Guam Employee Payroll Records Checklist

Description

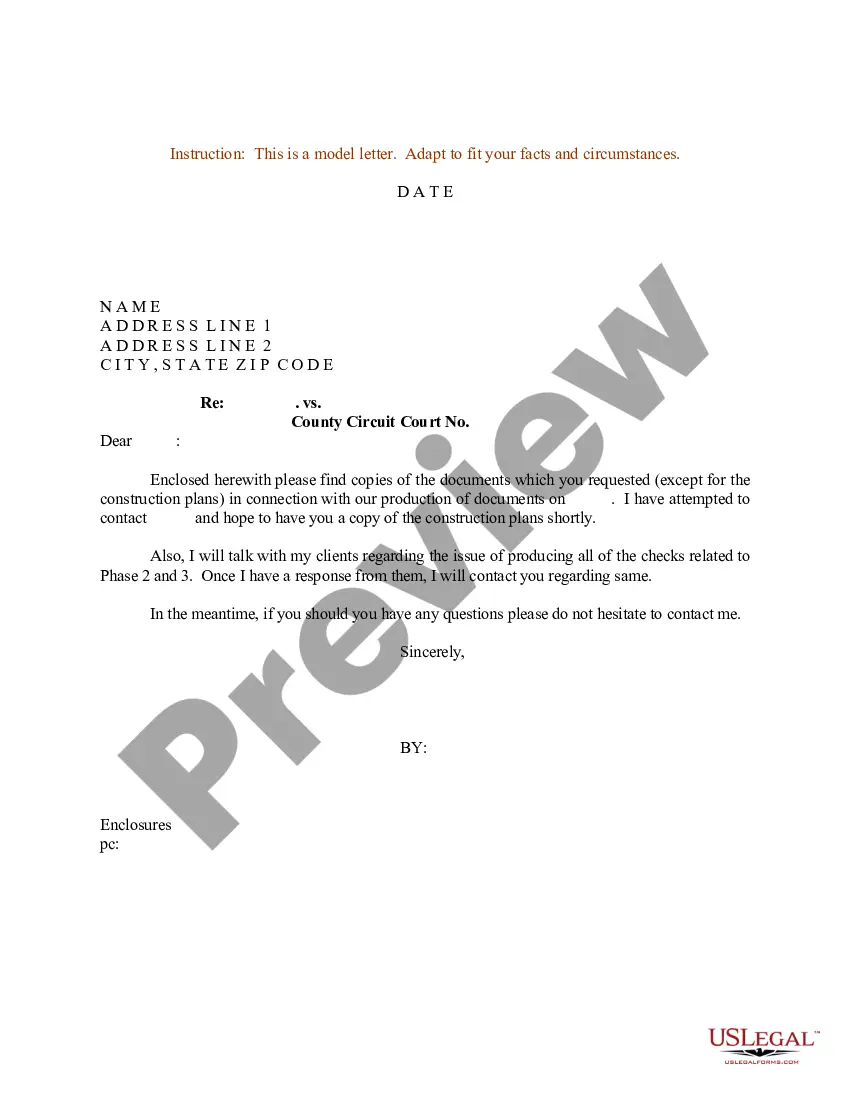

How to fill out Employee Payroll Records Checklist?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the site’s user-friendly and convenient search functionality to find the documents you need. Various templates for business and personal purposes are categorized by type and region, or keywords.

Utilize US Legal Forms to locate the Guam Employee Payroll Records Checklist in just a few clicks.

Every legal document template you purchase is yours to keep forever. You can access each form you've saved in your account. Go to the My documents section and select a form to print or download again.

Download and print the Guam Employee Payroll Records Checklist with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the Guam Employee Payroll Records Checklist.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Remember to read the information carefully.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred payment plan and enter your information to register for an account.

- Step 5. Complete the payment process. You can use your Visa or MasterCard, or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Guam Employee Payroll Records Checklist.

Form popularity

FAQ

In Guam, the amount of tax deducted from your paycheck depends on your income level and applicable tax brackets. Typically, residents can expect federal income tax, along with Guam's local income tax, to be withheld from their earnings. Utilizing a Guam Employee Payroll Records Checklist makes it easier to keep track of these deductions and understand their impact on your paycheck. By following this checklist, you can ensure accurate calculations and maintain compliance.

To file your Guam taxes online, you must visit the Guam Department of Revenue and Taxation's official website. They provide an easy-to-navigate online system for tax submissions. Keeping your payroll records organized is crucial, and using a Guam Employee Payroll Records Checklist can streamline this filing process. This checklist helps ensure that you have all necessary documents ready for a smooth online submission.

The Guam Department of Revenue and Taxation oversees tax collection on the island. This department ensures that all taxes, including income tax and sales tax, are collected efficiently. As you manage your payroll records, it is essential to stay updated on tax regulations. The Guam Employee Payroll Records Checklist can help ensure compliance with these tax collection guidelines.

To create a payroll checklist, begin by outlining all necessary payroll tasks in a logical sequence. Include items such as collecting employee data, submitting timesheets, and processing payments. Use resources like the Guam Employee Payroll Records Checklist to ensure you are covering all critical aspects of payroll processing and record-keeping.

A checklist in payroll serves as a systematic guide to ensure all necessary steps and documents are processed accurately. It helps payroll administrators track important tasks such as verifying employee hours and calculating taxes. Incorporating the Guam Employee Payroll Records Checklist can improve accuracy and compliance while facilitating efficient payroll management.

The best tool for creating a checklist depends on your specific needs and preferences. Many people find that using online platforms or project management software simplifies the process. Tools that allow customization and collaboration can be particularly useful; for example, consider using templates like the Guam Employee Payroll Records Checklist to ensure completeness and organization.

You can contact DOA Guam through their official website or by phone. They provide various channels for inquiries, which can guide you in accessing the right services or information. Whether you have questions about payroll records or require assistance related to the Guam Employee Payroll Records Checklist, reaching out to DOA will connect you to helpful resources.

Creating a payroll checklist involves gathering all necessary documents and steps involved in the payroll process. Begin by listing tasks such as collecting timesheets, calculating wages, processing deductions, and ensuring compliance with tax regulations. Refer to the Guam Employee Payroll Records Checklist to confirm you have all the essential records necessary for accurate payroll processing.

The Department of Administration (DOA) Guam offers various services, including payroll processing, employee benefits management, and human resources support. They also provide assistance with compliance, ensuring that payroll records meet local and federal regulations. Utilizing the resources of DOA can help streamline your payroll processes and maintain accurate records, aligning with the Guam Employee Payroll Records Checklist.

To create a checklist for employees, start by identifying the essential tasks and responsibilities required for their roles. You can divide these tasks into categories such as onboarding, daily duties, and compliance requirements. Use the Guam Employee Payroll Records Checklist to ensure all necessary documentation and payroll information are included, helping employees know what is expected of them.