This is an official Hawaii court form for use in a garnishment case, a Garnishee Return of Wages. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Garnishee Return of Wages

Description

How to fill out Hawaii Garnishee Return Of Wages?

Obtain entry to the most extensive collection of sanctioned forms.

US Legal Forms is essentially a system to locate any state-specific document in just a few clicks, even instances of Hawaii Garnishee Return of Wages.

There's no need to waste hours of your time searching for a court-acceptable template. Our certified experts ensure you receive the latest samples consistently.

After selecting a pricing plan, create an account. Pay using a credit card or PayPal. Download the document by clicking Download. That's it! You are ready to fill out the Hawaii Garnishee Return of Wages form and submit it. To confirm that all details are accurate, consult your local legal advisor for assistance. Join and effortlessly browse over 85,000 useful samples.

- To access the documents library, choose a subscription plan and create an account.

- If you have created it, simply Log In and click Download.

- The sample of the Hawaii Garnishee Return of Wages will instantly be saved in the My documents tab (a section for every document you download on US Legal Forms).

- To create a new account, refer to the brief instructions below.

- If you're about to use a state-specific template, ensure you select the correct state.

- If possible, review the description to grasp all the details of the document.

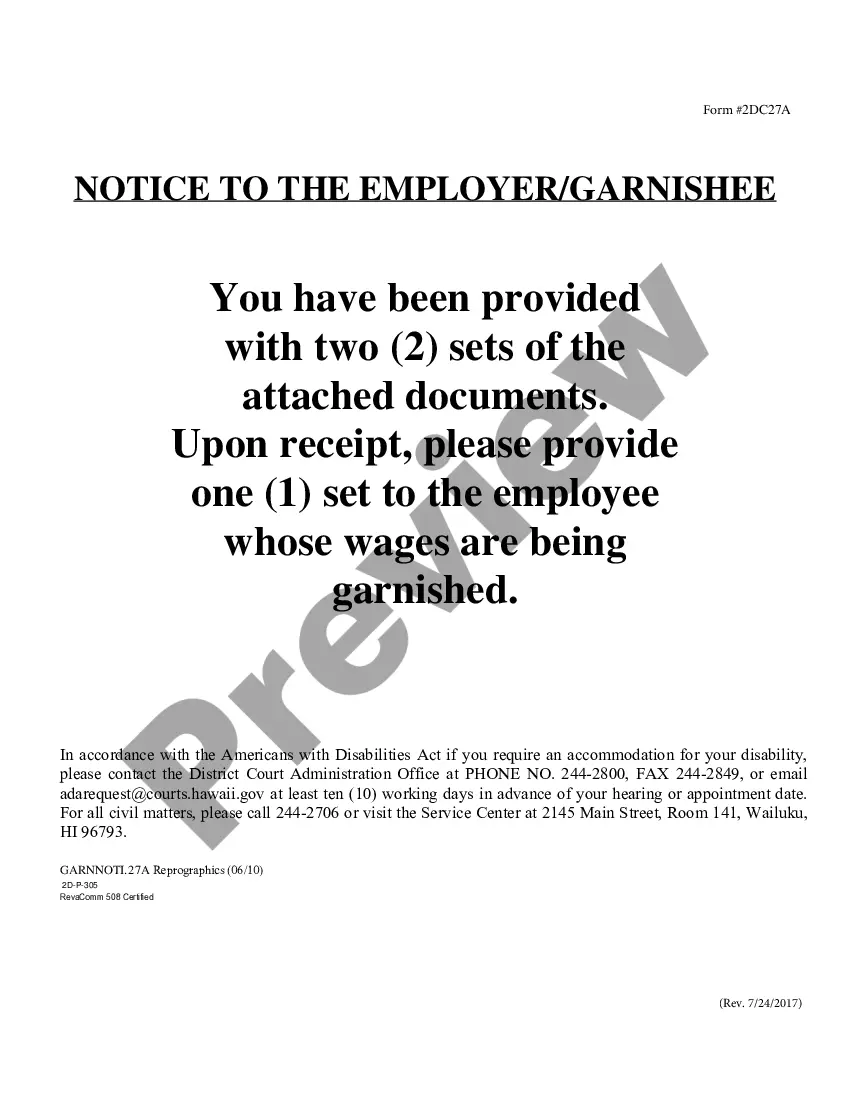

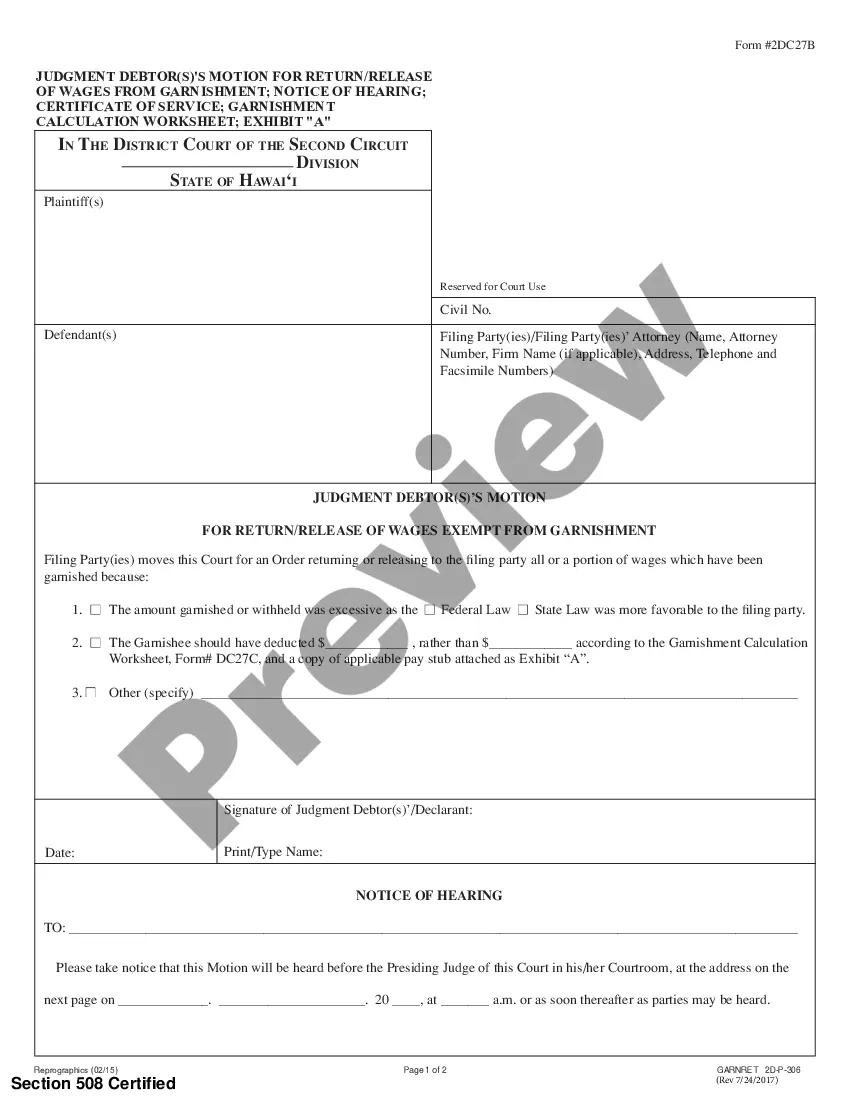

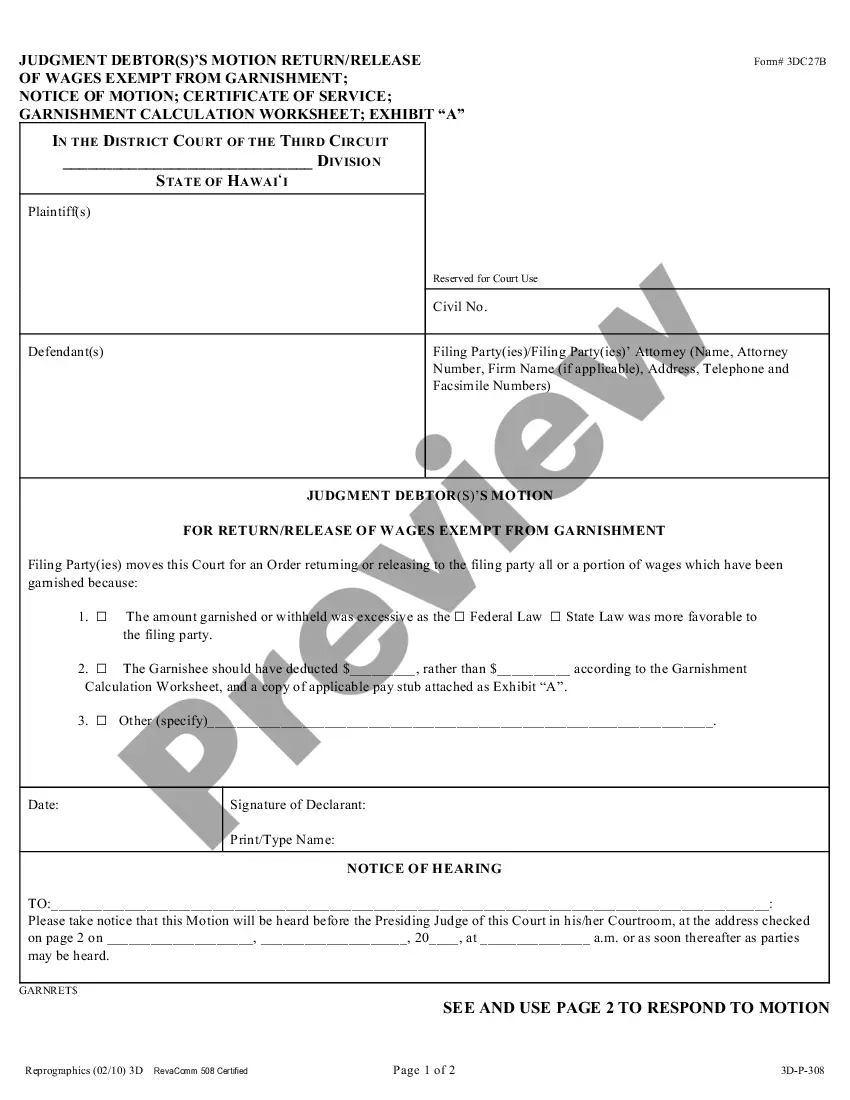

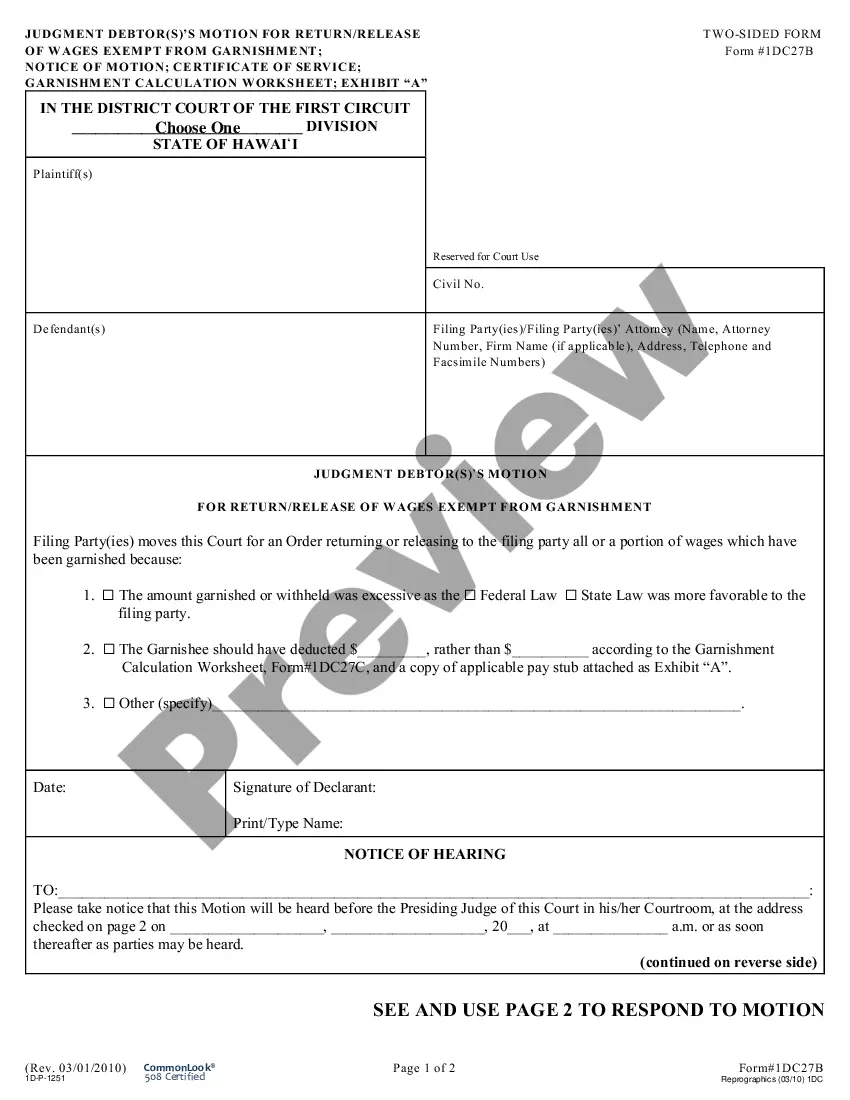

- Utilize the Preview feature if it's available to inspect the contents of the document.

- If everything seems correct, click on the Buy Now button.

Form popularity

FAQ

Reversing wage garnishment often requires legal action and communication with the court or creditor involved. You may need to file a motion or negotiate with your creditor to reach a settlement. Exploring resources like the US Legal Forms platform can guide you on dealing with Hawaii Garnishee Return of Wages efficiently and effectively.

To discover who is garnishing your wages, check your paycheck for any garnishment notices or deductions. You can also contact your payroll department or human resources for assistance. If you need further clarification or assistance regarding your situation, consider using the US Legal Forms platform, which provides valuable information about Hawaii Garnishee Return of Wages.

In Hawaii, the amount that can be garnished from your wages generally depends on your disposable earnings. Typically, legal limits state that garnishment cannot exceed 25% of your disposable earnings. This ensures that you retain enough income to cover your essential living expenses while addressing your Hawaii Garnishee Return of Wages obligations.

Handling an employee with wage garnishment requires sensitivity and a clear understanding of the legal obligations involved. First, it is crucial to keep communication open with the affected employee, ensuring they understand the garnishment process. Next, implement the garnishment according to Hawaii laws, keeping accurate records throughout. For additional resources and forms to manage the situation smoothly, US Legal Forms can be an invaluable tool to streamline compliance and communication.

The timeframe to recover garnished wages can vary depending on several factors, including the reason for garnishment and the steps taken to contest it. Generally, if the garnishment is found to be wrongful, you can initiate a legal process to potentially retrieve those wages. This process can take several weeks to months, as it involves documentation and possibly court hearings. Consulting with a legal expert can expedite the resolution regarding Hawaii Garnishee Return of Wages.

To notify an employee of wage garnishment, you should provide them with a written notice that clearly outlines the garnishment details. This notification should include the amount to be garnished, the reason for the garnishment, and any legal documentation that supports this action. It's essential to follow Hawaii's laws on wage garnishment notifications to maintain compliance. For guidance and templates, consider using US Legal Forms, which can help simplify the process.

To garnish wages in Hawaii, you must first obtain a court judgment against the debtor. After securing the judgment, you can file for a wage garnishment through the local courts. Following this process helps you understand the complexities involved in Hawaii Garnishee Return of Wages, and using services like US Legal Forms can simplify the procedural requirements.

When responding to a wage garnishment letter, it's important to review the document carefully and understand the grounds for garnishment. You may either accept the garnishment or challenge it by submitting the necessary forms to the court. Resources such as US Legal Forms can assist you in preparing an appropriate response, ensuring you effectively address any issues regarding your Hawaii Garnishee Return of Wages.

Typically, your employer cannot refuse to garnish your wages if there is a valid court order in place. Employers are legally obligated to comply with these orders and send the appropriate amount to the creditor. However, they may have specific inquiries or requirements based on the Hawaii Garnishee Return of Wages process, emphasizing the need for both employee and employer to understand their rights.

Yes, someone can garnish your wages without your prior knowledge. Generally, creditors can obtain a court order to garnish your wages if you do not respond to their claims or fail to appear in court. Understanding the implications of Hawaii Garnishee Return of Wages can help you safeguard your income and prepare for any actions that might be taken against you.