Guam Correction to Description in Communications Site Lease

Description

How to fill out Correction To Description In Communications Site Lease?

Have you been within a placement that you need to have files for possibly enterprise or personal uses almost every time? There are plenty of legal record themes available online, but getting types you can rely on is not easy. US Legal Forms gives thousands of form themes, just like the Guam Correction to Description in Communications Site Lease, which can be created to fulfill federal and state needs.

Should you be already informed about US Legal Forms website and also have an account, just log in. Afterward, you are able to acquire the Guam Correction to Description in Communications Site Lease web template.

If you do not have an account and would like to start using US Legal Forms, abide by these steps:

- Get the form you will need and ensure it is for the right area/area.

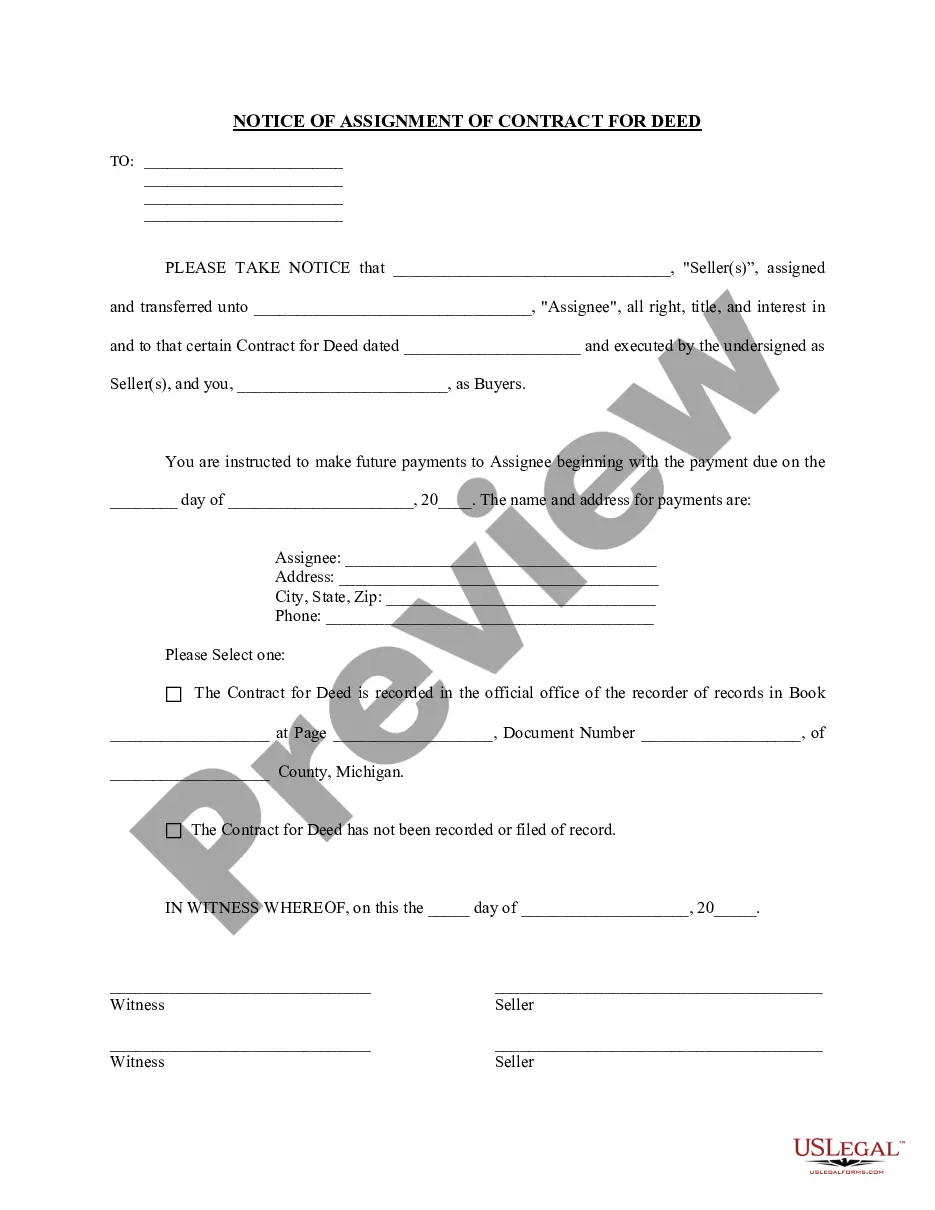

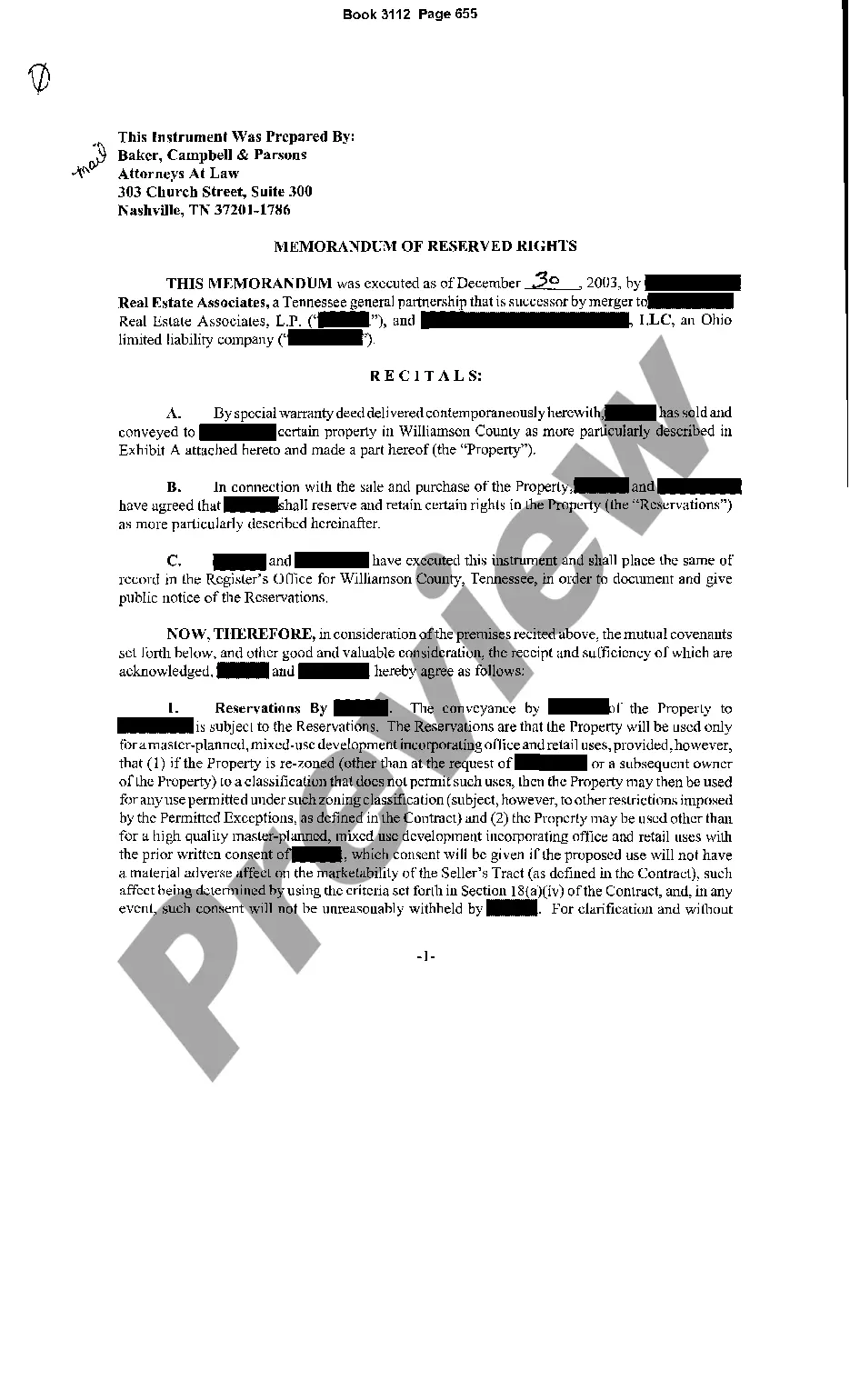

- Take advantage of the Review option to review the form.

- Read the explanation to ensure that you have chosen the right form.

- If the form is not what you`re trying to find, use the Look for discipline to get the form that meets your requirements and needs.

- If you get the right form, simply click Acquire now.

- Pick the prices prepare you would like, fill in the desired information and facts to generate your money, and pay for the order with your PayPal or charge card.

- Choose a convenient document format and acquire your copy.

Locate all of the record themes you have purchased in the My Forms food selection. You can aquire a additional copy of Guam Correction to Description in Communications Site Lease at any time, if needed. Just click the essential form to acquire or produce the record web template.

Use US Legal Forms, probably the most considerable selection of legal forms, to save lots of some time and avoid errors. The assistance gives skillfully produced legal record themes that can be used for an array of uses. Produce an account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

A. The modification grants the lessee an additional right of use not included in the original lease (for example, the right to use an additional asset). b. The lease payments increase commensurate with the standalone price for the additional right of use, adjusted for the circumstances of the particular contract.

As discussed in LG 9.2. 5, ASC 842 requires certain quantitative disclosures. One such disclosure relates to supplemental noncash information on lease liabilities arising from obtaining right-of-use assets. Furthermore, ASC 230 requires disclosure of all non-cash investing and financing transactions.

Lease Modifications under ASC 842 A lease modification occurs when there is a change in the scope or consideration of a lease that was not part of the original terms and conditions. Examples of lease modifications include changes to the lease term, adjustments to the leased space, or modifications to the lease payment.

Ing to the IFRS 16, A re-assessment of the lease liability takes place if the cash flows change based on the original terms and conditions of the lease. Changes that were not part of the original terms and conditions of the lease would be considered as lease modifications.

Begin with the reported operating income (EBIT). Then, add the current year's operating lease expense and subtract the depreciation on the leased asset to arrive at adjusted operating income. Finally, to adjust debt, take the reported value of debt (book value of debt) and add the debt value of the leases.

A lease modification, as defined by ASC 842, refers to changes in the terms and conditions of a lease that result in an alteration of the lease's scope or consideration. These modifications require specific accounting treatment to ensure compliance with ASC 842.

IFRS 16 Leases contains detailed guidance on how to account for lease modifications. A lease modification is defined as a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease.

If a lease modification creates a separate lease, the lessee makes no adjustments to the original lease and accounts for the separate lease the same as any new lease. For a modification that is not a separate lease, the lessee's accounting depends on the nature of the modification.