Guam Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

Discovering the right lawful file format might be a struggle. Needless to say, there are plenty of themes available online, but how do you get the lawful develop you want? Utilize the US Legal Forms internet site. The support delivers a large number of themes, for example the Guam Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, that can be used for enterprise and private requires. Every one of the kinds are checked by specialists and meet federal and state requirements.

Should you be currently registered, log in to your account and click on the Obtain option to get the Guam Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Utilize your account to appear from the lawful kinds you possess purchased formerly. Check out the My Forms tab of your account and obtain another version of your file you want.

Should you be a fresh user of US Legal Forms, here are easy recommendations for you to follow:

- Very first, make certain you have selected the right develop for your metropolis/region. You can examine the form making use of the Review option and browse the form outline to make sure it is the right one for you.

- When the develop does not meet your needs, take advantage of the Seach area to obtain the proper develop.

- Once you are positive that the form is suitable, go through the Purchase now option to get the develop.

- Opt for the rates program you desire and type in the necessary info. Design your account and pay money for the order utilizing your PayPal account or charge card.

- Choose the document formatting and acquire the lawful file format to your gadget.

- Full, edit and printing and signal the received Guam Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

US Legal Forms is definitely the largest local library of lawful kinds that you can find various file themes. Utilize the company to acquire professionally-manufactured files that follow state requirements.

Form popularity

FAQ

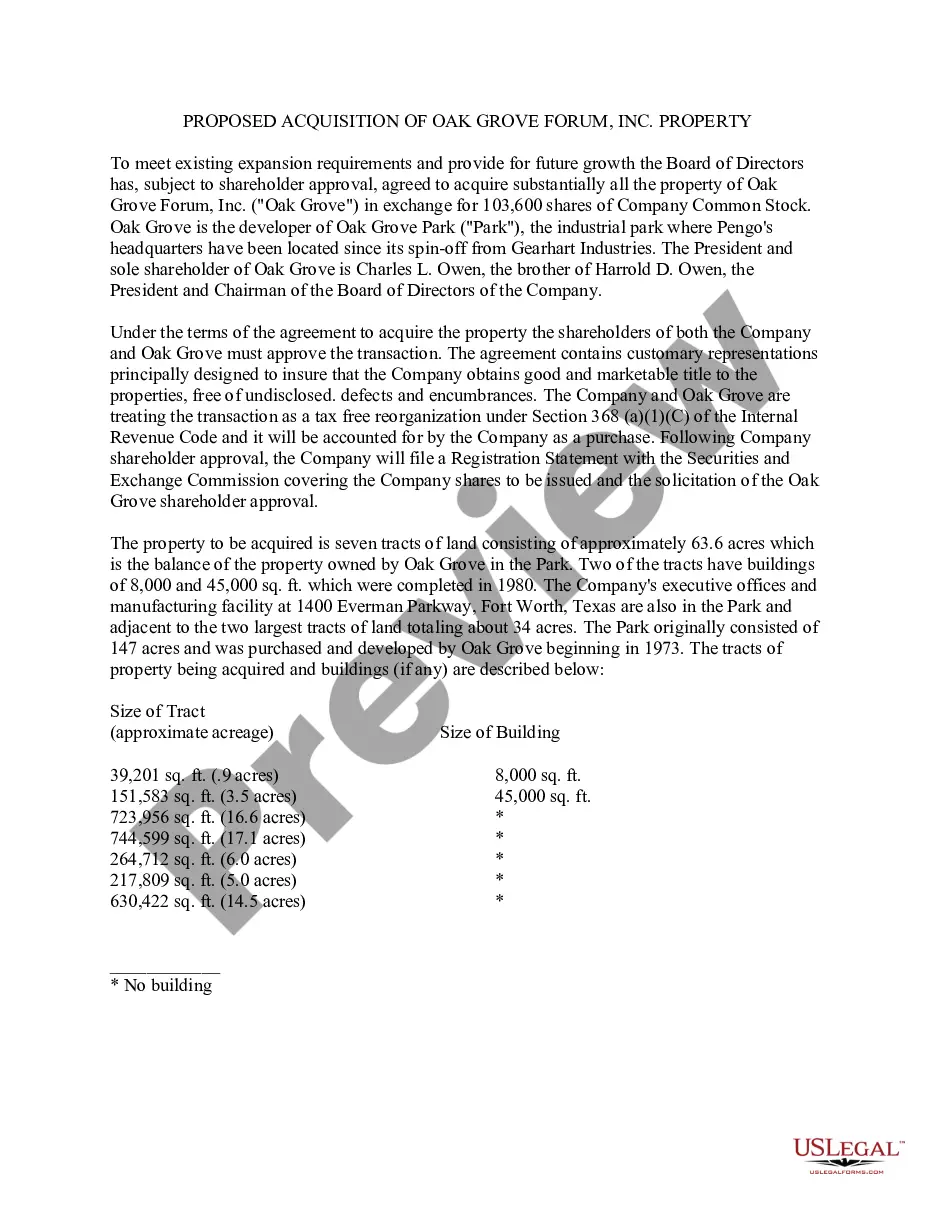

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

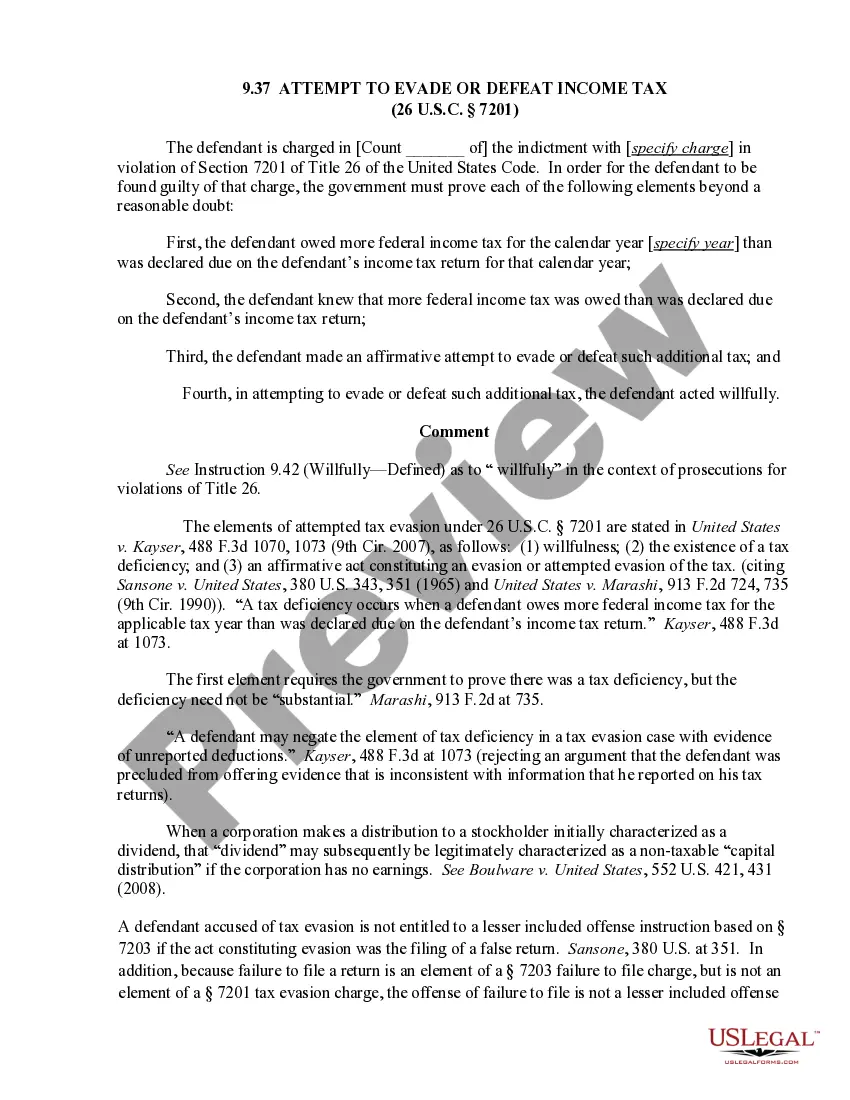

The means test compares a debtor's income for the previous six months to what he or she owes on debts. If a person has enough money coming in to gradually pay down debts, the bankruptcy judge is unlikely to allow a Chapter 7 discharge.

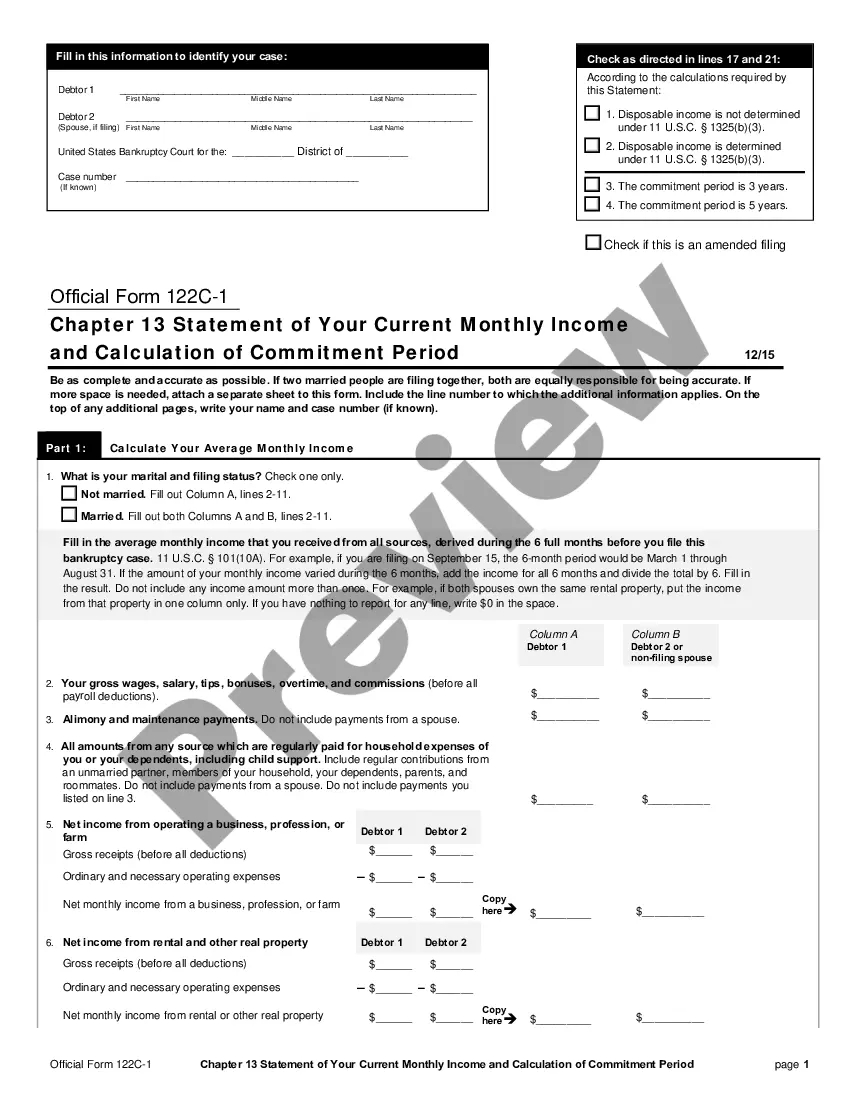

(10A) The term ?current monthly income?? (A) means the average monthly income from all sources that the debtor receives (or in a joint case the debtor and the debtor's spouse receive) without regard to whether such income is taxable income, derived during the 6-month period ending on? (i) the last day of the calendar ...

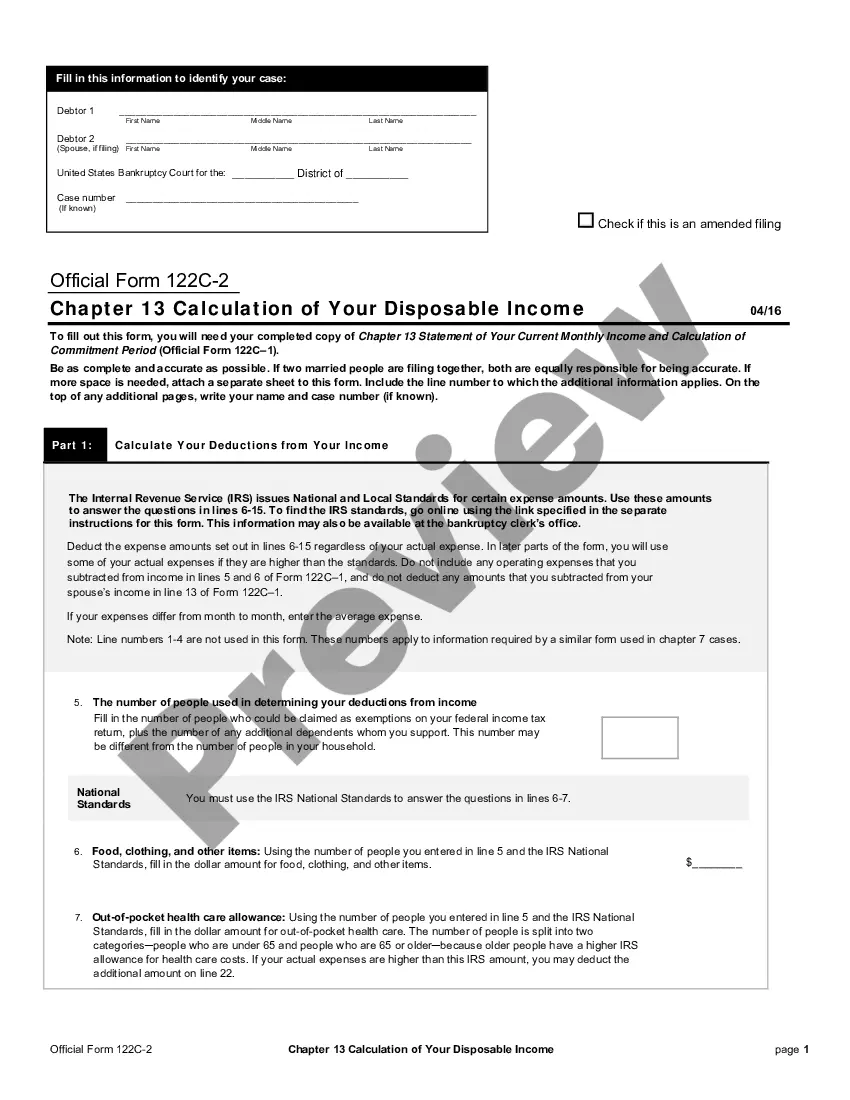

You can't pay more than your disposable income in Chapter 13, because your disposable income represents all earnings that remain after paying required debts. However, there is another step in the Chapter 13 payment calculation, and if you don't meet the criteria, the judge won't approve your plan.

After subtracting all the allowed expenses from your ?current monthly income,? the balance is your ?disposable income.? If you have no disposable income ? your allowed expenses exceed your ?current monthly income? ? then you've passed the means test.

For an individual, gross income is your total pay, which is the amount of money you've earned before taxes and other items are deducted. From your gross income, subtract the income taxes you owe. The amount left represents your disposable income.

The disposable income calculation starts with your gross income. You must also be a wage earner in order to file a Chapter 13. Then, certain expenses are deducted based on an IRS deduction. The deduction is based upon a national average, taking into consideration the metropolitan area you live.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.