This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

If you need to compile, download, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make the most of the site's straightforward and user-friendly search feature to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to locate alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Get Now button. Select the payment plan you prefer and enter your details to create an account.

- Use US Legal Forms to obtain the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have chosen the form for the correct city/state.

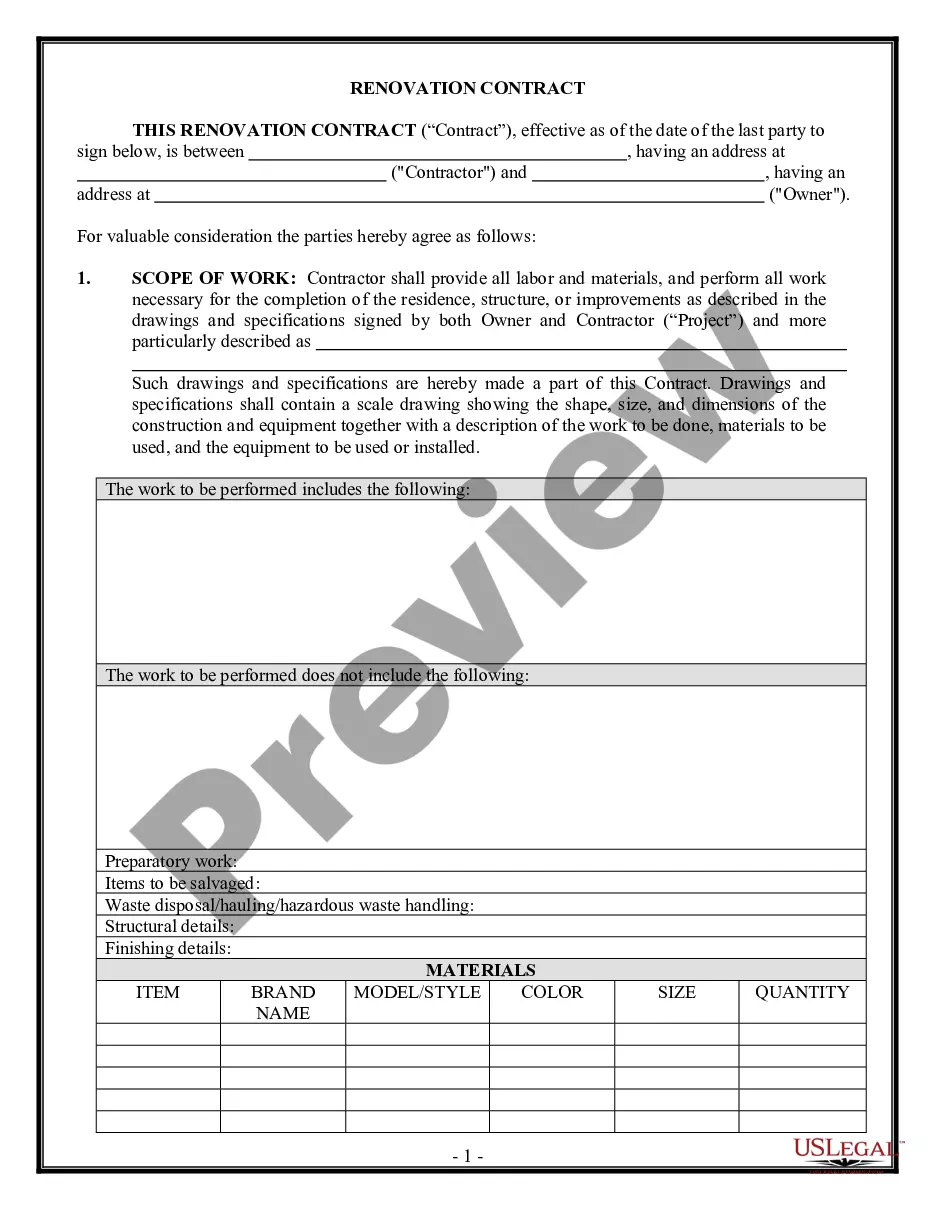

- Step 2. Use the Preview option to review the form's contents. Be sure to read the description carefully.

Form popularity

FAQ

Yes, a 13-year-old debt may still be collectable based on your state's statutes of limitations, which can vary widely. While some debts may fall outside the typical collection window, creditors may still attempt to collect them. It's prudent to familiarize yourself with the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities to determine your legal standing. For more guidance on handling old debts, explore resources on the US Legal Forms website.

In many cases, a debt may become uncollectible after a period of time, typically seven years in the United States, depending on the state laws. This time frame varies based on the type of debt and when the last payment or acknowledgment of the debt occurred. If you receive a notice related to the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities, understanding this timeframe can help you navigate your financial responsibilities more effectively. For personalized assistance, consider using the US Legal Forms platform.

Yes, Guam is a no-fault divorce territory. This means that either spouse can file for divorce without proving wrongdoing by the other spouse. If you are considering a divorce and want to understand your rights, including protections outlined in the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities, legal guidance can be beneficial.

In general, in a community property system like Guam's, both spouses can be held responsible for debts incurred during the marriage. However, certain exceptions may apply, particularly with the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities, which can help clarify individual responsibilities in specific scenarios. Understanding this can be essential for fair financial planning.

Yes, Guam is recognized as a community property territory. This designation means any property or debts accrued during the marriage is jointly owned by both spouses. Knowing this can significantly impact how individuals approach issues related to the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities, as it clarifies financial obligations.

Marriage laws in Guam require couples to obtain a marriage license before tying the knot. Additionally, both parties must be at least 18 years old, consent to the marriage, and fulfill other procedural requirements. Proper understanding of these laws can help you navigate marital responsibilities better, especially concerning the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities.

Guam operates under a system of community property, similar to several states in the mainland United States. This means that property acquired during marriage is typically owned jointly by both spouses. Therefore, when dealing with debts and liabilities, the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities can effectively clarify individual responsibilities within that context.

The nine community property states in the United States are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. These states divide property acquired during marriage equally between spouses upon divorce. If you are considering the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities, understanding these states is important in the broader context of community property laws.

In Guam, the statute of limitations on most debts is six years. This means that creditors must file a lawsuit to collect a debt within this timeframe. Understanding the statute of limitations can help individuals protect themselves, especially in the context of the Guam Notice of Non-Responsibility of Wife for Debts or Liabilities. Knowing this timeframe is essential for maintaining financial stability.

To avoid being responsible for your spouse's debts, you can file a Guam Notice of Non-Responsibility of Wife for Debts or Liabilities. This legal notice informs creditors that you do not accept responsibility for debts incurred by your spouse. Additionally, maintaining separate finances and refraining from co-signing loans can further protect you from such liabilities. For assistance with this process, consider using US Legal Forms, which offers detailed resources and templates for creating a Guam Notice of Non-Responsibility.