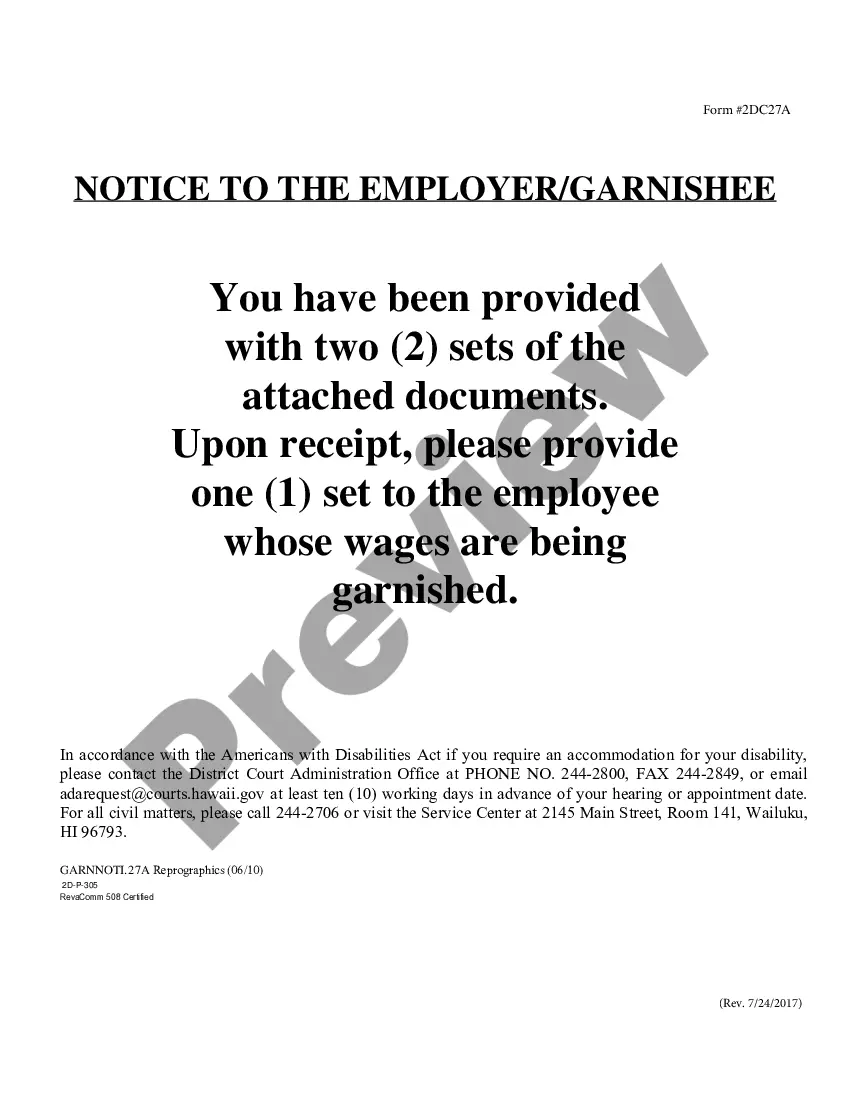

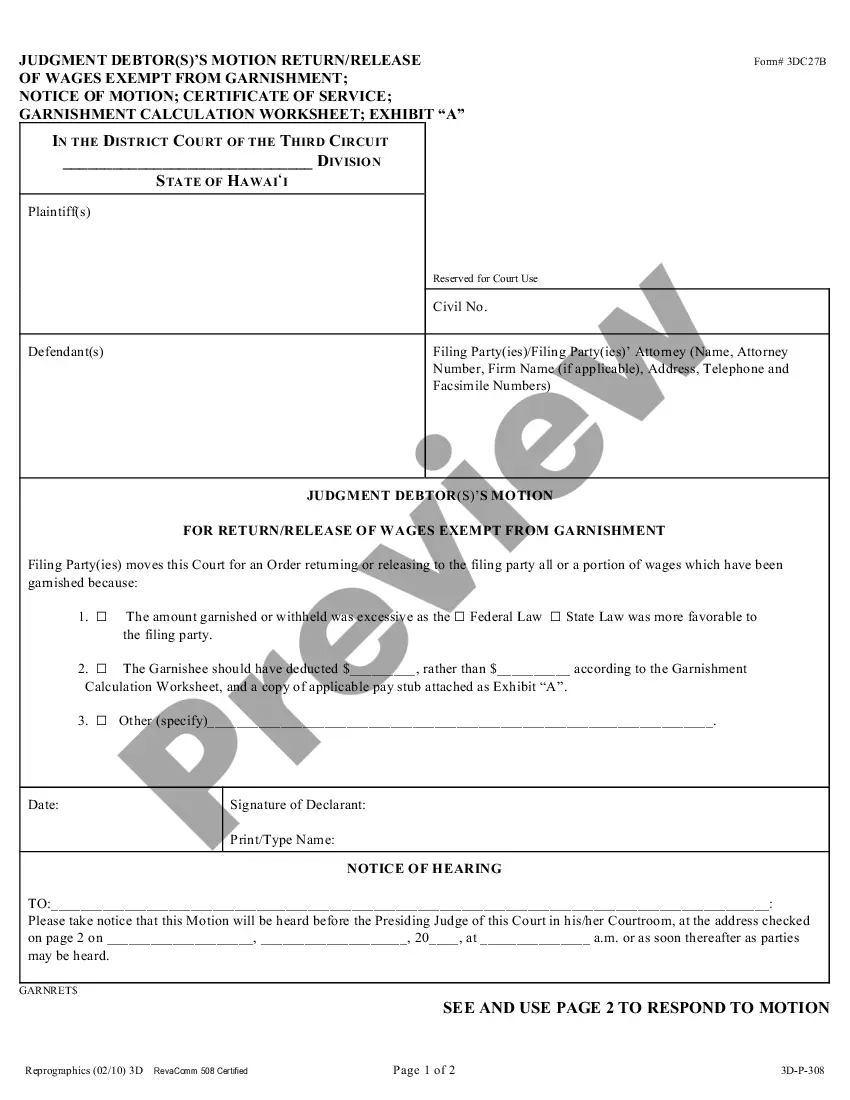

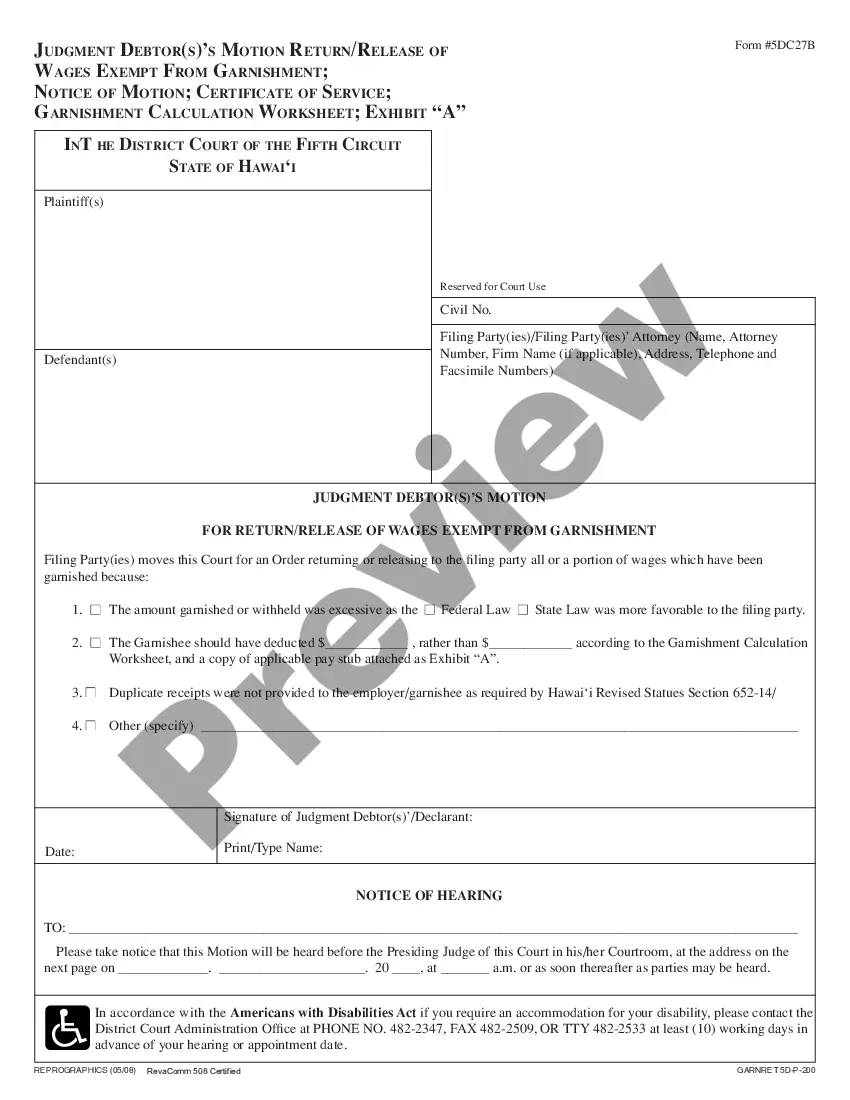

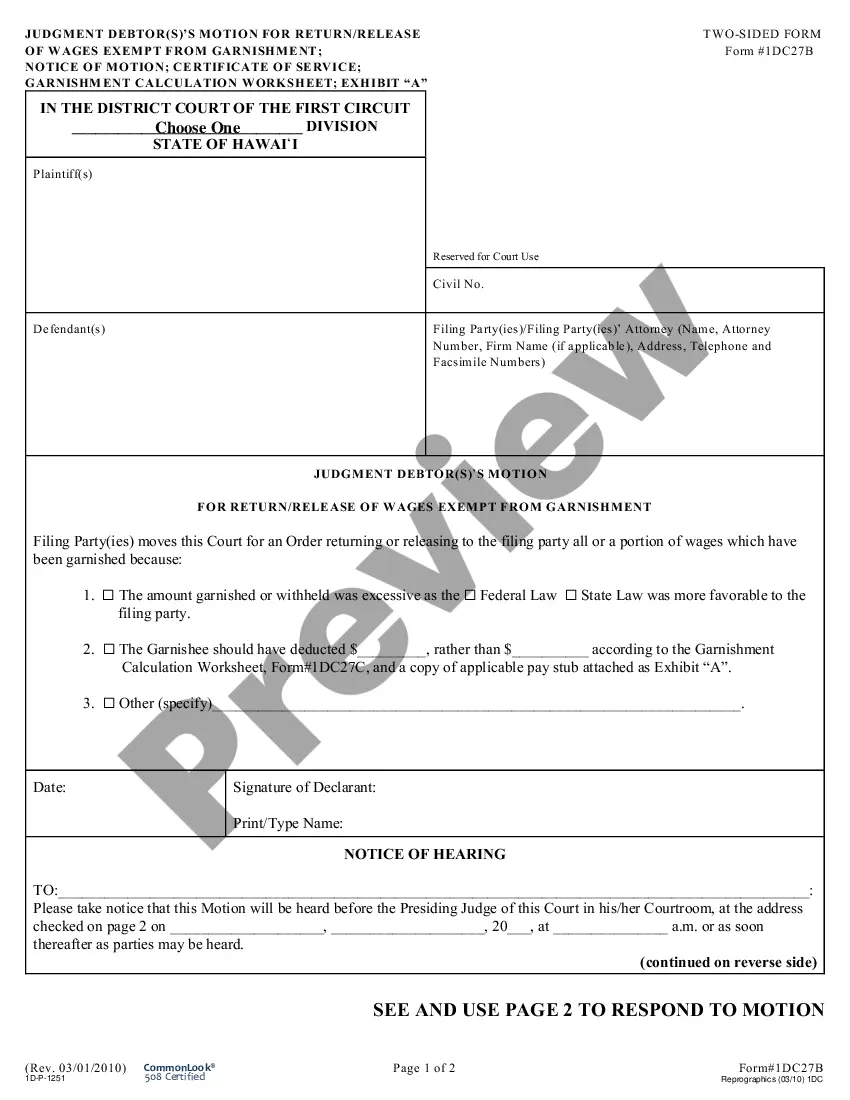

This is an official Hawaii court form for use in a garnishment case, a Garnishee Return of Wages. USLF amends and updates these forms as is required by Hawaii Statutes and Law.

Hawaii Garnishee Return of Wages

Description

How to fill out Hawaii Garnishee Return Of Wages?

Obtain entry to the most extensive collection of approved documents.

US Legal Forms provides a means to locate any state-specific file in just a few clicks, including Hawaii Garnishee Return of Wages templates.

There is no requirement to waste valuable time searching for a court-acceptable sample.

Utilize the Preview option if it exists to verify the document's details. If everything seems correct, click on the Buy Now button. Immediately after choosing a pricing option, create your account. Make payment via card or PayPal. Download the document to your device by clicking Download. That's it! You need to complete the Hawaii Garnishee Return of Wages form and review it. To confirm that all is accurate, reach out to your local legal advisor for help. Join and conveniently explore over 85,000 useful templates.

- Our certified professionals guarantee you obtain current documents consistently.

- To take advantage of the document repository, select a subscription and set up your account.

- If you have already registered, simply Log In and hit the Download button.

- The Hawaii Garnishee Return of Wages file will be instantly saved in the My documents section (a section for all documents you download from US Legal Forms).

- To establish a new account, adhere to the straightforward instructions provided below.

- If you plan to utilize a state-specific sample, ensure you select the correct state.

- If available, review the description to comprehend all the details of the document.

Form popularity

FAQ

In general, your employer must comply with a valid wage garnishment order unless it poses an undue hardship. However, they can refuse to garnish your wages if the garnishment order is not legally valid or if it exceeds the limits set by Hawaii’s wage garnishment laws. Understanding the Hawaii Garnishee Return of Wages process can clarify these legal requirements. If you face issues or need assistance, the US Legal Forms platform provides valuable resources to help you navigate these situations.

Hawaii wage garnishment laws allow creditors to collect debts by withholding a portion of your wages. Under these laws, the maximum amount that can be garnished is 25% of your disposable income, or the amount by which your weekly income exceeds 30 times the federal minimum wage, whichever is lower. It's essential to understand the Hawaii Garnishee Return of Wages process, as this protects both the creditor's rights and your financial well-being. For detailed guidance, consider exploring resources available on the US Legal Forms platform.

In Hawaii, wage garnishment typically follows the federal guidelines, allowing for up to 25% of your disposable income to be taken. However, specific debts may have different limits set by state laws. Staying informed about these regulations will help you manage your financial obligations without undue stress regarding the Hawaii Garnishee Return of Wages.

Under federal law, creditors can garnish up to 25% of your disposable income or the amount by which your income exceeds 30 times the federal minimum wage, whichever is lower. In Hawaii, state laws may specify additional limits on wage garnishments, especially for specific debts. Therefore, understanding how these rules apply to your Hawaii Garnishee Return of Wages is essential.

Reversing wage garnishment can be a crucial step for regaining control over your finances. You can challenge the garnishment in court, showing evidence that it is incorrect or excessive. Additionally, you may explore options for settlement or negotiate with the creditor, potentially using resources available through platforms like US Legal Forms to guide you through the process of dealing with your Hawaii Garnishee Return of Wages.

Yes, in some cases, creditors can garnish your wages without prior notice. Depending on Hawaii laws regarding the Garnishee Return of Wages, creditors may obtain a court order to garnish your wages directly from your employer. However, you will usually receive some form of notice before any action is taken, allowing you to understand your rights and options.

Filling out a challenge to garnishment form requires careful attention to detail. Start by providing accurate personal and case information, including the specific grounds for your challenge. The Hawaii Garnishee Return of Wages may play a crucial role in your arguments, so make sure to reference relevant points. If you need assistance, platforms like uslegalforms are available to guide you through the process.

Yes, you can negotiate with your creditor even after a wage garnishment is in place. It’s often possible to discuss a settlement or modified payment plan that better suits your financial situation. Using the Hawaii Garnishee Return of Wages as a basis for your negotiation can enhance your understanding of the garnishment limits and help you propose a fair offer.

To escape a wage garnishment, consider negotiating with your creditor directly to come to a more manageable payment plan. Additionally, exploring options like bankruptcy can provide relief, but it is vital to consult a legal expert beforehand. Understanding the Hawaii Garnishee Return of Wages process can also help you identify your rights and limitations, making it easier to strategize your next steps.

To write a letter to stop wage garnishment, start by clearly stating your intent to halt the garnishment. Include your name, contact information, and any relevant details about the garnishment, such as the case number. Make sure to mention the Hawaii Garnishee Return of Wages as it pertains to your situation, and outline your reasons for the request. Always send your letter via certified mail and keep a copy for your records.