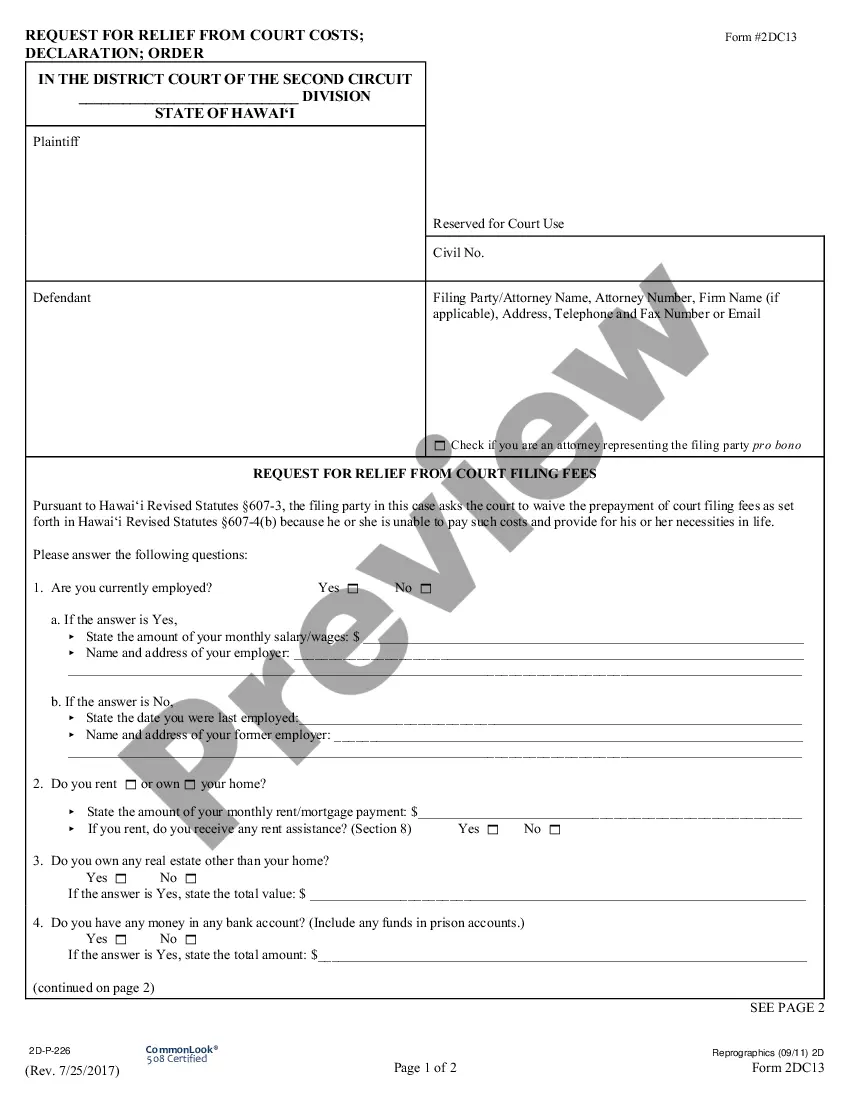

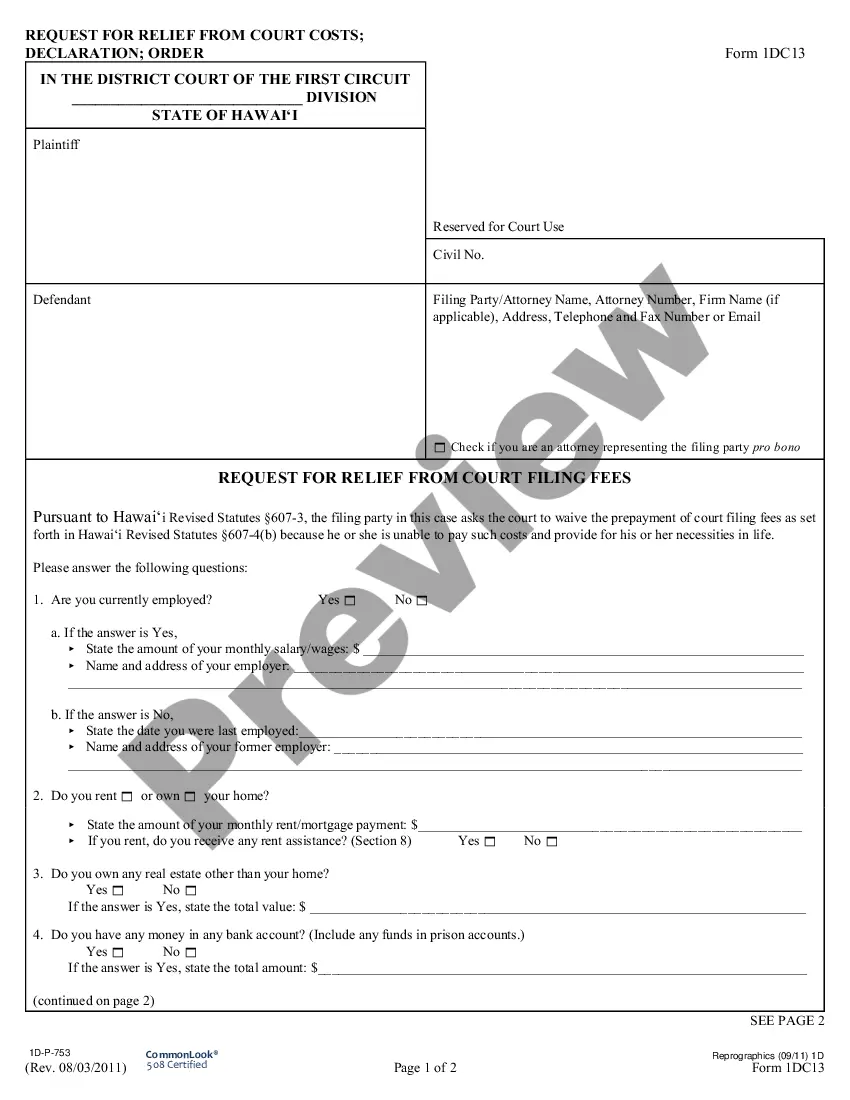

This official form should be completed and submitted by a party seeking relief from paying court costs due to financial hardship. The form requires that certain questions be answered regarding the party's finances and that the party sign a declaration as to the truth of the information provided in the form. A proposed Order is also included for the Court's review and signature.

Hawaii Cost Relief From Filing Fees

Description

How to fill out Hawaii Cost Relief From Filing Fees?

Obtain entry to one of the most extensive collections of approved forms.

US Legal Forms serves as a resource to locate any state-specific document in just a few clicks, including Hawaii Cost Relief From Filing Fees samples.

No need to waste hours searching for a court-admissible example.

Once you've selected a payment plan, create your account. Pay via card or PayPal. Download the document by clicking on the Download button. That's it! You should submit the Hawaii Cost Relief From Filing Fees template and check it out. To ensure everything is accurate, consult your local legal advisor for assistance. Register and effortlessly browse over 85,000 useful forms.

- To benefit from the forms library, choose a subscription and set up your account.

- If you've already registered, just Log In and click on the Download button.

- The Hawaii Cost Relief From Filing Fees document will be swiftly saved in the My documents section (a section for each form you download on US Legal Forms).

- To establish a new profile, follow the quick instructions outlined below.

- If you're planning to use a state-specific example, ensure you specify the correct state.

- If possible, review the description to understand all of the details of the form.

- Utilize the Preview feature if available to examine the document's content.

- If everything looks correct, click on the Buy Now button.

Form popularity

FAQ

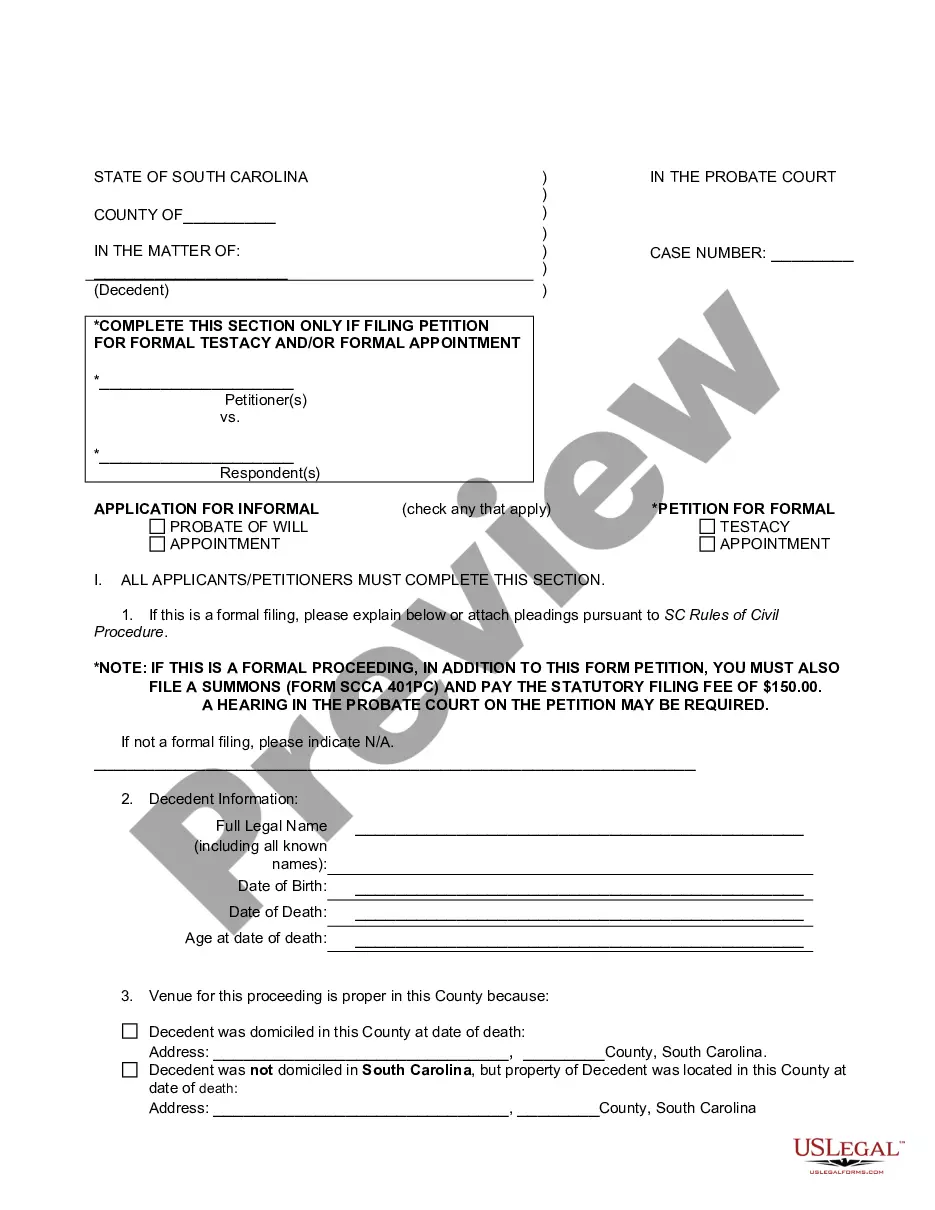

In Hawaii, an estate typically must have a value of $100,000 or more for it to go through probate. If the estate falls below this threshold, it may qualify for simplified procedures, avoiding some court processes. This requirement is crucial for anyone managing an estate, as it directly impacts financial and legal decisions. For help navigating these rules, consider utilizing resources like US Legal Forms.

The Hawaii Department of Commerce and Consumer Affairs registers partnerships and the cost to register is $15.

To start an LLC in Hawaii you will need to file the Articles of Organization with the Department of Commerce and Consumer Affairs, which costs $50. You can apply online, by mail, by fax, by email, or in person.

To start an LLC in Hawaii you will need to file the Articles of Organization with the Department of Commerce and Consumer Affairs, which costs $50. You can apply online, by mail, by fax, by email, or in person.

A. The State of Hawaii Basic Business Application, BB-1 Packet, must be completed and submitted with the one-time $20 license fee. It is recommended that the application be mailed in; however, it can also be applied for in person at any of the district offices. The application form is available on the website.

According to Hawaii's LLC Act, you are required to register your foreign company with the state of Hawaii if you are transacting business in Hawaii.However, state laws governing when foreign companies must collect state sales tax in their state provide some guidance on the issue.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

Hawaii business registrations can be filed with the Department of Commerce and Consumer Affairs, Business Registration Division through its Hawaii Business Express portal or by email, mail, or fax.