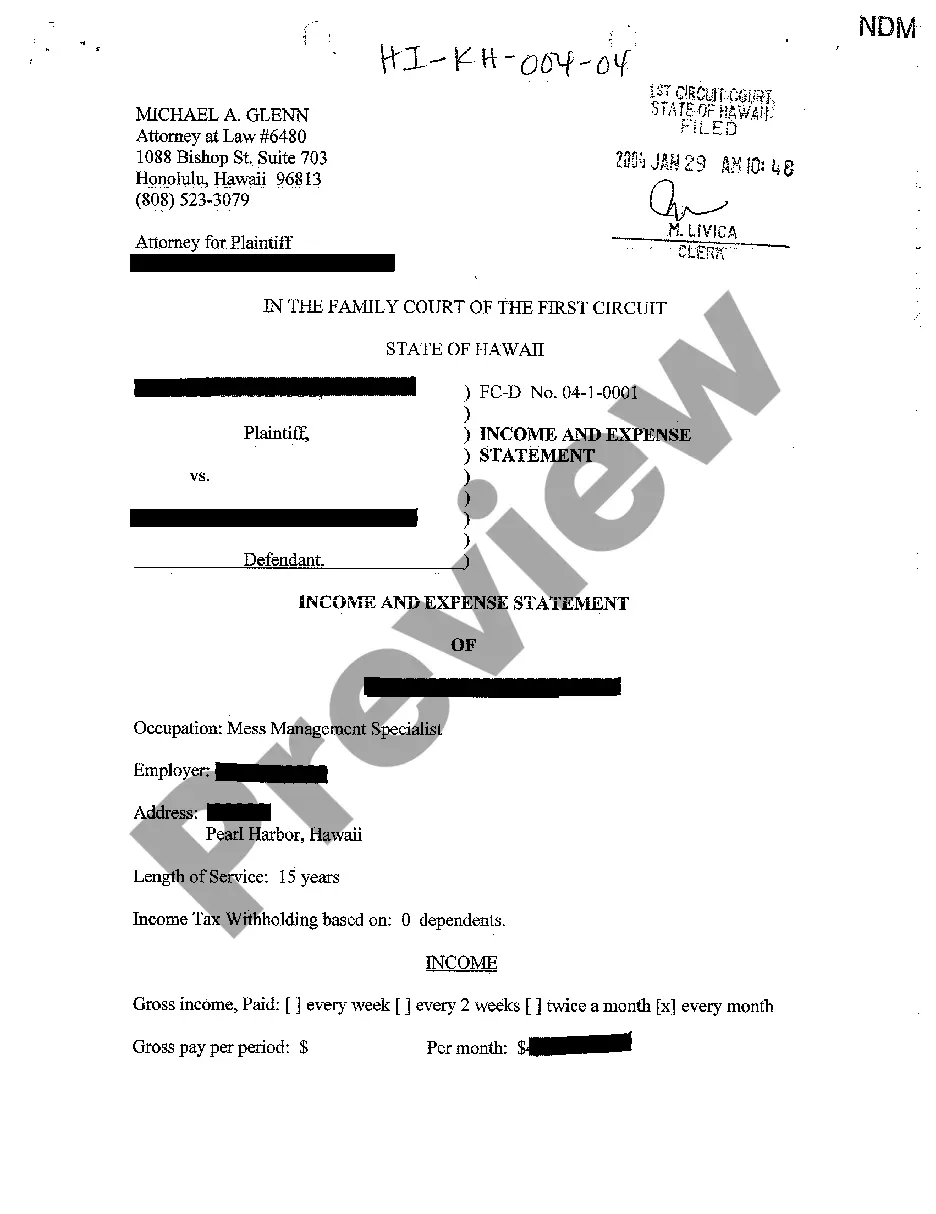

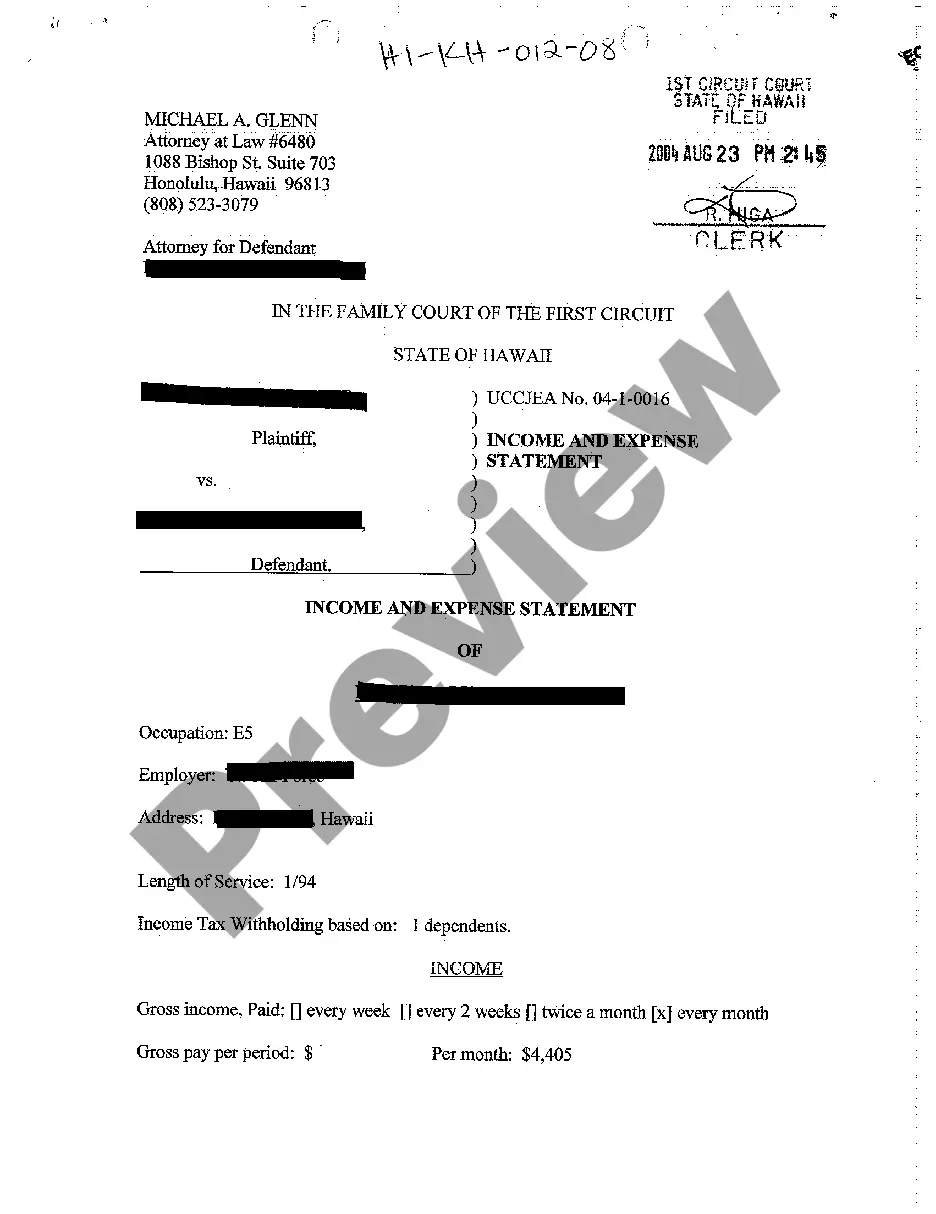

Hawaii Income and Expense Statement of Plaintiff

Description

How to fill out Hawaii Income And Expense Statement Of Plaintiff?

Amidst a multitude of both paid and complimentary samples available online, one cannot guarantee their reliability.

For instance, who created them or whether they possess the necessary qualifications to handle your requirements.

Stay composed and make use of US Legal Forms! Discover Hawaii Income and Expense Statement of Plaintiff templates crafted by experienced legal professionals and avoid the expensive and time-consuming process of seeking an attorney and subsequently compensating them to draft a document for you that you can easily find.

Select a pricing plan and register for an account. Complete the payment for the subscription via your credit/debit card or Paypal. Download the form in your desired file format. Once you’ve registered and purchased your subscription, you can utilize your Hawaii Income and Expense Statement of Plaintiff as frequently as needed or until it remains valid in your state. Modify it in your preferred online or offline editor, complete it, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- If you have an existing subscription, Log In to your account and locate the Download button adjacent to the form you are searching for.

- You will also have the option to view your previously downloaded files in the My documents section.

- If this is your first time using our website, adhere to the guidelines outlined below to effortlessly obtain your Hawaii Income and Expense Statement of Plaintiff.

- Ensure that the document you view is valid in your state.

- Review the template by accessing the information through the Preview function.

- Click Buy Now to commence the ordering process or search for another example utilizing the Search box in the header.

Form popularity

FAQ

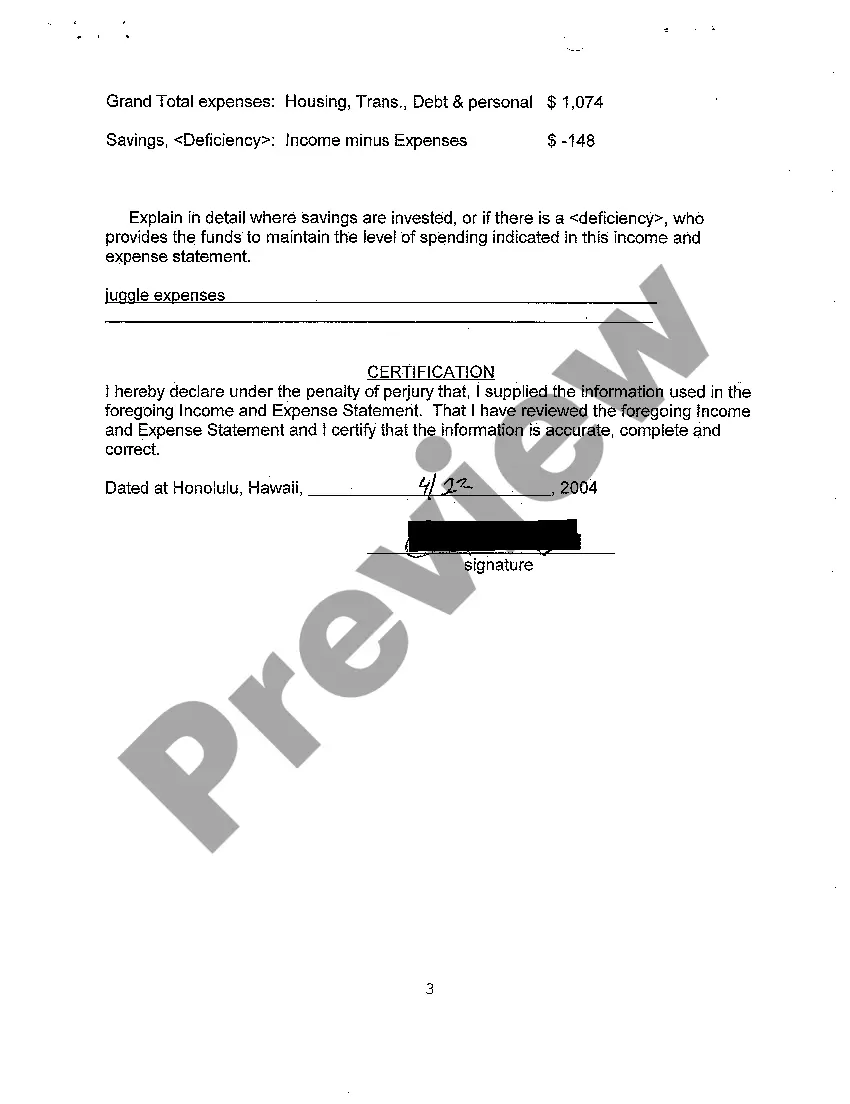

Yes, filling out an income and expense declaration is often required in legal matters, especially in family law cases. This document provides the court with a clear understanding of your financial condition. Failing to submit the Hawaii Income and Expense Statement of Plaintiff may impact the outcome of your case. USLegalForms can guide you in completing this declaration accurately.

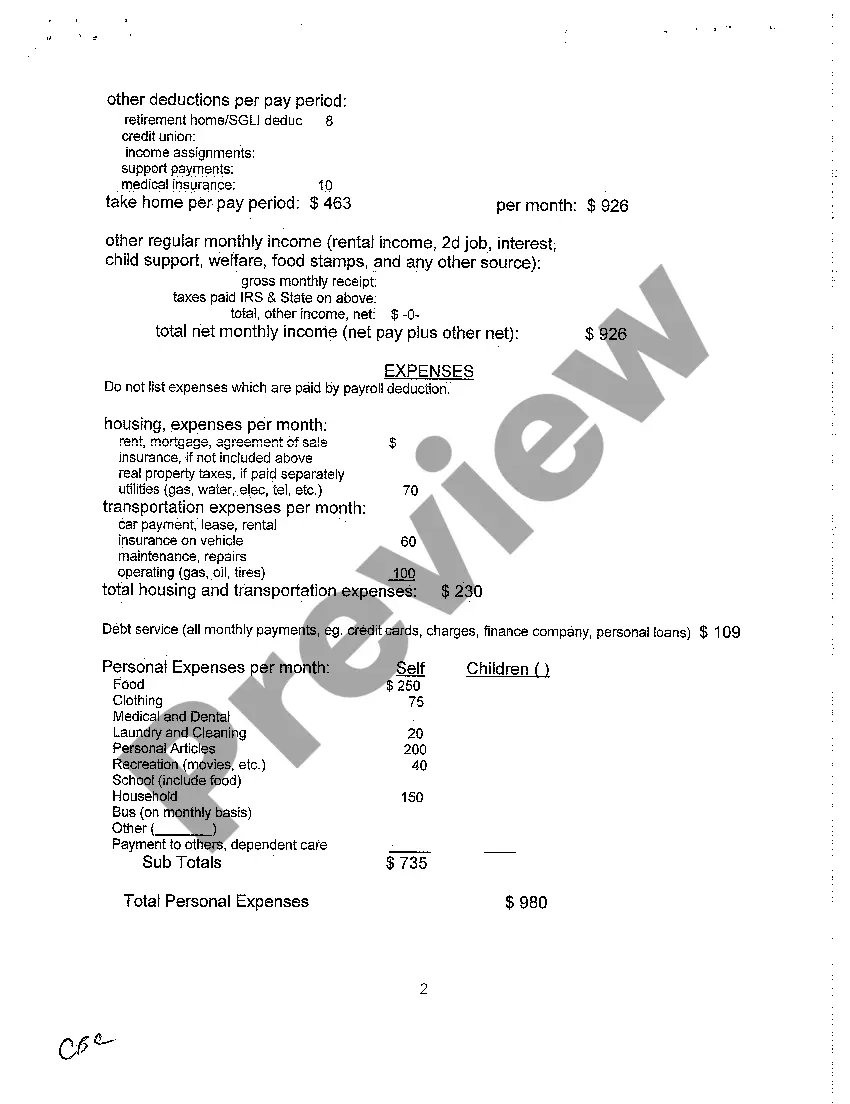

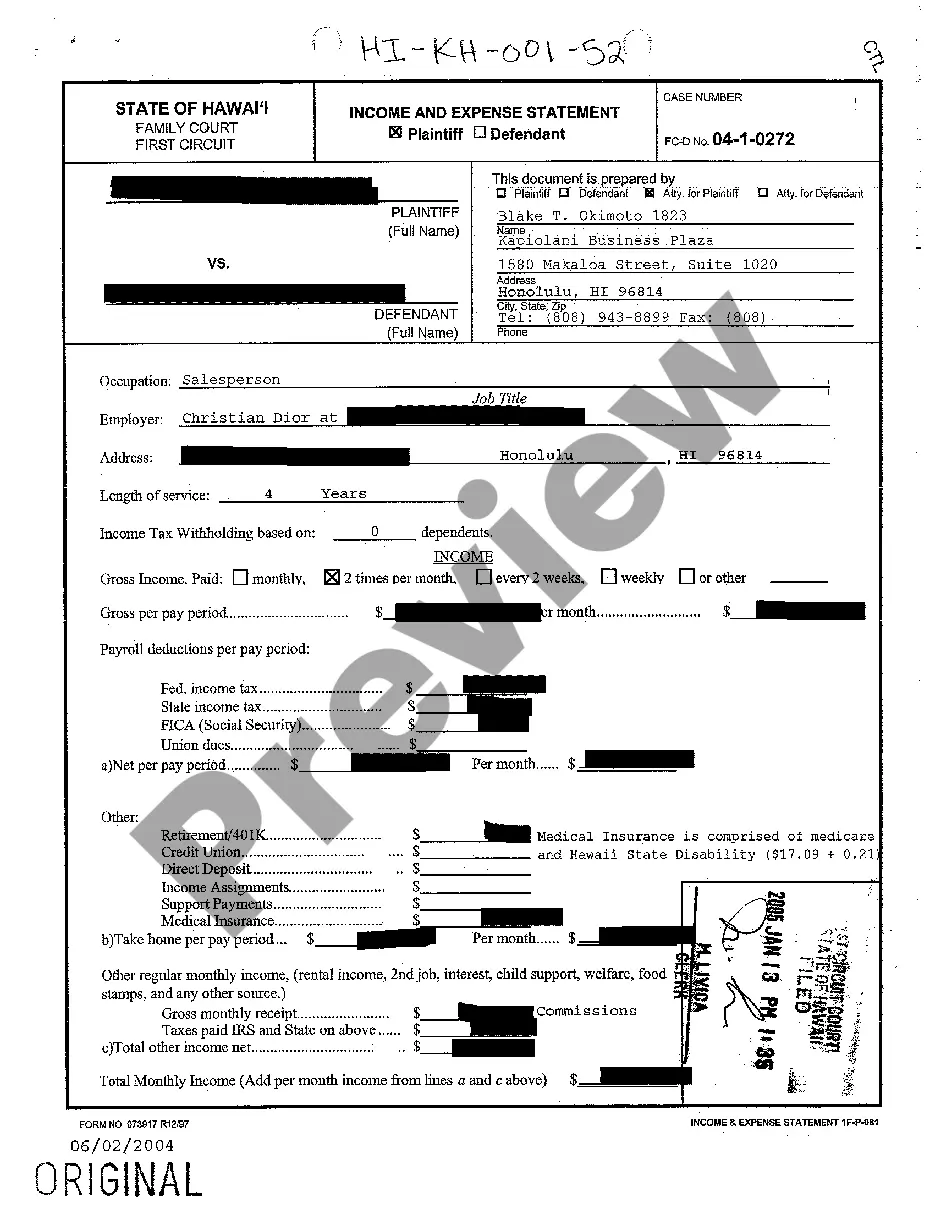

To prepare an income and expense statement, begin by identifying your income streams and documenting them accurately. Follow this with a detailed account of your expenses, categorizing them for clarity. Once compiled, you will have a comprehensive view of your financial situation. For residents in Hawaii, using USLegalForms can help you efficiently fill out the Hawaii Income and Expense Statement of Plaintiff with ease.

To create an income and expense report, gather all your financial documents first. Organize your income sources, such as salaries and bonuses, then list all your monthly expenses like rent, utilities, and groceries. Next, summarize this information into a clear format. Using a platform like USLegalForms can simplify this process, especially when completing the Hawaii Income and Expense Statement of Plaintiff.

Yes, the income and expense declaration must be filed with the court. This is a key part of your court case as it provides the judge with essential information regarding your financial situation. By using the Hawaii Income and Expense Statement of Plaintiff from US Legal Forms, you can ensure that you include all required details for submission. Remember to file the declaration by the court's deadline to avoid any complications.

To file an income statement, first collect all necessary information regarding your finances, including income from all sources and monthly expenses. You can easily complete the Hawaii Income and Expense Statement of Plaintiff using online platforms like US Legal Forms, which offers user-friendly templates. After filling out the form accurately, you need to print it and submit it to the appropriate court. Make sure to keep copies for your records.

To write a Hawaii Income and Expense Statement of Plaintiff, start by listing your income sources in a clear format. Next, compile your recurring and necessary expenses, ensuring you categorize them effectively. This organized approach allows for an easy review of your finances. Tools like US Legal Forms can simplify this process, providing templates tailored for accuracy and compliance.

On a Hawaii Income and Expense Statement of Plaintiff, you record all sources of income, including wages, bonuses, alimony, and any other financial support. Additionally, document all regular expenses such as rent, utilities, food, and transportation costs. This information provides a complete picture of your financial situation, crucial for legal proceedings. Using this detailed statement can strengthen your case and ensure fair evaluations.