This office lease clause is a more detailed form giving the tenant additional rights and the landlord further obligations as it relates to tax increases.

Guam Detailed Tax Increase Clause

Description

How to fill out Detailed Tax Increase Clause?

Are you presently within a situation in which you require documents for sometimes organization or person purposes virtually every day time? There are a lot of legitimate record web templates available on the Internet, but finding ones you can trust isn`t easy. US Legal Forms provides thousands of form web templates, such as the Guam Detailed Tax Increase Clause, which can be written to satisfy state and federal requirements.

Should you be already informed about US Legal Forms web site and also have a merchant account, basically log in. Following that, you may download the Guam Detailed Tax Increase Clause format.

If you do not offer an account and need to start using US Legal Forms, abide by these steps:

- Find the form you need and make sure it is for your appropriate city/area.

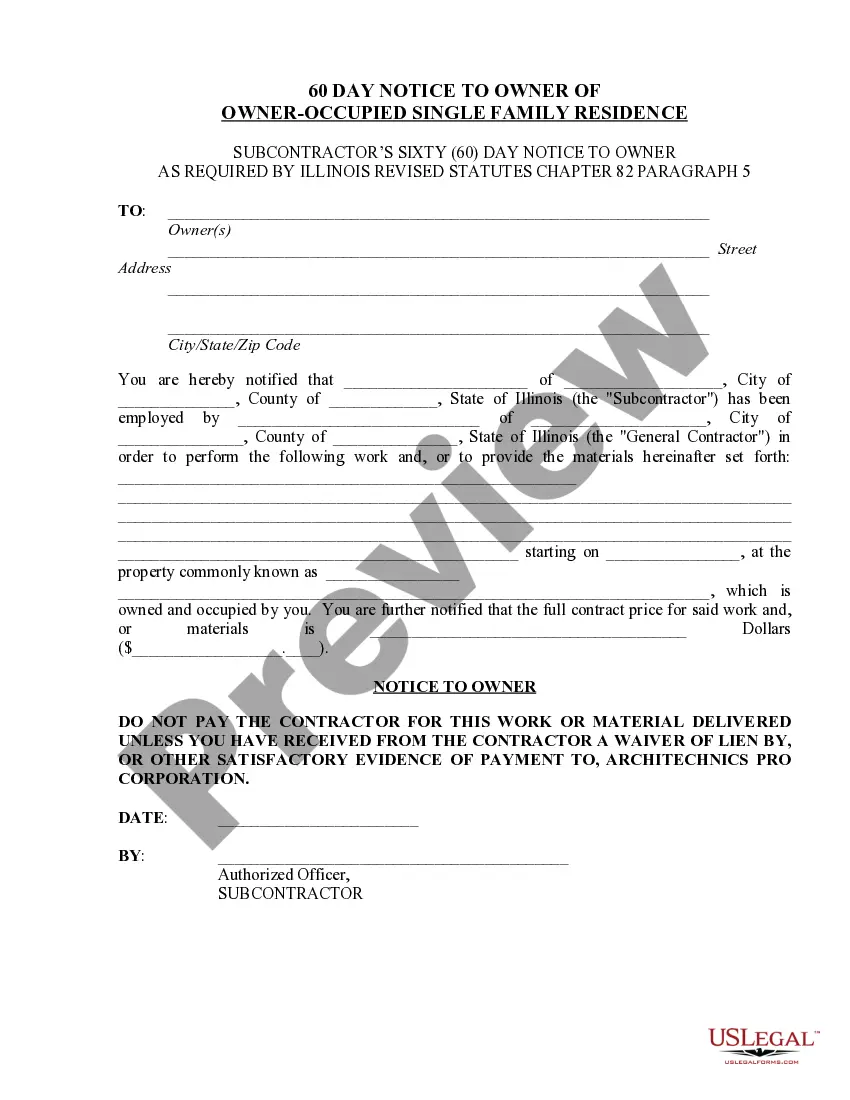

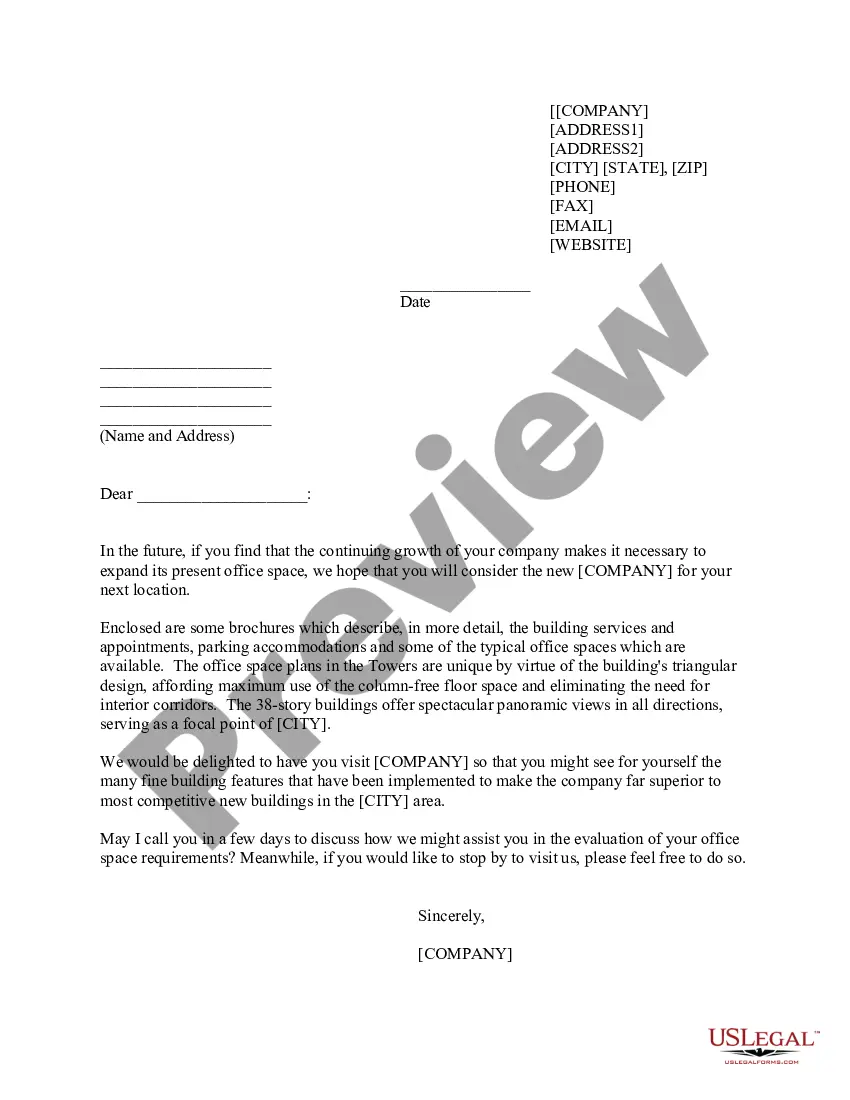

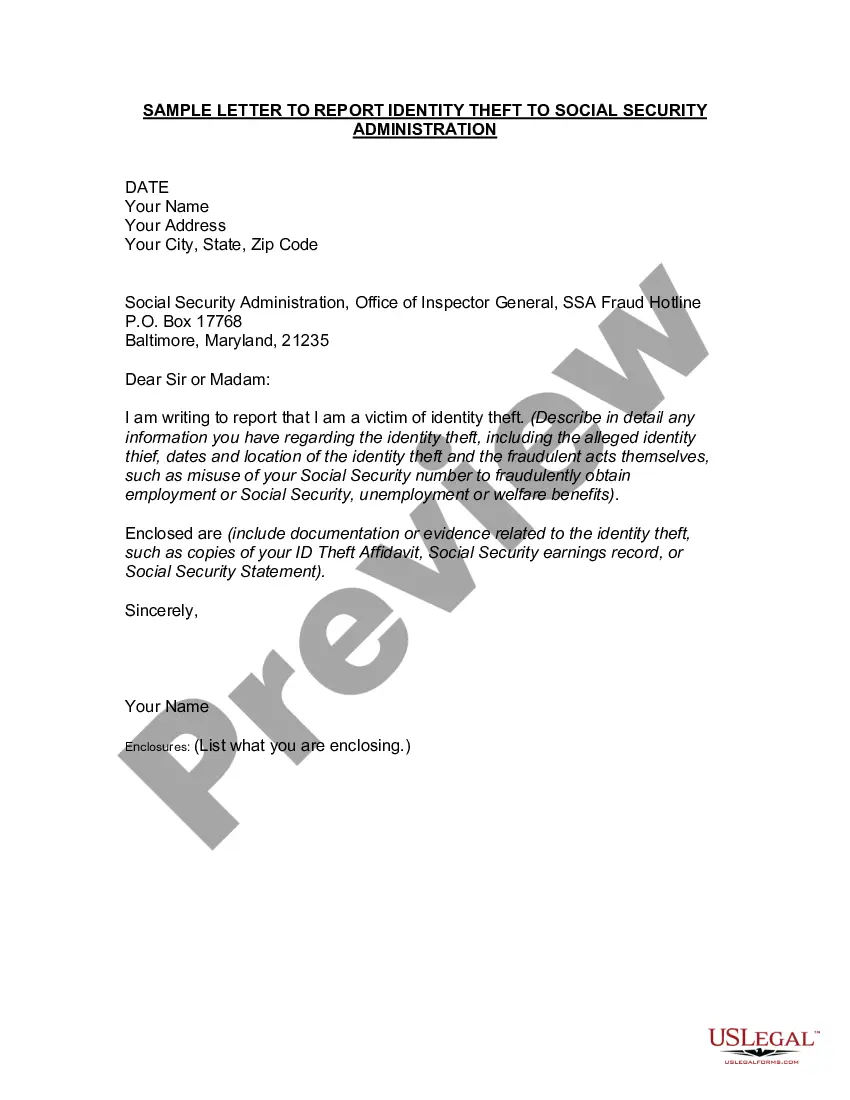

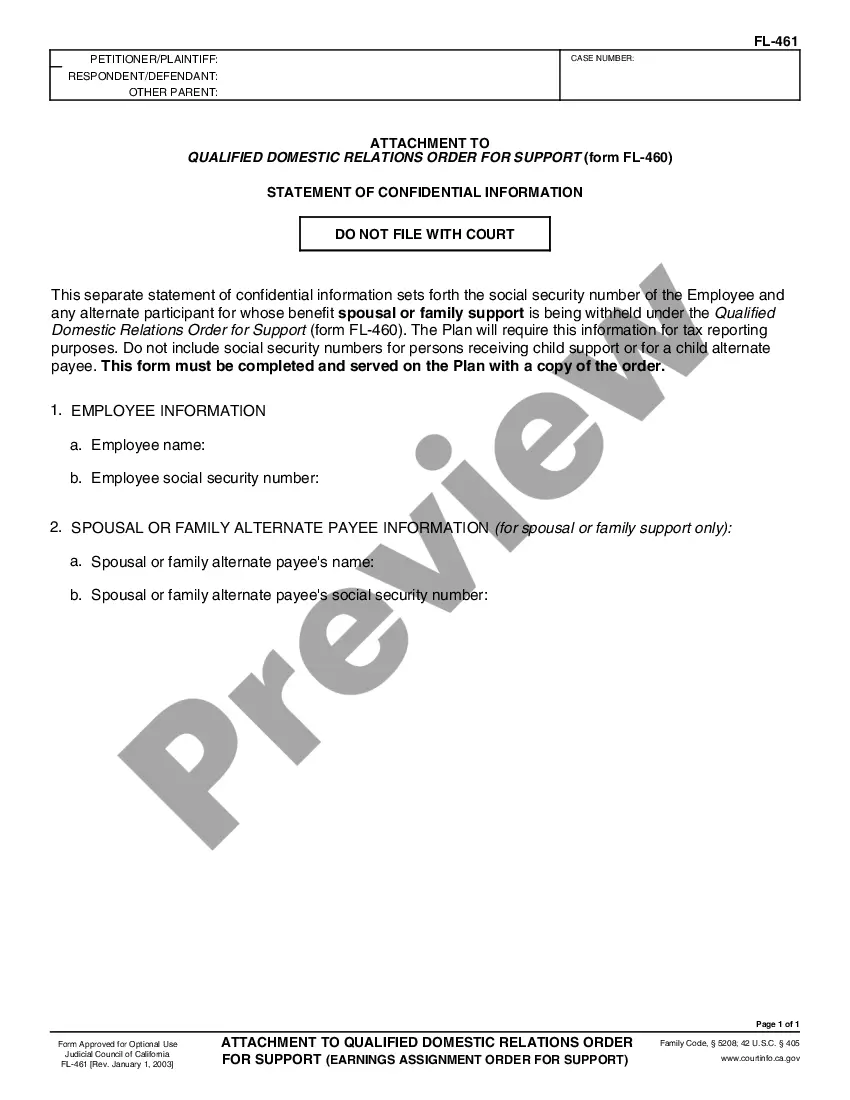

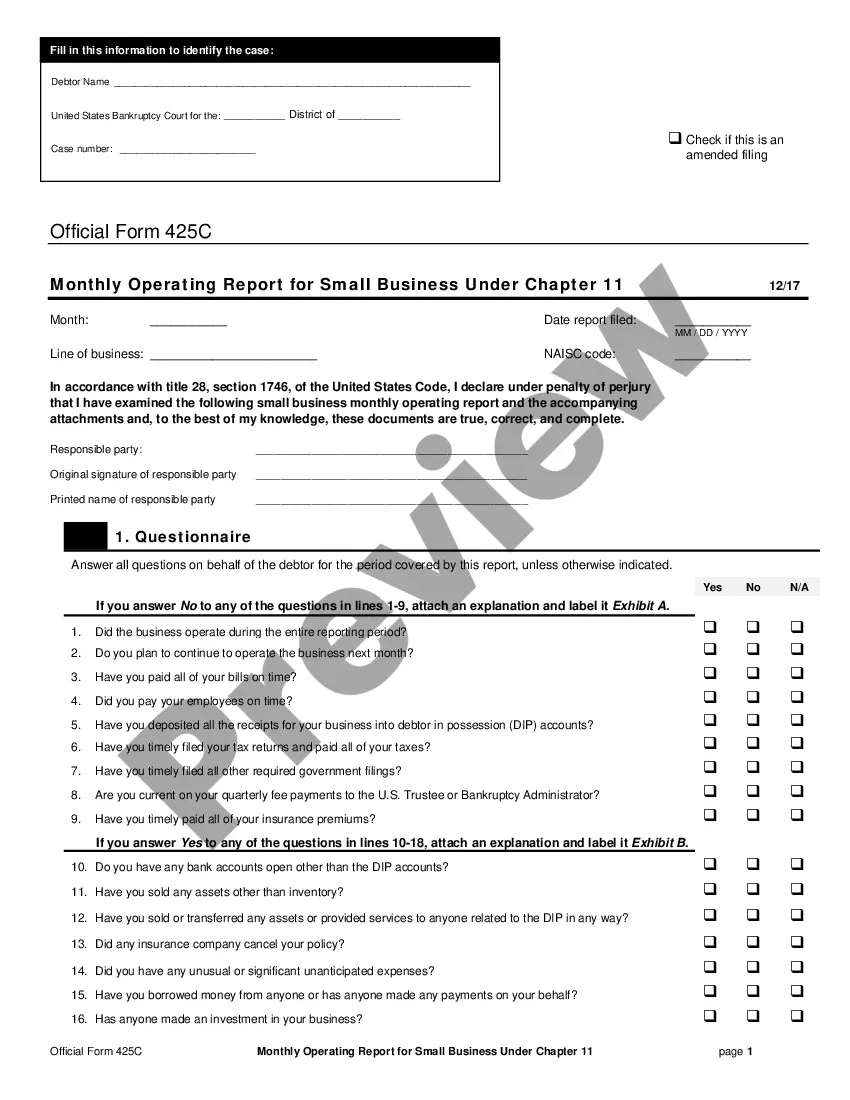

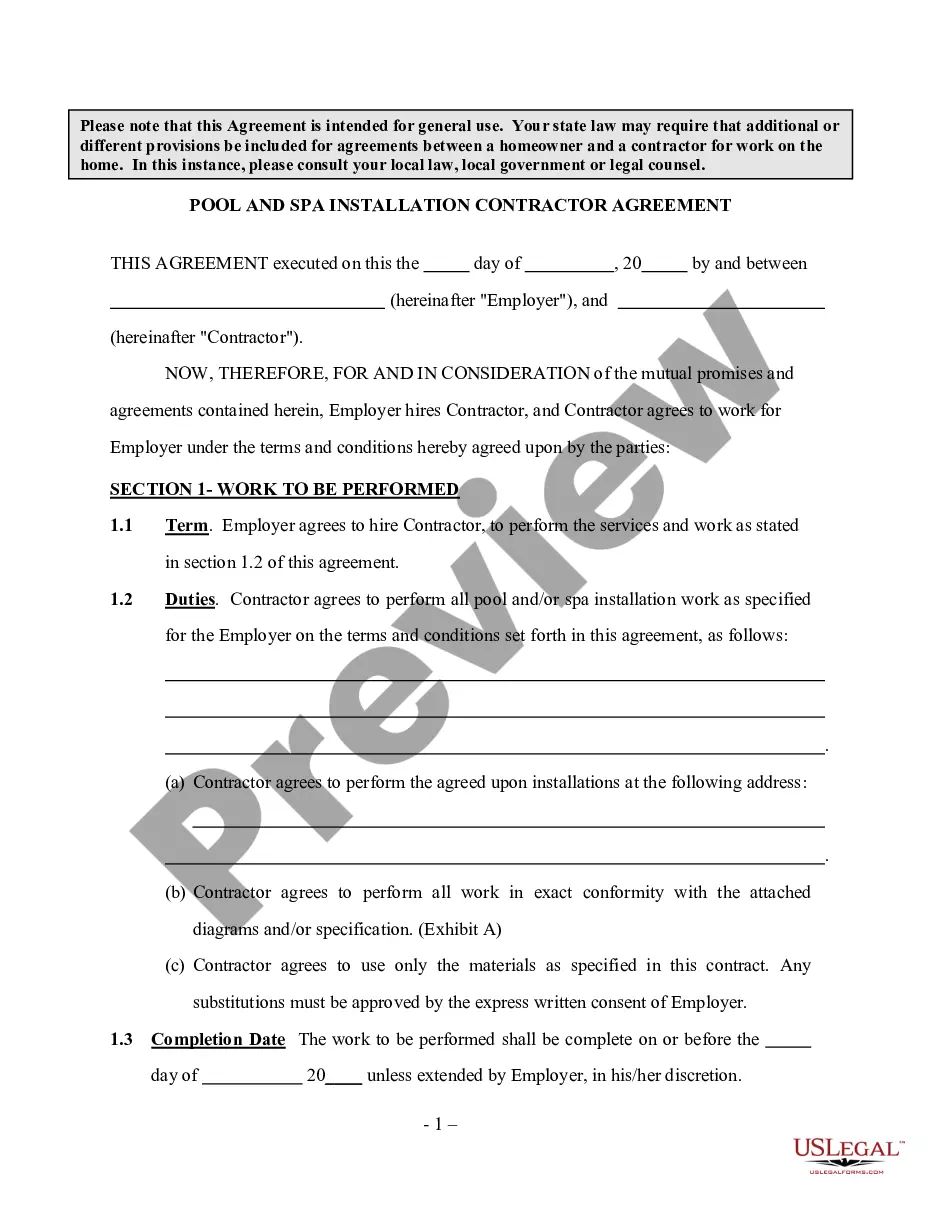

- Take advantage of the Review option to review the shape.

- Read the explanation to ensure that you have chosen the right form.

- If the form isn`t what you`re searching for, use the Lookup industry to discover the form that suits you and requirements.

- When you find the appropriate form, just click Buy now.

- Pick the costs prepare you would like, submit the necessary info to generate your bank account, and purchase the transaction making use of your PayPal or charge card.

- Select a hassle-free paper format and download your version.

Locate every one of the record web templates you possess bought in the My Forms menu. You may get a more version of Guam Detailed Tax Increase Clause anytime, if required. Just click on the essential form to download or print out the record format.

Use US Legal Forms, by far the most substantial selection of legitimate forms, to conserve time as well as stay away from mistakes. The support provides expertly made legitimate record web templates that can be used for a range of purposes. Create a merchant account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

Key Takeaways. Bermuda, Monaco, the Bahamas, and the United Arab Emirates (UAE) are four countries that do not have personal income taxes. If you renounce your U.S. citizenship, you may end up paying a tax penalty called an expatriation tax.

U.S. territories can be divided into two groups: Those that have their own governments and their own tax systems (American Samoa, Guam, The Commonwealth of Puerto Rico, The Commonwealth of the Northern Mariana Islands and the U.S. Virgin Islands), and.

Guam will rebate 75% of income taxes for 20 years on income from qualifying Guam businesses. If the business is conducted as an "S" corporation, the rebate is available to shareholders.

And the U.S. territories are American citizens who are taxed without representation in Congress. While citizens of all territories pay many federal taxes, D.C. is the only territory where people pay federal income taxes.

In the 1990s Guam enacted a package of financial services development legislation to become a financial tax haven. The Guam resident trust shelter was very popular. It involves a tax rebate from a Guam resident trust, provided half of the rebated taxes are kept on deposit in Guam for five years.

The return (Form BRQ) was still required to be filed quarterly and the deposits made monthly (same requirements as above). From April 01. 2004 to Present, the tax rate decreased to four percent (4%).

Guam tax law mirrors US federal tax law, and the Guam corporate tax rate is the same as the US federal corporate tax: 21%. Full-time residents of Guam file taxes with the Government of Guam, with the exception is self-employment taxes, which are filed with the US.

Personal and Corporate Income Tax Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one return?either to Guam or the United States.