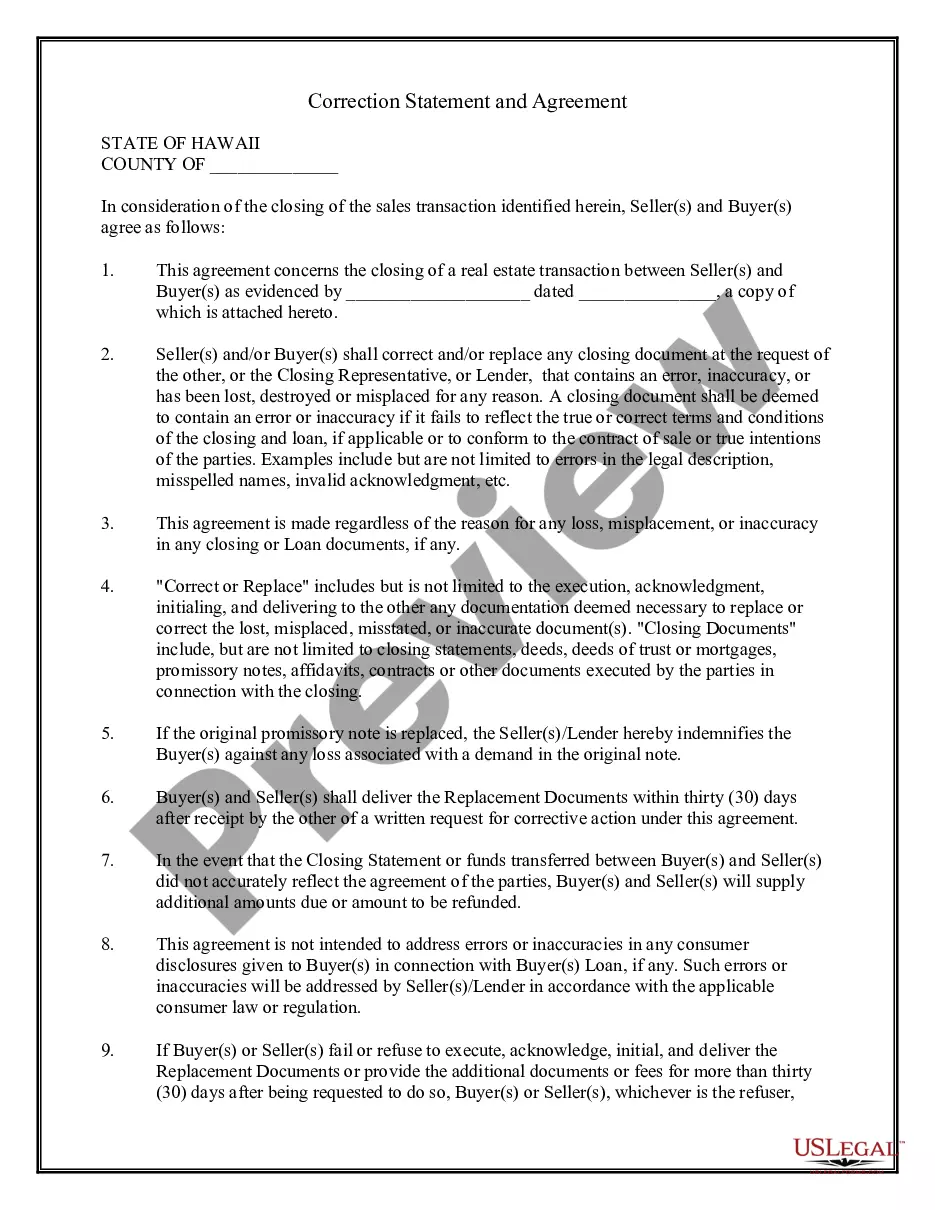

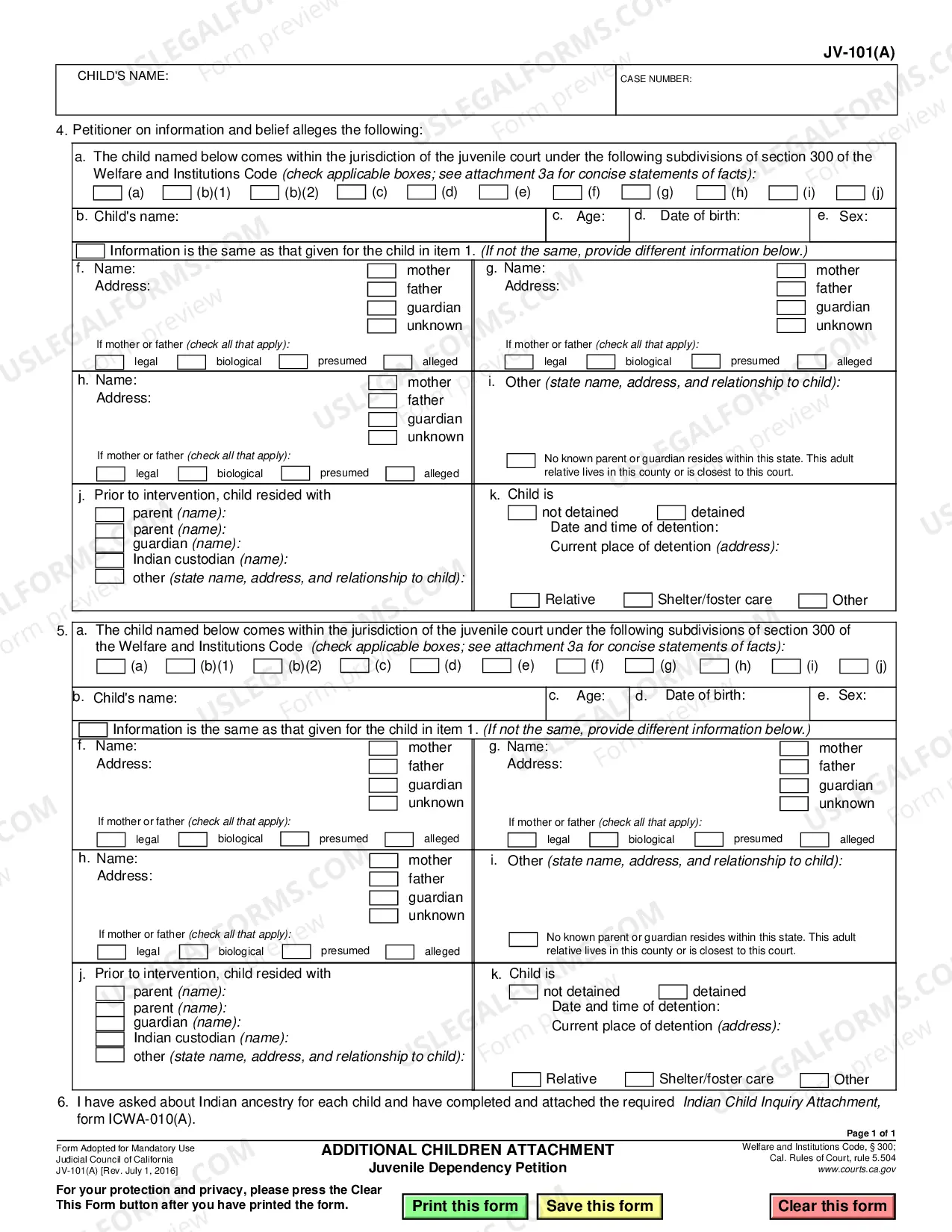

This form is for a buyer and seller to sign at closing agreeing to execute corrected documents and to provide replacement documents in the event any documents are lost or misplaced. Upon ordering, you may download the form in Word, Wordperfect, Text or Rich Text formats.

Hawaii Correction Statement and Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii Correction Statement And Agreement?

Obtain one of the most comprehensive collections of sanctioned documents. US Legal Forms is essentially a tool to locate any state-specific form in just a few clicks, including templates for Hawaii Correction Statement and Agreement. No need to squander your time searching for a court-acceptable sample. Our certified professionals ensure that you receive the latest documents consistently.

To utilize the forms library, choose a subscription and set up an account. If you’ve already created one, simply Log In and click Download. The Hawaii Correction Statement and Agreement template will be promptly saved in the My documents section (a section for each form you download on US Legal Forms).

To establish a new account, adhere to the concise guidelines provided below.

That's it! You should complete the Hawaii Correction Statement and Agreement template and verify it. To ensure everything is correct, consult your local legal advisor for assistance. Register and effortlessly access over 85,000 useful forms.

- If you plan to use a state-specific document, make sure to select the correct state.

- If possible, examine the details to understand all the nuances of the form.

- Utilize the Preview feature if available to check the document's details.

- If everything is accurate, click Buy Now.

- After selecting a pricing plan, register an account.

- Pay using a credit card or PayPal.

- Download the sample to your device by clicking the Download button.

Form popularity

FAQ

A quitclaim deed in Hawaii allows a property owner to transfer their interest in a property without guaranteeing that the title is clear. This type of deed is used frequently in estate planning or to clear up title issues. When using a quitclaim deed, it’s wise to consult the Hawaii Correction Statement and Agreement to address any potential tax impacts.

Partnership non-resident withholding in Hawaii requires partnerships to withhold taxes from distributions made to non-resident partners. The withholding rate typically aligns with the state’s income tax rates. Using the Hawaii Correction Statement and Agreement ensures partners understand their withholdings clearly.

You should mail your Hawaii amended tax return to the Department of Taxation, which addresses might differ based on your location. Make sure to use the correct forms and include necessary documentation. For assistance, the Hawaii Correction Statement and Agreement can help clarify any issues you may encounter in this process.

The withholding tax rate for partnerships in Hawaii generally depends on the type of income being distributed. Typically, this rate can vary but often aligns with federal guidelines. Learning about the Hawaii Correction Statement and Agreement can offer transparency in this process, ensuring partners understand their tax responsibilities.

withholding partnership is one that does not deduct taxes from payments made to its partners. Typically, these partnerships pass income directly to their partners, who are responsible for reporting and paying taxes. If you are involved in such a partnership, understanding the Hawaii Correction Statement and Agreement is essential for ensuring proper tax treatment.

You can obtain a copy of your deed online through the Bureau of Conveyances’ website, where they offer various digital services. This is a convenient option, especially if you are dealing with a Hawaii Correction Statement and Agreement. Additionally, platforms like US Legal Forms can guide you through this online process, ensuring you access the documents you need seamlessly.

To get a copy of your house deed in Hawaii, you need to contact the Bureau of Conveyances directly or check their online services. You may need to provide identification and details of the property. Services like US Legal Forms can help with the necessary forms and the process involved, keeping your focus on crucial matters like your Hawaii Correction Statement and Agreement.

In Hawaii, deeds should be recorded at the Bureau of Conveyances. This bureau maintains official property records and ensures the legality of transactions. If you need guidance, the US Legal Forms platform can assist in navigating the procedures related to a Hawaii Correction Statement and Agreement, ensuring your documents are processed correctly.

To obtain a digital copy of a deed in Hawaii, you can visit the official Hawaii Office of Elections website. They provide resources on accessing public records, including deeds. Additionally, using services like US Legal Forms can simplify this process by allowing you to request necessary documents online, particularly when dealing with a Hawaii Correction Statement and Agreement.

The recording process for a deed in Hawaii usually spans from several days to two weeks. Factors such as the specific county and the current workload of the recorder’s office can influence this timeframe. Preparing accurate documentation, including the Hawaii Correction Statement and Agreement if needed, can help streamline this process. Ensure all your documents are in order to avoid any delays.