Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

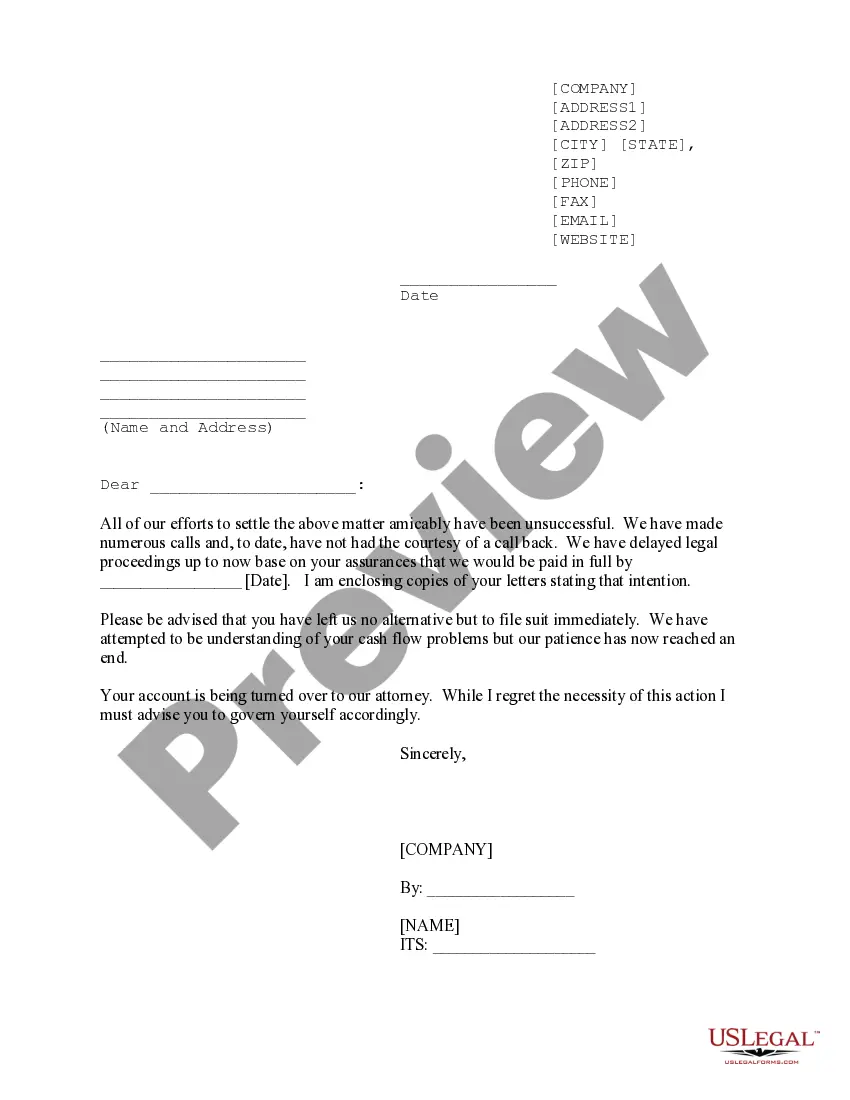

How to fill out Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

If you aim to be thorough, acquire, or generate legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Make use of the site’s straightforward and user-friendly search feature to retrieve the papers you need.

Numerous templates for corporate and individual purposes are categorized by groups and claims, or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finish the payment. Step 6. Retrieve the format from the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Every legal document format you acquire is yours indefinitely. You will have access to every type you obtained in your account. Click on the My documents section and select a type to print or download again. Stay competitive and secure, and print the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor with US Legal Forms. There are numerous professional and jurisdiction-specific forms available for your business or personal needs.

- Employ US Legal Forms to secure the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to receive the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

- You can also access forms you previously obtained in the My documents section of your account.

- For first-time users of US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form’s content. Be sure to read the overview.

- Step 3. If you are dissatisfied with the type, use the Search field at the top of the screen to find alternative types in the legal document format.

Form popularity

FAQ

To ask a debt collector to validate a debt, send a written request within 30 days of their initial contact. In your request, include your account number and state clearly that you would like validation of the debt. When referencing the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor, emphasize your consumer rights and the expectation of proper documentation to support their claims.

Yes, a debt collection agency must prove you owe the debt when you request validation. They should provide documentation that confirms the debt, such as a contract or account statements. This requirement is part of your rights under the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor, intended to protect consumers from erroneous collections.

To get a collection agency to verify your debt, start by sending a written request for validation. This request should include your personal information and account details. The agency is legally required to provide proof that you owe the debt under the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor. If they fail to respond or cannot validate the debt, they must cease collection efforts.

If the creditor cannot validate the debt, they must cease all collection efforts and may have to remove the negative information from your credit report. It is vital to follow up with the collection agency in writing, asserting your rights under the Fair Debt Collection Practices Act. This situation illustrates the importance of knowing your rights, and using platforms like uslegalforms can aid in formal communication. This aligns perfectly with the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor practices.

To ask a collection agency to validate the debt, draft a concise letter identifying the debt and requesting proof of its validity. Mention your rights under applicable federal laws that require them to provide this verification. Make sure to keep a copy of your request for your records. You can find assistance on uslegalforms to frame this request properly, reinforcing your position under the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor system.

To write a letter requesting debt validation, start with your contact information and today's date. Clearly state that you are requesting validation of the debt in question. Include specifics about the debt, such as the amount and creditor’s name, while citing your rights under the Fair Debt Collection Practices Act. Accessing resources from uslegalforms can streamline creating this letter, ensuring compliance with the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor guidelines.

When writing an answer to a debt collection lawsuit, start by clearly stating your name and the case number at the top of the document. Next, respond to each allegation made against you, indicating whether you admit or deny each claim. It’s crucial to include any defenses you may have as well. For guidance, consider using uslegalforms for templates tailored to respond effectively under the Guam acceptance framework.

To ask a collection agency for proof of debt, write a formal request that specifies your right to obtain this information. Reference the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor in your communication to emphasize your understanding of your rights. Ensure your request is sent via a trackable method to keep a record. This way, you can stay informed and protect yourself during the debt collection process.

When responding to a debt collection agency, it’s important to stay calm and professional. Acknowledge their communication and clearly state your position regarding the debt. If you believe the debt is invalid or you need more information, refer to the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor to validate your claims. This structured approach can help you handle the situation effectively.

To request proof of debt from a collection agency, you should start by sending a written request. This request should clearly state that you are seeking verification of the debt under the Guam Acceptance of Claim by Collection Agency and Report of Experience with Debtor guidelines. Be sure to include your contact information and any relevant details about the debt. This approach helps ensure transparency and provides you with the necessary documentation.