Missouri Personnel Status Change Worksheet

Description

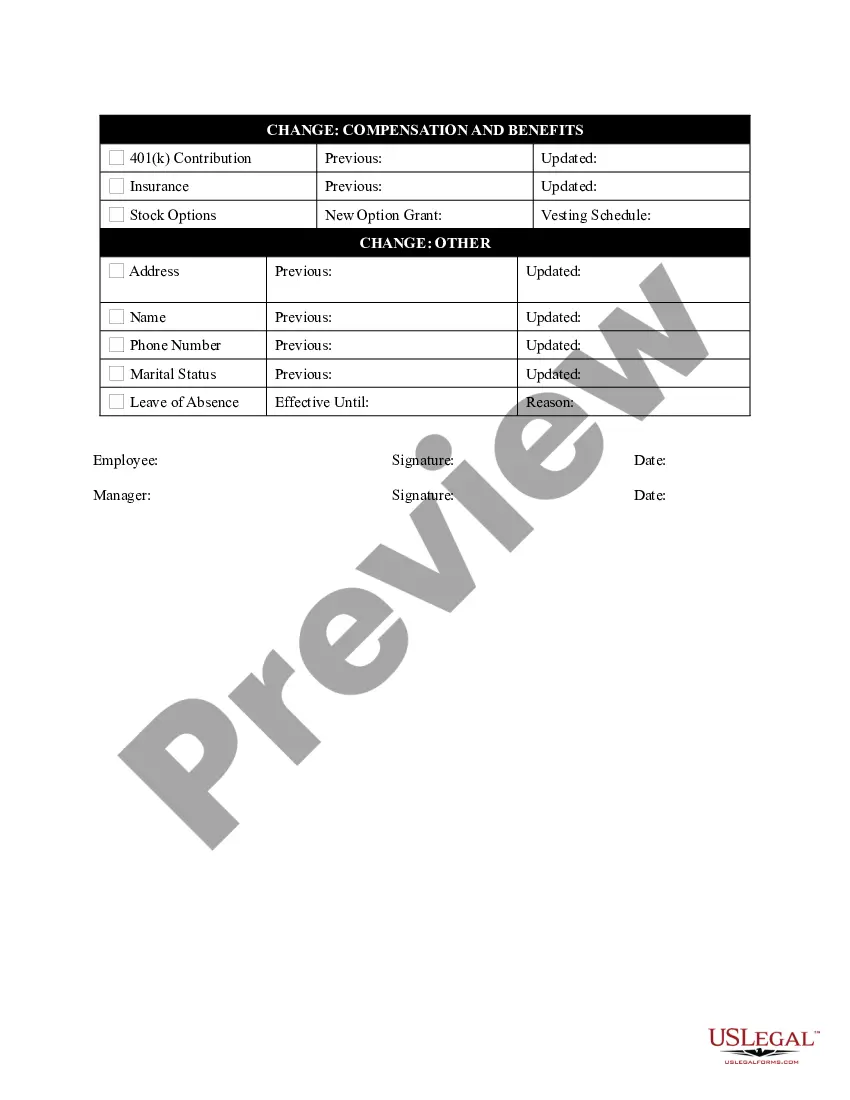

How to fill out Personnel Status Change Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can download or print.

By utilizing the website, you will discover thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest forms like the Missouri Employee Status Change Worksheet in no time.

If you possess a monthly subscription, Log In and acquire the Missouri Employee Status Change Worksheet from the US Legal Forms library. The Download button will be visible on each form you encounter. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to complete the purchase.

Select the format and download the document onto your device.

- Ensure you have selected the appropriate form for the city/state.

- Click the Preview button to inspect the form's content.

- Review the form details to confirm that you have selected the correct document.

- If the form does not meet your criteria, utilize the Search box at the top of the screen to locate the one that does.

- Once satisfied with the form, validate your choice by clicking the Buy now button.

- Then, select the pricing plan of your choice and provide your information to register for the account.

Form popularity

FAQ

You are a resident and have less than $1,200 of Missouri adjusted gross income; You are a nonresident with less than $600 of Missouri income; OR. Your Missouri adjusted gross income is less than the amount of your standard deduction plus your exemption amount.

Box 1 (Required) Print first name, middle initial, last name, home address, city, state, and zip code. Box 2 (Required) Complete with nine-digit social security number. Box 3 (Required) Must have a check mark in one box only. Box 4 (Optional) Place a check mark in the box only if your last name differs from that shown

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Form MO W-4 revised for 2020The Department has released an updated Form MO W-4 for calendar year 2020. Employees are required to submit Form MO W-4 to their employer when beginning employment, when their filing status changes or to adjust the amount of withholding.

This form is to be completed by a Missouri resident employed in a foreign state. Missouri Department of Revenue. Withholding Affidavit. For Missouri Residents. Form MO W-4C (Revised 11-2013)

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

To be exempt from withholding, both of the following must be true:You owed no federal income tax in the prior tax year, and.You expect to owe no federal income tax in the current tax year.

Box 1 (Required) Print first name, middle initial, last name, home address, city, state, and zip code. Box 2 (Required) Complete with nine-digit social security number. Box 3 (Required) Must have a check mark in one box only. Box 4 (Optional) Place a check mark in the box only if your last name differs from that shown

You are exempt ONLY if you receive every penny back that was withheld (box 17 on your W-2). Sign the form and date it (date = day you completed and signed, not your birthdate).