Guam Receipt for Down Payment for Real Estate

Description

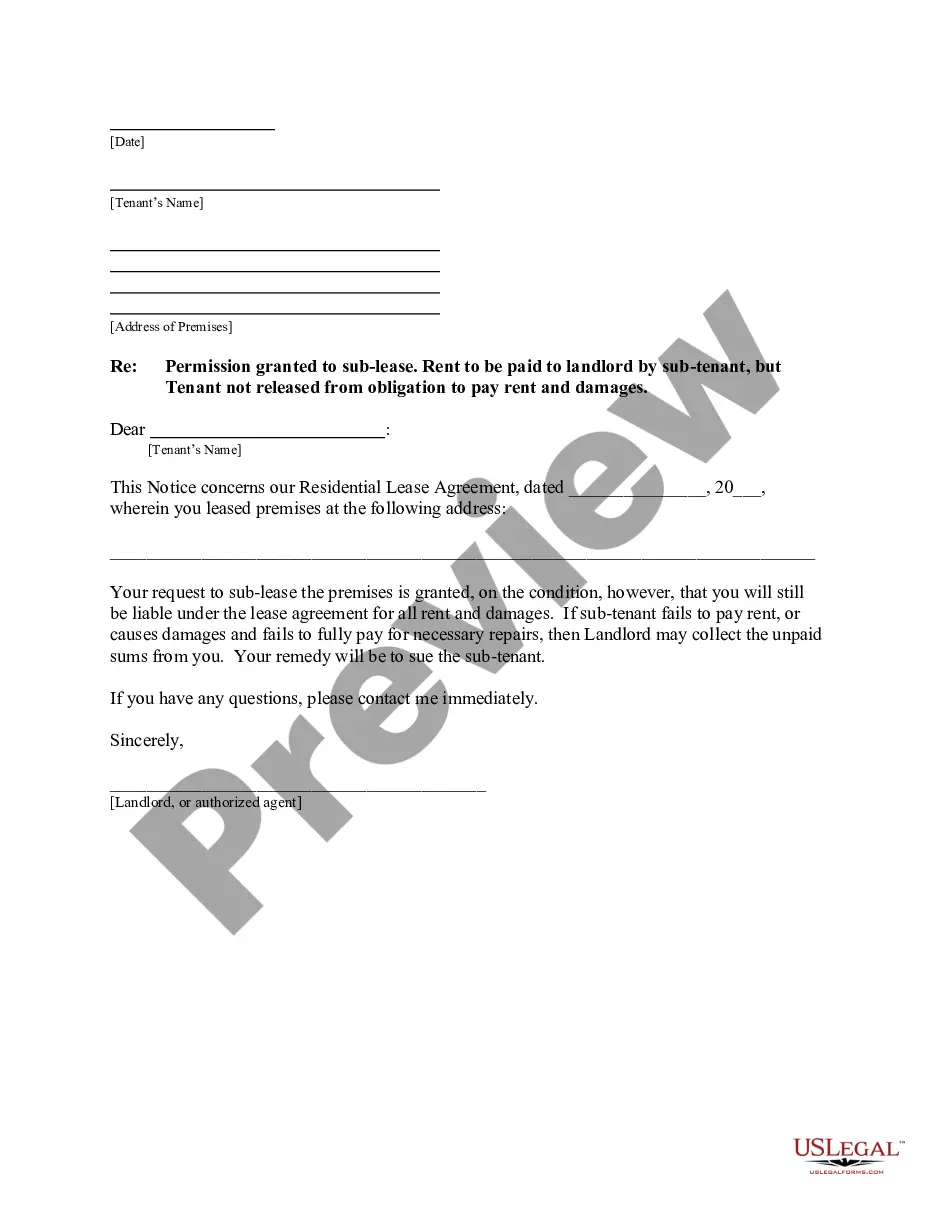

How to fill out Receipt For Down Payment For Real Estate?

If you need to finalize, retrieve, or print legal document templates, utilize US Legal Forms, the largest variety of legal forms, accessible online.

Leverage the site's straightforward and uncomplicated search functionality to acquire the documents you require.

A range of templates for businesses and personal purposes are organized by categories and states, or by keywords.

Step 4. Once you find the form you need, click the Get Now button. Choose the pricing plan you prefer and enter your credentials to create an account.

Step 5. Process the transaction. You can use your Visa, Mastercard, or PayPal account to complete the payment.Step 6. Select the format of your legal document and download it to your device.

- Use US Legal Forms to obtain the Guam Receipt for Down Payment for Real Estate in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to get the Guam Receipt for Down Payment for Real Estate.

- You can also access templates you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Confirm you have chosen the form for the appropriate city/state.

- Step 2. Utilize the Review option to examine the form's details. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Writing a receipt for payment involves identifying the transaction date and including the names and contact information of both parties. Clearly outline what the payment was for, such as stating it connects to the Guam Receipt for Down Payment for Real Estate. Don't forget to specify the amount, and include necessary signatures to confirm acceptance.

When writing an invoice for a down payment, start with your business name and contact information at the top. Include the buyer's details, a description of the property involved, and specify that it is a down payment related to the Guam Receipt for Down Payment for Real Estate, along with the amount. Make sure to include an invoice number, the date, and clear payment terms.

To write a deposit receipt, include the names of both the buyer and seller, along with their contact information. Clearly state the amount of the deposit, the purpose, and reference any specific agreements related to the Guam Receipt for Down Payment for Real Estate. Ensure to date the receipt and add a signature from the receiving party to validate the transaction.

The turnaround time for Guam tax returns typically ranges from 8 to 14 weeks, depending on the complexity of your return and the volume of submissions received by the tax office. If you file electronically, you may see a quicker response. Ensure all necessary documentation, including your Guam Receipt for Down Payment for Real Estate, is submitted for a smoother process.

If you live or earn income in Guam, you are generally required to file Guam taxes. This includes income earned through regular employment or investments in real estate. Utilizing a Guam Receipt for Down Payment for Real Estate may help streamline your financial reporting when filing taxes.

Yes, Guam is considered a U.S. territory for tax purposes, but there are some unique tax laws in place. Residents often file tax returns that may differ slightly from those of the states. Keeping your Guam Receipt for Down Payment for Real Estate can aid in properly identifying taxable transactions.

Customs tax in Guam applies to goods imported into the island. This tax is calculated based on the value of the imported items and can vary depending on the type of goods. If you're considering purchasing property, having your Guam Receipt for Down Payment for Real Estate will help you understand potential costs involved.

Yes, you typically need to file a Guam tax return if you earn income in Guam. Even if you are a resident of the contiguous United States, income earned in Guam is subject to Guam tax laws. To ensure compliance, consider keeping your Guam Receipt for Down Payment for Real Estate handy, as it may be required for various tax calculations.

You can file an income tax return online through various reputable platforms. These services often guide you through the process, ensuring you include all necessary documentation, including the Guam Receipt for Down Payment for Real Estate if applicable. Filing online not only saves time but also provides a straightforward way to submit your taxes correctly.

Yes, you can file your Guam tax online, making the process more convenient and efficient. Look for online platforms that cater to Guam tax filings, where you can easily upload essential documents such as the Guam Receipt for Down Payment for Real Estate. This option allows for real-time updates and faster processing of your return.