Guam Employee Notice to Correct IRCA Compliance

Description

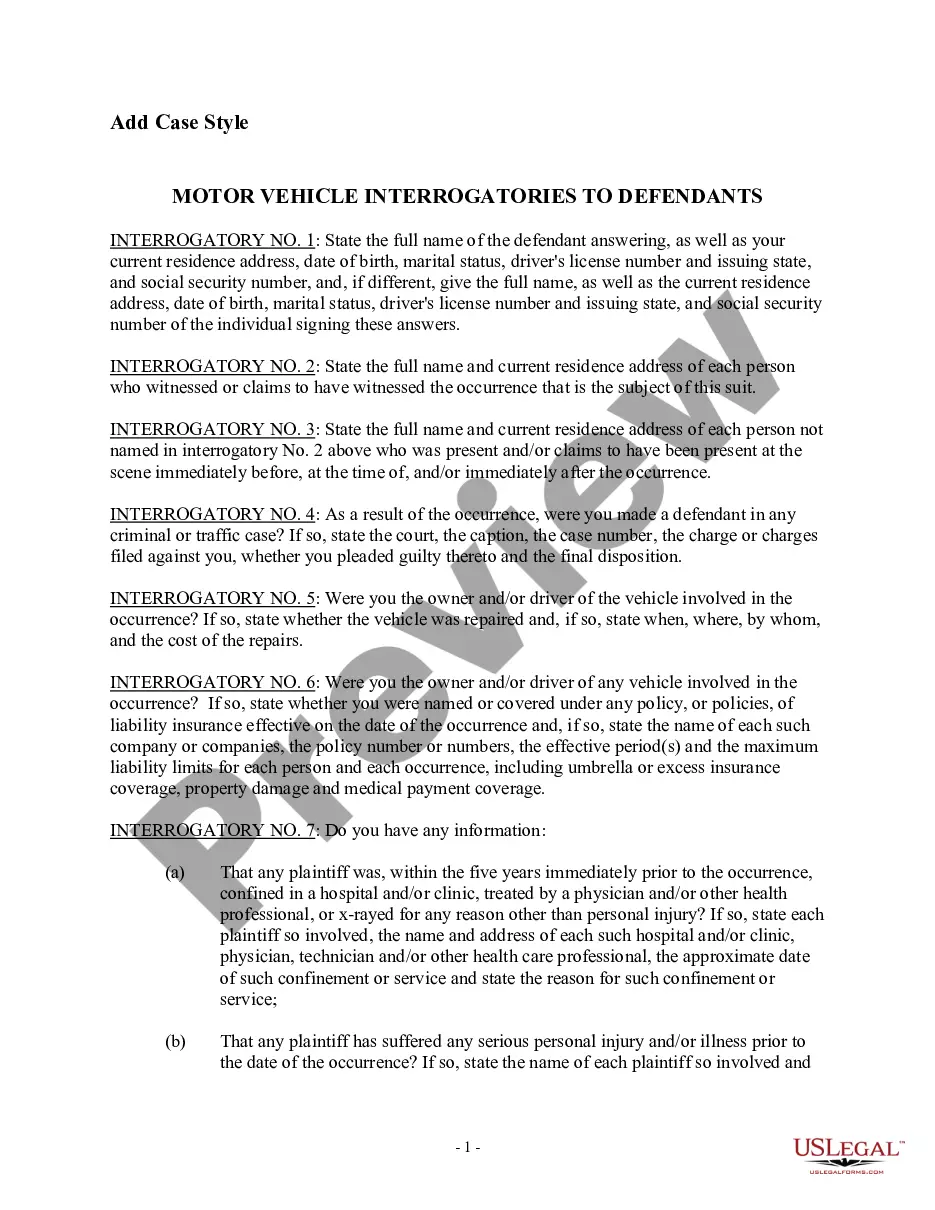

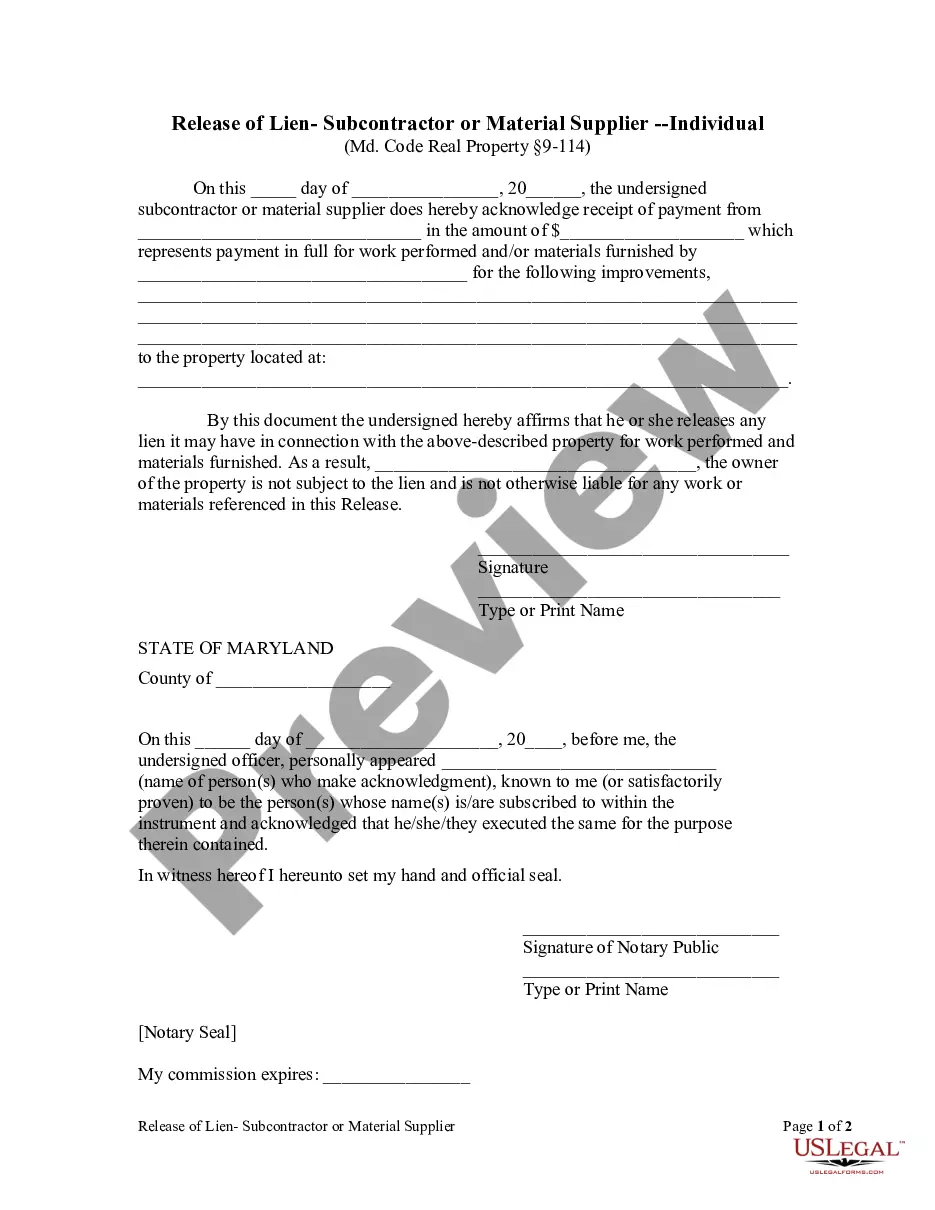

How to fill out Employee Notice To Correct IRCA Compliance?

US Legal Forms - one of the largest collections of legal forms in the USA - offers a vast selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords.

You can find the newest versions of forms like the Guam Employee Notice to Correct IRCA Compliance in just seconds.

Examine the form summary to ensure you have chosen the correct one.

If the form does not meet your requirements, utilize the Search box at the top of the screen to find the one that does.

- If you have a subscription, Log In to download the Guam Employee Notice to Correct IRCA Compliance from the US Legal Forms library.

- The Download button will be visible for every form you view.

- You can access all previously saved forms in the My documents section of your profile.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Make sure you have selected the correct form for your city/county.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Yes, compliance with the IRCA mandates that employers must verify the employment eligibility of every new hire. This process involves completing Form I-9 and ensuring proper documentation is in place. By following these guidelines, employers can confidently navigate hiring procedures and reduce the risk of needing a Guam Employee Notice to Correct IRCA Compliance.

When it is necessary to update or reverify Form I-9, employers should take the following steps:Step 1: Ensure Documentation Provided Is Acceptable.Step 2: Complete Section 3 of the Form I-9.Step 3: Update Tracking Spreadsheet and Establish Need for Future Reverifications.

To correct multiple errors in one section, you may redo the section on a new Form I-9 and attach it to the old form. You can also complete a new Form I-9 if it contains major errors (such as entire sections that were left blank or you completed Section 2 based on unacceptable documents).

To comply with the law, employers must: Verify the identity and employment authorization of each person they hire; Complete and retain a Form I-9, Employment Eligibility Verification, for each employee; and. Refrain from discriminating against individuals on the basis of national origin or citizenship.

To correct multiple errors in one section, you may redo the section on a new Form I-9 and attach it to the old form. You can also complete a new Form I-9 if it contains major errors (such as entire sections that were left blank or you completed Section 2 based on unacceptable documents).

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.

When it is necessary to update or reverify Form I-9, employers should take the following steps:Step 1: Ensure Documentation Provided Is Acceptable.Step 2: Complete Section 3 of the Form I-9.Step 3: Update Tracking Spreadsheet and Establish Need for Future Reverifications.

The Immigration Reform and Control Act (IRCA) of 1986 requires all U.S. employers, regardless of size, to complete a Form I-9 upon hiring a new employee to work in the United States.

The IRCA requires employers to certify (using the I-9 form) within three days of employment the identity and eligibility to work of all employees hired. I-9 forms must be retained for three years following employment or 1 year following termination whichever is later.

Use Form I-9 to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for each individual they hire for employment in the United States. This includes citizens and noncitizens.