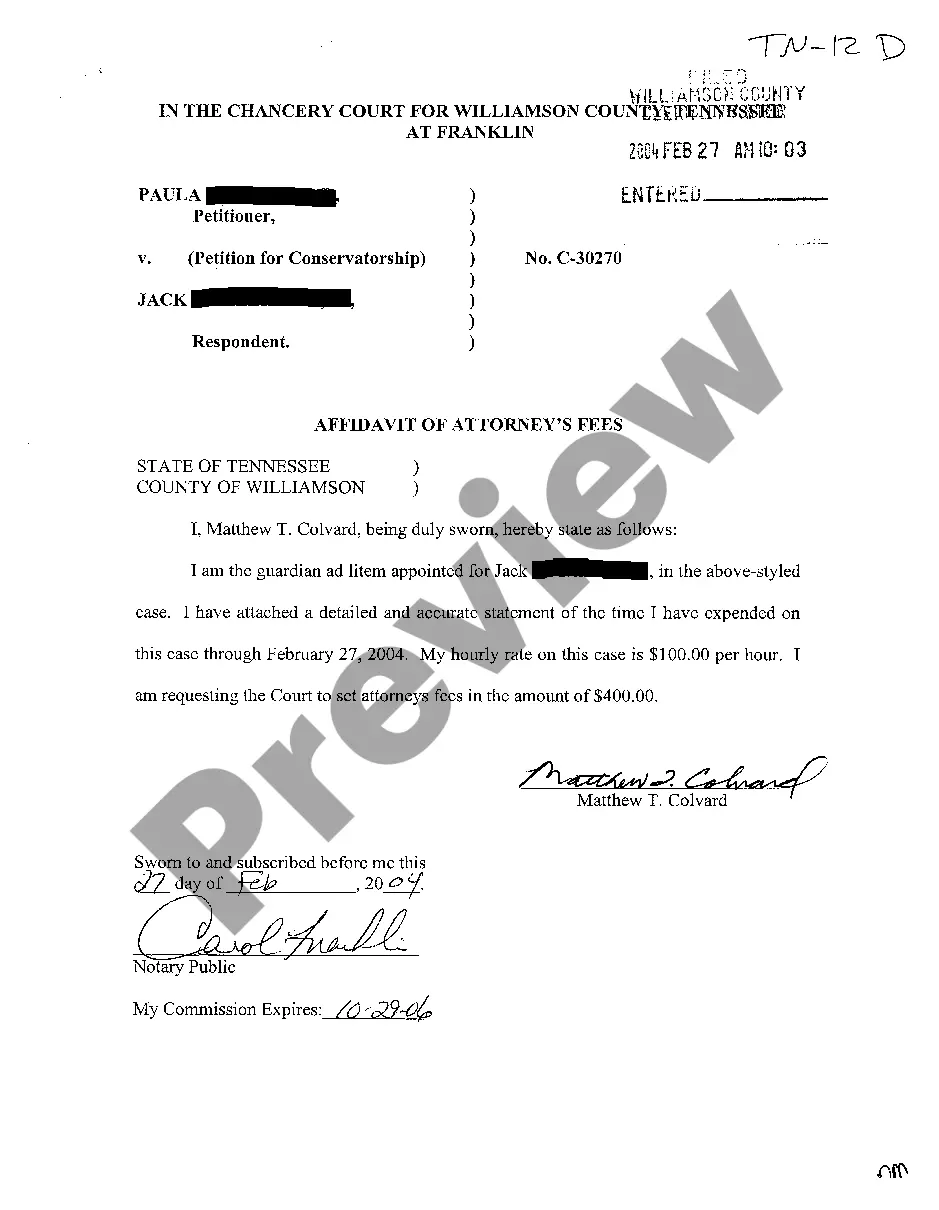

This form is a motion to approve a reaffirmation agreement and the form also contains an order. The debtor may use this form to request approval of the reaffirmation agreement. The court will either approve or deny the request.

Hawaii Motion for Approval of Reaffirmation Agreement

Description

How to fill out Hawaii Motion For Approval Of Reaffirmation Agreement?

Access one of the most extensive collections of sanctioned forms.

US Legal Forms is genuinely a platform where you can locate any state-specific document in just a few clicks, including Hawaii Motion for Approval of Reaffirmation Agreement templates.

No need to waste countless hours attempting to find a court-acceptable template. Our qualified professionals guarantee you receive the latest samples consistently.

After selecting a pricing plan, create your account. Make payment via card or PayPal. Download the sample to your computer by clicking on the Download button. That's it! You should complete the Hawaii Motion for Approval of Reaffirmation Agreement form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and easily access more than 85,000 helpful templates.

- To utilize the document library, choose a subscription and create an account.

- Once registered, simply Log In and click on the Download button.

- The Hawaii Motion for Approval of Reaffirmation Agreement file will be automatically saved in the My documents section (a section for each form you download from US Legal Forms).

- To create a new account, refer to the brief instructions provided below.

- If you're planning to use a state-specific document, ensure you specify the correct state.

- If possible, review the description to understand all of the details of the form.

- Utilize the Preview feature if it’s available to check the document's content.

- If everything looks correct, click Buy Now.

Form popularity

FAQ

Typically, the debtor signs the reaffirmation agreement along with the creditor. This mutual agreement ensures both parties understand their obligations. It's essential that you review the terms carefully, as reaffirmation will make you liable for the debt post-bankruptcy. Consulting resources such as US Legal Forms can guide you in properly completing a Hawaii Motion for Approval of Reaffirmation Agreement.

A reaffirmation agreement allows a debtor to retain certain secured debts, like a car or a home, during bankruptcy. By signing this agreement, you essentially agree to remain responsible for the debt despite the bankruptcy process. This action can help you rebuild your credit while keeping your valued assets. For a smooth process, consider filing a Hawaii Motion for Approval of Reaffirmation Agreement through platforms like US Legal Forms.

The legal requirements for a reaffirmation agreement typically include the necessity for the agreement to be in writing, signed by both parties, and filed with the court. Furthermore, the agreement must state that reaffirming the debt is in your best interest and detail the terms clearly. Consulting with legal resources can simplify this process, ensuring you comply with all necessary regulations.

After a reaffirmation agreement is approved, you must continue to make timely payments to the creditor to keep your asset. This may help you rebuild your credit over time. Additionally, it is essential to maintain communication with your lender to address any issues that may arise.

At a reaffirmation hearing, the judge reviews the terms of your reaffirmation agreement to ensure it is fair and in your best interest. The judge will ask whether you understand the agreement and its consequences. This oversight helps protect your rights throughout the reaffirmation process.

If you choose not to reaffirm your mortgage but continue making payments, you can keep your home as long as you stay current on your payments. However, not reaffirming means the mortgage remains unsecured, which might affect your creditor's collection options. It is wise to discuss your situation with a professional to ensure you understand the risks involved.

When you reaffirm a debt, you agree to remain legally responsible for it even after declaring bankruptcy. This decision can help you keep certain assets, like your home or car, while allowing you to restore your credit history. Be sure to carefully consider the implications and consult with a legal expert before proceeding.

Reaffirmation can take several weeks to finalize, depending on the complexity of your case and the court's schedule. Typically, you must submit a Hawaii Motion for Approval of Reaffirmation Agreement along with completed paperwork and attend a hearing. Make sure to stay in touch with your attorney to keep the process moving smoothly.

Yes, it is possible to reverse a reaffirmation agreement in certain circumstances. If you filed a Hawaii Motion for Approval of Reaffirmation Agreement, you can request the court to vacate or modify it. However, you should consult with your attorney to understand your specific situation and options available to you.

Yes, you can negotiate a reaffirmation agreement. This process allows you to discuss terms with your creditor before reaching a final agreement. When you pursue a Hawaii Motion for Approval of Reaffirmation Agreement, you have the opportunity to ensure that the terms are manageable for your financial situation. Utilizing uslegalforms can help streamline this negotiation process, providing you with templates and guidance tailored to your needs.