Guam Release of Liability of Employer - Ski Trip

Description

How to fill out Release Of Liability Of Employer - Ski Trip?

Are you presently in a placement where you frequently require documents for business or specific purposes almost every day.

There are numerous authentic document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides a vast array of form templates, such as the Guam Release of Liability of Employer - Ski Trip, which are designed to comply with federal and state regulations.

If you find the right form, simply click Acquire now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Guam Release of Liability of Employer - Ski Trip template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

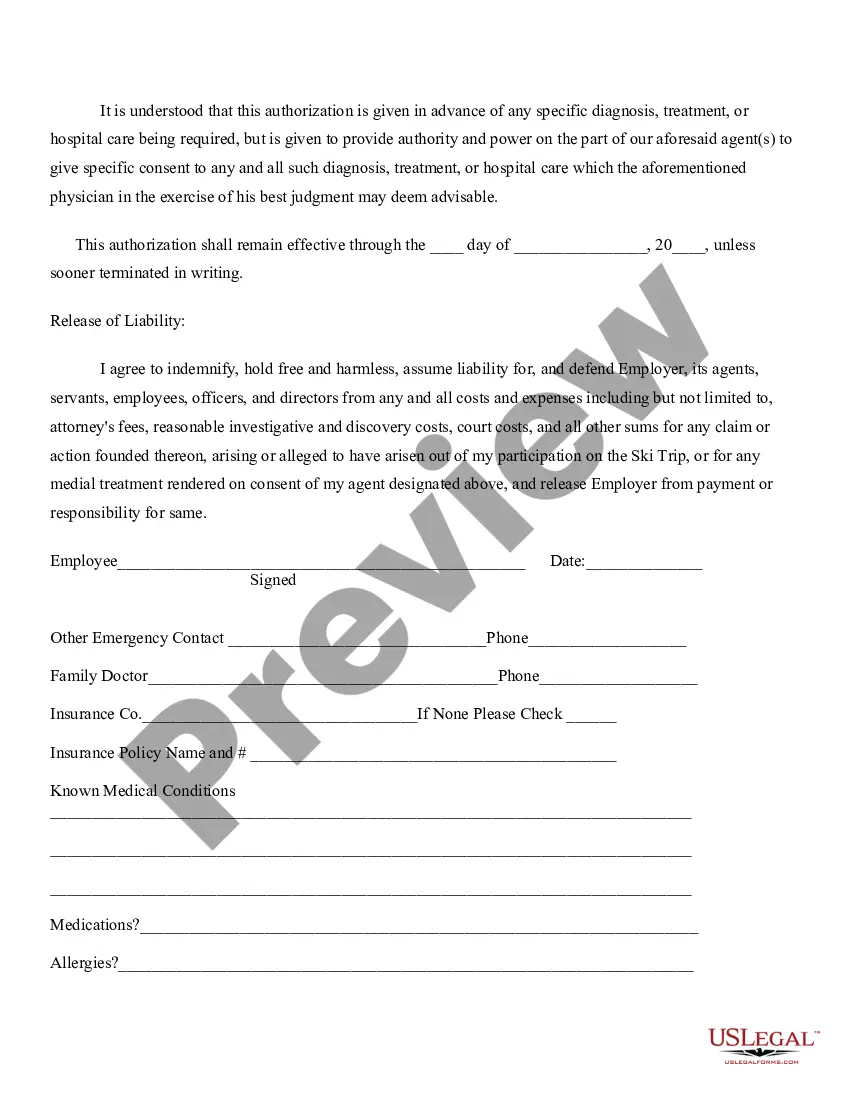

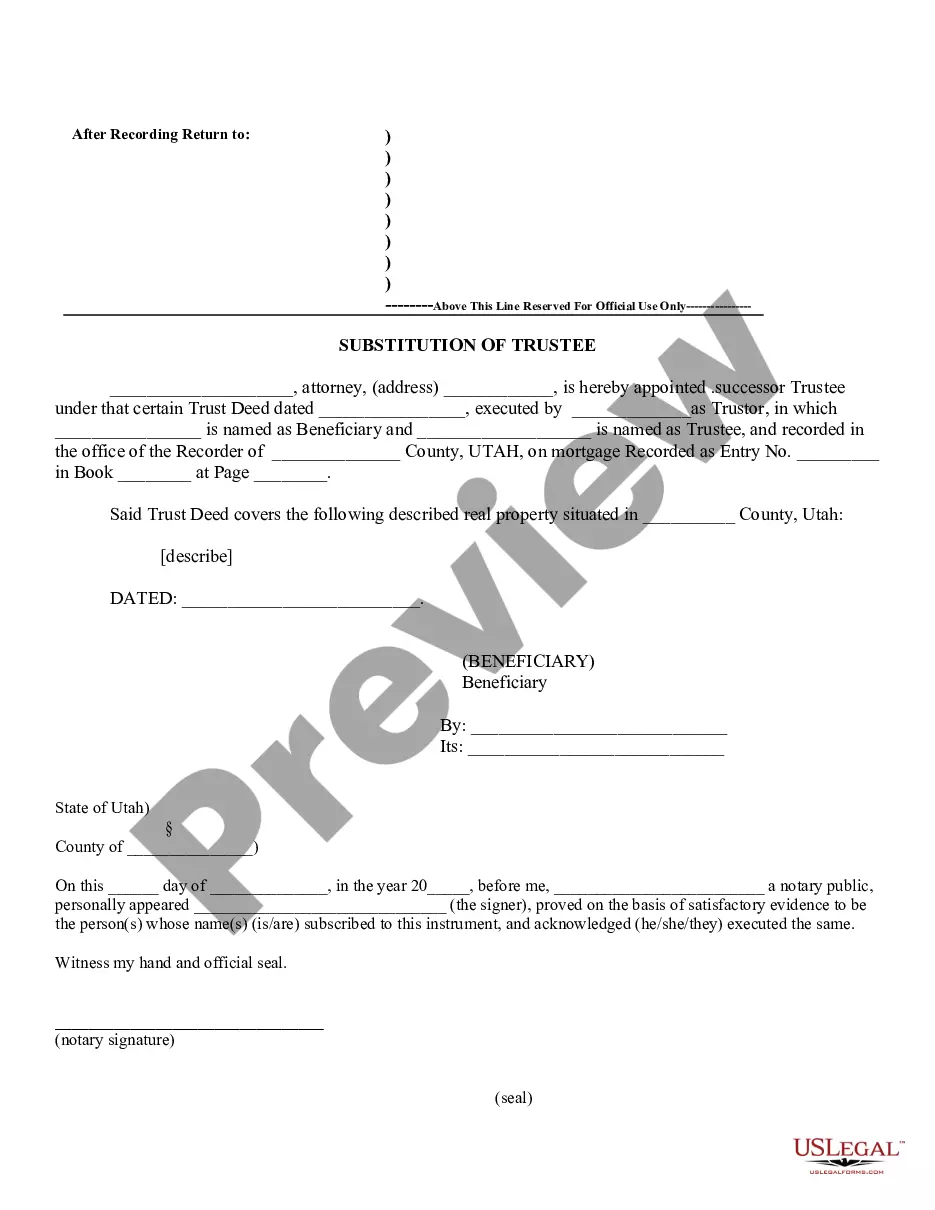

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

The gross receipts tax in Guam refers to the tax levied on a company’s total receipts, including sales and services rendered. This tax applies to all entities operating within the territory. Understanding this tax is particularly useful when managing costs for a Guam Release of Liability of Employer - Ski Trip, as it could affect your overall budget.

Filing a Guam tax return is necessary for individuals and businesses that earn income or conduct business activities in the territory. Even if your business is not profitable, filing remains important for compliance. As you prepare for events like a ski trip, keep this in mind, as it relates to your Guam Release of Liability of Employer - Ski Trip.

The Gross Receipts Tax (GRT) in Guam is imposed on the total revenue received by businesses from their operations. This tax applies to all sales and services, and understanding this can significantly affect business planning. If you're considering activities such as a ski trip, a clear grasp of the GRT is vital when using a Guam Release of Liability of Employer - Ski Trip.

The BPT tax rate in Guam varies depending on the nature of the business, typically ranging from 4% to 5%. This rate impacts how much a company needs to budget, particularly when organizing events like ski trips. Knowing the BPT tax rate can aid in drafting a Guam Release of Liability of Employer - Ski Trip more effectively.

The Business Privilege Tax (BPT) in Guam is a tax imposed on businesses for the privilege of conducting business within the territory. This tax applies to various types of income generated by businesses, essential for funding public services. Awareness of the BPT is crucial when planning a Guam Release of Liability of Employer - Ski Trip, as it affects overall business costs.

The director of revenue and taxation in Guam oversees the administration of tax laws and ensures compliance across the territory. This role is essential for maintaining financial order in Guam, especially for businesses planning activities like hosting ski trips. Understanding local tax regulations can help those drafting a Guam Release of Liability of Employer - Ski Trip.