Guam Resolutions - General

Description

How to fill out Resolutions - General?

If you wish to finish, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site's straightforward and user-friendly search functionality to locate the documents you require.

Many templates for both business and personal use are sorted by categories and jurisdictions, or keywords.

Step 4. After locating the form you need, select the Buy Now option. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Guam Resolutions - General in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to retrieve the Guam Resolutions - General.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

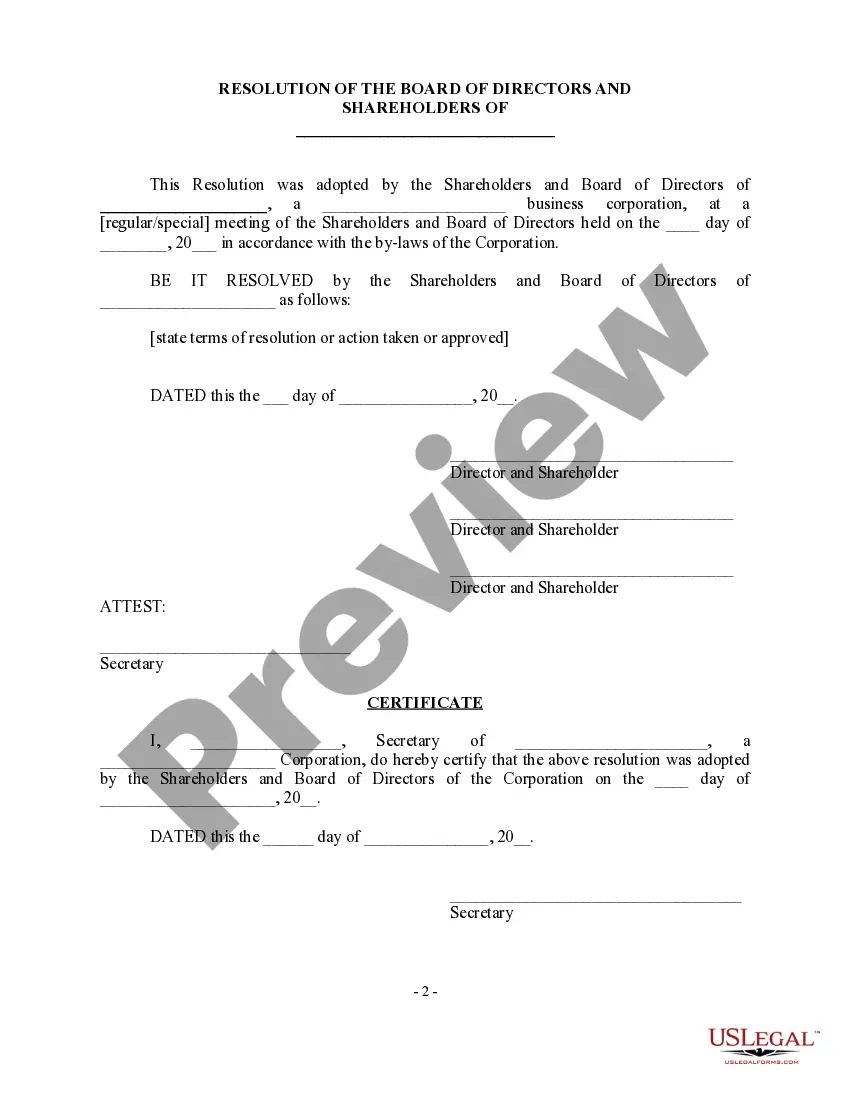

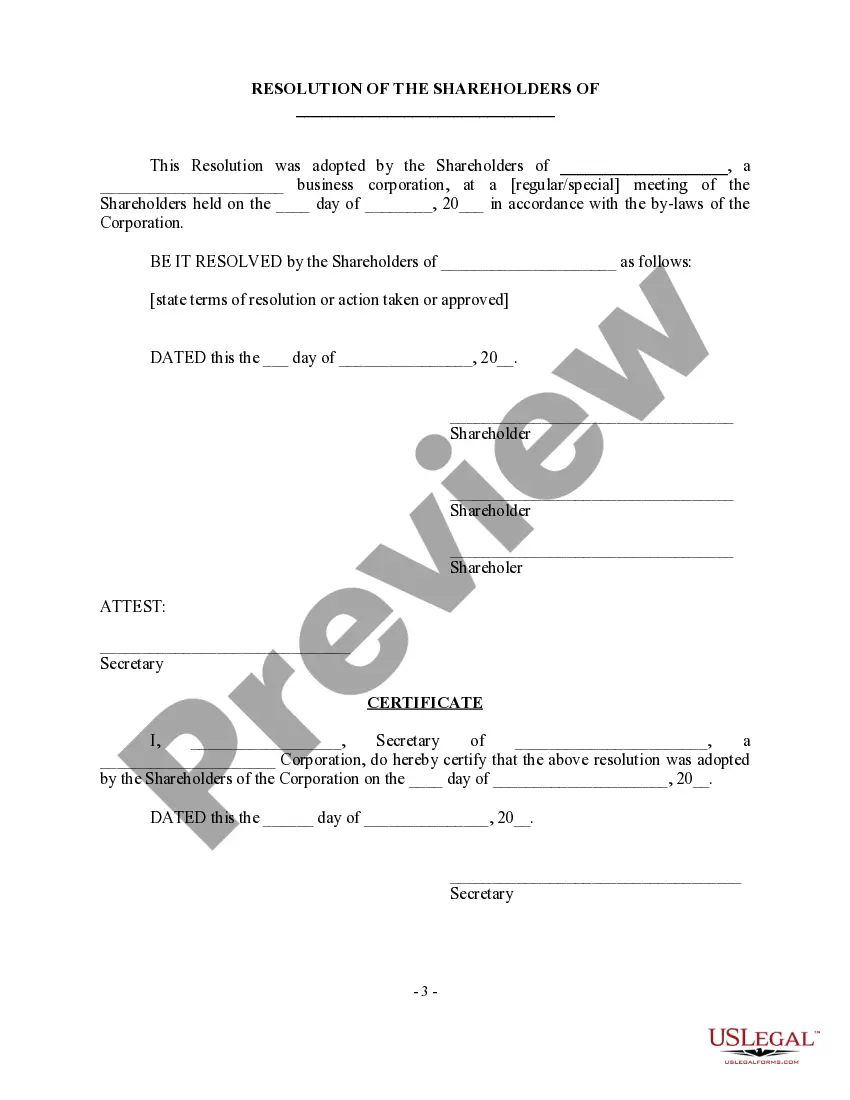

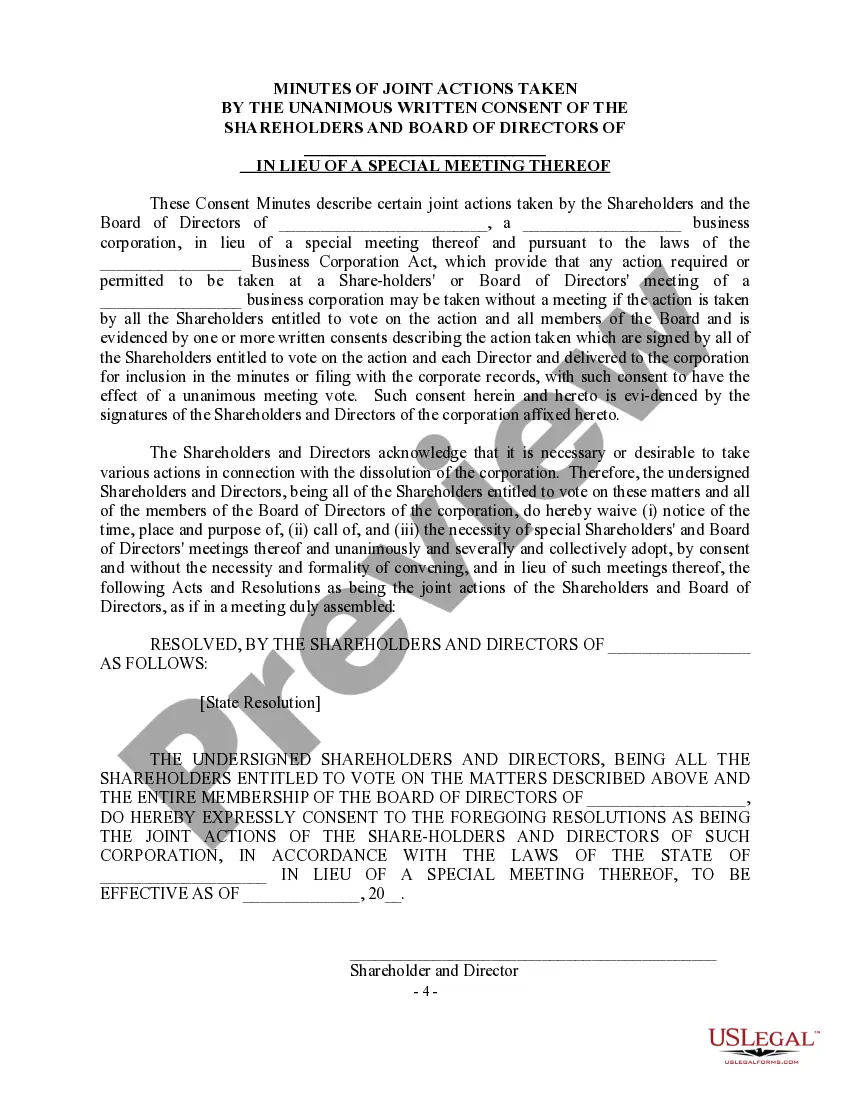

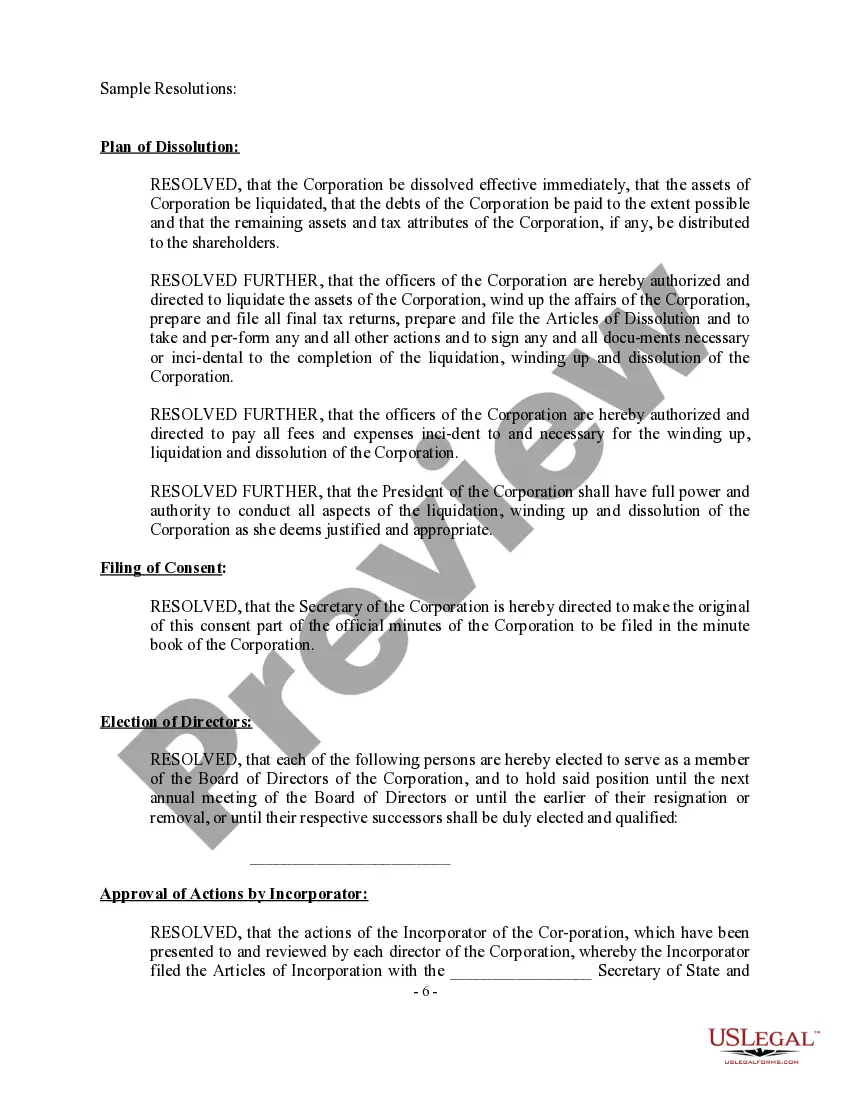

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search box at the top of the screen to find other versions of your legal document template.

Form popularity

FAQ

Creating an annual report for your business involves compiling financial statements, summarizing business activities, and including important metrics. This documentation is vital for maintaining compliance and fostering transparency in your operations. To ensure your report aligns with Guam Resolutions - General, consider using platforms like USLegalForms, which can provide templates and detailed instructions.

If you are a resident or earn income in Guam, you are required to file Guam taxes. This includes both individual tax returns and business filings. To ensure your submission meets the standards set out in Guam Resolutions - General, consider utilizing resources such as USLegalForms for step-by-step assistance.

Yes, Guam is considered a United States territory for tax purposes. As a result, residents of Guam are subject to some U.S. tax laws, while also adhering to local Guam tax laws. For clarity on your tax obligations under Guam Resolutions - General, consulting a tax advisor familiar with Guam laws can be very helpful.

The Business Privilege Tax (BPT) in Guam is a tax imposed on the gross receipts of businesses operating in the territory. This tax is essential for funding local programs and services, and it affects various types of businesses. Understanding BPT is crucial, especially in the context of Guam Resolutions - General; use resources like USLegalForms to help navigate these requirements.

If you earn income while living or working in Guam, you may need to file a Guam tax return. The Guam tax system operates similarly to the United States tax system, and residents have specific filing obligations. To ensure compliance with Guam Resolutions - General, review your income sources and consider consulting with a tax professional or using platforms like USLegalForms for guidance.

Guam is owned by the United States as an unincorporated territory. The US government maintains ownership rights, which include various responsibilities towards the local population. This ownership relationship influences everything from federal funding to infrastructure development on the island.

Guam is controlled by the United States, which has ultimate authority over its governance and legal matters. Local government operates under the framework established by the Organic Act. Residents of Guam are actively engaged in local politics, but federal laws and regulations ultimately apply.

The adjutant general of Guam serves as the head of the Guam National Guard and is responsible for the state’s military affairs. This role includes overseeing emergency management and coordinating with federal agencies during crises. This position is crucial for ensuring Guam's readiness in defense and disaster response.

Guam is not a member of the United Nations as it is a US territory. However, the United States, as a member state, represents Guam in international matters. This designation influences how Guam engages with other nations and international organizations, affecting its participation in global discussions.

Guam is an unincorporated territory of the United States. This means that while Guam governs itself in many local matters, the US federal government manages defense and other key areas. Thus, the people of Guam live under the jurisdiction of the United States, even as they maintain their unique local identity.