Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

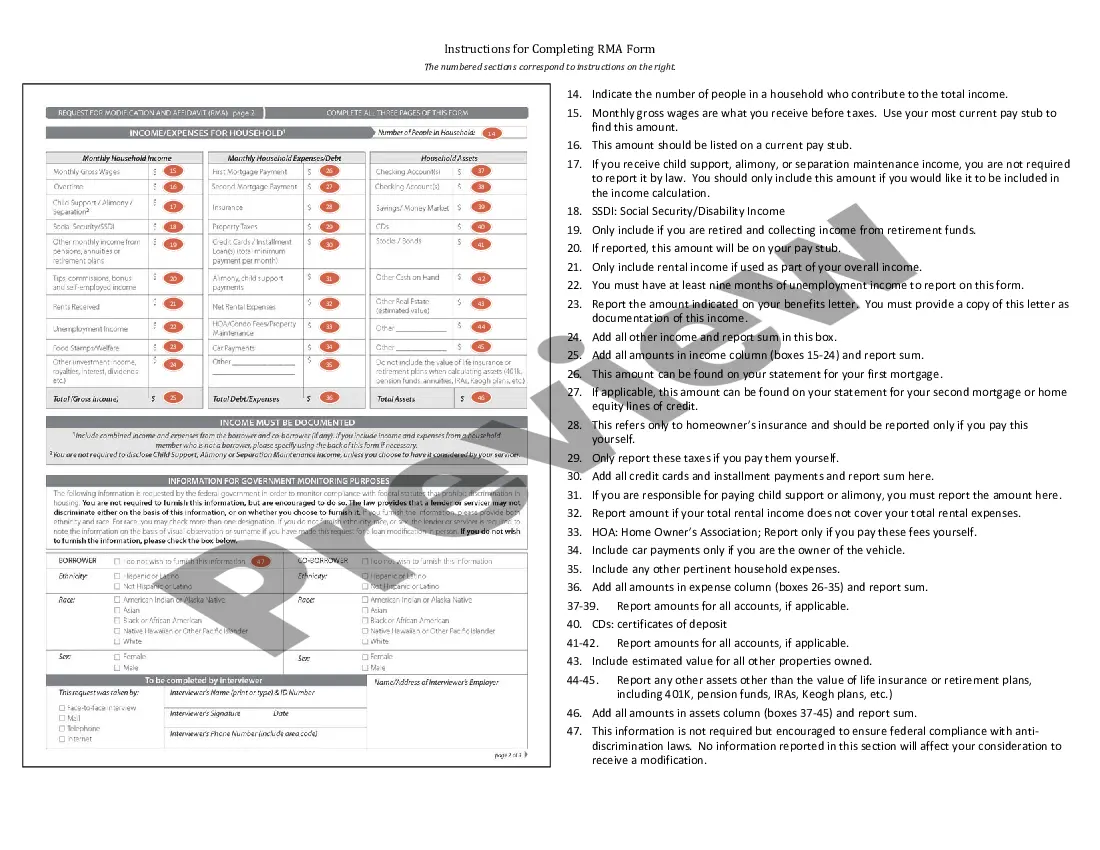

How to fill out Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

If you wish to gather, acquire, or create authentic document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Take advantage of the website's simple and user-friendly search to find the documents you need.

Various templates for business and personal purposes are categorized by types and claims, or keywords.

Every legal document template you obtain is yours indefinitely. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and acquire, and print the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to access the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and select the Acquire option to download the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps provided below.

- Step 1. Ensure you have chosen the correct form for the right city/state.

- Step 2. Use the Preview option to review the form’s content. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find other versions of the legal document.

- Step 4. Once you find the form you desire, click the Purchase now button. Select your preferred payment plan and provide your information to register for the account.

- Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it onto your device.

- Step 7. Complete, modify, and print or sign the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

Form popularity

FAQ

A loan modification hardship letter should clearly explain your financial difficulties, including any loss of income or increased expenses. Be honest and straightforward while outlining your current situation and how a modification would help. Utilizing the guidance provided in the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form can enhance the effectiveness of your letter.

Loan modification requirements may include documentation of income, employment status, and financial hardships. Lenders often require borrowers to demonstrate their current inability to meet original loan terms. By reviewing the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form, you can ensure your application meets necessary criteria.

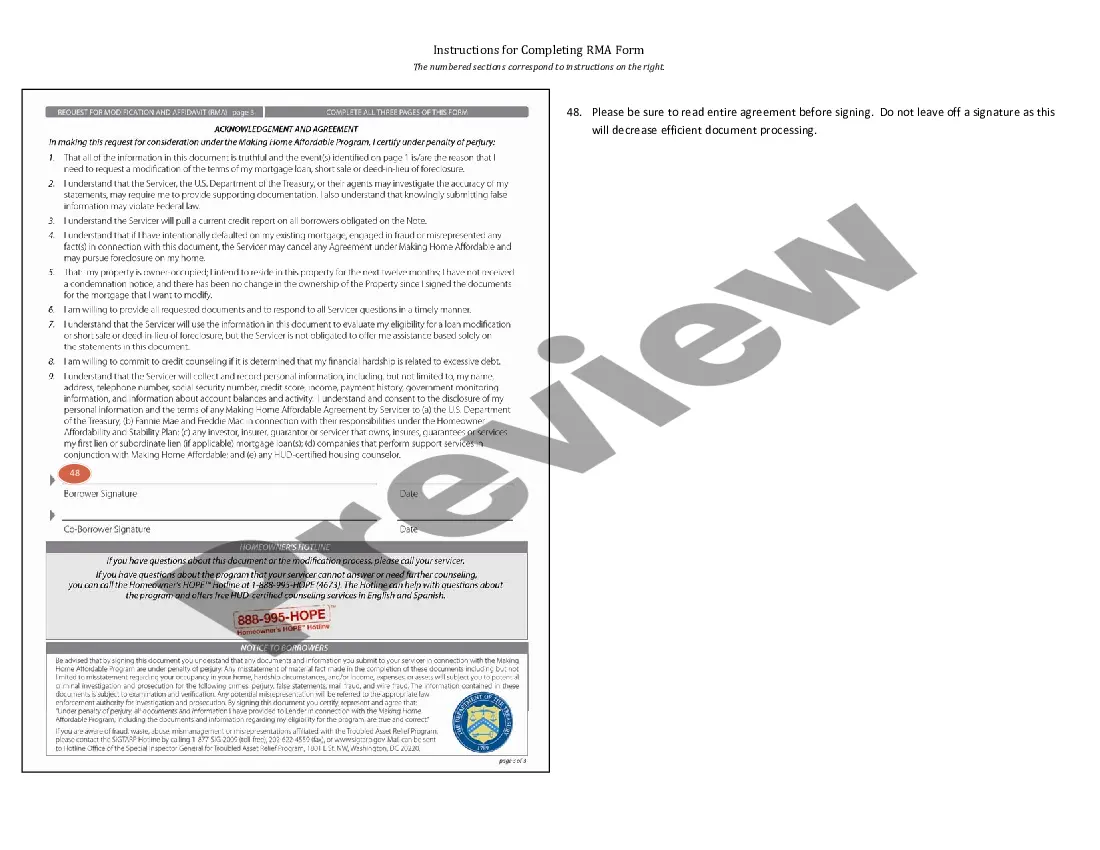

To initiate a loan modification, you typically need to contact your lender and express your interest in modification. After completing and submitting the Request for Loan Modification and Affidavit RMA Form, your lender will evaluate your situation through documentation and financial review. Being proactive and following up can help you stay informed about your application status.

The approval timeframe for a loan modification can vary greatly depending on the lender and the complexity of the homeowner's financial situation. Generally, it can take anywhere from a few weeks to several months to receive a decision. Staying organized and ensuring all required documents are submitted accurately can help expedite the process.

The Georgia Haf program is designed to assist homeowners facing financial difficulties due to the COVID-19 pandemic. This program provides financial aid to help cover mortgage payments, helping to stabilize housing for affected residents. Understanding the program's guidelines can enhance the chances of successfully completing the Request for Loan Modification and Affidavit RMA Form.

The RMA mortgage form is a critical document used in the loan modification process. This form allows homeowners to request modifications to their mortgage loan terms, helping them manage their payments more effectively. By following the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form, homeowners can ensure they provide all necessary information for their request.

A good hardship letter clearly explains your current financial situation and the reasons you are unable to meet your mortgage payments. In the letter, you should outline your specific hardships, such as job loss or medical expenses, while remaining concise and honest. When composing your letter, refer to the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form, which provide guidance on how to strengthen your case and make a compelling argument for your loan modification request.

A loan modification form is a document that you submit to your lender to request changes to the terms of your mortgage. This form is crucial for initiating a loan modification, as it typically includes your financial information and reasons for seeking a modification. To ensure a smooth process, follow the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form carefully, and provide all necessary details to improve your chances of approval.

Approval for a loan modification can vary based on your unique financial situation. While it may feel daunting, following the Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form meticulously can improve your chances. Factors such as your ability to show hardship and consistent income play a critical role in the approval process. Using a platform like uslegalforms can simplify your journey and provide the assistance you need.

The Georgia Instructions for Completing Request for Loan Modification and Affidavit RMA Form require specific criteria to be met for a successful application. Typically, you must demonstrate a financial hardship and provide documentation of your income. Lenders will also look at your credit history and payment behavior. Understanding these requirements will help you better prepare for your loan modification application.