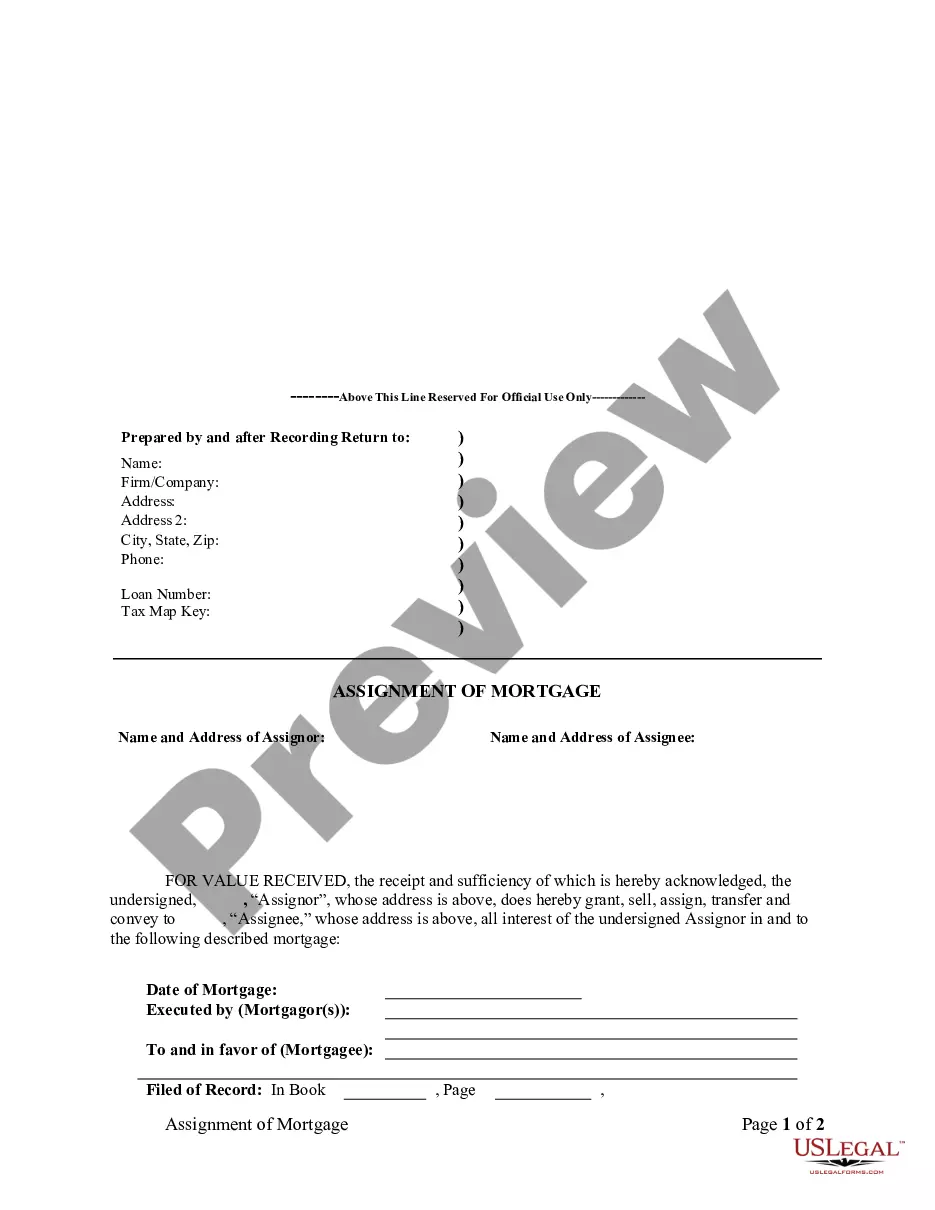

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Hawaii Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Hawaii Assignment Of Mortgage By Individual Mortgage Holder?

Access one of the most comprehensive catalogs of legal documents.

US Legal Forms serves as a platform where you can locate any state-specific document within a few clicks, including examples of Hawaii Assignment of Mortgage by Individual Mortgage Holder.

No need to waste time searching for an example that is court-admissible.

After selecting a pricing plan, create an account. Pay by credit card or PayPal. Download the document to your computer by clicking the Download button. That's it! You should fill out the Hawaii Assignment of Mortgage by Individual Mortgage Holder form and verify it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and easily browse around 85,000 valuable samples.

- To utilize the forms library, select a subscription and create an account.

- If you have already registered, simply Log In and click Download.

- The Hawaii Assignment of Mortgage by Individual Mortgage Holder template will promptly be saved in the My documents tab (which contains all forms you download from US Legal Forms).

- To create a new account, refer to the brief recommendations listed below.

- If you are planning to use state-specific documents, ensure that you select the correct state.

- If feasible, review the description to comprehend all the details of the form.

- Utilize the Preview function if available to examine the document's contents.

- If everything is in order, click Buy Now.

Form popularity

FAQ

An assignment of a mortgage occurs when one party transfers its rights and obligations under a mortgage to another party. For instance, if an individual mortgage holder in Hawaii decides to transfer their mortgage to a different lender, this transaction is categorized as a Hawaii Assignment of Mortgage by Individual Mortgage Holder. Such an assignment usually involves a formal written document that details the terms of the transfer. Using platforms like US Legal Forms can simplify this process, ensuring all legal requirements are met.

Transferring ownership of a property in Hawaii typically requires drafting a Hawaii Assignment of Mortgage by Individual Mortgage Holder document, along with a deed. The deed should clearly state the new owner's name and the legal description of the property. Once the documents are prepared and signed, they must be recorded with the county office where the property is located. Utilizing platforms like USLegalForms can simplify this process and ensure that all necessary requirements are met.

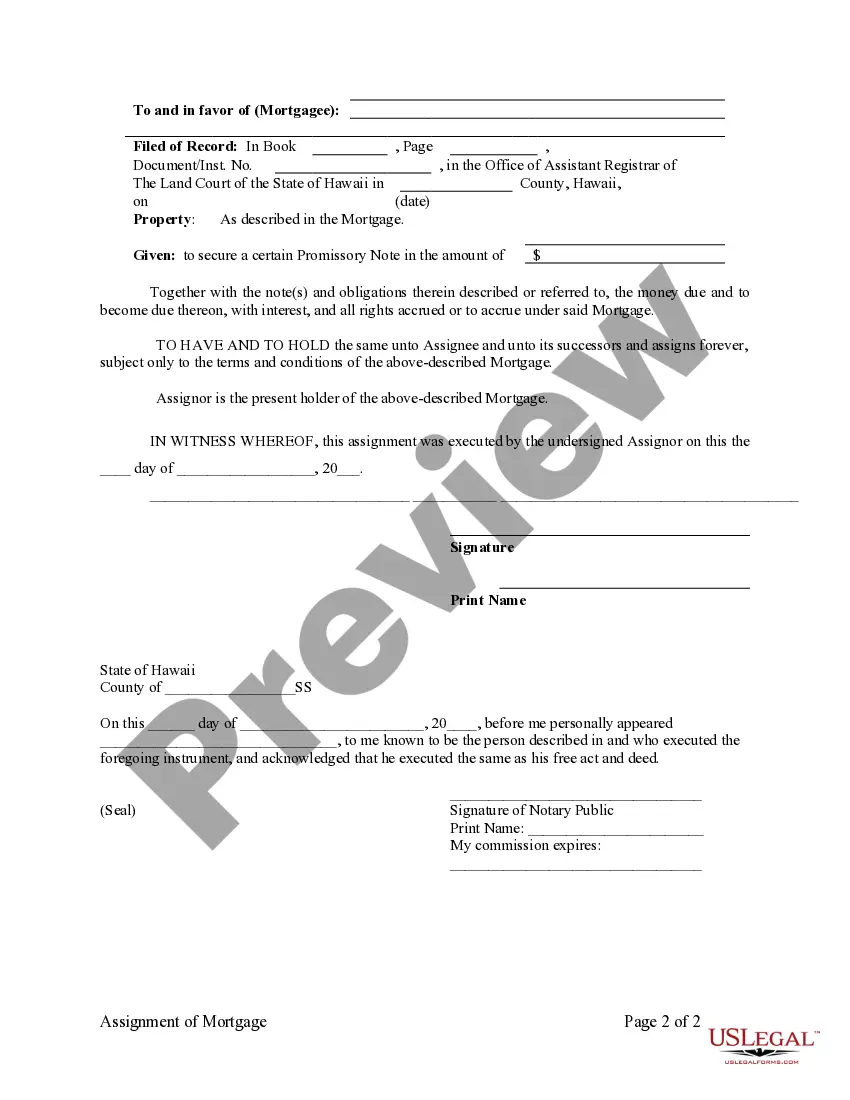

In Hawaii, both the original mortgage holder and the party receiving the assignment must sign the document. The mortgage holder retains ownership of the mortgage until they formally transfer a portion or the entirety of their rights. It's also important to have a notary present during signing to validate the process. This ensures that the assignment of mortgage by individual mortgage holder is legally binding.

To complete an assignment of mortgage in Hawaii, you must obtain the appropriate forms that comply with state regulations. Next, fill out the assignment document with the required details, ensuring you include the names of the parties involved, the mortgage identification, and the legal description of the property. Once completed, both parties should sign the document in the presence of a notary. Finally, record the assignment with the local county office to make it official.

Yes, you can assign a mortgage to someone, but it requires approval from the lender. The lender must agree to the Hawaii Assignment of Mortgage by Individual Mortgage Holder, ensuring that the new borrower meets their financial criteria. It's essential to carefully review the terms of the original mortgage to understand any restrictions on assignments.

The easiest way to transfer ownership of a house in Hawaii is to utilize a deed, such as a quitclaim deed or warranty deed. A quitclaim deed allows the current owner to transfer their interest in the property to another person without guaranteeing that the title is clear. For those considering a Hawaii Assignment of Mortgage by Individual Mortgage Holder, the deed can play a crucial role in updating responsibilities associated with the mortgage.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

In the case of mortgage liens, courts use the date of a recording to determine the priority for which liens should receive payment first. To understand which documents have been or must be recorded, check with your state and county recording division.