A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

Guam Agreement to Purchase Common Stock from another Stockholder

Description

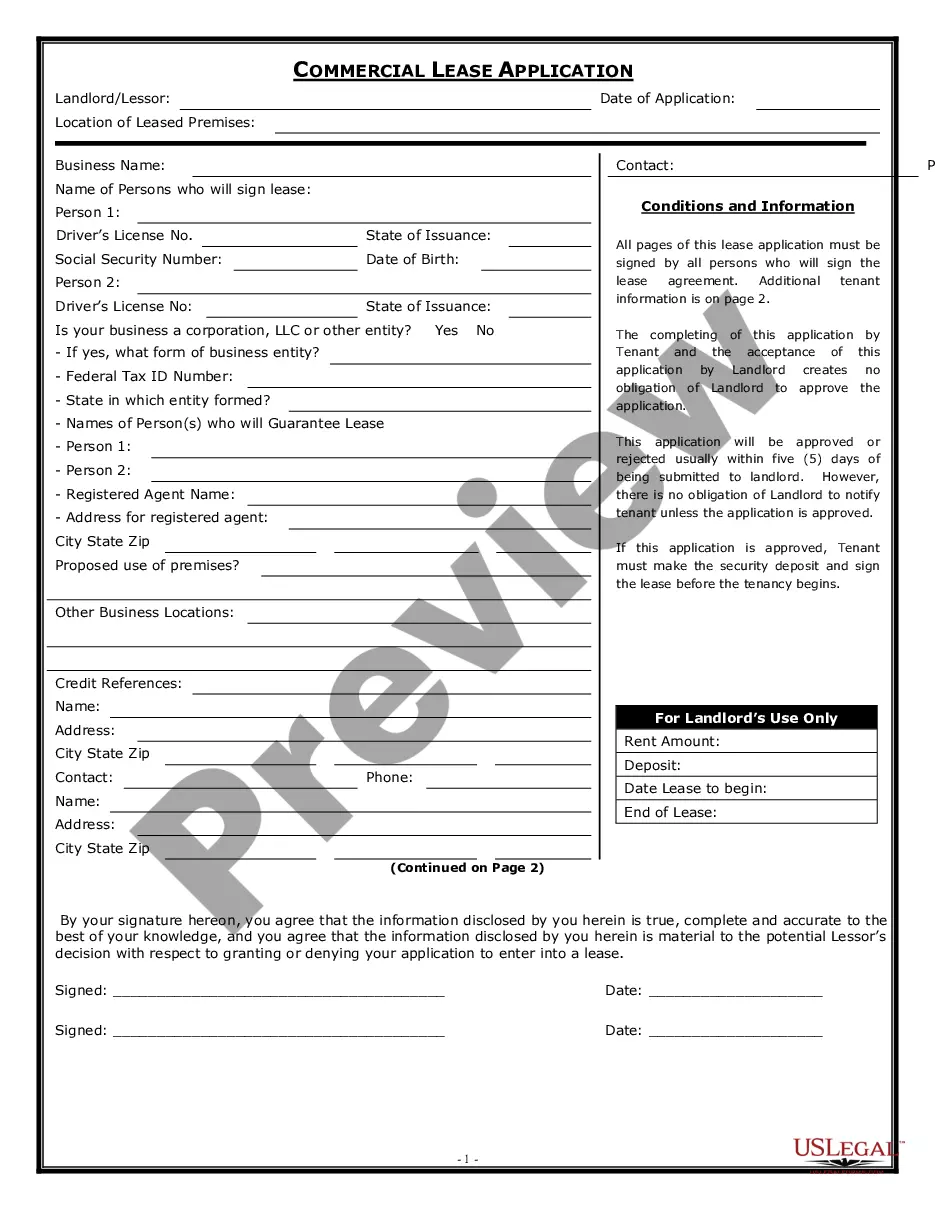

How to fill out Agreement To Purchase Common Stock From Another Stockholder?

If you aim to be thorough, acquire, or create valid document templates, utilize US Legal Forms, the largest repository of lawful forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Utilize US Legal Forms to access the Guam Agreement to Acquire Common Stock from another Stockholder in just a few clicks.

Every legal document template you purchase is yours permanently.

You will have access to all forms you downloaded in your account. Visit the My documents section and select a form to print or download again.

- If you are a current US Legal Forms user, sign in to your account and click the Download button to obtain the Guam Agreement to Acquire Common Stock from another Stockholder.

- You can also find forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the content of the form. Always remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative forms in the legal form category.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your information to register for the account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, revise, and print or sign the Guam Agreement to Acquire Common Stock from another Stockholder.

Form popularity

FAQ

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

How to WriteStep 1 Download The Stock (Shares) Purchase Agreement.Step 2 Set This Agreement To A Specific Date.Step 3 Produce The Purchaser's Identity.Step 4 Attach The Seller's Information.Step 5 Define The Entity Behind The Shares The Purchaser Shall Buy.Step 6 Provide A Discussion On The Concerned Shares.More items...

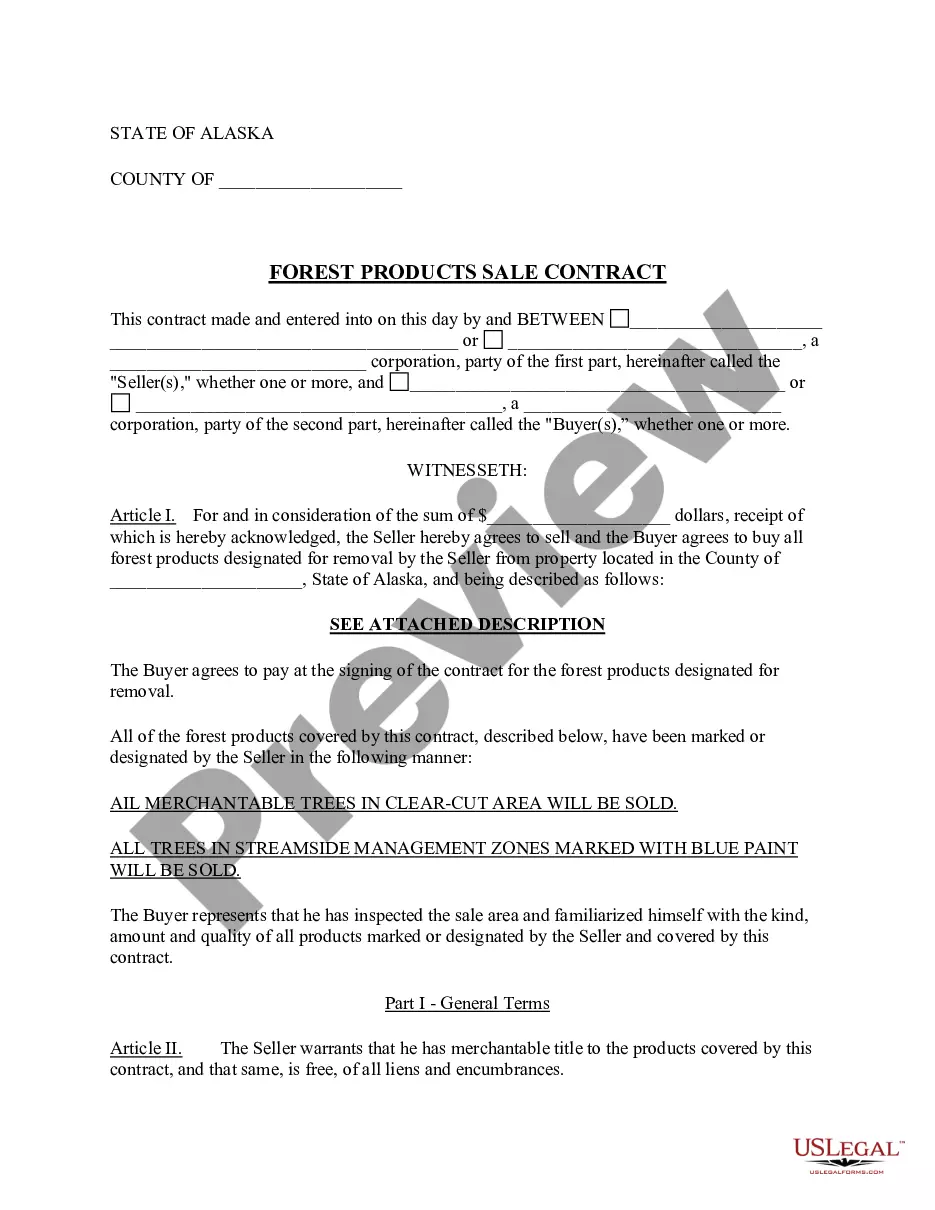

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

Amendment. The procedure for amending a shareholders agreement that covers ownership and stock transfer issues can be detailed in the document itself or the bylaws. In either case, the subject must be proposed at a meeting of the board of directors.

You typically see the following in a stock purchase agreement:Your company's name.The name and mailing address of the entity buying shares in your company's stocks.The par value (essentially the sale price) of the stocks being sold.The number of stocks the buyer is purchasing.The transaction's date, time and location.More items...

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.