This is an official Hawaii court form for use in a garnishment case, a Garnishee Return of Wages. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Garnishee Return of Wages

Description

How to fill out Hawaii Garnishee Return Of Wages?

Obtain entry to one of the most extensive collections of legal documents.

US Legal Forms is truly a platform where you can discover any state-specific document in just a few clicks, including Hawaii Garnishee Return of Wages samples.

There's no need to waste numerous hours of your time searching for an admissible example.

After selecting a pricing plan, create an account. Pay using a card or PayPal. Download the document to your computer by clicking Download. That’s all! You should complete the Hawaii Garnishee Return of Wages form and review it carefully. To ensure accuracy, contact your local legal advisor for assistance. Sign up and easily browse through more than 85,000 beneficial forms.

- To utilize the document library, select a subscription, and create your account.

- If you have established it, simply sign in and hit Download.

- The Hawaii Garnishee Return of Wages file will instantly be saved in the My documents tab (a section for all documents you download from US Legal Forms).

- To set up a new account, follow the straightforward instructions below.

- If you need to use a state-specific example, make sure you specify the correct state.

- If possible, read the description to understand all aspects of the document.

- Use the Preview feature if it’s available to inspect the content of the document.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

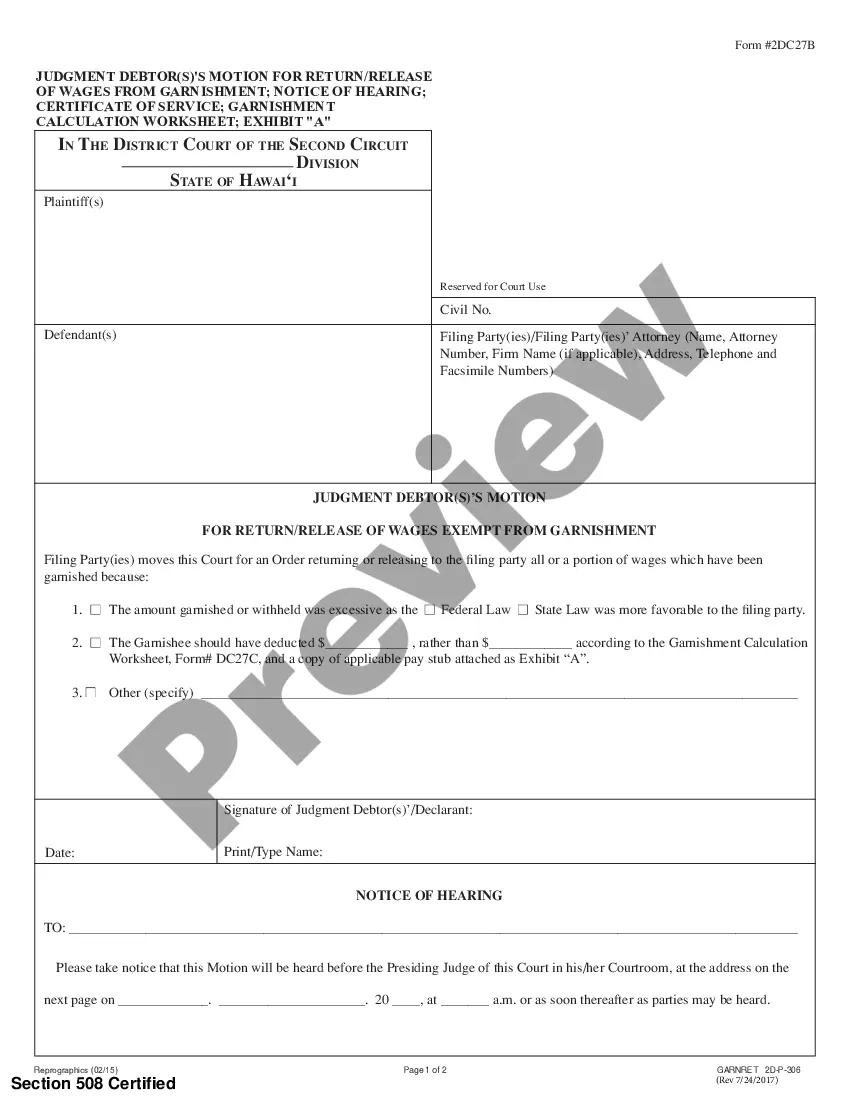

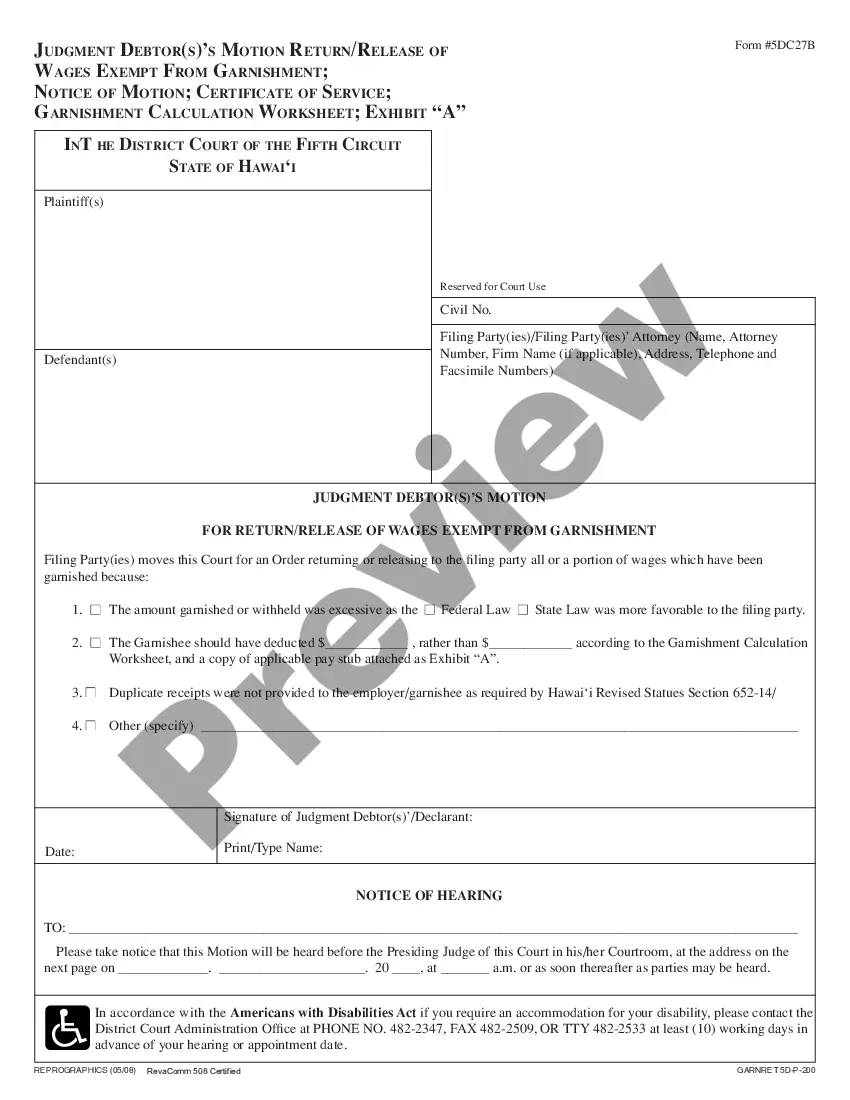

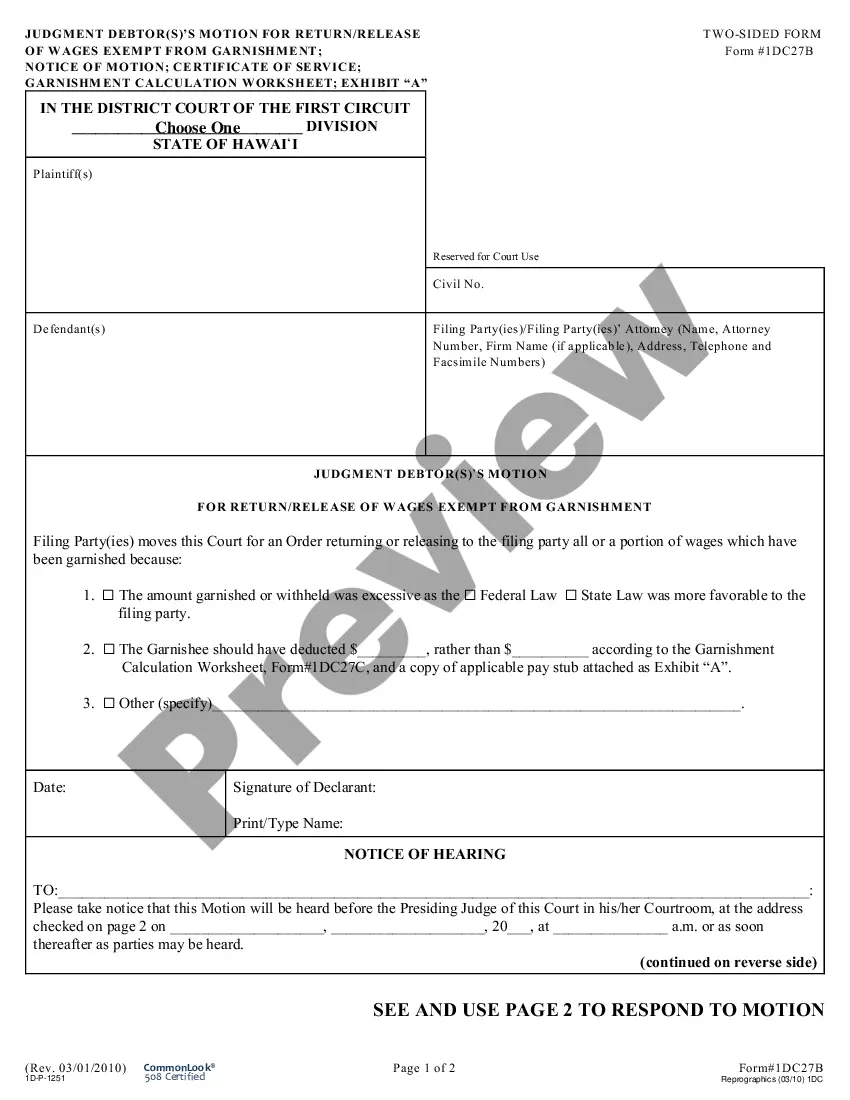

In most cases, wage garnishments follow a court order, meaning you typically receive notice before the process starts. However, if you have not been attentive to your debts, you may find yourself receiving a Hawaii Garnishee Return of Wages unexpectedly. It's vital to monitor your financial obligations and understand your rights, which is where US Legal Forms can assist you in staying informed.

In Hawaii, it is illegal for employers to fire employees solely because of wage garnishment, but it can still happen in some cases. Employers may perceive wage garnishment negatively or believe it affects your performance. Knowing your rights under the Hawaii Garnishee Return of Wages is essential to protect yourself, and resources like US Legal Forms can help you address any wrongful termination issues.

Employers are generally required to comply with a valid wage garnishment order in Hawaii; they cannot refuse to garnish wages without a legal reason. If your employer fails to follow the court order, they may face legal consequences. Understanding the implications of a Hawaii Garnishee Return of Wages is crucial, and using platforms like US Legal Forms can provide clarity on these obligations.

While quitting your job may seem like an option to avoid wage garnishment, doing so can have significant consequences. Once you leave your job, creditors may pursue other means to collect their debts, and it won't necessarily stop the garnishment order. If you are facing a Hawaii Garnishee Return of Wages, consider seeking legal advice to explore your options rather than resigning from your position.

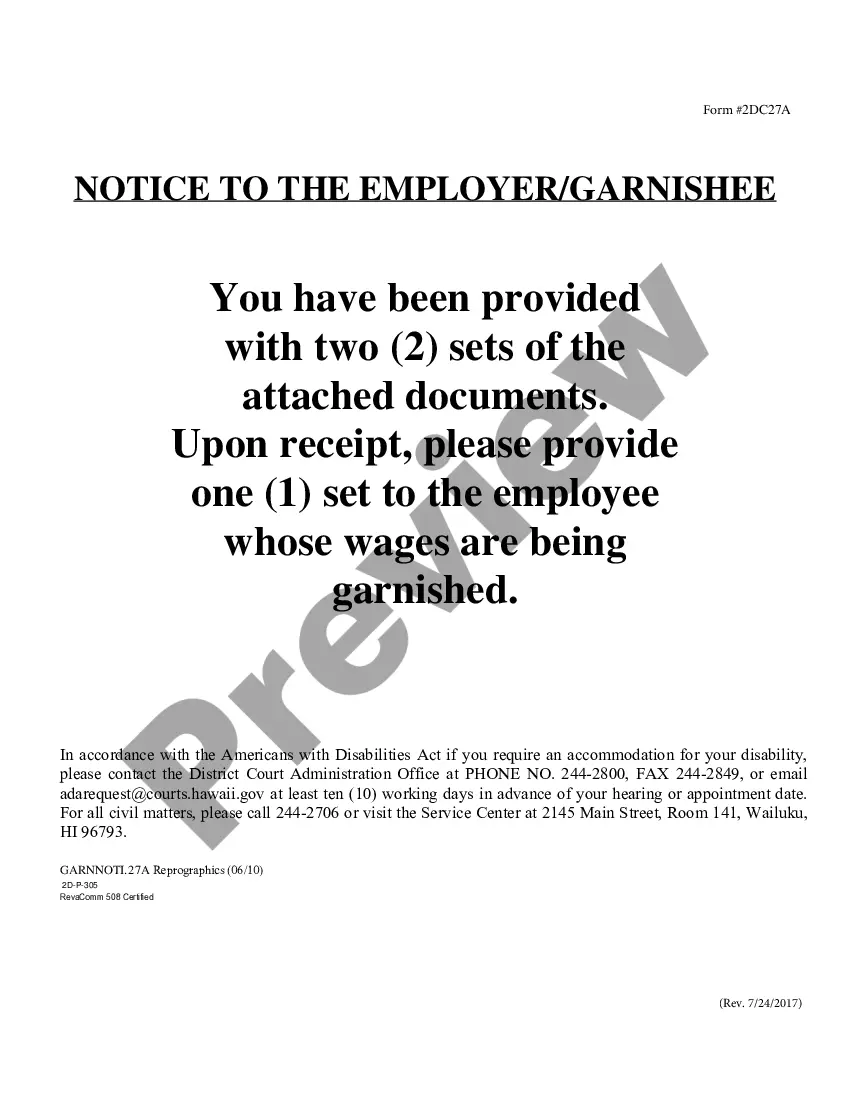

To effectively notify your employee of wage garnishment, deliver a clear and concise written notice that outlines the garnishment details. Include information about the amount to be withheld and any pertinent deadlines. Following the guidelines set forth in Hawaii law is crucial to ensure proper communication. Using the US Legal platform can streamline this process with helpful resources and templates.

Wage garnishments are generally not considered confidential, as they are often subject to public records. Employers may need to inform relevant parties, such as the employee and their creditors. However, best practices dictate that you handle all information respectfully and minimize unnecessary disclosure. Understanding the nuances of Hawaii garnishee return of wages can help ensure compliance and discretion.

Handling an employee with wage garnishment requires clear communication and adherence to legal requirements. Ensure the employee understands their rights and the specifics of the garnishment. It's important to manage payroll adjustments appropriately while staying compliant with Hawaii garnishee return of wages laws. Platforms like US Legal Forms can provide templates that simplify managing these situations.

The process to recover garnished wages can vary based on the circumstances surrounding the garnishment. Typically, it may take several weeks to a few months after the resolution of the underlying case. In Hawaii, understanding the specific guidelines related to garnishee returns of wages can significantly influence the time frame. It’s beneficial to consult legal resources to expedite the recovery process.

To notify an employee of wage garnishment, you should provide a formal written notice that details the garnishment and its implications. Be clear about the amount deducted and the reason for the garnishment. Additionally, make sure to comply with Hawaii laws regarding the timing and method of notification. Utilizing the US Legal platform can help you prepare the necessary documentation efficiently.

Garnishments can occur without immediate notification. Court orders allow creditors to initiate garnishment proceedings, meaning you might not be aware of the actions being taken against your wages initially. However, they must notify you eventually, usually in the form of official paperwork. Being proactive in understanding your financial situation can mitigate surprises in matters related to Hawaii Garnishee Return of Wages.