Guam Statement of Current Monthly Income for Use in Chapter 11 - Post 2005

Description

How to fill out Statement Of Current Monthly Income For Use In Chapter 11 - Post 2005?

Are you inside a place that you need papers for either business or specific reasons almost every day time? There are tons of authorized file layouts available on the Internet, but getting types you can depend on is not simple. US Legal Forms delivers 1000s of kind layouts, such as the Guam Statement of Current Monthly Income for Use in Chapter 11 - Post 2005, that are composed to meet federal and state demands.

If you are currently familiar with US Legal Forms website and get a free account, simply log in. Afterward, you may download the Guam Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 template.

Should you not have an profile and need to begin to use US Legal Forms, follow these steps:

- Find the kind you want and ensure it is for the correct town/region.

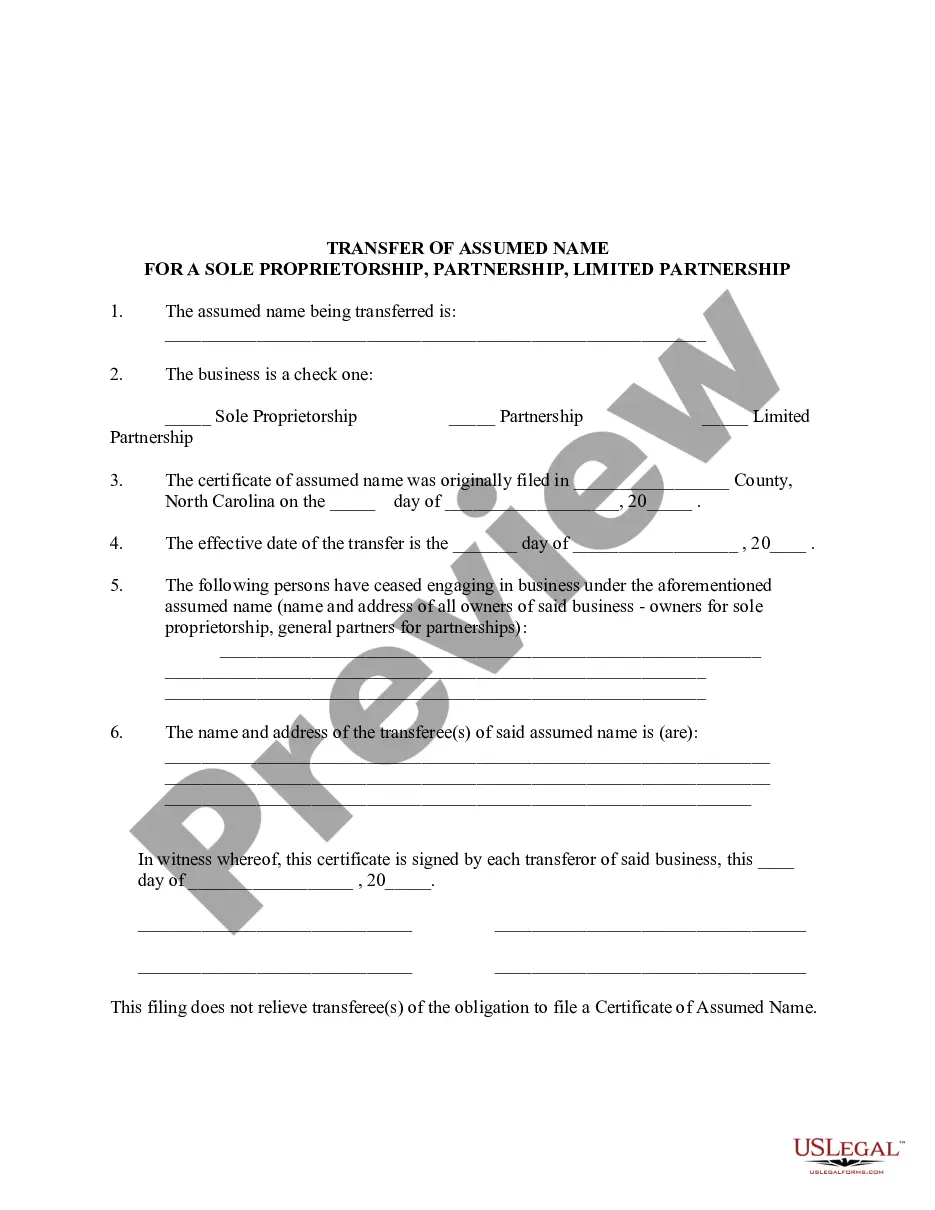

- Use the Preview option to examine the shape.

- Look at the description to ensure that you have selected the appropriate kind.

- In the event the kind is not what you are looking for, make use of the Look for discipline to get the kind that meets your needs and demands.

- Once you obtain the correct kind, just click Buy now.

- Choose the prices program you want, fill in the desired information and facts to produce your bank account, and pay money for the order making use of your PayPal or charge card.

- Pick a handy paper structure and download your copy.

Discover every one of the file layouts you have purchased in the My Forms food selection. You can aquire a more copy of Guam Statement of Current Monthly Income for Use in Chapter 11 - Post 2005 any time, if needed. Just click on the necessary kind to download or print the file template.

Use US Legal Forms, by far the most substantial collection of authorized varieties, to save efforts and steer clear of mistakes. The assistance delivers appropriately produced authorized file layouts which can be used for an array of reasons. Create a free account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

Official Form 122A-1 (Chapter 7 Statement of Your Current Monthly Income), Official Form 122A-1Supp (Statement of Exemption from Presumption of Abuse Under § 707(b)(2)), and Official Form 122A-2 (Chapter 7 Means Test Calculation) (collectively the ?122A Forms?) are designed for use in chapter 7 cases.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.

You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person. However, if your disposable income is more than a certain sum, you will not be able to file.

Calculation of Current Monthly Income: To begin the means test, debtors calculate their current monthly income, which equates to twice the gross income earned in the six months leading up to the bankruptcy filing.

Current monthly income (CMI) is the average income from all sources in the six months prior to filing for bankruptcy. A person's CMI determines their eligibility for Chapter 7 bankruptcy which requires a person's CMI to be below the state median or pass a multi-factored test.

Income is calculated by looking at the debtor's income for the six-months prior to filing. A debtor who previously had a higher income but has been laid off in the last year, for example, would be able to rely on their most recent income to satisfy the Means Test.

In the test, you compare your income with the median income of a similar size household in your state. If your income is lower, you pass the test.