Guam Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Means Test Calculation For Use In Chapter 7 - Post 2005?

Are you currently within a placement in which you need paperwork for sometimes organization or personal functions virtually every day time? There are a variety of legitimate file templates accessible on the Internet, but locating ones you can trust isn`t straightforward. US Legal Forms delivers thousands of type templates, such as the Guam Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005, which can be created to meet state and federal specifications.

When you are already familiar with US Legal Forms website and possess a free account, merely log in. Next, you are able to acquire the Guam Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005 template.

Should you not provide an accounts and want to start using US Legal Forms, follow these steps:

- Get the type you require and ensure it is to the right town/region.

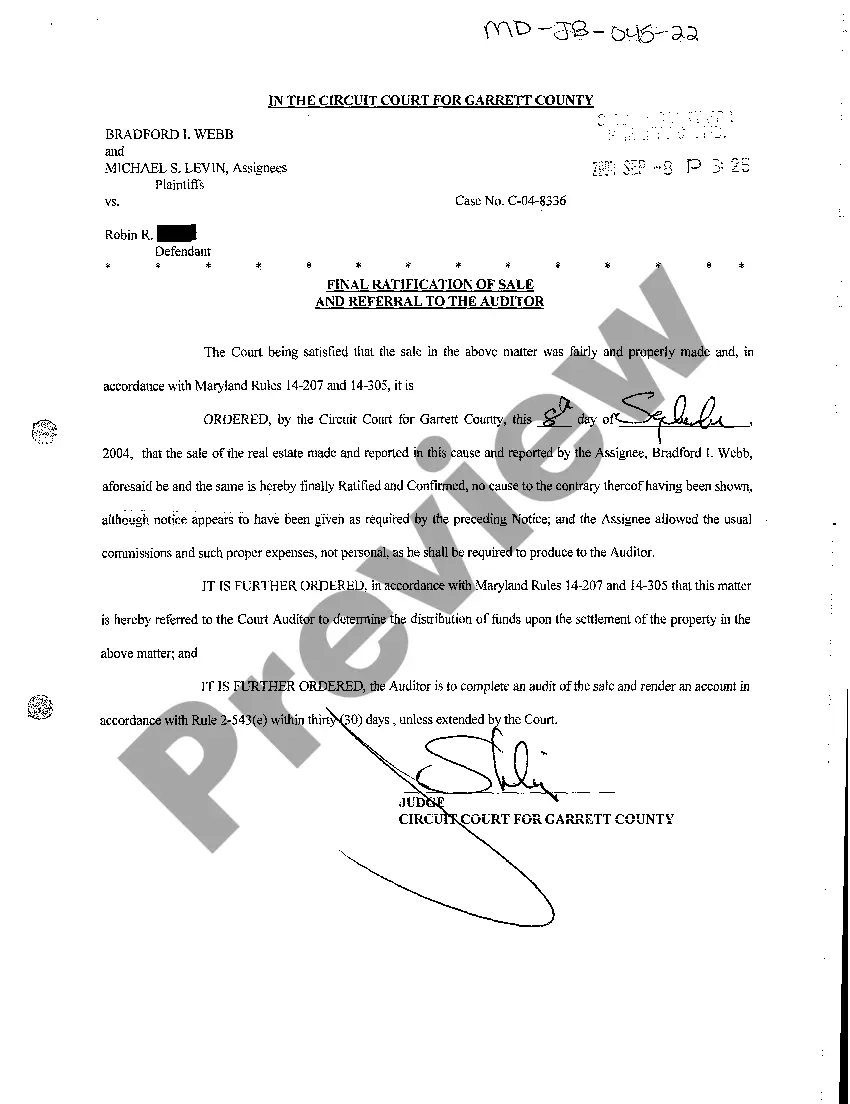

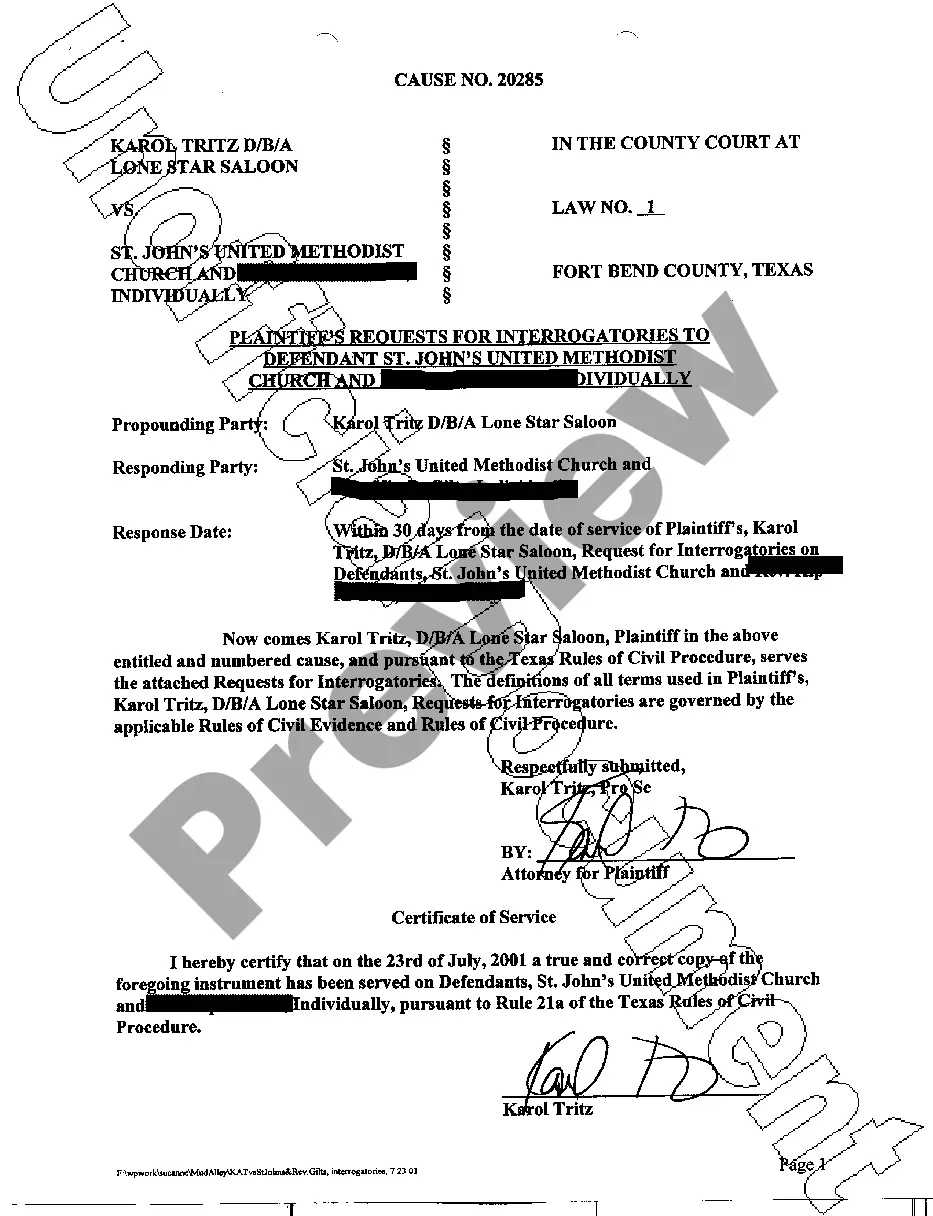

- Use the Preview key to check the form.

- Browse the outline to actually have chosen the correct type.

- In the event the type isn`t what you`re looking for, take advantage of the Look for field to discover the type that suits you and specifications.

- When you find the right type, just click Acquire now.

- Select the pricing plan you would like, fill in the specified info to create your account, and purchase an order making use of your PayPal or credit card.

- Pick a hassle-free paper formatting and acquire your copy.

Get all of the file templates you might have bought in the My Forms menu. You can obtain a extra copy of Guam Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005 any time, if possible. Just click on the necessary type to acquire or produce the file template.

Use US Legal Forms, by far the most comprehensive collection of legitimate types, in order to save efforts and prevent errors. The support delivers expertly made legitimate file templates that can be used for a selection of functions. Generate a free account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

? income can vary month to month, and the means test finds the average. Your figure should include not only your wages, but also rental income, child support, alimony, pension or other regular monthly income. Social Security income does not count.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.

This formula takes a look at the amount of disposable income compared to the level of unsecured debt. If the debtor's disposable income, projected for a five-year period, is more than 25 percent of the total unsecured debt, the debtor will likely be denied a Chapter 7 filing.

The Chapter 7 means test determines whether allowing someone to discharge their debts would be an abuse of the bankruptcy system. If your gross income based on the six months before filing bankruptcy is below the median income for your state, you pass the means test.

To calculate your six-month average gross income, you first need to add up your wages, salaries, and tips for the past six months. Then, divide that number by six to get your average monthly income. If you receive any income from sources other than employment, you'll need to factor that in as well.

Form 122A-1: Chapter 7 Statement of Your Current Monthly Income. Form 122A-1 focuses on your marital and filing status, as well as your monthly income as compared to your state's median income.

If a filer qualifies for an exception to the means test, they will file Form 122A-1Supp. You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person.