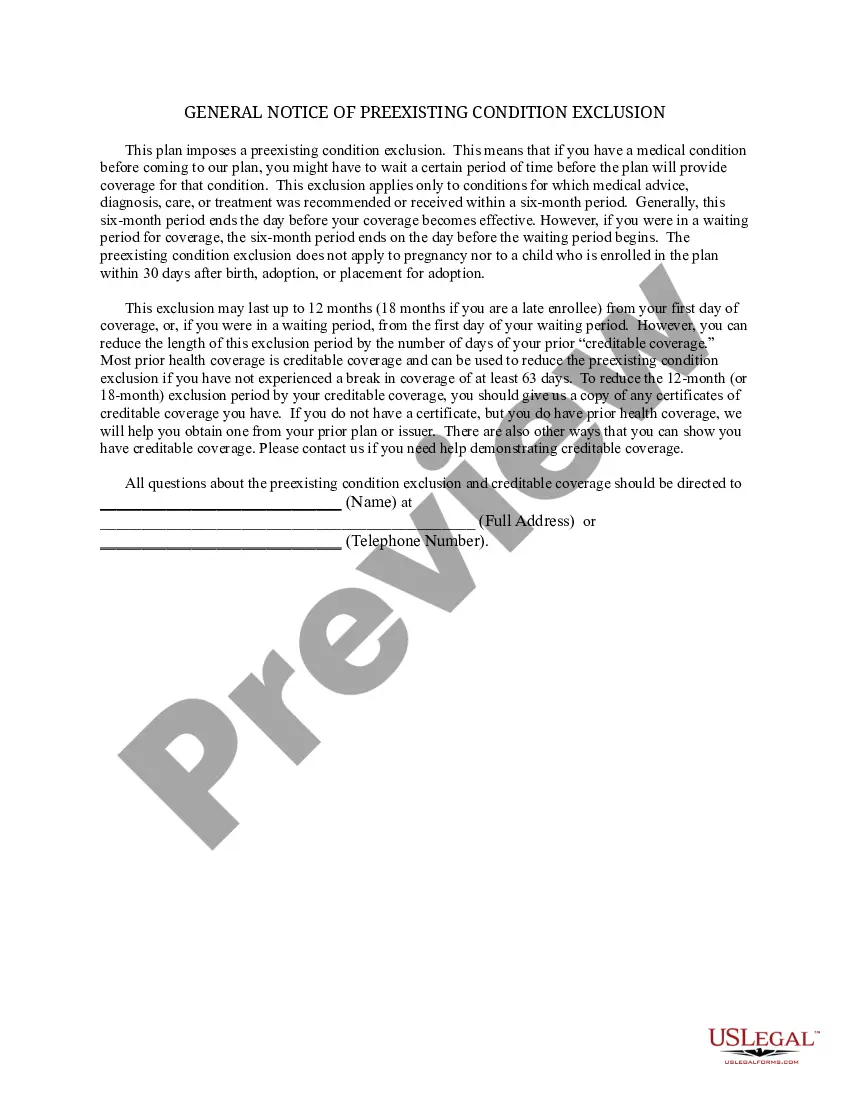

District of Columbia Individual Notice of Preexisting Condition Exclusion

Description

How to fill out Individual Notice Of Preexisting Condition Exclusion?

It is feasible to invest hours online trying to locate the legal document template that meets the federal and state requirements you require.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can conveniently obtain or print the District of Columbia Individual Notice of Preexisting Condition Exclusion from your portal.

If necessary, make changes to the document. You can complete, edit, and sign the District of Columbia Individual Notice of Preexisting Condition Exclusion.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the District of Columbia Individual Notice of Preexisting Condition Exclusion.

- Every legal document template you receive is yours indefinitely.

- To obtain another version of any document obtained, navigate to the My documents section and click the corresponding button.

- If you're visiting the US Legal Forms site for the first time, follow the straightforward steps outlined below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the document description to confirm you have selected the appropriate form.

Form popularity

FAQ

You'll need to declare all existing medical conditions when buying travel insurance. If you're not sure whether to declare, it's important not to assume it's covered. Always ask your insurance provider, otherwise you risk any claim you need to make being rejected.

A health problem, like asthma, diabetes, or cancer, you had before the date that new health coverage starts. Insurance companies can't refuse to cover treatment for your pre-existing condition or charge you more.

Yes. Under the Affordable Care Act, health insurance companies can't refuse to cover you or charge you more just because you have a pre-existing condition that is, a health problem you had before the date that new health coverage starts.

Conditions for Exclusion HIPAA did allow insurers to refuse to cover pre-existing medical conditions for up to the first 12 months after enrollment, or 18 months in the case of late enrollment.

The time period during which a health plan won't pay for care relating to a pre-existing condition. Under a job-based plan, this cannot exceed 12 months for a regular enrollee or 18 months for a late-enrollee.

There might be a scenario's where system determines records for more than one condition type in the pricing procedure. In order to avoid this we can set up conditions or a group of conditions to be mutually exclusive. This is called condition exclusion.

The time period during which an individual policy won't pay for care relating to a pre-existing condition. Under an individual policy, conditions may be excluded permanently (known as an "exclusionary rider").

It limits the time a new employer plan can exclude the pre-existing condition from being covered. An employer health plan can avoid covering costs of medical care for a pre-existing condition for no more than 12 months after the person is accepted into the plan.

Examples of pre-existing conditions include cancer, asthma, diabetes, and even pregnancy. Under the Affordable Care Act (Obamacare), health insurance companies cannot refuse to cover you because of any pre-existing conditions nor can they charge you more money for coverage or subject you to a waiting period.

A medical illness or injury that you have before you start a new health care plan may be considered a pre-existing condition. Conditions like diabetes, COPD, cancer, and sleep apnea, may be examples of pre-existing health conditions. They tend to be chronic or long-term.